Word on the street is that this has been caused by fear of what coronavirus, or to use its catchier name, COVID-19, could do to global financial performance, including the more than 1,000 companies contained within just those four faceless indices I’ve mentioned. Years ago I proved I was a useless trader so with that in mind I’d also still suggest that some of the moves are caused by the coronavirus being a good excuse to have a market pullback given markets like the S&P500’s current hefty valuation.

Down market moves like this then give those of us who are paid to sell drama a great opportunity to come up with headlines like “Coronavirus meltdown: Airlines plunge as global stock markets suffer their worst week since the 2008 financial crisis” (I won’t link to the source of that one but if you’re interested Google is your friend) through to something a little more data driven like “Shares drop in worst week since financial crisis”

If you didn’t take personal finance seriously, articles like those might even be enough to cause you to panic (whether or not the first $100 billion trading day for the ETF SPY (an S&P500 tracker) was panic is of course debatable) with your own wealth or even not get started on the road to financial independence in the first place.

Of course in amongst all this there are good quality reasoned articles trying to balance up the drama. As I have the data to hand (I check my financial position every Saturday morning with a decent coffee in hand, it takes 15 minutes) I’m also going to also have a go at presenting a bit of balance by simply sharing what this week has meant for somebody who is now financially independent and working a plan that should enable us to just live off the dividends of a globally diversified asset class diversified portfolio, that now consists largely of ETF’s tracking indices like those above, in the not too distant future.

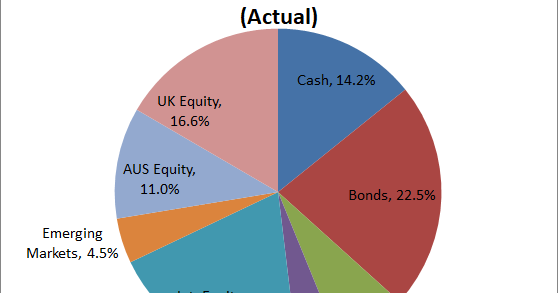

Today my asset allocation looks like this

Click to enlarge, Current RIT Asset Allocations

with my financial journey now looking like this

Click to enlarge, RIT Progress Towards Retirement and In Retirement

I could present that information in two ways. Firstly, I’m down £83,700, which is more than 3 years of planned spending, which sounds pretty scary or secondly, I’m down 5.8% which puts my wealth back to where it was in June 2019, which sounds a little more benign. The difference between the referenced markets 9.6% to 11.5% declines and my performance is diversification of asset classes, countries where those assets exist and currency movements.

Where it gets even more interesting is, that while no final decision has been made, it’s looking more and more likely that we’ll be emigrating yet again to more sunnier climes. Our visa application has passed it’s first hurdle, resulting in a chunk more money being spent, so we may only be a few months away from having to make a big decision. Priced in the currency of that country and that 5.8% decline becomes an even more modest 5.1%. In wealth terms I’m back to where I was in December 2019!

Looking at it that way my next step is to have another cup of joe, after all it’s a pretty grey and wet day out there today, then financially do absolutely nothing.

As always though, you need to do your own research and act accordingly. Have you done anything in the financial markets this week and are you planning to take any action in the near future?