By Sandy Smith-Nonini, Affiliated Research Assistant Professor, University of North Carolina-Chapel Hill

As I write1, President Trump rolls out more executive orders, many ignoring federal rules or judicial precedent, aimed at boosting corporate power, fossil fuel dependency, and eliminating federal aid for transitioning to sustainable energy sources.

The timing is concerning, as many climate indicators recently began blinking red. The New Year ended a two-year spate of record-setting global heat, closing out the warmest decade in history. A new study by the Global Carbon Project team projects that at current rates of greenhouse gas emissions, the world has a 50:50 chance of its average temperature staying consistently above 1.5 degrees Celsius (C) by 2030 – the limit set by the Paris Accords to avoid run-a-way climate heating.

Some of the federal aid at risk is for electricity upgrades to enable electric vehicles, battery storage and smarter, more stable grids – again, not a moment too soon as the United States has seen a doubling and lengthening of electrical outages in the last two decades, often associated with extreme weather events (also more frequent). Trump policies may slow that process, favoring most utilities’ preference for natural gas – the rationale being that gas plants are more reliable than renewables because they can be called into service rapidly when demand rises. But as the case which follows illustrates, gas dependence can also undermine grid stability.

For the moment, the “muzzle velocity” (as Steve Bannon puts it) of Trump’s shock and awe has Democrats ducking for cover. Non-MAGA bystanders might be forgiven for a sudden urge to take up origami or Wordle rather than watch the news. But fossilized politics – a reference to rigid political ideology [ie. interests] and to long-term consequences of ignoring climate change – have repercussions. This is a cautionary tale about natural gas and corporate power in Texas. The First Act is a tragedy; the Second Act offers a brief history and looks under the hood of market-based utilities; the Third Act recounts how deregulation and reliance on natural gas can bite elite government in the butt (causing a scramble to scapegoat and pass the buck); the Final Act contests common claims about renewables and lays out a politics of pragmatic possibility.

Act One: The Texas Freeze

A little over an hour past midnight on February 15, 2021 during a frigid ice storm, the Texas electric grid went down, leaving 10 million people across the state in life-threatening cold for up to five days. The “Freeze” caused hundreds of deaths, and more than $130 billion in costs to the state.

The blackout was a nightmare for Rakeisha Murphy of Humble, Texas: no heat or water, burst pipes, spoiled food, and since she worked remotely by computer – a lost job. But her worst fears centered on her son who was paralyzed from the waist down. “His life depends on machines . . . . His feeding (device) needed electricity and we didn’t have that for 5 days. So I was afraid I might lose my son,” she said in a video interview for Texas Helping Texans Recover Fund, a private organization supporting a class action lawsuit over the Freeze (THTRF 2023).

Winter Storm Uri, which pushed Siberian weather into the lower Midwest, dropped temperatures to -6° F (-21° C) in San Antonio where lows rarely drop below 42° F (5.5° C). Ice brought down trees making roads impassable. Having received little warning, citizens had not stocked up on supplies and were forced to get by with cash, food, and gasoline on hand.

At least 246 people died, many from hypothermia, but a CDC study found the real death toll was likely over 700. Low-income people of color like Rakeisha lost power for longer periods than other groups, and like many other Texans, instead of a discount for the traumatic week without power, her electric bill skyrocketed. “After Uri, they jacked up our light bills ridiculously high. . . . It’s been high every month since the Freeze,” she said (THTRF 2023).

The blackout drew attention to the state’s deregulated electric system — the most purely market-based grid in the country, which dates to 2002 when a decade of neoliberal reform of electricity was rolled out. Variations of deregulated grids exist today in 18 US states and over 100 countries, but Texas energy systems have notoriously lax oversight after two decades of Republican rule that caters to interests of the oil and gas industry.

I study energy crises, the topic of my upcoming book The Energy Permacrisis (Routledge 2025). In this age of climate extremes, crises are more common and often occur at the intersection of two complex systems: (1) fossil fuel-dependent energy services and (2) financialization (read: profit or credit based on obscure assets whose value derives from other people’s debt).

