A little after 1 am on Feb. 15, 2021 during a frigid storm, the Texas electric grid came close to a catastrophic collapse. Blackouts left 10 million people in life-threatening circumstances for up to 5 days. The “Texas Freeze” caused hundreds of deaths, and more than $130 billion in costs to the state. 1

For Rakeisha Murphy of Humble, Texas, it was a nightmare: No heat or water, burst pipes, spoiled food, and since she worked remotely by computer – a lost job. But Rakeisha was most alarmed over her son who was paralyzed from the waist down. “His life depends on machines . . . . His feeding (device) needed electricity and we didn’t have that for 5 days. So I was afraid I might lose my son,” she said in a video interview.

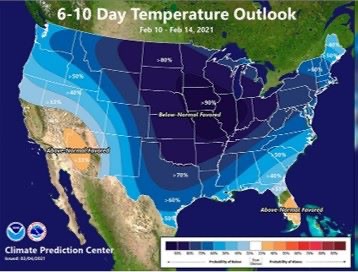

The Freeze was caused by Winter Storm Uri which pushed Siberian weather into the lower Midwest, dropping temperatures to -6° F (-21° C) in San Antonio where lows rarely drop below 42° F (5.5° C). Ice brought down trees, making roads impassable.

Figure 1: Weather map showing polar vortex prediction for the week of the Texas Freeze. Source: US National Oceanic and Atmospheric Administration. Author’s archives.

With little warning, citizens had not stocked up on supplies, and were forced to get by with cash, food and gasoline on hand. The storm caused 246 deaths, many from hypothermia. A CDC study found the real death toll may exceed 700.

Low-income people of color like Rakeisha lost power for longer periods than other groups and many struggled to pay high electric bills after the storm.

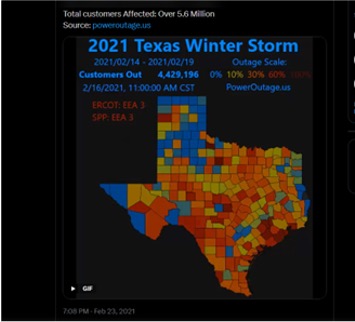

Click HERE for interactive GIF of Figure 2 below showing sequence of Texas Freeze blackouts for each county across the state in the week of Feb. 14 – 19, 2021.

Figure 2: Color code: Percent of customers in county affected: Yellow: 10%, Orange:30%, Red: 60% Source: poweroutage.us. Author’s archives.

The blackout drew attention to the state’s deregulated electric system, the most purely market-based grid in the country, in a place where entrenched Republican rule caters to interests of the oil and gas industry.

Ironically, energy markets, lauded by economists for their feedback on supply and demand, failed to save Texas. In fact, revelations since 2023 suggest that the market was the scene of the crime. A new lawsuit alleges that illegal price gouging in the Texas energy market may have caused the Freeze blackout.

As a political anthropologist (and former journalist), I study energy crises, the topic of my upcoming book The Energy Permacrisis (Routledge 2025). In the age of climate extremes, such crises often occur at the intersection of two complex systems – capitalist financialization and energy services.

A few months after the storm I was invited to the University of Texas – Rio Grande Valley to show a documentary [ii]2 I had made on Puerto Rico’s 2017 blackout and to interact with a panel on the Freeze. I had seen pressure for electricity deregulation — and its sidecar: privatization — up close during fieldwork in Puerto Rico and Greece. Chronic debt left both places vulnerable to creditors who used the crises to push for dismantling public utilities and selling assets cheap to multinationals.

Today the need for renewable energy to mitigate climate change is spurring a new push to loosen regulations of the grid.

Investigating the Texas Freeze led me on a journey into the poorly understood history of deregulated electricity and revealed multiple risks the model poses for the public. Today the need for renewable energy to mitigate climate change is spurring a new push to loosen regulations of the grid. The Texas Freeze offers a cautionary tale about risks of corporate-shaped “re-regulation” that eschews public oversight (Özden-Schilling 2021, 29). This is important given that variations of deregulated grids now exist in 18 US states and over 100 countries.

