January 2025 Dividend Income Update

Well hello, and welcome to a new dividend income update – my first of 2025!

As many readers know, we have maintained a hybrid investing approach for over 15 years now and we’ll continue with this approach in 2025:

- We invest in Canadian and U.S. dividend paying stocks – about 25-some stocks that collectively deliver income and growth, and

- We invest in some low-cost equity ETFs – that deliver (hopefully) long-term growth for extra diversifcation.

You can always read a bit more about what we own, why and where (i.e., in what accounts) on this dedicated My Dividends page here.

January 2025 Dividend Income Update

What will the investing year bring?

We’re already a few weeks into the start of another investing year and while it’s probably wise to never say never when it comes to predicting investing returns, it’s hard to imagine 2025 being as good as recent years.

While every individual stock we own cannot be a high-flyer, some stocks we do own continue to fly higher to support our dividend income and overall growth story.

At the time of writing this post recently:

- Walmart (WMT), up about 5% YTD and over 150% since we’ve owned it.

- Brookfield (BN), while up only slightly this year this stock is also up over 70% in the last 5-years since we’ve owned more of it.

- Waste Connections (WCN), up about 7% or so YTD but is also up an impressive 90%+ in the last 5-years.

Source: Google Finance.

There are other examples in our portfolio too.

Beyond these stocks, we also own our usual suspects of bond-like proxies but certainly not every Canadian bond-proxy stock is doing as well.

You’ll recall as part my/our hybrid investing approach, I’ve essentially created our own Canadian dividend fund over the last few decades.

As part of that DIY Canadian dividend fund, we focus on “TULF” stocks and I use XIU over the years to help screen these “TULF” stocks to own:

- “T” = Telecommunication companies e.g, Telus.

- “U” = Utilities e.g., Fortis.

- “L” = Low-yielding dividend growth stocks with growth potential e.g., Canadian National Railway.

- “F” = Financials e.g., big Canadian banks.

Basically, I own companies that I believe you and I need to rely on, collectively, for bond-like income:

- Telcos – people love their internet and cell phones.

- Utilities – people like electricity.

- Low-yielding growth stocks – we need to ship things around our country, so owning rail companies make sense.

- Financials – people get mortgages and borrow money and need insurance.

I think you get the idea by now…!

Admittedly, some of the stocks in our DIY Canadian stock collection are not high-flyers (e.g., Telus of late, Canadian Natural Resources, and a few others). I mean, they can’t be – it’s largely impossible for everything to be a winner all the time. Some stocks will do well at times while others lag in price. Just the way it goes. Averaging it all out, things are just fine. Even though I don’t obsess over benchmarking, my Canadian non-registered portfolio (where we keep only Canadian stocks) is up over 140% over the last 10-years to date. This is pretty much right on where XIU has performed without the fees. Again, not surprising since we own most of the top-20 stocks that XIU has anyhow.

During this multi-year bull market run, even some lazy ETFs we own have done well. The ex-Canada global ETF we own is up quite a bit since we started buying some in 2016. It’s up about 10% annualized over the last 9 years. (The 10-year returns for this ETF should be out in a few months.) And in more recent years, the NASDAQ-100 ETF we own is providing a nice tech-kicker return too; returning well over 100% over the last 5-years.

Although I’m largely pessimistic about near-term returns given how well 2023 and 2024 returns were in particular, I am equally hopeful our portfolio will continue to generate returns at or beyond 5% annualized in the coming decade – those target returns along with my inflationary assumptions are included in our financial independence projections.

2025 is a Transition Year

Where do we go from here, for the rest of 2025?

With our TFSAs now maxed out of contribution room, and with some part-time work planned to occur soon (official details on the way….), we don’t have new money to invest in 2025 as much as we used to.

