More and more trading in U.S. stocks is coming from overseas. Some of those traders are used to how trading in futures, FX and other markets work, where they offer trading outside U.S. working hours, sometimes 24 hours a day.

As the U.S. stock market moves closer to trading “around the clock,” there are some things we need to think about.

To be fair, trades in U.S. stocks can already occur after hours (especially when there is news). Although, the rules for trading are different – and a lot of the investor protections like the NBBO aren’t enforced.

There are many considerations tied to trading around the clock, such as when does a day conclude and the next trading day start. It doesn’t necessarily need to be midnight. Additionally, having a brief moment to allow for the industry to process things like dividends and splits and other corporate actions – many of which affect prices – is necessary as we migrate our procedures to support around the clock markets.

For example, if a stock is doing a split, limit prices and share quantities will need to change. So, if a company does a 10-for-1 stock split:

- The price should fall to 1/10th of its prior price, so the market cap (valuation) is the same after the split.

- The share quantities to buy and sell should increase by 10x.

- That way the cash required is the same as before the split.

When would be a good time to do this?

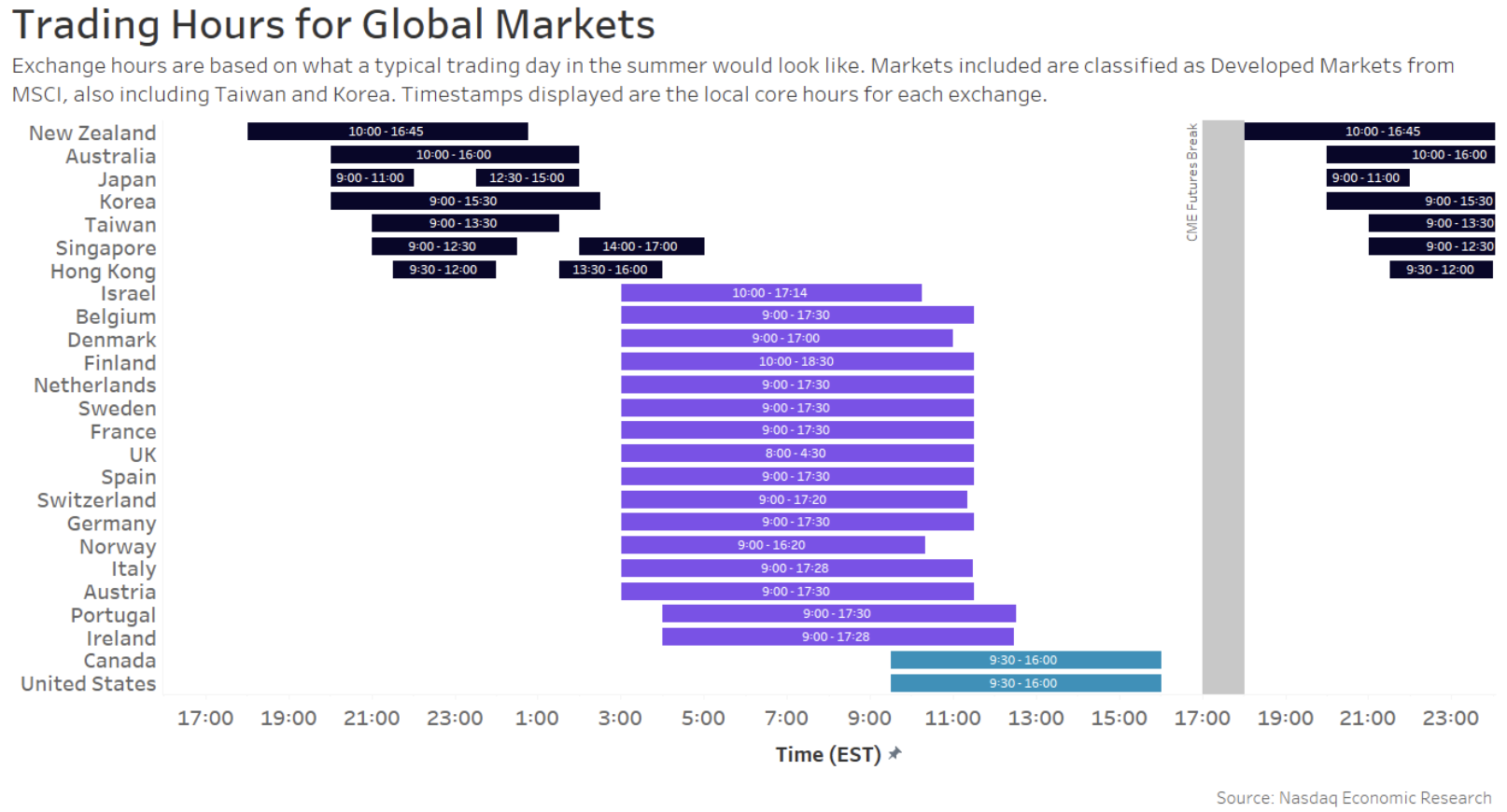

If we look at the different times that all the largest stock markets are “officially” open around the world, midnight U.S. time might not be the most logical time to pause the market.

At midnight in the U.S., markets in countries like Australia, Japan and Korea are already open. That means investors in those countries are also awake and able to trade (locally).

Chart 1: Official stock market hours for the larger markets around the world

Interestingly, there is a period shortly after the U.S. close where no markets in the world are open. Japan and Korean markets do not open until 10 p.m. (New York time). Even CME’s Globex Futures market pauses each night during this window, halting trading from 5pm-6pm (New York time).

When we look at stock trading activity, based on time stamps reported to the SIP (Chart 2), we see that the period from 4 p.m. until 6 p.m. is still reasonably busy, and residual trading appears elevated right up to 8 p.m., which is when the SIP itself officially pauses for the night, reopening at 4 a.m.

However, when the SIP reopens, there are trades reported from the period when the SIP was closed, although they are much lower than when the SIP is open and tend to cluster around the top-of-each-hour.

Chart 2: Volumes shown by trade timestamps on the SIP during an average 24-hour day

Maybe by midnight (U.S. time) tomorrow should already have started

Although it might seem natural to us in the U.S. to stop the day around midnight, it’s important to remember that this is about international investors.

Looking at times where international trading might be more active, it might make sense to pause markets earlier in the evening and start tomorrow’s trading before the clock officially strikes midnight.

It’s just one of the things we need to think about changing!