Key AP automation features

You’re eager to see how automating your AP will save your organization time and reduce errors. However, not all AP automation solutions are the same. For instance, some solutions require complex integrations to work or will need more manual oversight than others. When making a selection, you want to think about the needs of your finance team, what’s going to add the most value to your business and whether the solution will scale as you grow. Otherwise, you’ll have to restart the process once you reach a certain size. As you seek out an AP automation solution, here are a few key features you should look for and why they add value:

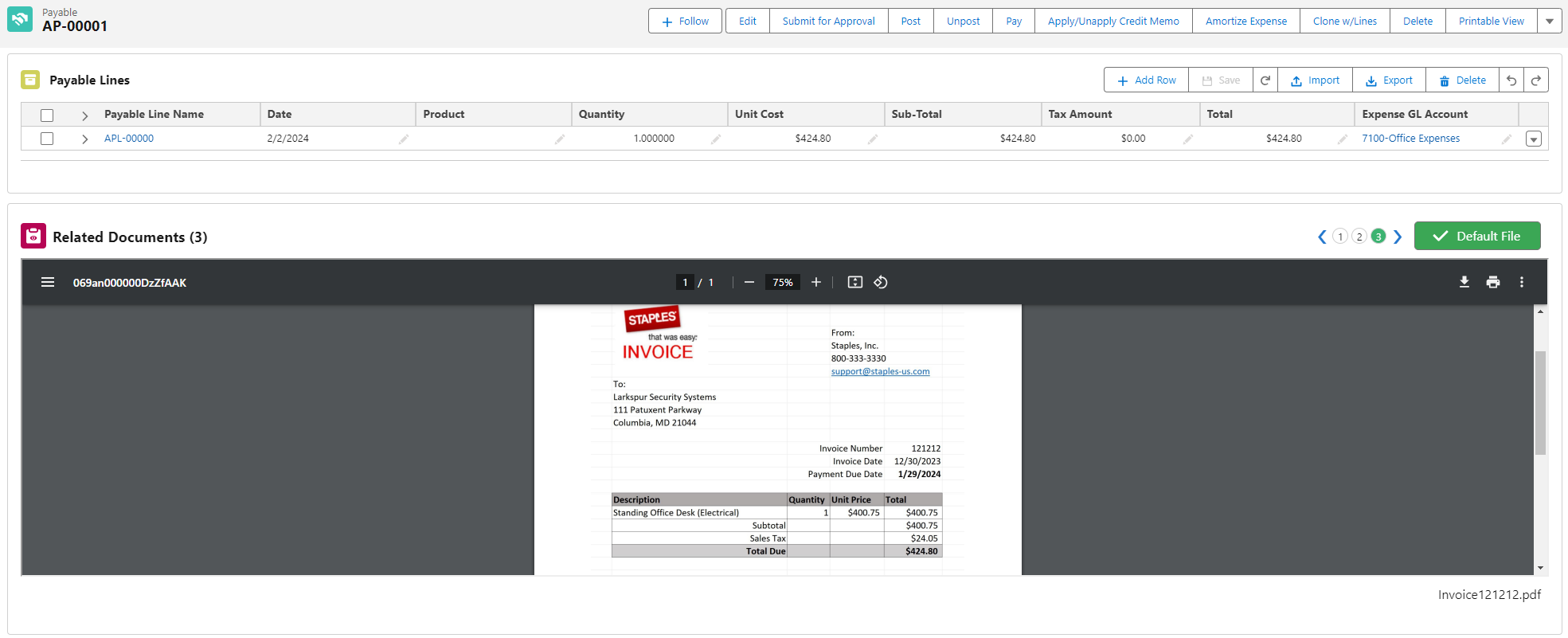

Automatically create payables via email

An automated AP solution streamlines the entry of bills into your system with automated email processing. Vendors send their invoices to a designated email address, where they are automatically picked up and a payable is created. The system intelligently matches the vendor based on the sender’s information, minimizing manual input. An image of the bill is displayed on-screen, allowing you to quickly review and complete any additional fields before saving and posting the payable. This feature reduces errors, speeds up data entry, and ensures all invoices are accounted for in real-time.

