The AI private market is further heating up.

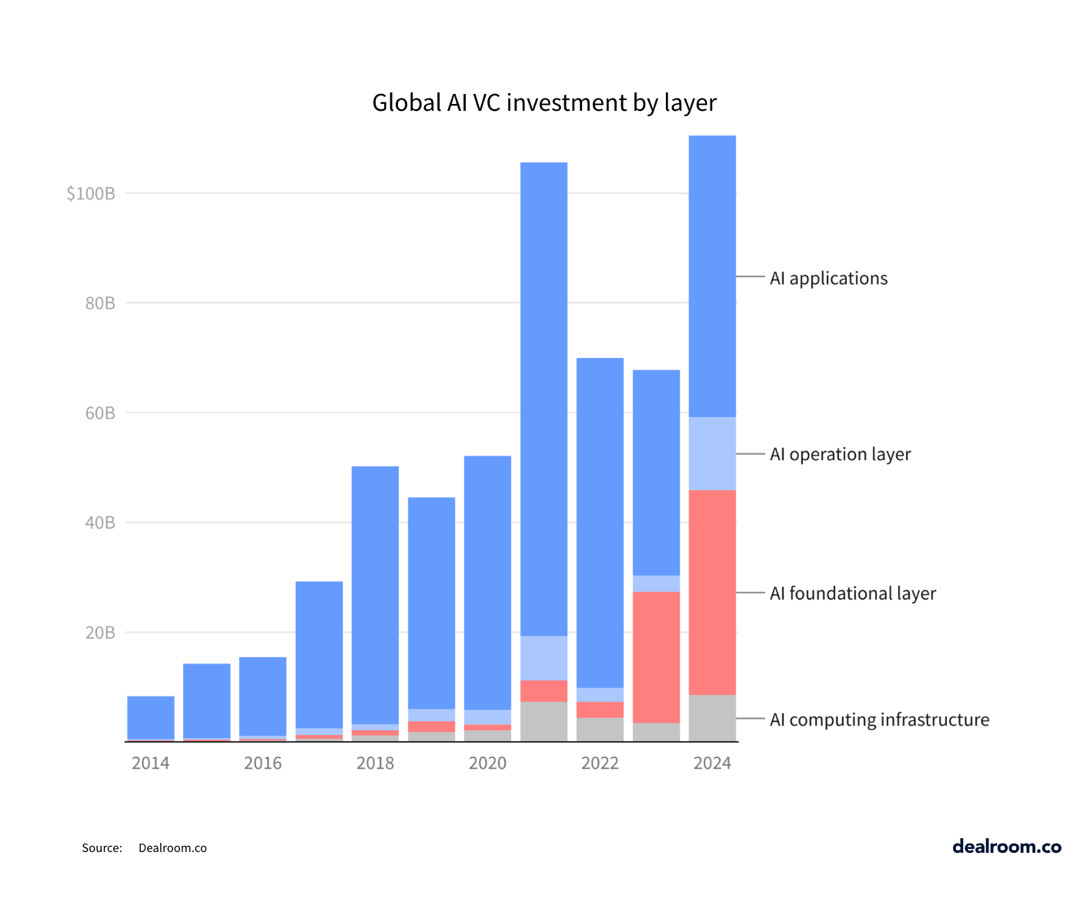

Indeed, AI startups raised $110B in 2024, a 62% increase. Nonetheless, overall tech funding fell 12%.