I first saw pressure for electricity deregulation – and its sidecar: privatization – up close during fieldwork in Puerto Rico and Greece in the 2010s. Chronic debt left both places vulnerable to creditors who took advantage of “shocks” (from a devastating hurricane in Puerto Rico and a debt crisis in Greece) to push for dismantling public utilities and selling assets cheap to multinationals.

It was the showing of a documentary I produced on the year-long Puerto Rico blackout that first took me to Texas in fall 2021. Faculty at the University of Texas–Rio Grande Valley used the film to kick off two panel discussions by academic and local experts on the recent Freeze event. Investigating the Texas fiasco led me on a journey into the obscure history of deregulated electricity, revealing the multiple risks that market-based fossil fuel services pose to the public.

Act II: How We Got Here

Scene 1: Messing with Electricity

Corporate utilities that have monopolies over their service area predominate in the United States. In the 1930s, reforms limited their power and created state public utility commissions (PUCs) to regulate them. Until the 1970s PUCs were widely seen as effective at keeping electricity affordable and reliable. Their great vulnerability is “regulatory capture” as lobbying from the utility industry (and campaign donations) influences politicians and PUC members. The Texas PUC is appointed by the Governor, whose politics align tightly with the state’s hydrocarbon industry2.

The push for deregulation arose from higher electric rates caused by the 1970s oil crisis and debt from poorly planned nuclear power plants. Neoliberal economists, utilities and fossil fuel companies found common cause in advocacy for market-based reforms. Low natural gas prices at the time bolstered claims that gas-fired generation would lower rates. Even some environmental groups, seeking to enable solar on the grid, supported the reforms. The danger of accelerated global heating from natural gas methane emissions was not known at the time.

Scene 2: Inside the Box

Let’s take a brief peak at “what’s in the box” of a deregulated utility. To enhance competition, utility reformers pushed large power companies to “unbundle” (or sell off) assets so smaller companies could compete in their service area. Public utilities were advised to sell to private owners (often at a large discount). The promise of cheap electricity in states with high rates helped get politicians on board. At the center of a so-called ”restructured utility” is an energy futures market where traders for energy companies offer competing bids for fuel and electricity prices, broken down by short intervals. Trading firms and banks also bid as “paper traders” who have no role in power generation but seek to profit through arbitrage.

But there’s a catch: Each utility market is overseen only for involved corporate shareholders. While states still have PUCs, there is poor public, media or regulatory access inside these utility exchanges. Even federal regulators rarely poke their head inside. In Canay Ozden-Schilling’s words, “The consumer-utility relationship fell out of sight” (2021, 46).

Scene 3: Problems with the Market Model

Many analysts see electricity as a poor candidate for market rules because it is so essential to modern life, making it price inelastic – supply and demand feedback fails to curb profiteering. Ratepayers have little or no choice of suppliers, electricity is hard to store, and utilities often neglect low profit (but essential) tasks like grid maintenance. Despite public outrage over the destructive Enron fraud scandal in newly deregulated California (McLean and Elkind 2013), Texas politicians moved ahead on deregulation in 2002, promising lower electric rates.

But that did not pan out. Reporters at the Wall Street Journal found that nearly 20 years later, the 90% of Texans living in deregulated areas had paid $28 billion more for electricity than those in regulated areas3. The wizard behind the curtain is natural gas, the most popular fuel in market-based systems. Similar findings held up nationwide. The gap between rates for regulated vs. deregulated systems widened as gas prices rose after 2005 then closed gradually as gas prices fell after 2010. Steve Isser, who penned a book on the history of electric restructuring, described the reforms as based on assumptions that “cheap natural gas was here to stay” (2015)”

The early premise that restructuring would boost renewables also looks iffy. While some market-based grids (including Texas) expanded renewables, a 2022 comparative survey found overall slower uptake of solar and wind in states with restructured grids than in other states, as discussed further below.

