THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Budgeting can be complicated, and it’s easy to fall into bad budgeting habits without noticing the problem.

Budgeting mistakes can make it much more difficult to reach your financial goals, so it’s important to identify any issues that could be holding you back.

Everyone’s budgeting experience is different, but there are a number of typical errors that you may not be aware of.

This article will cover a few of the most commonly overlooked budgeting mistakes and how you can adjust your approach to fix them.

| Budget Mistake | Budget Fix |

|---|---|

| Too Strict | Allow fun money in your budget |

| Not Getting Out of Debt | Budget for more money to pay down debt |

| Not Having Goals | Create short and long term financial goals |

| Forgetting About Unexpected Costs | Build an emergency fund |

| Forgetting About Small Expenses | Review previous statements to find all your spending |

| Budgeting Alone | Find an accountability partner |

| Manually Budgeting | Use an app |

| Not Enough Money to Cover Budget Expenses | Boost income with side hustles |

| Impulse Spending | Identify and fix spending issues |

| Using The Wrong Budget | Find the right budget method for your situation |

| Forgetting About Bills | Set up reminders |

| Setting Your Budget in Stone | Review your budget and adjust when needed |

12 Budget Mistakes Too Many People Make

#1. Stop Being So Strict

It’s good to take budgeting seriously, but being overly tight with spending can actually have a negative effect.

Trying to cut out things like entertainment and hobbies will only make you resent your budget, and you’ll be more likely to ignore your financial goals by making an impulse purchase.

I’m guilty of this one.

Back when I created my first budget, I completely cut out entertainment.

It was great for a little while, but eventually I got angry and ended up overspending on my credit cards.

How to fix it: Include leisure costs in your budget.

While there’s nothing wrong with trying to reduce how much you spend on things you don’t need, that doesn’t mean you should go too far in the opposite direction.

Be realistic about how much you want to spend on fun, and try not to let yourself feel bad about having a good time.

Begin by looking through previous bank statements to track how much you usually spend on these costs.

From there, you can determine whether you’re content with your existing habits or need to make an adjustment.

If you do decide to start spending less, aim for small, gradual changes rather than changing your lifestyle immediately.

#2. Budget For More Than Minimum Payments

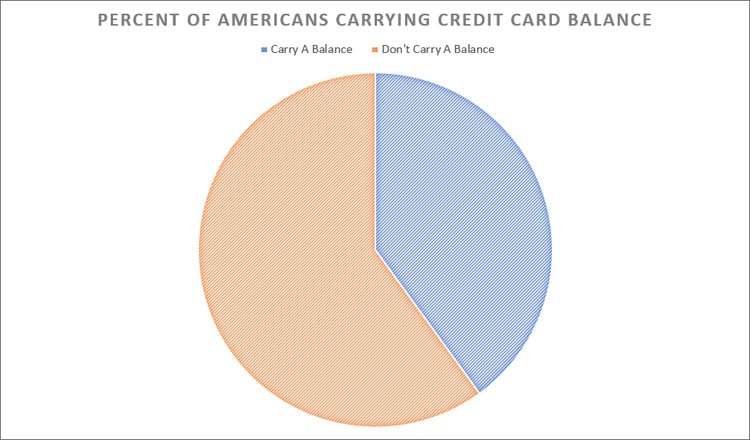

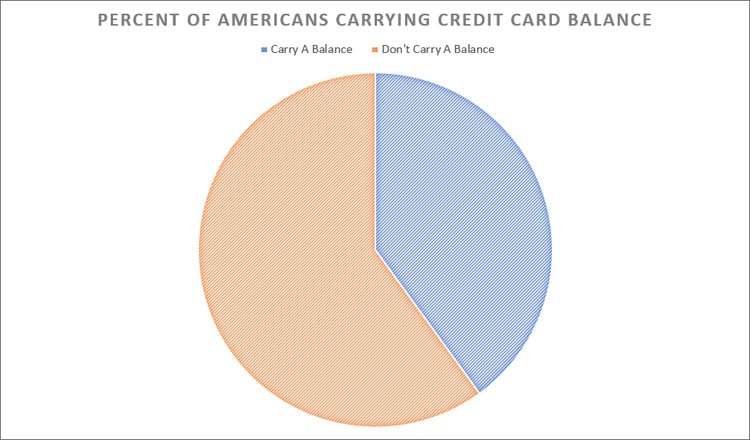

Nearly 40% of American households carry a credit card balance from one month to the next, and they might not consider this debt an important financial concern.

“I’ve made the minimum payment, so I’m good, right?” is the general thought process.

The truth is that credit cards usually come with extremely high interest rates compared to other forms of credit, and over time, the interest accrual will kill your budget.

Paying off debt isn’t an exciting way to use the extra money in your paycheck, but the balance will only continue to grow if you don’t start making payments.