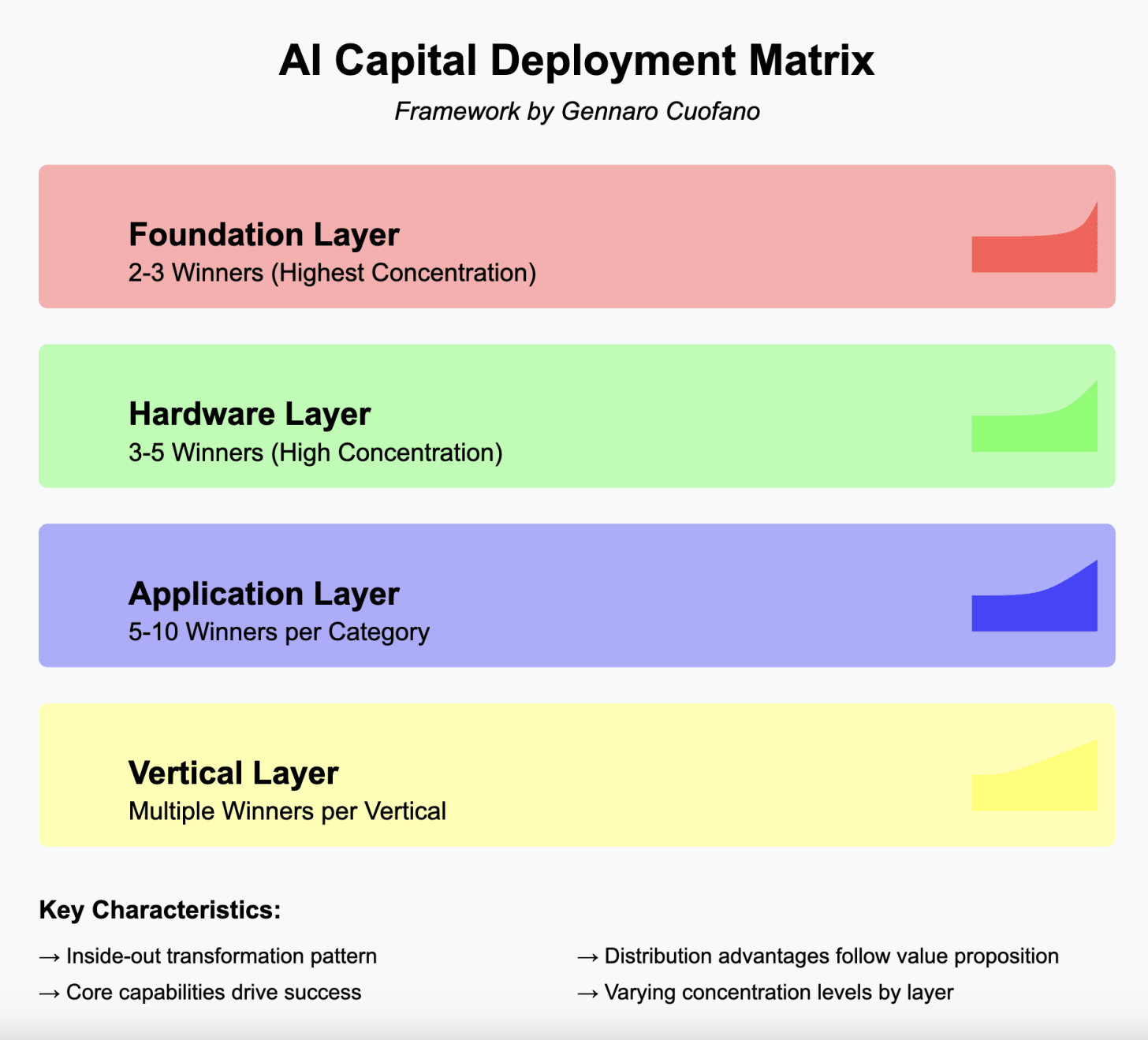

The interesting take is how much of this capital has been rising on the foundational layer side, as I’ve pointed out here.

Indeed, historically, most private capital has flown toward the applications side, which is the one that has the most potential in terms of outsized outcomes and returns.

And yet, in the last couple of years, the foundational layer had the lion’s share.

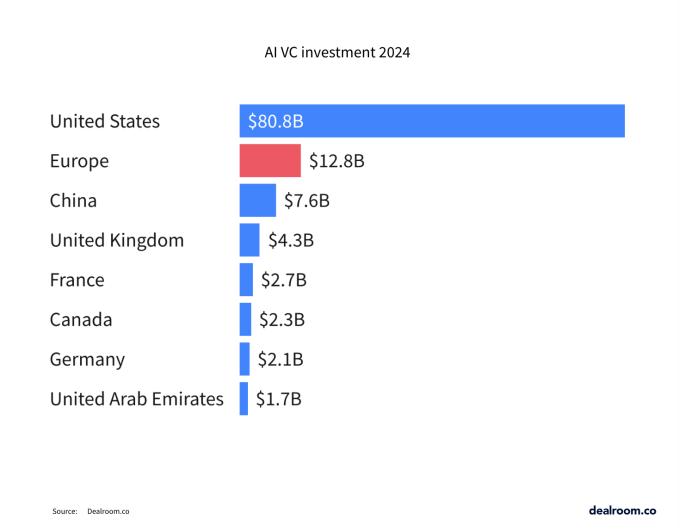

And most of this private capital went to the US.