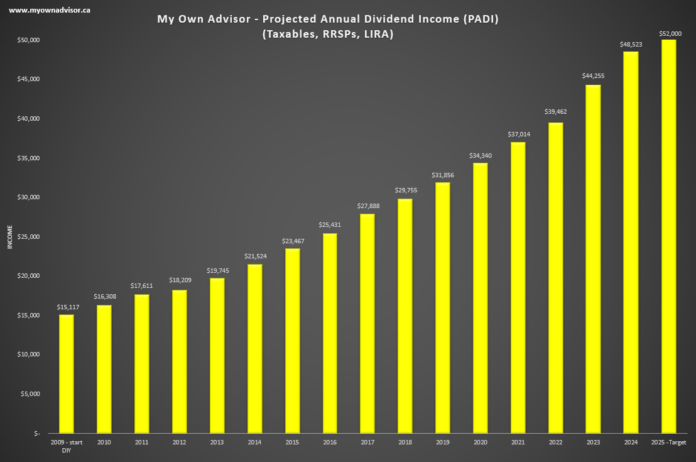

2025 is going to be a significant transition year for us and I’m sure our dividend income updates will reflect that. Instead of dividend income rising by the thousands per year (see chart below!) I anticipate our dividend income earned will level off a bit starting in 2025.

Without any new significant funds to invest this year (although some investments may occur sporadically), the income growth will need to come from dividend or distribution raises almost exclusively moving forward – inside our taxable accounts.

Beyond that, cash/cash equivalents rising in value in our registered accounts will be used for withdrawals to meet our lifestyle needs. Those registered withdrawals will need to occur as early as winter/spring 2026. So, my expectations that our dividend income will rise in perpetuity as part of these updates needs to be tempered.

Then again, that’s the entire point.

We’ve worked hard over the years to build assets as part of this hybrid portfolio to start semi-retirement with in 2025 – so here we are after decades of investing.

As we start a new year of monthly income updates, here are some other reminders to level-set:

- I do not post these updates to announce that our approach to investing is superior to anyone or anything else. These posts are not to brag. Hardly. Rather, I have and will continue to share these updates to chronicle both our financial independence journey and to share what’s working or not, in that journey. I’ve been doing this for 15 years. That journey is going to be a drawdown journey very soon!! It is my hope you can use this information to make your own personal finance decisions to your benefit and engage with me along the way.

- Through these updates, I am never suggesting that such stocks or ETFs posted on this site are for your direct purchase. Your investing journey is personal and unique to you.

- While some stocks do very well in our portfolio, at times, others lag or are downright terrible at times. You know the saying “…past performance is never indicative of future results”? Well, that’s very true. As such, I need to make a few decisions now and then to either buy stocks that I believe are on sale or kick stocks to the curb (see Algonquin Power)!

- Finally, related to this point, all portfolios need some attention from time to time. A 60/40 stock/bond portfolio needs rebalancing. Even plowing money into an all-in-one equity ETF should have at least a dollar-cost-averaging approach to employ and monitor. Failure to adapt and revisit how you’re investing when conditions around you change is just silly IMO. Time has a way of forcing all of us to challenge our assumptions, and make changes, usually for the better!

As I start 2025 and these updates in particular, I’m very curious to say the least to see how things could work out for us.

Our hybrid investing approach has been a multi-decade journey that has included a few twists and turns for sure but things have stablized in recent years to prepare for what’s to come.

January 2025 Dividend Income Update Summary

At the time of this post, we’re projecting we might earn close to $52,000 in 2025 from a few key accounts (not all our accounts mind you) to help fund semi-retirement. That assumes no dividends nor distributions get cut in our portfolio and it also assumes we don’t buy many equities in 2025 either.

If I do make a few major purchases in 2025 I will let you know and if dividend cuts occur that impact our income in a big way I will let you know too.

It’s early days this year. We just started another investing year amidst a whirlwind of global and political uncertainty like never before. 2025 could be an interesting investing year to say the least but I am hopeful it is a rewarding one to build upon from what we started so many years ago…

Mark