How Deregulation of Utilities left the Public at Risk

Until the 1980s three-quarters of US electricity was run by corporate monopolies and regulated by public utility commissions (PUCs). While far from perfect, PUCs acquired a good record for keeping electricity affordable and reliable. 3

Price rises in the 1970s oil crisis and utility debt from poorly planned nuclear power plants led to soaring electric rates, putting pressure on politicians. The crisis spurred interest in renewables, but without utility reforms, solar and wind had no chance of getting on the grid since utilities had legal monopolies.

In the 1990s neoliberal economists, utilities and fossil fuel companies found common cause in advocacy for deregulation. Low natural gas prices at the time bolstered claims that gas-fired generation would lower rates. Even some environmental groups, seeking to enable solar on the grid, supported the reforms. The danger of accelerated global warming due to methane emissions from natural gas was not known at the time.

What’s in the Box?

Like Brad Pitt at the end of the serial killer film “Seven” (Figure 3 ), electricity users deserve to know “what’s in the box” of a deregulated utility. The answer, in this case, is not Gwyneth Paltrow’s severed head. But it may be equally scary.

To enhance competition, utility reformers pushed large power companies to “unbundle” or sell off assets so smaller companies could compete in their service area. The promise of cheap electricity got politicians on board — especially in states with high rates.

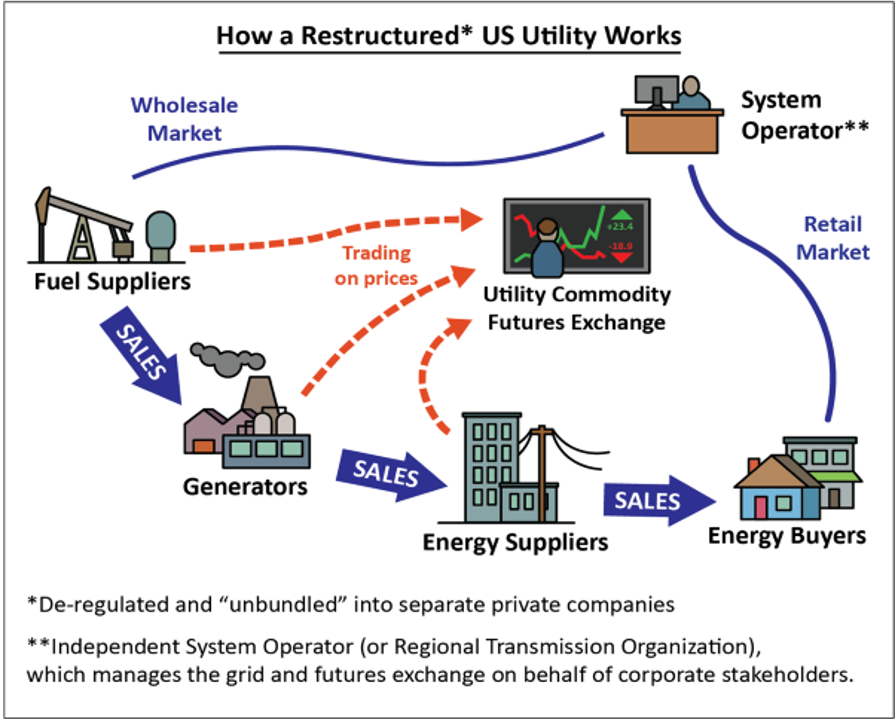

At the center of a ”restructured utility” (Figure 4 below) is an energy futures market. A System Operator manages the exchange where traders for energy companies offer competing bids for fuel and electricity prices for “same day” or “next day” dispatch of power, broken down by shorter intervals. Trading firms and banks also bid as “paper traders” who have no role in power generation, but seek to profit through arbitrage.