As I’ve been explaining in the last year, this is happening because we’re going through a build-up of the whole ecosystem. Thus, we’re still in the market development phase.

As the market develops, we’ll see more and more capital move from foundational to vertical and application layers.

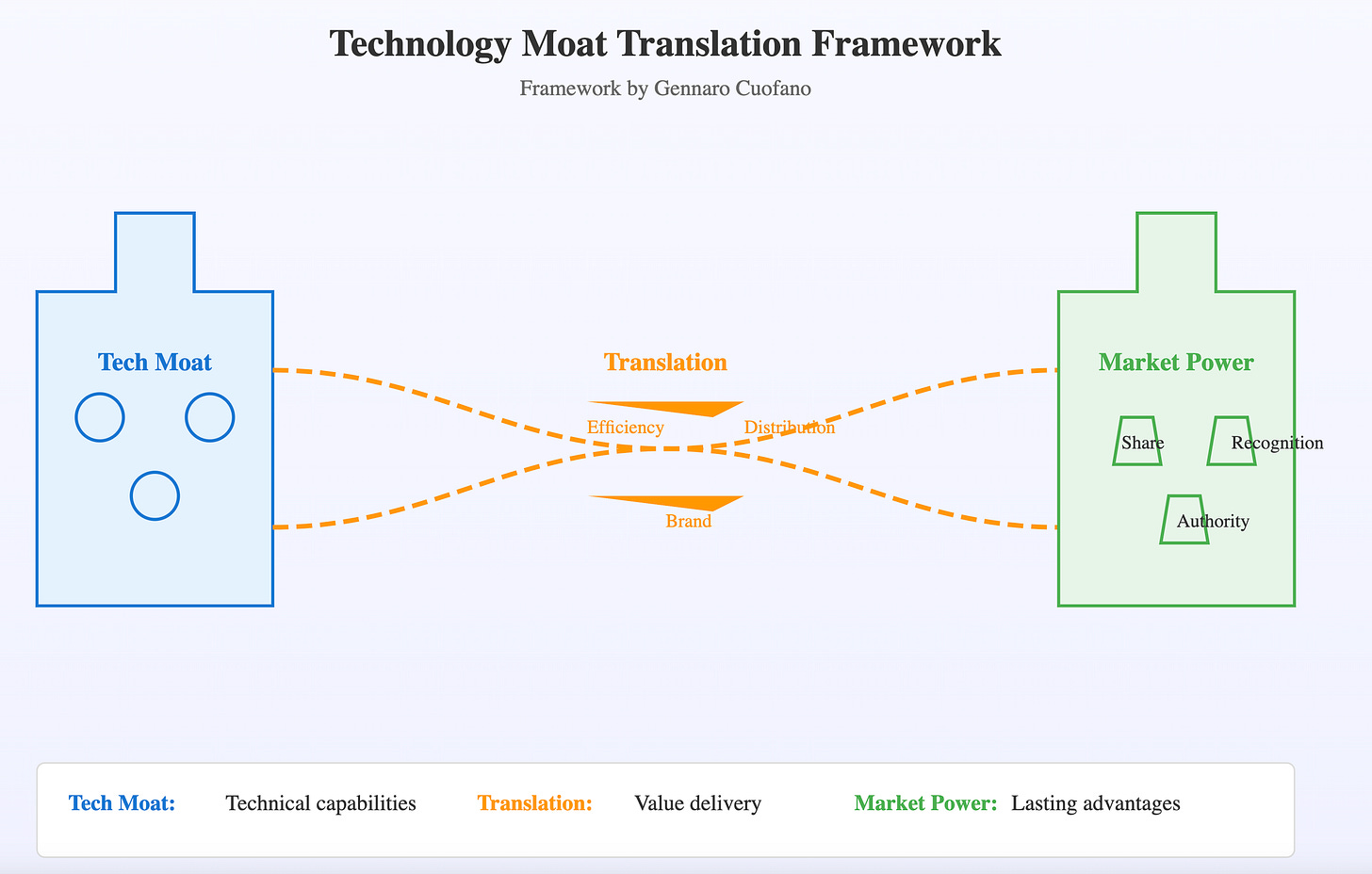

One key thing to understand why that much capital is flowing there is to look at this as a tentative way to capture future market shares of a developing market.

However, we’re still in the very early stage of it.

And that, which is building up, is a foundational market!

