I’m still occasionally asked what my FIRE number is and while I did have a number in mind when I started my journey, I realised that over time, it was not so simple as it really depended on what kind of life I was going to live and enjoy post-work, so the goal had become a moving, fluctuating target.

Sometimes, I get in my head that I will travel and visit some of (not all of, since I’m not aiming for Fat FIRE!) the places around the world I’ve always fancied visiting. The FIRE number goes massively up.

Other times (and more often of late), I think about just enjoying my home comforts, pottering around the garden, learning new stuff, new not-too-expensive hobbies, improving my knowledge on things I already (think I) know such as investing and committing to some regular volunteering. The FIRE number goes a bit lower.

I think it will likely be something in between the above.

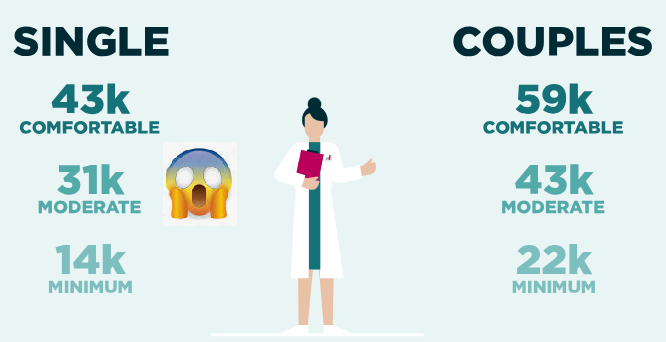

For many years, I had loosely based my future required income on a ‘Moderate’ standard of living as cited by Retirement Living Standards (RLS), namely an income for a single person of £23.3k, rounded up in my spreadsheets to £24k per year/£2k a month.

However, as I mentioned last year, the RLS adjusted their numbers, accounting for higher cost of living and I was rather shocked.

A jump from £23k to £31k! At the time, my hopes were quite dented, adjusting the required income to £31k, my spreadsheets would need to be extended by a few more rows and columns and I would need to work out how much i) more I needed to save, ii) more my investments needed to grow by, and iii) longer I needed to work.

For me, I mean, I’m not sure what I would spend £31k on, if I had it? I’d have to be frivolous and wasteful.

Those were my words, so I resolved to show how wrong RLS could be by tracking my own spending for 2024. My own guess on my spending? Being generous, £29k max.

Tracking

The last time I was logging my spending to the nearest penny/pound, I had been up to my eyeballs in credit card debt and trying to desperately clear it, so this was not an exercise I particularly enjoyed doing due to some not-so-great memories. However, it was something I felt I needed to do and which I had put off for far too long.

By month 4 of tracking, I saw with growing dread how wrong I was – not on my usual household monthly household spending, which I already knew was around £1.5k a month but so wrong on everything else.

My costs of living have gone up but not just the essentials – what I spent living my life appear to have spiralled, lifestyle inflation doing its thing.

My social life is nowhere as active as it used to be but when I do go out, I seem to spend quite a lot.

I did not think I had so many lunches out.

I spend a lot on birthday presents for friends and family. I have a big family.

I spend a lot more when I’m on holiday than I thought I did.

By the end of the year, my disbelieving eyes saw that the total I spent was £33,157.71.

How did that happen? I was shocked and dismayed that if I take off the £1.7k unexpected car repairs I paid earlier in the year (covered by my emergency fund), my spending comes out as pretty much the £31k cited by RLS. Damn you for being right shakes fist>!

I have, it appears, been in my own words, ‘frivolous and wasteful’. Except I haven’t been, I’ve just been living my life.

To get a more accurate picture of my spending, I should track another year but I can’t face doing this exercise again, no matter how useful it will be. Mentally, I was really struggling by month 8, my thoughts often in a cloud, drawn back to the dark days of tracking my spending and extreme budgeting as I tried to pay down my debts.

Anyway, the fluffy wool has been pulled away from my eyes and I know that £24k income is not enough for my lifestyle.

What to do, what to do?

One good bit of news to come out of tracking my spending was that I still really don’t spend much on myself and I don’t feel like I am doing without.

So do I rein in my spending on the other stuff?

But I like the life I’m living so I’m not sure that I want to change too much, although I will be having discussions with my friends on more budget-friendly places for our outings and lunches. We used to be quite good at looking for places with discounts and special offers so I will start with those suggestions again I think.

I can’t see me stopping my trips to London to watch sporting events like Wimbledon and the NFL – tickets are not guaranteed for these events so if I can grab them, I will, (though not at any ridiculous cost).

So I’ve resigned to adjusting my spreadsheets to account for £31k retirement income and begin mulling over how my FF can provide such income for my post-work life.

I’m planning to look at decumulation again at some point, I touched upon it briefly four years ago but need to figure out more detail so I can plan more realistically.

Let’s hope I can articulate my thoughts into something which makes sense – it already hurts my brain just contemplating it!

Anybody else find out recently that their spending has spiralled and caught them unawares? Have you had to adjust your FIRE plans?