Tristan Zhou is an award-winning photographer, videographer and cat lover based in Seattle, WA. Graduated from Shanghai Institute of Visual Art with BFA in Photography and San Francisco Art Institute with BFA in Filmmaking, he

Tristan Zhou is an award-winning photographer, videographer and cat lover based in Seattle, WA. Graduated from Shanghai Institute of Visual Art with BFA in Photography and San Francisco Art Institute with BFA in Filmmaking, he

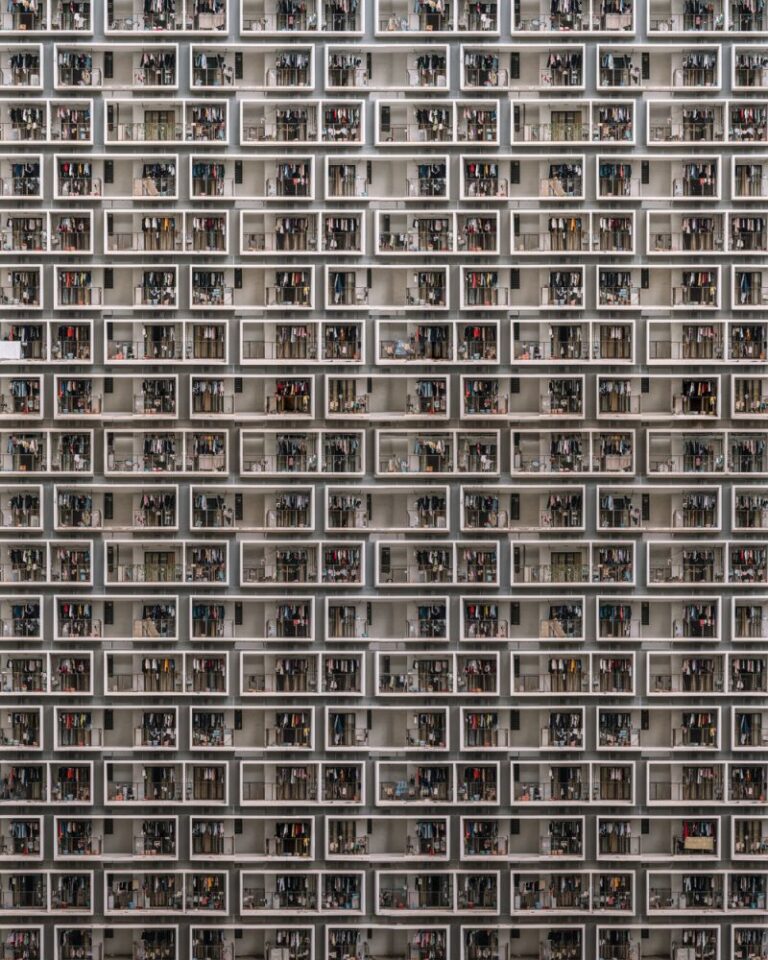

Tristan Zhou: An Urban Storyteller

Goldfinger Movie Review | A Novel Chapter

Goldfinger is the third James Bond movie released in 1964. In this adventure, Bond is sent to stop gold magnate Auric Goldfinger from contaminating the US gold supply at Fort Knox.

Plot (contains spoilers)

In the film’s opening sequence which became a tradition for the series from this point, Bond is sent to somewhere in South America to destroy a drugs laboratory and he also kills an assassin sent to kill him.

After the title sequence Bond is in Miami where he is met by Felix Leiter who has instructions from M for him to investigate Auric Goldfinger who has been cheating at a game of gin rummy, with his employee Jill Masterson watching the opposite player from a vantage point on their hotel room balcony. Bond intervenes and blackmails Goldfinger into losing, however after an evening with Jill, Bond is knocked out and she is murdered by being covered in gold paint.

In London, M tasks Bond to find out how Goldfinger is smuggling gold out of the country and sets up a golf match between the pair, which Bond tricks Goldfinger into betting on a gold bar and losing. Bond then tracks Goldfinger to Switzerland where he discovers Goldfinger smuggles the gold by melting it into the bodywork of his car, however he also overhears him discussing “Operation Grand Slam”. Whilst in Switzerland he also meets Tilly Masterson, Jill’s sister who tries to assassinate Goldfinger twice to avenge her sister but trips an alarm and is later killed during their escape from the factory. Bond is also captured and strapped to a table with a laser beam advancing towards him. He lies that MI6 know about Operation Grand Slam and Goldfinger spares his life.