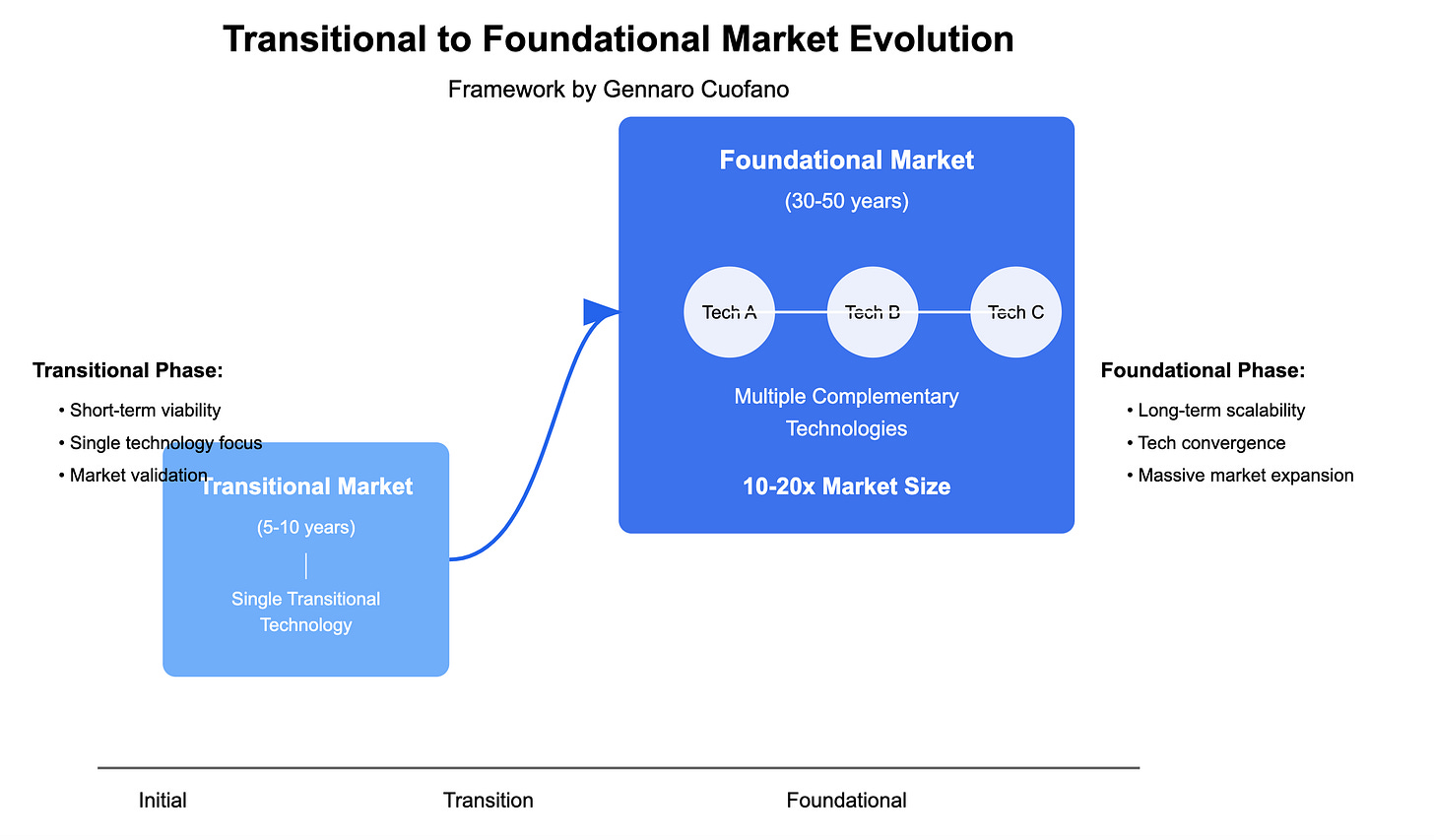

If you’ve been following the latest issues, I’ve explained what’s a transitional market:

How we move from transitional to foundational:

A foundational market represents a stable, long-term market built upon multiple complementary technologies that converge to create a sustainable business model.

Unlike transitional markets, which are temporary and often based on a single breakthrough, foundational markets provide a lasting “business opportunity window” of 30-50 years due to their structural stability and adaptability.

That matters, in terms of context, because that creates a much larger opportunity window, and that has some pretty practical consequences from a business perspective.