Figure 4: Diagram of components in a deregulated grid. Design and artwork by Roque Nonini.

But there’s a catch: Each utility market is overseen only for involved corporate shareholders. While states still have Public Utility Commissions, there is no public, media or regulatory access inside utility marketplaces. Even federal regulators rarely poke their head inside. In Canay Ozden-Schilling’s words, “The consumer-utility relationship fell out of sight” (2021, 46).

Problems with the Market Model

Many analysts see electricity as a poor candidate for market rules because it is so essential to modern life, making it price inelastic — supply and demand fails to curb profiteering. Ratepayers have little choice of suppliers. Electric current is hard to store, posing risks to reliability. And utilities may neglect low profit (but essential) tasks like grid maintenance.

Despite the notoriety of the 2000 Enron scandal in newly deregulated California, Texas politicians moved ahead on deregulation in 2002, hoping to lower electric rates. But that has not panned out. The Texas Coalition for Affordable Power found that 12 years later the 90% of Texans living in deregulated areas had paid $22 billion more for electricity than those in regulated areas. A similar pattern exists nationally.

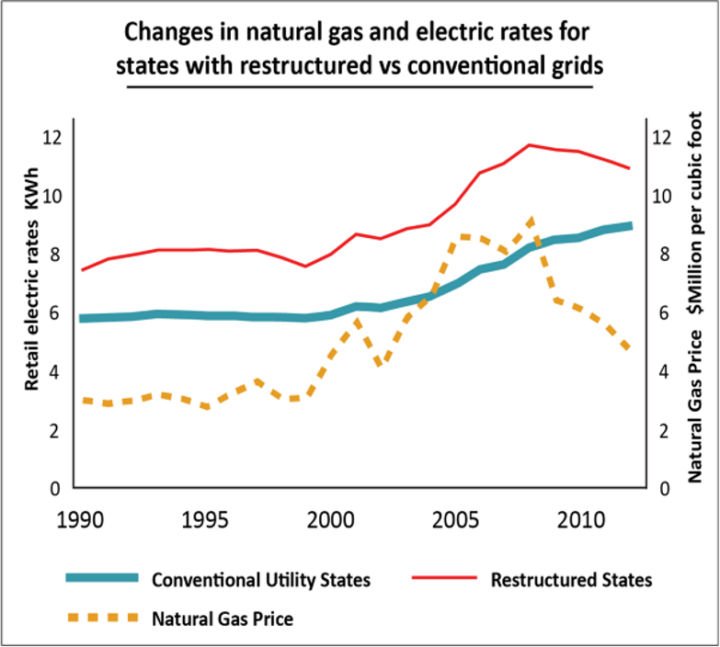

The wizard behind the curtain is natural gas, the most popular fuel in restructured systems. The gap between rates in the two types of systems widened as gas prices rose after 2005 then closed gradually as gas prices fell after 2010. (See Figure 5). Promotion of market-based systems was likely based on assumptions that “cheap natural gas was here to stay.”

Figure 5: US average retailelectric rates and natural gas prices–Source: Fig. 6 in Borenstein, Severin and James Bushnell 2015The U.S. Electricity Industry After 20 Years ofRestructuring. National Bureau of Economic Research. Working Paper 21113. April. Redrawn by Roque Nonini. Re-produced with permission.

The promise that restructuring would boost renewables also looks iffy. While some market-based grids expanded renewables, a 2022 comparative survey found overall slower uptake of solar and wind on restructured grid states than in other states.

Behind the Texas Freeze Blackout

So what went wrong in Texas? Two days after the February 15 blackout began Texas’ Republican Governor Greg Abbott went on Fox News to blame windmills. But he had to walk this back when reports showed that lack of natural gas for power plants caused 55% of the outages. Texas’ electricity was 46% gas-fired. Low gas supplies had reduced pressure in pipelines below the level power plants need to run.