Pussy Galore, Goldfinger’s pilot, flies Bond as captive to his stud farm in Kentucky in a private jet. Whilst there he escapes his cell and learns Goldfinger’s plan is seemingly to rob the United States Bullion Depository at Fort Knox by launching a nerve gas into the atmosphere which will knock everyone out in the vicinity for 24 hours, in a meeting he has with American mafia figures.

However the gangsters ridicule his plan, especially Mr. Solo who wants to be paid immediately and leaves the others who are then fatally gassed. Mr. Solo is killed by Goldfinger’s henchman Oddjob and his body destroyed in a car crusher.

Bond confronts Goldfinger about the plan and the implausibility of moving the gold. Goldfinger agrees it is impossible to do so and Bond deduces that when he overheard Goldfinger talking in Switzerland it was to a Chinese scientist who provided him with an atomic device and Goldfinger’s plan is to irradiate the gold, not to steal it. This will cause Goldfinger’s gold to triple in value and cause economic chaos in the West which the Chinese can also benefit from. However as Goldfinger’s prisoner, will he be able to stop the plan?

Thoughts

If Dr. No set the Bond formula on screen, and From Russia with Love refined it, then Goldfinger was definitely the movie that perfected it and set the template for the Bond series which has largely gone unchanged up until the most recent entry, No Time To Die, 57 years later and is still a movie that later entries are compared against.

Sean Connery has definitely perfected the mannerisms and presence of Bond by this point and every part of the character now seems to come easily to him, whether he is playing verbal games with Auric Goldfinger, flirting with the various Bond girls in this movie, or in dangerous and deadly situations.

Honor Blackman is also fantastic as Pussy Galore and is one of the few Bond girl characters that have both stood the test of time and stood out in the series which has so many other Bond girl characters. She is tough and independent and starts the movie as an anti-hero with Bond seemingly changing her mind during the course of the story. I remember seeing a documentary called Bond Girls Are Forever during the time Casino Royale was released, hosted by Maryam D’Abo and it is discussed how much of a modern woman Pussy is compared to other characters of the time which is probably part of this movies long-lasting appeal.

Gert Frobe is also great as the villain, although it’s arguable the iconography of Oddjob has endured more than he does, with Harold Sakata’s stature but quiet menace, as well as his steel-rimmed bowler hat making him a very memorable henchman that set the template for many others later on in the series, such as Jaws, Nick Nack and others.

The movie does indeed have many iconic moments for Bond fans, including Shirley Eaton painted gold, the car chase in the Swiss Alps, the laser scene where Bond asks Goldfinger if he expects him to talk and he coldly replies “No, Mr. Bond I expect you to die!” which still leave an impression today and again have been used to compare later entries against.

I also find the score is significantly improved here. John Barry already made vast improvements in From Russia With Love but the usage of the music is much better here, whether this is due to him or Guy Hamilton’s direction I would like to find out at some point. Also using an actual song for the title sequence, with Shirley Bassey’s haunting and brassy vocals setting yet another template for the vast majority of other Bond themes to follow.

The movie does have some moments which may be slow for some people compared to big budget movies today but I find these moments don’t feel as long as later entries and the movie is overall very well-paced compared to the first two entries, which can meander a little during the first half.

In conclusion, if you want to see a movie which has set a template for a franchise for over 50 years and become a classic in the Bond series then I would recommend giving this movie a watch.

Do you enjoy Goldfinger? Let me know down below your thoughts on this entry in the series.

#586: Money Doubles Every 10 Years (and Most People Never Notice!), with Scott Yamamura

If you are a complete beginner at finances, or if you know someone who is, this episode is for you.

If you are a complete beginner at finances, or if you know someone who is, this episode is for you.

The biggest hurdle for beginners? Money seems complex and intimidating. But Scott Yamamura, author of Financial Epiphany, explains personal finance doesn’t have to be complicated. He breaks compound interest into three easy-to-grasp frameworks:

- Money as a Multiplying Ability: Just like athletes have peak physical abilities in their 20s, your money has its greatest multiplying power when you’re young. At age 22, every dollar invested can multiply 16 times by retirement (assuming a 40-year career and 7.2 percent returns).