The average credit card interest rate is over 14% for existing accounts and more than 19 percent for new accounts.

How to fix it: Increase the amount you budget for credit card payments.

You might feel overwhelmed by your credit card balance and other debts, but you can start moving toward becoming debt-free by putting as much as you can toward them.

Since debts grow the longer the balance remains unpaid, they should always be one of your top financial priorities.

If you’re currently managing multiple debts, start by paying down the balance with the highest interest rate before moving to the lowest, also known as the debt avalanche method.

This is the most efficient way to get out of debt while avoiding as much interest as possible.

#3. Use Goals to Power Your Budgeting

If you can’t connect your budgeting habits to real-life goals, it will be tough to stick to your budget when you have no motivation.

When you’re simply choosing between a free budget template (perhaps one you found online) and something you really want, there’s a good chance you’ll give yourself immediate satisfaction.

You need to connect your budget to real, actual goals.

Why are you going through this monthly exercise of budgeting and sticking to it? You need to write down exactly why you’re doing this.

And of course, vague or generic goals probably won’t help you stay motivated.

Some people try to “save money” without committing to anything specific, but this isn’t usually an effective long-term approach.

I’ve found that I need to be extremely detailed with my goals in order to be motivated by them.

How to fix it: Define your short and long-term goals.

Budgeting is almost always beneficial, but it’s easier to stay committed if you’re targeting both short and long-term financial goals.

Rather than spending less just to be more frugal, you’ll be moving toward a tangible goal like starting to invest, saving for retirement, or building a college fund for a loved one.

For the same reasons, it’s best to come up with a concrete, measurable goal each month.

Start with something small, even just $25 or $50 per month will go a long way.

When you’re tempted by something you don’t need, keep both your immediate and long-term needs in mind.

It’s easier to hold off when you believe the money you save is going to something more important.

And here is a bonus tip I use. I create a vision board in my journal.

It has images of my goals and I review them every morning.

This lights a fire inside me that carries through the entire day to be smart with my money so I can reach my goals.

#4. Include Unexpected Costs In Your Budget

It’s easy to budget for recurring and regular expenses like groceries, subscriptions, and gas, but things get more complicated for new or one-time costs.

If you need to go to the dentist and take your cat to the vet in the same month, you’ll find yourself going over budget quickly.

When unavoidable expenses completely change your budgeting plans, it can be tough to get back on track.

In order to budget effectively, you’ll need to maintain a long-term outlook that takes costs into account before they come up.

This will help you avoid financial surprises and stick to your budget without breaking the bank for major expenses.

How to fix it: Build an emergency fund and budget for surprises.

With an emergency fund, you’ll be able to cover unexpected costs that would otherwise derail your budget.

Once you’ve saved enough money, your emergency fund will also be your first fallback if you lose your primary source of income.

Many experts therefore recommend building a fund equal to at least three months of expenses.

It will take time to reach that goal, but just a few hundred dollars will help you get through a range of difficult financial situations.

Even if you’re currently in debt, it’s still a good idea to put at least some of your paycheck toward an emergency fund if you don’t already have one.

Just as an emergency fund gives you some insurance for surprise expenses, you can budget for the costs you are expecting by starting to think about them a few months in advance.

If your ten-year anniversary is coming up, for example, don’t wait until that month to budget for the cost of a gift.

Instead, identify it as a future expense around six months in advance, then divide the cost and save a fraction of the total each month.

Rather than budgeting for $300 all at once, for example, you can start taking $50 out of your paycheck six months beforehand and distribute the savings more evenly.

If the seller offers financing with little or no interest, take advantage of this option to give yourself even more time to pay off the debt.

If you know you’ll have six months to make payments, for example, you could divide that initial $300 into twelve payments of just $25.

The more you can spread out these costs, the easier it becomes to account for them in your monthly budget.

#5. Focus on the Small Stuff Too

When you first started budgeting, you probably focused on the largest and most obvious expenses.

It’s satisfying to save a lot of money with a single change, and this is undoubtedly the simplest way to budget.

On the other hand, when you prioritize your most expensive purchases each month, it’s easy to forget how quickly the smaller things add up.

You could be spending a lot less (and taking some pressure off of other changes) by regularly reviewing the less conspicuous areas of your budget.

How to fix it: Review your statements every month.

Most of us lose track of how much we spend on things like subscriptions, coffee, and nights out, but these are often the expenses that put us in financial trouble.

Rather than being satisfied with a few changes, make sure to thoroughly examine your bank statements at the end of each month to see exactly where your money is going.

If you’re having trouble staying on top of your budget, consider downloading one of the many free and low-cost mobile apps designed for users new to budgeting.

They’ll help you categorize your expenses, set up automatic payments, and make the best adjustments to start moving in the right direction.

Once you develop the habit of looking over your statements, you’ll start to get an idea of your most problematic spending habits.

From there, you can begin to develop realistic financial goals that match your current budget and long-term needs.

