Stock Market Outlook entering the Week of February 23rd = Uptrend

- ADX Directional Indicators: Downtrend

- Institutional Activity (Price & Volume): Mixed

- On Balance Volume Indicator: Uptrend

ANALYSIS

The stock market outlook remains in an uptrend, although Friday’s sell-off damaged bullish sentiment.

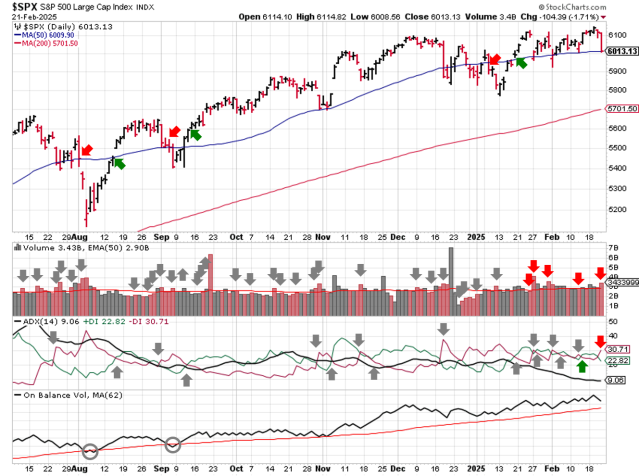

The S&P500 ( $SPX ) fell 1.7% last week. The index is at the 50-day moving average and ~6% above the 200-day moving average.

SPX Price & Volume Chart for Feb 23 2025

The ADX filled back to a downtrend during Friday’s sell-off. Institutional activity moved to mixed, since the index retreated to the 50-day. Distribution days are elevated, but not in the danger zone…yet.

S&P Sector Performance for Week 08 of 2025

The Energy sector ( $XLE ) provided shelter from the selloff, leading all sectors higher last week while upshifting to a bullish bias. Consumer Discretionary ( $XLY ) was the worst performer and moved from neutral to bearish bias along with Industrials. Materials ( $XLB ) and Technology ( $XLK ) moved back to neutral bias.

Sector Style Performance for Week 08 of 2025

High Dividend ( $MTUM ) was the best performer last week; Small Cap Growth ( $IWO ) was the worst.

Quality ( $QUAL ) moved back to neutral bias, High Dividend ( $SPHD ) moved to bullish bias, and High Beta ( $SPHB ), Large Cap Growth ( $IWF ), Mid Cap Value ( $IJJ ), and Defensive ( $POWA ) moved to bearish.

Asset Class Performance for Week 08 2025

U.S. Bonds outperformed last week, indicating a flight to safety for some investors. The increase pushed bonds back to a bullish bias. On the downside, U.S. equities, Oil, and Bitcoin ( $IBIT ) all fought for last place, with equities and oil falling to bearish and neutral bias, respectively.

COMMENTARY

You probably noticed that our bias indicator is swinging back and forth between bullish and bearish, much like the ADX. Whipsaws are a feature of all signal-based processes, not a bug. Shorter timeframes tend to flip more often than longer timeframes, but it can lower your level of confidence regardless. That’s why it’s important to confirm any signal with some other “test”, rather than trying to guess when prices will bottom or top.

Typically, a shift in bias indicates a change portfolio allocations and risk management strategies used by institutional investors ( i.e. the big money ). They can adjust many aspects of their holdings, including exposure to asset classes, sectors, styles, and/or strategies.

Right now, a change in capital flows isn’t surprising, given the new political agenda within the United States. Some actions create higher uncertainty ( risk ), others re-prioritize investment theses ( e.g. green energy ).

Don’t underestimate the impact of corporate capital expenditures, particularly in the Ai-related areas. Many companies are wrestling with the implications of innovations like DeepSeek Ai, which could ripple through the semiconductor value chain.

Speaking of semiconductors, all eyes are on Nvidia ( $NVDA ) earnings this week, to be released Wednesday after market close. We also get Durable Goods orders and the 2nd Q4 GDP estimate on Thursday, as well as the latest PCE inflation data on Friday.

Best to Your Week!

P.S. If you find this research helpful, please tell a friend.

If you don’t, tell an enemy.