I have talked to both investors who only invest in stocks but are trying to invest in unit trust and also investors who only invest in unit trust but never invest in stocks.

I learn over time that something as simple as the buying and selling process may be intuitive for me but can be scary if you never did it before. If you are unsure, you will procrastinate and not buy.

I should try my best to dumb down some of these stuff if I can.

One of the main differences between buying a unit trust off a distribution platform and buying an exchange traded fund (ETF) through a broker like Interactive Brokers is you have to learn how a brokerage trade system work.

If you want to invest $5000 in a unit trust, you key into your system that you wish to buy $5000 worth of XXX. Your unit trust purchase will transact with the NAV price at the end of the day.

An ETF is listed on a stock exchange and one of the thing you need to figure out is this buying and selling queue system. You can only buy/sell when there is an agreement between the buyer and seller at a certain price. If there is no agreement, no sale take place.

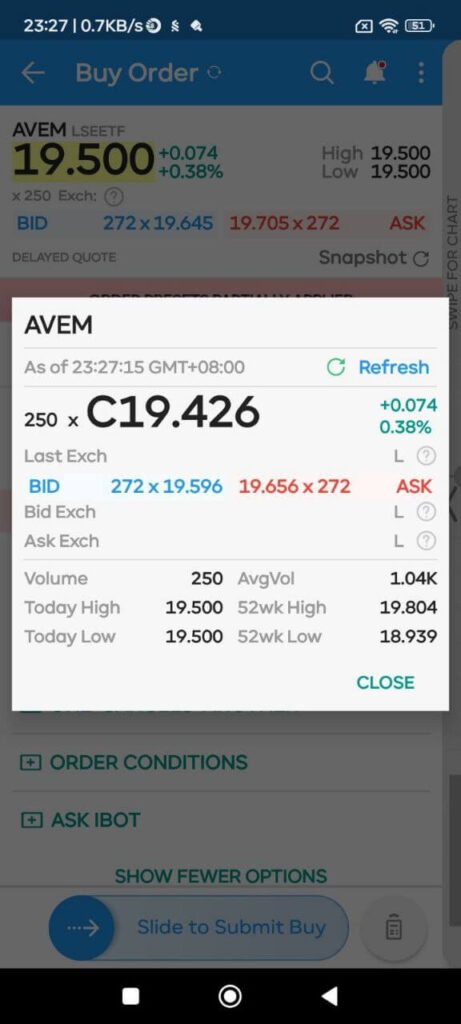

Let me use a screen from Interactive Brokers of a prospective ETF that one may wish to purchase as an example:

Suppose I wish to purchase this ETF AVEM (Avantis Emerging Markets UCITS ETF) listed on the London Stock Exchange. You can see in the top but faded part which shows the ticker (AVEM) and the exchange it is listed at (LSEETF). The same ticker can trade in multiple exchange and these two together help you identify correctly what you intend to buy.

The current price is at $19.50 (faded not the one in the foreground) and it has gain $0.074 or 0.38% for the day since the open. You can also see a bid of 272 x 19.645 and a ask of 272 19.705.

The bid is the front of the queue of the people queuing to buy. If you are buying you are queuing at the buy queue. The ask is the front of the queue of the people queuing to sell. If you are selling you are queuing at the sell queue.

The faded part means at the front of the buy and sell queue, 272 shares are queuing at 19.645 and 19.705. The price here is not exact.

So how does one transact?

You need to wait until someone who is queuing to sell is willing to sell as low as 19.645 for transaction to take place. Or for someone who is queuing to buy that is willing to buy as high as 19.705 for the transaction to take place.

This is a trading exchange essentially.

Now, the prices that you see ($19.645 and $19.705) are not the updated prices. These prices are delayed by 20 minutes.

Then how do you know what is the current price?

Interactive Brokers provide a Snapshot function (see under the faded part there is a Snapshot with a wheel next to it). If you click on it, Interactive Brokers will fetch the latest bid and ask prices for you to make a decision at a small cost. Don’t worry about the cost, it has never been a concern.