Act III: Behind the Freeze Blackout

Scene 1: A Frigid Gas Fracaso4

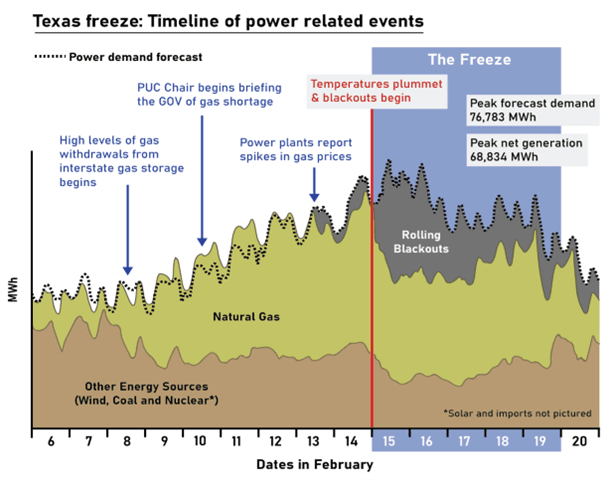

So what went wrong in Texas? Two days after the February 15 blackout began, Texas’ Republican Governor Greg Abbott went on Fox News to blame icy windmills. Indeed, the storm impacted all energy sources, but it turned out to be gas, not wind, that caused the biggest deficit in expected energy on the grid that night. Low gas supplies in pipelines had reduced pressure below the level many power plants needed to run, causing 55% of the outages.

Texas’ electricity was 51% gas fired and most power plants depended on “just-in-time” delivery of gas by pipelines from wells in nearby shale basins. Most reports in the months to come laid blame for the blackout on lack of weatherization, which left wellheads and valves on gas processing equipment vulnerable to freezing up. Cross-border grid sharing was not an option because Texan politicians had voted to isolate nearly all the state grid from neighboring grids after a similar 2011 freeze. This allowed Texas to sidestep federal weatherization rules which only covered inter-state grids. Texas leaders had rejected backup power due to faith in the new market model. Nor were power plants required to remain in service if they could not make a profit.

As power plants tripped offline in the wee hours of February 15, the grid’s frequency dropped to dangerous levels, putting it within 5 minutes of total collapse. Operators initiated rolling blackouts to avoid a full grid failure which might have left the state in the dark for many weeks.

Due to the lack of back-up power, raising the wholesale price was the only option regulators had to incentivize more power generation when demand exceeded supply.. DeAnn Walker, chair of the Texas PUC, raised the price to the maximum – a whopping $9,000 per MWh – the highest price cap of any state (and 400 times higher than the Texas average!). But the gas shortage in pipelines precluded most plants from producing power, so the high price made no difference. Further, when power plants later got access to buy gas, they faced exorbitant prices from suppliers and many ran up huge debts.

The surge in wholesale prices led to roughly $50 billion in charges which bankrupted some electric retailers who had guaranteed discounted prices to their ratepayers. Later the public learned that a regulatory error in keeping the high price in place too long caused $16 billion in over-charges. Some officials proposed reversing the excess charges, but energy “paper” traders, who made millions in profits by speculating on price swings in the energy futures exchange, lobbied the PUC intensely to reject repricing, and that is what commissioners did.

The Texas legislature, many members of which echoed Gov. Abbott’s scapegoating of renewables, supported only limited reforms. These included weatherization of power plants, but, to the consternation of many observers, exempted the lightly regulated gas pipelines5 despite gas shortages having caused the blackout. Seeking to enhance grid reliability after the Freeze, legislators set aside funds for . . . you guessed it . . . more gas plants! Why the bias? It might have had something to do with the $6.3 million that several companies accused of gas price gouging in the storm had donated to seven top state elected officials since 2017.

Scene 2: Lucky Bets or Corporate Fraud?

During the Freeze, as citizens burned furniture to stay warm, gas companies, banks, and trading firms that speculated in the futures exchange took home an astounding $11 billion in profits. The biggest winners were Energy Transfer Partners ($2.4 billion) and Kinder Morgan ($1.4 billion), both of which held monopolies on gas pipelines and storage facilities. The CEO of Energy Transfer later donated $1 million to Gov. Abbott’s re-election fund.