By evaluating your budget every month, you can adjust your goals based on lifestyle changes or results from the previous month.

Your budget shouldn’t be static. It’s important to consistently adapt your approach to your current financial circumstances.

#6. Find Ways to Cultivate Accountability

Many compare budgeting to dieting.

If you don’t like dealing with money and have no incentive to change, change likely won’t happen.

How to fix it: Find an accountability partner.

Another option for you, if you have trouble sticking to your budget, is to ask someone close to you to check in on your progress and hold you accountable for your decisions.

Make sure this is someone you trust completely.

It’s important that they’ll tell you the truth if things aren’t going well.

With an accountability partner, you won’t be able to shrug things off if you miss your targets.

In the same way that an exercise partner can help you keep making progress even when you aren’t motivated, accountability partners give you another reason to stick to your budget.

#7. Use Technology to Identify Better Strategies and Errors

Budgeting using a pad and paper can make it extremely difficult to stay on top of your spending.

You have to constantly update your budget physically, which is easy to avoid doing.

More than that, the potential for human error means that you can make mistakes that will cost you money.

How to fix it: Use a budgeting app.

Budgeting apps make it easier to stay on top of your net worth, transactions, and even your existing debt.

With the right app, it makes it easier to budget and identify errors in your spending that you didn’t notice before (such as forgotten subscriptions that you didn’t account for in your budget).

#8. Boost Your Income

Reducing your spending will help you budget with greater ease.

However, it’s only one-half of the equation.

In order to make budgeting and financial planning easier on you, you will need to have more income flowing in.

If you feel like you can’t spend any less to make your budget possible, there are solutions.

How to fix it: Boost your income.

The key to dealing with budgeting that seems far too restrictive and impossible to maintain is to look for ways to generate more income.

There are plenty of ideas out there that can help you make more money.

Depending on your time or your abilities, you could pick up a part-time job, freelance, take on a side hustle, or look for small ways to generate income, like taking surveys.

Every penny counts!

#9. Identify Your Spending Weaknesses

Some people never struggle with a desire to fend off impulse purchases.

Others have a very difficult time saying “no” to themselves when it comes to spending money.

Those in the latter category struggle with budgeting because all of their money is being spent on non-essentials.

It’s okay to treat yourself every once in a while, but impulse spending or retail therapy can quickly grow out of control, plunge you into debt, and put your health and safety at risk.

How to fix it: Identify your weakness and take action to stop buying things.

The first step is to see where you’re overspending. For example, you may be someone who loves to buy collectibles or sign up for subscription boxes.

Once you’ve figured out where you’re overspending, take the appropriate action.

If you tend to use your credit to buy things you want, lock up your credit cards temporarily.

If you use saved online payments for impulse purchases, delete them from your phone.

The harder you make it to shop impulsively, the less strain you’ll put on yourself and your budget.

#10. Recognize That Some Budgets May Not Fit You

Returning back to the dieting comparison, some people may start a budget, only to get discouraged when they aren’t seeing results.

This may be due to people picking up whatever budget they hear of first and then trying it out.

The 50/30/20 budget might be popular, but that doesn’t mean that it’s going to work for everyone.

How to fix it: Try several budgeting methods.

When one budget works for you, you don’t have to necessarily try to make it work.

There are other budgeting methods out there that may be more suitable for your financial situation.

Whether it’s zero-based budgeting, the cash envelope system, or something else altogether, experiment with several budgets until you find that’s the right fit for you.

#11. Establish Reminders for Bills and Other Expenses

Budgeting only works when you are on top of your financial responsibilities.

Missing monthly bills or forgetting about infrequent expenses can quickly make budgeting a nightmare.

It’s easy to end up falling behind, which creates unnecessary obstacles for you.

How to fix it: Set up reminders for all of your bills.

If you have reminders that you need to pay your bills activated on your phone, you know what you need to pay and when you need to pay it.

This helps you stay on top of your expenses so your money is leaving your account as planned.

Pro tip: Schedule reminders ahead of time for infrequent expenses like preventative car maintenance or birthday gifts.

#12. Identify Adjustment Periods and Change With Your Financial Needs

Budgets are not something you can set and forget.

If you’ve noticed that your budget is suddenly not working, there’s something going on behind the scenes.

What does this mean for you? It generally means it’s time for a change.

How to fix it: Adjust your budget as needed.

Has your income gone down due to a demotion? Have utilities and food prices started to spike? Are you spending more due to health issues you’re experiencing?

All of these scenarios will influence your budget.

Take notice of when life circumstances and change your budget as your financial needs and circumstances shift.

Final Thoughts

Budgeting is the best way to build better spending habits, but many people give up on their budgets in the first few months.

These tips will help you develop realistic expectations and create the budget that’s right for your income, expenses, and financial goals.

Remember to check your statements every month to look for even more ways to save money.