- The Doubling Framework: Money can double approximately every 10 years with average market returns. This explains why a dollar invested at 22 becomes $2 by 32, $4 by 42, $8 by 52, and $16 by 62.

- The Halving Concept: With each decade that passes, your money’s multiplying power gets cut in half. This is the inverse of the above idea.

Scott shares how these simple frameworks helped him front-load his son’s college savings. “We can stop now because it’s going to double,” he said.

For beginners struggling with analysis paralysis, Scott offers a Rubik’s Cube analogy: You don’t need to understand all 43 quintillion possible combinations to solve it — you just need one simple method to get started.

Similarly, you don’t need to master every financial concept to begin investing.

The most important step is just to get started. You can learn the complexities later, but starting early gives your money more time to grow.

Scott also emphasizes finding your “why” — a purpose bigger than just accumulating wealth. He shares a moving story about a man named Ernie who funded his mission trip to Sierra Leone, showing how money can be used to make a profound difference in people’s lives.

Timestamps:

Note: Timestamps will vary on individual listening devices based on dynamic advertising run times. The provided timestamps are approximate and may be several minutes off due to changing ad lengths.

(0:00) Introduction

(1:16) Scott discusses reframing compound interest as “money multiplying ability”

(3:47) Money multiplying power works like athletic ability – strongest when young

(7:02) Scott addresses challenges of saving when young and broke

(10:29) Explanation of the Rule of 72 for doubling money

(13:43) Every dollar invested at 22 multiplies 16x by retirement

(17:08) What to do if you’re starting late with retirement savings

(20:44) Three core ideas of compound interest

(23:19) Using the concept of “halving” to create urgency to invest

(30:30) Finding your “why” to overcome financial temptations

(33:07) Scott shares personal story about Sierra Leone mission trip

(36:46) The joy of spontaneous giving as motivation for building wealth

(40:53) Balancing retirement savings with paying off debt

(43:38) Simplifying finance through the Rubik’s Cube analogy

(52:50) Paula’s wrap-up with actionable investing advice for beginners

Thanks to our sponsors!

NetSuite

NetSuite is the number one cloud financial system, bringing accounting, financial management, inventory, HR, into ONE platform, and ONE source of truth. Head to NetSuite.com/PAULA and download the CFO’s Guide to AI and Machine Learning.

Trust & Will

Trust and Will has simplified the process of creating and managing your will or trust online, from finding out what’s right for your family to finalizing documents with a notary. Gain peace of mind today with Trust and Will. Get 10% off plus free shipping of your estate plan documents by visiting trustandwill.com/paula.

How We Protect Our Blended Family – Life Happens

“When we, as LGBTQ+ adults, make the decision to get into a relationship and start a family, it’s not always with the support of our own family.” That is a poignant statement that will resonate with a lot of people.

This insight came from MyLin and SK Stokes Kennedy, who are married and raising their blended family in Southern California. The couple appeared on season six of “Black Love,” where they opened up about the challenges of cultivating their partnership and raising three children.

We are thrilled that they agreed to work with us again this year on spreading the message about the importance of life insurance.

Life insurance? You may ask, “Where does that come into all of this?” Well, it may be more important than most people think, so read on as we chat with MyLin and SK.

Life Happens: When is the first time you both heard about life insurance?

MyLin + SK: We became familiar with it after getting married but didn’t get it until we were pregnant with our first child together.

LH: Why did each of you decide to purchase life insurance?

MyLin + SK: We realized that we didn’t want the other, or our kids, to suffer financially in the midst of grieving if, or when, something happens to us.

LH: What type of coverage do both of you have and why?

MyLin + SK: We currently have term life insurance. In doing research, we found that it was the least expensive option at this point for us.

LH: Why should everyone have life insurance, especially LGBTQ+ adults?

MyLin + SK: When we, as LGBTQ+ adults, make the decision to get into a relationship and start a family, it’s not always with the support of our own family. So, if something happens to us, there is the chance that our desires are not withheld by the surviving family. Wills can be contested, things drawn out. With life insurance, you can ensure that your partner and kids receive what you want them to.

LH: Have you had conversations about life insurance with your family or friends?