When you press the Snapshot, you see the smaller box in the foreground which shows a

- Bid 272 x $19.596

- Ask 272 x $19.656

This is the current front of the buy and sell queue. With this you are able to make a decision the price you purchase it at.

The different between the Bid and the Ask is what people say is the bid-ask spread. In this case it is ($19.656 – $19.596)/$19.596 = 0.30%.

The bid-ask spread shows the trading liquidity of the ETF. The smaller this spread the more liquid. Of course this is what is shown on the interface but if you have large enough quantity, you might be able to transact at a different price offline.

If you are desperate to buy, you pay 0.30% more than those at the front of the queue to buy at the ask ($19.656). If you are desperate to sell, you pay 0.30% more than those at the front of the queue to sell at the bid ($19.596)

Different ETFs have Different Bid-Ask Spread, at Different Time of the Day

The Bid-Ask spread vary from stock to stock, ETF to ETF. Some stocks don’t have much shares outstanding if you don’t consider those major shareholders. People say that the float is small.

The number of people who wish to trade the stock is not a lot and so even if you want to buy or sell, you have a problem. The bid-ask spread tends to be wider. Locally, you can see Vicom and Global Testing as examples.

ETFs have less of this problem because there are market makers whose job is to “create the market” by facilitating ETF units to buy and sell. They earn something from that bid-ask spread.

Still, some ETF have narrower bid-ask spread than others.

The bid-ask spread changes at different time in the day as well.

I have listed the bid price, ask price and the spread of some of the ETF I own or look at below:

London Stock Exchange usually start trading at 3.30pm Singapore Time or 4pm Singapore Time.

Some of those ETF with wider spread will be MOTU, IFSW, AVEM. Those with narrower spread will be AGGU.

Those spread were taken at 4pm.

Here is the spread at 7pm:

Not much difference.

Here is the spread at 9pm:

IOGP and GGRA got much wider.

Here is the spread at 11pm:

Some of the spread of the ETF became narrower. The US market start trading around 9.30 or 10.30 Singapore time.

I notice that after US market starts trading the bid and ask spread tend to be narrower. If you observe something different, do let me know.

This means that if you wish to buy or sell with more narrow spread, doing it after the US market open for trading might be better.

Addressing the Wider Bid-Ask Spread Compared to the US-Traded ETFs

Some investors will justify their decision to invest in US ETFs, as compare to UCITS ETFs listed in European exchange by pointing to the tighter bid-ask spread.

I have a part philosophical and part rational view to that.

Before I start, I am looking at this through the lens of longer-term investors with a strategic portfolio strategy. This means you buy and don’t change your allocation much, other than rebalancing.

Firstly, for that $1 of investment, you are subjected to that bid-ask spread once.

If you invest that $1 and never have to sell until 20 years later, that 0.30% one-time spread is going to be spread out over a long time.

Secondly, that cost is wide but not egregious.

You got to ask yourself: Are you executing a trading strategy that a cost of 10-30 basis points makes significant difference?

If yes, then this bid-ask spread is definitely a problem.

If your strategy is so long term, this bid-ask spread is not going to be a big factor in the long run.

Would you worry over this small bid-ask wide spread but potentially jeopardize your family’s estate by ignoring the higher magnitude estate tax consideration?

I have a solution for you if this cost is still an issue.

You wait to buy during a 1% down day. After a 1% down day, your price even after factoring the bid-ask spread will still be lower. Do the opposite for selling.

But Kyith isn’t this timing the market?

Yes it is, but what I am suggesting is not something so advanced, difficult to execute or something that you have to wait for a long time.

Sometimes I wonder in amazement why people will just queue and don’t buy and sell when there is a high chance there is a rally to take advantage or a market drawdown to avoid. Wouldn’t the potential gain/loss be much bigger than this spread?

I don’t know man.

This is how I look at it.

I think if I see that the bid-ask spread to be any different from this, I will try and provide some updates. That is the little thing that I can help readers with.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

The post The Bid-Ask Spread Seems to Be Tighter for UCITS ETFs Deeper into the Night. appeared first on Investment Moats.