In 2023, a new class action lawsuit introduced a new perspective on the windfall market profits of the pipeline companies and other energy traders. The suit challenged the dominant narrative that poor weatherization was sufficient to explain the blackout, arguing instead that manipulation of gas supplies and price gouging were the root causes of the grid failure.

The lawsuit alleges that large gas companies curtailed gas in the lead-up to the storm to run up wholesale gas prices and enable profiteering. Betting on prices is legal, but manipulating gas supplies for profit is not. Gas prices at trading hubs in Texas and nearby states soared 700 to 1000-fold during the storm, impacting much of the Midwest by adding billions in excess charges to power plants that were ultimately passed to rate-payers.

CirclesX, a Texas energy data company, filed suits against 92 pipeline companies and corporate traders on behalf of Texans who incurred losses. Its CEO, Erik Simpson, had witnessed gas price manipulation decades earlier when he worked for Enron. He used proprietary software to analyze complex public data from meters on pipelines to create a database of gas sales and pipeline transfers during the Freeze.

The suits align with claims by many power plants of price gouging. Simpson claims that large gas suppliers with storage facilities moved gas from well-regulated interstate pipelines to loosely regulated intrastate pipelines before the storm. Gas suppliers then allegedly cited the weather emergency as a rationale to cancel deliveries of contracted (lower priced) fuel to power plants. In this period, Simpson claims that gas firms traded their stored gas multiple times on the market to bid the price up before releasing it and selling the gas either on the spot market (at current prices) for lucrative profits or to desperate power plants which lacked on-site storage and were willing to pay the high prices to stay in service.

Vistra, which runs five power plants in Texas, reported many cancellations of deliveries with suppliers citing “force majeure” (“act of God”) clauses. Curt Morgan, Vistra’s CEO, said that 70% of the cancellations took place before the temperature drop. Over half the drop in pipeline gas volume also preceded the extreme cold and blackout (See Figure 2). Hundreds of lawsuits were filed after the storm.

Simpson believes companies routinely curtail gas to drive up prices during weather extremes, but this time speculation combined with cold weather triggered a grid failure. Energy economist Ed Hirs told NPR that withholding (curtailing supplies) in a tight market is common, noting, “We teach the electricity game at school” (meaning the University of Houston, where he is based).

Other supporting evidence for the alleged curtailment of gas come from a report by University of Texas-Austin researchers, drawing on data from Wood Makenzie, that found evidence of large gas withdrawals at multiple interstate and Texas intrastate storage facilities more than a week ahead of the temperature drop (See Figure 2). Four of the gas storage facilities with large withdrawals were owned by pipeline companies that made large profits from trading during the Freeze. The UT researchers noted that “regulators and policymakers have very limited information about contracts and hedging relationships.”

Allegations from CirclesX also fit with findings from phone logs that Walker, the former Texas PUC chair, turned over to state legislators showing over 100 communications about the gas shortage, with briefings of the governor and legislators on Feb. 10 and 11, well ahead of the extreme weather (and the governor’s Fox News interview blaming windmills). She was fired by Gov. Abbott after testifying. The Texas Attorney General began an investigation, but allies of Abbott stopped the effort. The Texas Railroad Commission, which regulates natural gas, has not weighed in on the allegations of price manipulation, maintaining that gas contracts are a private matter and fall outside its jurisdiction.

Texas electric and gas customers were left on the hook to pay higher rates and fees for Freeze debts which a Forbes tally estimated at $10 billion, most from state bonds issued to bail out indebted utilities. Some fees may remain on bills for up to 30 years. As one energy consultant said to me: “That’s a ton of money for something that lasted 5 days.”

Final Act: Beyond Fossilized Politics

It is ironic that energy markets, lauded by economists for their feedback on supply and demand, not only failed to save Texas in 2021, but may have been the scene of the crime. Proof depends on the CirclesX data getting a proper hearing in court. As of now, the case has survived initial legal hurdles. Other storm-related gas price manipulation suits, informed by the CirclesX data, are pending in San Antonio and Kansas; one suit was settled in Oklahoma.