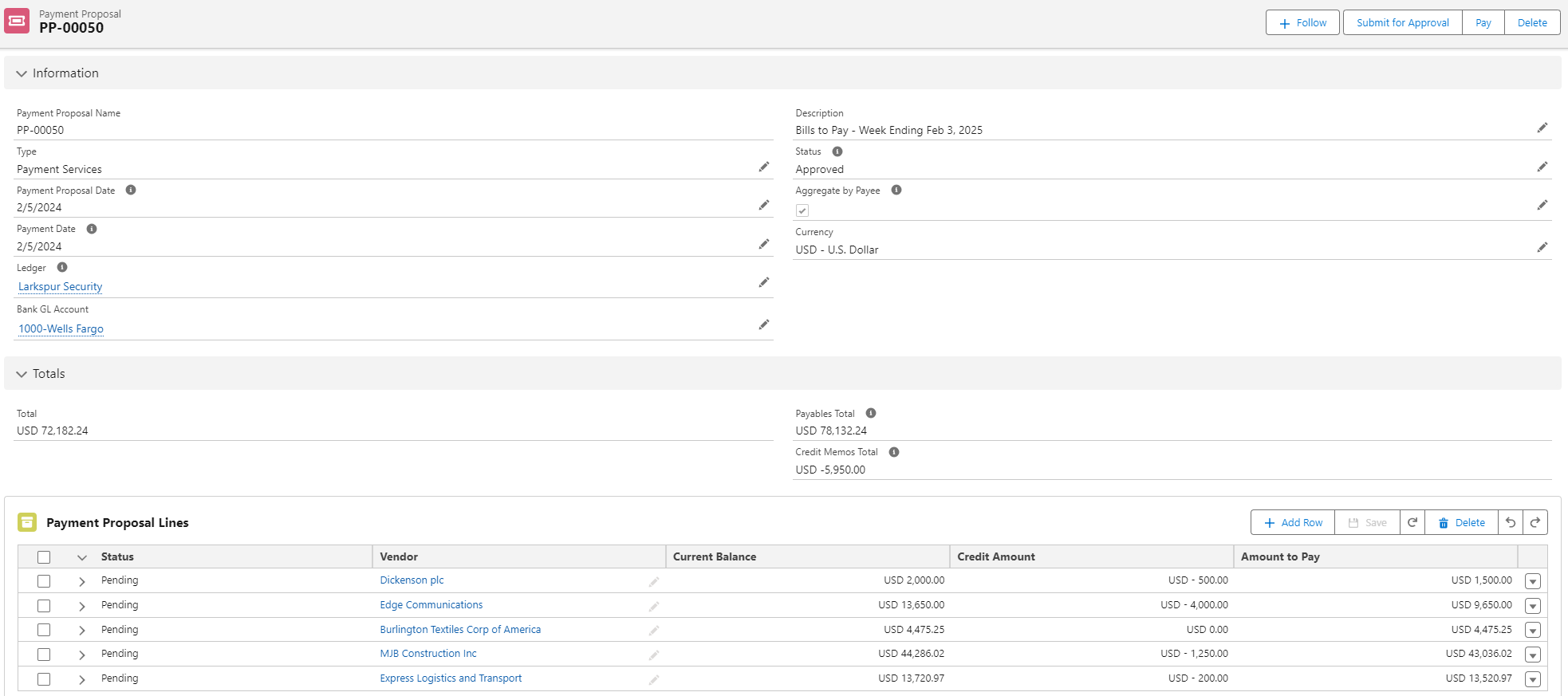

Share a payment proposal for approval

Payment proposals simplify the time-consuming process of identifying and grouping bills for payment. Whether you’re paying a single vendor or managing complex searches—like grouping all bills from a specific project or those offering early-payment discounts—this feature makes it easy. Ideally the system you choose can automatically calculate discounts based on your payment schedule, ensuring you never miss out on savings.