Most power plants depended on “just-in-time” delivery of gas by pipelines from wells in nearby shale basins. But sub-freezing weather caused wellheads to freeze along with valves on gas processing equipment, which had not been weatherised. Power plants that needed to buy gas faced exorbitant prices from suppliers and many ran up huge debts.

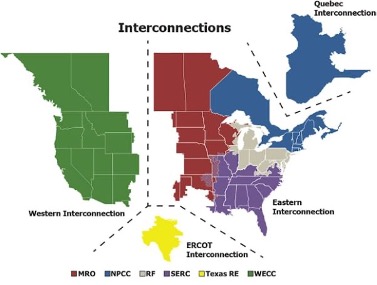

Cross-border grid sharing was not an option because Texan politicians had voted to isolate nearly all the state grid from other grids (Figure 6), in a bid to sidestep federal weatherization rules applying to inter-state grids.

Figure 6: Interconnections of United States electric grids. Source: National Electric Reliability Agency (NERC). Author’s archives.

As power plants tripped offline in the wee hours of February 15 the grid’s frequency dropped to dangerous levels, putting it within 5 minutes of total collapse. Operators initiated rolling blackouts to avoid a full grid failure which might have left the state in the dark for many weeks.

Texas had no backup power, so raising the wholesale price was the only way panicked regulators could incentivise more power plants to go online. DeAnn Walker, chair of the Texas PUC, raised the price to the maximum of $9,000 per MWh — the highest price cap of any state (400 times higher than average!). But the gas shortage precluded offline plants producing power so the high price made no difference.

The huge price surge led to roughly $50 billion in charges to electric consumers, bankrupting some companies. Later the public learned that there were also $16 billion in overcharges. Some officials proposed reversing the charges, but energy traders, who made millions in profits, lobbied the PUC intensely to reject repricing, and that is what commissioners did.

The Texas legislature supported only limited reforms, including weatherization of power plants, but exempted gas infrastructure despite gas shortages having caused the blackout. Gas pipeline companies had donated $6.3 million to seven top elected officials in recent years.

Winners and Losers: Luck or Corporate Fraud?

During the Freeze as citizens burned furniture to stay warm, gas companies, banks and trading firms that speculated on the futures exchange took home over $11 billion in profits. The big winners were Energy Transfer Partners ($2.4 billion) and Kinder Morgan ($1.4 billion), both of which held monopolies on gas pipelines and storage facilities. The CEO of Energy Transfer later donated $1 million to Gov. Abbott’s re-election fund.

But in 2023 a new class action lawsuit challenged the dominant narrative that weather had caused the blackout and may explain the huge corporate windfalls and root cause of the grid failure.

The lawsuit alleges that large gas companies curtailed gas in the lead-up to the storm to run up wholesale gas prices and enable profiteering. Betting on prices is legal, but manipulating gas supplies for profit is not. Gas prices at trading hubs in Texas soared more than 700-fold during the storm, affecting multiple states and adding billions in excess charges to power plants that had to buy gas.

CirclesX, a Texas energy data company, filed the suit against 92 pipeline companies and traders on behalf of Texans who incurred losses. CEO, Erik Simpson, had witnessed gas price manipulation decades earlier when he worked for Enron. He undertook a 2-year investigation of gas sales and pipeline transfers during the Freeze using proprietary software.

Supporting Evidence of Price Manipulation

The suit supports claims by many power plants of price gouging on gas. Simpson’s data allegedly shows that large gas suppliers with storage facilities moved gas from well-regulated interstate pipelines to loosely regulated intrastate pipelines before the storm. Suppliers then allegedly used the emergency to cancel deliveries of contracted (lower priced) fuel. In this period, gas firms allegedly traded that gas multiple times on the market to bid the price up, before selling their hoarded gas for lucrative profits on the spot (hub) market or to desperate power plants which lacked on-site storage and agreed to the high prices to stay in service.