MyLin + SK: Yes, we’ve had convos with both. With our moms being the most important ones because of what positions we may be left in if they don’t have life insurance.

LH: What did one of those conversations look like?

MyLin: So, I found out my mom had a very small policy through her job that was under $10,000, which isn’t covering her funeral costs. That led to us looking into getting her a proper policy that would cover her funeral costs (my mom knows a lot of people so it will be big, and we will need funds), bills/debt, mortgage, her car note. There is so much that I don’t want to fall on my brother and I or have to create a GoFundMe and beg people for it. I just want it already taken care of.

LH: What does life insurance mean to you?

MyLin + SK: For us it means security and peace of mind, knowing that if anything unfortunate happens to either of us (or both of us), our kids will be taken care of.

LH: What do you wish more people knew about life insurance?

MyLin + SK: We wish people understood the gravity it held. How much pain and stress dealing with financial struggles after losing a loved one can be and that we can do something about it now. We just need the knowledge and awareness spread that it’s not a huge, expensive monthly bill.

LH: What research findings from our 2024 Insurance Barometer Study (Life Happens and LIMRA) do you find the most interesting?

MyLin + SK: I was interested to see that 62% of people that said they don’t have life insurance also feel as though they need it. The desire is there, they just need more knowledge. So, there is opportunity there to get them the knowledge they need to make that next step.

LH: We agree—and that really is our mission!

MyLin + SK: And then that 22% of people that do have it say they need more. I feel like we land in that 22%. We’ve had life insurance for about five years now and pay $83 a month for all our policies, which includes $150,000 policies for each of us as parents and $15,000 policies for each of our three kids.

Our goal is to jump up to $500,000 of coverage on us as parents because we want our kids to have funds for their future education, just not paying off bills and debt. So even we know that there is room for growth and to receive more knowledge. That’s why we like partnering with you all. It motivates us to dig a little deeper and get more knowledge—and also to share it. Because we know more people need it.

Get Started

Don’t let being unsure of how much or what kind of life insurance to buy stop you from getting coverage. To start, you can do a quick calculation with our Life Insurance Needs Calculator to get a general idea of how much you may need. And if you want help choosing the right kind of policy that fits your budget, you can talk with an insurance professional at no cost or obligation. If you don’t have someone to work with, you can use Life Happens’ Agent Locator here.

You Must Subscribe to Keep Reading…

Value Investing Strategy (Strategy Overview)

Allocations for March 2025 (Final)

Cash TLT LQD SPY

Momentum Investing Strategy (Strategy Overview)

Allocations for March 2025 (Final)

1st ETF 2nd ETF 3rd ETF

February 28, 2025 • Posted in Miscellaneous

Below is a weekly summary of our research findings for 2/24/25 through 2/28/25. These summaries give you a quick snapshot of our content the past week so that you can quickly decide what’s relevant to your investing needs.

Subscribers: To receive these weekly digests via email, click here to sign up for our mailing list. (more…)

Please log in or subscribe to continue reading…

Gain access to hundreds of premium articles, our momentum strategy, full RSS feeds, and more! Learn more

Italian Citizenship Iure Sanguinis: How to Apply

How to Obtain Italian Citizenship Iure Sanguinis as a U.S. Citizen

Italian citizenship iure sanguinis (by right of blood) allows descendants of Italian citizens to claim Italian nationality through their lineage. This principle applies to individuals of Italian descent, even if they were born outside Italy, provided that their ancestors did not formally renounce their Italian citizenship before passing it on to the next generation.

For U.S. citizens with Italian ancestry, the eligibility to apply for Italian citizenship iure sanguinis depends on specific legal requirements. The law applies to descendants of Italian emigrants who left Italy after 1860, when Italy became a unified nation. This means that U.S. citizens whose grandparents emigrated from Italy may qualify for citizenship, provided that the Italian bloodline remained unbroken.

One of the most important aspects of iure sanguinis is that it applies to both paternal and maternal lineage. However, there is a crucial legal distinction: descendants from a maternal line can claim citizenship only if the child was born after January 1, 1948, due to historical gender-based restrictions in Italian nationality laws. Those born before this date can still claim citizenship, but only by filing a petition with an Italian court.