Energy companies that use opaque utility futures markets to bid up prices for profit are using shadow banking strategies to boost capital accumulation, by taking advantage of a crisis at the expense of ratepayers. Importantly, the Freeze itself was emblematic of the wider environmental and social crisis of climate change, which is caused by fossil fuels. Speculative profits help liberate oil and gas companies from the heavy lift and unsustainable landed extraction of mineral wealth.

Despite Texan Republicans’ scapegoating of renewables, it was solar and wind, not natural gas, that stabilized the Texas grid in two recent summer heat waves. Led by the state’s abundant (privately financed) wind energy, which grew rapidly in the 2000s, renewables are now cheaper than their fossil competitors6. They are put on the market first in utility price auctions, and contributed a remarkable 26% to the state’s energy on the grid.

In a 2023 Texas Tribune investigation insiders to energy policy struggles said that ironically, it was wind’s success that had generated hostility from the oil and gas industry which now fears renewables cutting into gas revenues. “It wasn’t seen as a real resource (or) threatening,” Dub Taylor, director of the state energy conservation office, told the Tribune. “And then suddenly overnight it was” (Foxhall et. al 2023).

Oil and gas folks also read the tea leaves on Wall Street. Several recent studies of investment portfolios show that clean energy assets have been outperforming fossil fuel stocks. Even Forbes found clean energy beating the fossil variety. Analysts say investors are wary that oil company holdings will see losses as electric cars are rolled out, not only in the United States but also in China and Europe. Another likely concern is reports by analysts of shale reserves who predict that as sweet spots are drilled out, shale oil and gas will peak and begin to decline by the early 2030s.

If you add in the potential of battery storage, which has been soaring in Texas and stands to gain in other states, subsidized by the Inflation Reduction Act, we see a different angle on Trump’s attacks on clean energy policy. This offers an important counterpoint to malaise over the lost election. When it comes to environmental advocacy on electricity, progressives have been winning. The volley of White House threats are not truly about renewables being weak or making the grid unreliable, or that they need expensive subsidies. It’s about the fossil fuel industry’s fear of losing market share and stock values. As in 2008, and after the 1970s oil crisis, the recurring resort of powerful corporations facing losses is to line the pockets of politicians who make good on yet another taxpayer (or ratepayer) bailout.

But if the current administration gets away with trashing the US green transition, we risk the kind of damages and massive public theft perpetrated in the Texas Freeze spreading across the country, not to mention the ongoing speed up in climate chaos. Fossilized politics is a politics of extinction. What we need is a politics of life. And we don’t have four years to waste.

Footnotes

References

Foxhall, Emily, Kai Elwood-Dieu and Zach Despart. 2023. Texas power struggle: How the nation’s top wind power state turned against renewable energy. Texas Tribune.

Isser, Steve. 2015. Electricity Restructuring in the United States: Markets and Policy from the 1978 Energy Act to the Present. Cambridge University Press

King, Carey, Josh D. Rhodes, and Jay Zarnikau. 2021. The Timeline and Events of the February 2021 Texas Electric Grid Blackouts. University of Texas at Austin Energy Center. https://energy.utexas.edu/sites/default/files/UTAustin%20%282021%29%20EventsFebruary2021TexasBlackout%2020210714.pdf

McLean, Bethany and Peter Elkind. 2013. The Smartest Guys in the Room: The Amazing Rise and Scandalous Fall of Enron. Penguin Random House.

THTRF. 2023. Texans Helping Texans Recovery Fund. https://www.thtrf.com/news

Sandy Smith-Nonini, PhD, is an affiliated research assistant professor in Anthropology at the University of North Carolina-Chapel Hill. Her current book The Energy Permacrisis is due out with Routledge in 2025. She authored Healing the Body Politic (Rutgers 2010) and many academic and media articles on health, labor and energy.