Vistra, which runs five power plants, reported many cancellations of deliveries with suppliers citing “force majeure” (“act of God”) clauses. Curt Morgan, Vistra’s CEO, said that 70% of the cancelations took place before the temperature drop (Figure 7). Over half the drop in pipeline gas volume also preceded the blackout. Hundreds of lawsuits were filed after the storm.

Simpson believes companies routinely curtail gas to drive up prices during weather extremes, but this time speculation, combined with cold weather, led to a grid failure. Energy economist Ed Hirs told NPR that withholding in a tight market is common, noting “We teach the electricity game” at the University of Houston where he is based.

University of Texas-Austin researchers found evidence of large gas withdrawals at storage facilities a week ahead of the temperature drop. (Figure 7). Researchers noted that “regulators and policymakers have very limited information about contracts and hedging relationships.”

Figure 7: Timeline of events leading up to the Texas Freeze. Design and artwork by Roque Nonini.

Allegations from CirclesX fit with findings from phone logs that Walker, former Texas PUC chair, turned over to state legislators showing over 100 communications about the gas shortage, with briefings of the governor and legislators on Feb. 10 and 11, well ahead of the extreme weather (Figure 7). She was fired by the Governor after testifying. The Texas Attorney General began an investigation, but allies of Abbott stopped the effort.

Texas electric and gas customers are on the hook for higher utility rates plus fees from over $10 billion in state bonds issued to bail out indebted utilities and pay Freeze costs. The fees may remain on bills for up to 30 years.

Also, the Freeze-related gas price spike at Texas hubs drove up prices for power plants and consumers in states across the Midwest as far north as Minnesota.

But if electricity is to be the centerpiece of a renewable future, it means citizens, environmentalists and honest politicians are now burdened with the heavy lift of re-regulating the grid.

Discussion

Deregulation of utilities is best understood as part of a juggernaut of corporate activism after 1980 aimed at recovering avenues of capital accumulation following blows to profitability from a high interest rates and a decade of high oil prices. As Michael Hudson observed, privatised utilities offer corporations both a source of rents and the security of monthly payments by ratepayers enmeshed in bureaucracies and dependent on electricity.

Allowing opaque futures exchanges to set prices inside utilities created a form of shadow banking on the sly – a tactical nuke slipped into thousands of pages of economistic jargon with few lawmakers grasping the risks of high-speed trading and derivatives. For oil and gas corporations, shadow banking profits help liberate them from the heavy lift and unsustainable landed extraction of mineral wealth and tie profits instead to the apparatus of the state.

But if electricity is to be the centerpiece of a renewable future, it means citizens, environmentalists and honest politicians are now burdened with the heavy lift of re-regulating the grid.

Featured image: A woman sits in cart in line of people waiting for grocery store to open in Austin, TX, created using Chat GPT.

Notes

Abstract: This essay offers an alternative narrative on the 2021 Texas Freeze blackout, raising questions about natural gas-fired electricity and the need for closer public oversight of electric utilities. This is important given the role of electricity in the green transition and the rising frequency of extreme climate events. The Freeze left 10 million people in bitter cold for days, caused over 200 deaths and over $130B in state debts, much of it passed to ratepayers. The blackout was initially blamed on frigid cold and poor weatherization. But suspicion also fell on the state’s deregulated electric grid which uses a futures market to dispatch fuel and energy. Traders speculating in this energy market took home over $11B in profits. In 2023 a class action suit based on new data from gas flows connected such speculative gains to alleged price gouging by large gas suppliers. The companies allegedly curtailed gas in pipelines days ahead of the storm to drive up prices. Their actions may have actually triggered the blackout. The essay offers a brief history of electric deregulation and uses the story of the Texas Freeze to illustrate how such grids raise risks for grid reliability and electricity affordability. I argue that restoring public regulation of utility energy markets may be crucial to the green transition.