Claiming Italian Citizenship Iure Sanguinis: Legal Pathways

There are three main ways for U.S. descendants to apply for Italian citizenship iure sanguinis:

Administrative Process via the Italian Consulate

- This is the most common route for applicants residing abroad. It involves submitting a request to the Italian consulate that serves their U.S. jurisdiction. The process requires gathering official documentation proving the Italian lineage, including birth, marriage, and naturalization records. Due to the high demand, consulate appointments can have long waiting times—sometimes exceeding 5 years.

Application via Residency in Italy

- An alternative to the consular process is applying directly in Italy by establishing residency in the ancestral town of the Italian ancestor. This method can significantly reduce the waiting time compared to consular applications, as local municipalities (comuni) typically process requests faster.

Judicial Petition in Italian Courts

- For cases involving a maternal lineage before 1948 or excessive consular delays, applicants can seek legal recognition through the Italian court system. This requires filing a petition in an Italian tribunal, often with the assistance of a legal expert specializing in citizenship law. Damiani&Damiani is an international law firm based in Italy, provides comprehensive legal support for Italian citizenship by descent, guiding clients through complex court procedures and ensuring their rights are recognized.

Eligibility Requirements and Required Documents

To apply for Italian citizenship iure sanguinis, the applicant must prove the uninterrupted transmission of Italian nationality. The key requirements include:

The applicant must provide a complete set of civil records, including:

- Birth, marriage, and death certificates (both U.S. and Italian)

- Naturalization records or a statement of “no record” of naturalization

- Apostilles and certified translations of all non-Italian documents

Why Choose the Legal Route for Italian Citizenship?

Many applicants choose to work with legal professionals to avoid delays, missing documents, or procedural errors. Cases involving:

- Maternal lineage before 1948

- Lost or missing documents

- Discrepancies in records

often require judicial intervention rather than administrative processing. A legal expert ensures that the process is handled efficiently, increasing the likelihood of success.

Secure Your Italian Citizenship Iure Sanguinis

Claiming Italian citizenship iure sanguinis is a valuable investment in your future. It grants you the right to live, work, and study in the European Union, access world-class healthcare, and connect with your Italian heritage. With the right approach and professional support, your journey to Italian citizenship can be seamless and successful.

How Renter Preferences and Tech Innovations Are Reshaping Multifamily Property Management

Published on November 4th, 2024

By Brittany Benz

As renter preferences continue to evolve, property managers face a critical question: How can they keep pace with these shifting demands while staying competitive?

With an influx of new apartment homes coming online, the answer lies in prioritizing resident experiences and offering innovative solutions that address the changing landscape.

On an episode of the Rooms with Ronald podcast hosted by Ronald Harrington, Steven Beringer, VP of Strategy at AppFolio, shared valuable insights from the 2024 Renter Preferences Report that tracks renter behaviors and priorities. Drawing from the report, Beringer outlined a strategic roadmap for property managers navigating today’s increasingly complex rental market.

Keep reading to get highlights from their conversation, including tips for enhancing the resident experience and the transformative role of technology in multifamily leasing.

Understand Renter Preferences and Expectations

With nearly half a million new apartment homes expected to be delivered annually through 2025, property managers need to prioritize the resident experience to keep up with the influx.

This includes asking questions, such as:

- Why are renters moving?

- What services are attracting them to units?

- How do they view their relationship with their property manager?

- How do their maintenance experiences affect their choices?

According to Beringer, “…the Renter Preferences Report shows us that the relationship [residents] have through that leasing process — and the TLC that’s given in that process — can materially change their perspective on choosing a place.”

As vacancy rates fluctuate, property managers need insights like these to remain competitive, while offering amenities and experiences that go beyond monetary concessions.

Prioritize Positive Experiences Over Concessions

According to Moody’s Analytics, concessions are at an all-time high. While offering financial incentives can fill vacant units, relying on concessions alone isn’t a sustainable strategy.

In fact, high concessions can correlate with poor customer service. One-time price reductions might attract new renters, but maintaining a positive relationship with residents is key to long-term success.

Data from AppFolio’s report confirms that residents who are satisfied with their property management experience are 30% more likely to renew their lease.

Beringer states, “Property managers need to continually be thinking about how to be competitive because we don’t always want to win on concessions alone…We want to be able to provide differentiated experiences both in terms of the units and buildings themselves and the amenities that are provided.”