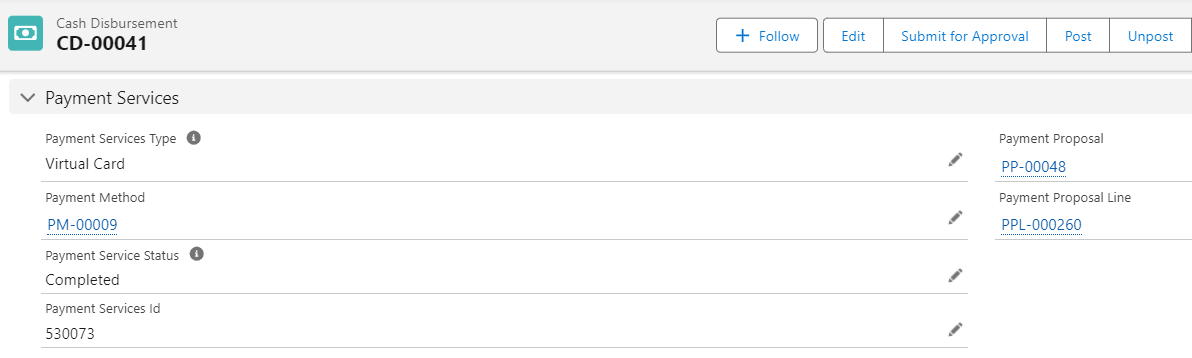

Disburse funds faster

Once payment proposals are approved, automated payment distribution ensures the timely disbursement of funds. Scheduled jobs automatically handle the payment of approved batches, creating cash disbursement records, applying credit memos, and distributing payments via the vendor’s preferred method—whether that’s a virtual card, ACH, or check. This feature not only saves time but also reduces the risk of errors and fraud, while providing vendors with timely payments and detailed remittance advice.

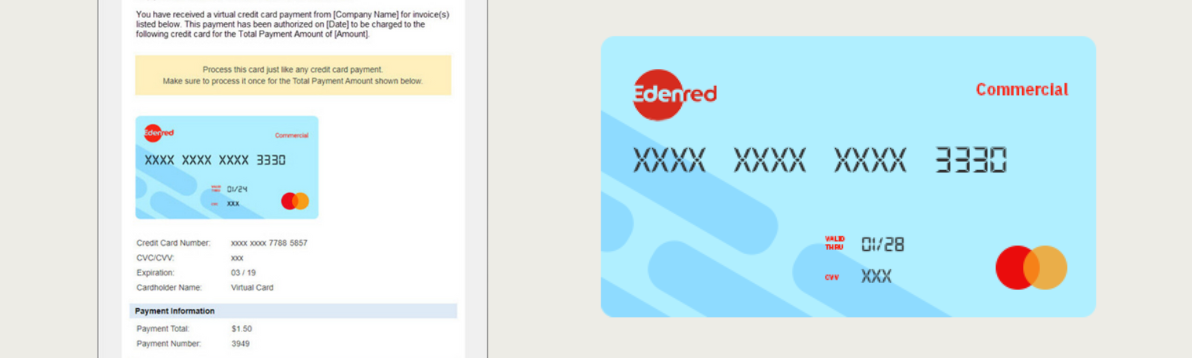

Secure payments through virtual cards

Increase security and reduce transaction costs with virtual cards—single-use credit card numbers generated for specific vendor payments. By using virtual cards, you eliminate the need for physical checks, reduce the risk of fraud, and avoid transaction fees typically associated with traditional payment methods. Each payment is tightly controlled and easily tracked, providing an additional layer of security for your AP process.