Focus on Improving Maintenance Experiences

One of the most surprising findings from the Renter Preferences Report was the high level of satisfaction renters have with maintenance. The survey found that 86% of renters were likely to recommend their property management company because they were satisfied with maintenance.

Beringer attributes this satisfaction to low-effort experiences, where technology streamlines the process for both residents and maintenance staff. From the moment the resident submits the request to scheduling the service appointment to getting the problem resolved, how easy was the process for them to navigate? By using digital tools to help with tasks like intake or a resident portal for communications, property managers can keep residents satisfied.

Not to mention, technology can play an integral role in managing vendors. Whether it’s staying on top of W2s, tracking jobs, or automating make-ready boards, tech-forward maintenance solutions can simplify processes and contribute to higher satisfaction scores.

Integrate Consumer-Grade Technology

If we can learn anything from the maintenance satisfaction ratings, it’s that technology has the power to transform the relationship between manager and renter. These days, technology has become an expectation for renters.

Residents now demand swift, tech-savvy interactions with property managers. That means having access to technology platforms where residents can:

- Pay rent

- Submit work orders

- Schedule maintenance

- Socialize with neighbors

- Get valuable information, such as moving checklists

This is why it’s so important to go beyond “raw technology” that managers typically use and integrate consumer-grade technology into property management.

Leverage Artificial Intelligence (AI) to Do the Heavy Lifting

When it comes to AI, Beringer sees it as a tool to augment — but not replace — property management jobs. One way you can use AI to make your job easier includes enhancing processes like leasing by providing real-time responses to tenant inquiries.

You can also utilize AI to personalize relationships. Let’s say you have a walkthrough with a potential renter in a few minutes. AI technology can research that person and summarize the data for you right in the moment. That way, you can make that walkthrough personalized, while letting AI do some of the heavy lifting.

As another example, Beringer references AppFolio’s early integration of AI in its technology. “You can speak into your phone and say, ‘Add a guest card.’ This is the name, this is the phone number — and it will literally just say it’s done…AppFolio has that literally live in customer’s hands today.”

With AI technology advancing rapidly, it will only continue to make leasing and property management more efficient and personal.

Provide Flexible Rent Payments and Security Deposit Alternatives

One particularly pressing trend is the growing demand for flexible rent payments and security deposit alternatives. AppFolio’s report found that the demand for these services nearly doubled year-over-year, reflecting a growing need for financial flexibility among renters.

This shift highlights the importance of offering services that cater to renters’ financial health, which Beringer believes will become a key differentiator for property managers.

Younger renters are particularly unlikely to accept traditional payment methods, such as paper checks. Instead, they expect convenient, tech-driven options, like online payments, that align with their fast-paced, mobile-first lifestyles.

How to Select the Right Property Management Technology

If done correctly, property management technology has the potential to improve satisfaction and performance across the board. However, if it’s not, it can have an adverse effect, resulting in negative experiences. Beringer offers two valuable pieces of advice for property managers looking to implement new technology solutions.

Involve the Entire Team in the Selection Process

Despite the difficulties of managing multiple opinions and perspectives, it’s worth trying to get everyone on the same page before you select technology. Gathering input from the people who will be using these platforms every day is key to driving adoption.

Beringer said, “I personally have experienced that if you make the selection of software a group and team effort, it’s more likely to succeed.”

Ask yourself, “Who is this technology going to affect the most?” For example, if you’re looking at leasing software, you need input from your leasing professionals because they’re going to become your subject matter experts.

Be Mindful of the Timing and Speed of Implementation

Tech fatigue is a real issue. With so many new software products on the market, companies need to be careful not to overload staff with too many new tools at once.

Beringer noted, “I think [property managers] are trying too many things, and then they’re spreading [themselves] too thin. They’re not getting real results, and it’s bad data where they’re making some of their decisions.”

By integrating technology thoughtfully and providing adequate support during implementation, Beringer believes property managers can ensure successful adoption, and improve both resident satisfaction and operational efficiency.

While the data from the 2024 Renter Preferences Report is incredibly valuable in understanding how technology is reshaping the multifamily housing industry, there are so many more insights to uncover. Read the full report to get more information about how you can exceed renter expectations and stand out from the competition.