Which is better? A Roth or traditional IRA? Keep your answer in mind because we will get back to your answer in a bit. Oh, and over 95% of people get the answer wrong so prepare for an eye opening experience.

There are two camps when it comes to retirement planning. Some insist the Roth is better due to all that wonderful tax-free growth. Others say traditional retirement accounts are better because you can invest all that money from the tax deduction. So, is the tax-free growth of a Roth better? Or the tax deduction from the traditional IRA?

Let’s do some math. (I’ll do the heavy lifting, but if you think I am playing it fast and loose with the number you are welcome to verify my work. In fact, I insist!)

First, we need to assure we are comparing apples-to-apples.

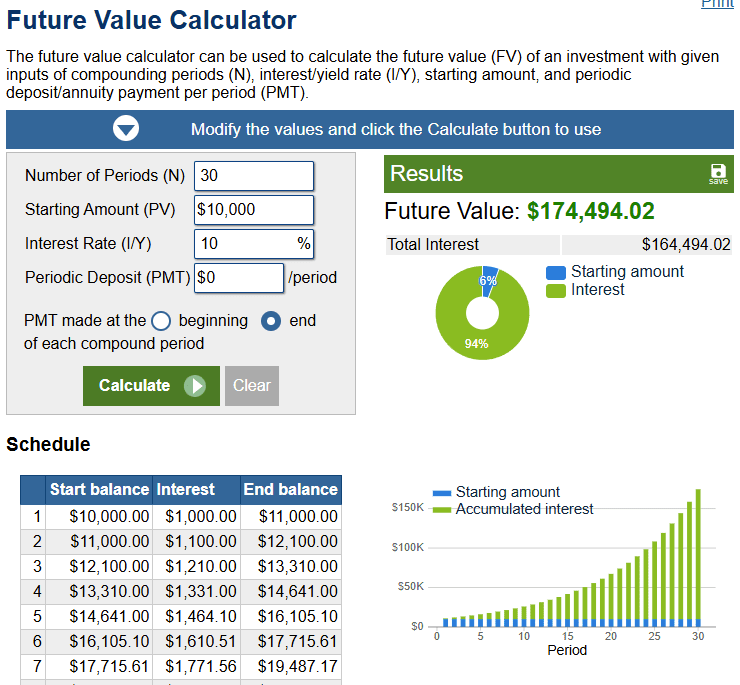

In our illustration we have $10,000 to invest into a retirement account. We will then let the investment grow for 30 years at an annual growth rate of 10%.

Since our example only has $10,000 we can’t stack the deck by dropping $10,000 into a Roth without considering the taxes that will be paid on that $10,000.

Finally, we will assume a 20% tax bracket for our hypothetical person. (Yes, I know there is no 20% tax bracket and that you can’t drop $10,000 into an IRA in a single year (yet). We are using the nice round numbers as illustration only. You can expand the math as much as you want because it will give the exact same answer every time!)

Here is the Roth future value printout. Taxes claimed $2,000 with the remaining $8,000 going to work. No worries. All that growth is excluded from taxable income! In 30 years you have $139,595.22. Not bad.

Now we have the traditional, and deductible, IRA. The full $10,000 goes to work because the $10,000 invested is deducted from income. However, when the day of reconning arrives all the distributions are taxable.

Well, it looks like the traditional IRA with deductible contributions has $174,494.02 in 30 years while the poor Roth investor has a mere $139,595.22. Traditional wins.

WAIT! The traditional IRA has to pay tax on those distributions. So we will assume a complete distribution from the Roth and traditional IRA accounts, just for illustration.

We will assume tax rates have not changed in retirement for our example person. The traditional IRA will face a 20% tax on distributions. It looks like this:

$174,494.02 – $34,898.80 (20%) = $139,595.22

WHAT!!!

If the tax rate does not change the Roth and traditional are exactly the same? It is only timing when you pay the tax? Get out of here!

But it is true. At the end of the day the Roth and traditional IRA are exactly the same when all parameters are unchanged. It can even be argued that investing in a traditional IRA is a bet on your tax bracket being lower in the future. Kind of like day trading. And we know how that goes.

In a vacuum, without any other considerations, the Roth and traditional IRA are the same.

In a vacuum. And the real world is not so neat and clean.

Roth vs Traditional IRA In the Real World

If taxes were simple and straightforward our above example would be fine. And as we will see shortly, taxes don’t go down as much as you think in retirement and can actually go up. That puts the traditional IRA at a disadvantage.

Then there are the advantages of having a lower income (due to the traditional IRA contribution) during your earnings years. You might get a Saver’s Credit or other credits.

Let’s review parameters that can change the answer to our original question.

Contributing to an IRA

Roth IRA

The Roth IRA is a simple product. You get no deduction going in.

Traditional IRA

Contributions to a traditional IRA can be either deductible or non-deductible. Since we are not comparing the non-deductible traditional IRA we will not say more about it than that it is the least beneficial retirement plan option with the exception of backdoor Roth strategies.

Deducting retirement plan contributions gives you the ability to manipulate your tax return for maximum efficiency.

The Saver’s Credit applies to both Roth and traditional IRA contributions. And the Earned Income Credit is not changed by making an IRA or other retirement plan contribution.

The Premium Tax Credit is another story. If you have health insurance from the healthcare.gov site you have the opportunity to use the Premium Tax Credit. You can use this calculator to see how much of a credit you can enjoy.

The list of possible advantages to an up front deduction for IRA contributions is long. From lesser known tax strategies like tax-gain harvesting to the Premium Tax Credit, current deductions can save serious money.

Distributions From an IRA

Roth IRA

While the Roth IRA is simple in concept, putting money in and taking money out without tax consequences, some of the greatest value the Roth has to offer is above and beyond a simple tax break at your current level tax bracket.

Unlike the traditional IRA, the Roth IRA does not have required minimum distributions. You can also take a distribution of your contributions at any age without tax or penalty once you meet the 5-year holding period that begins from the day of your first ever Roth contribution. (This is why you want to start a Roth as early as possible.)

Roth distributions do not add to your income. That seems straight forward at first, but the consequences are even bigger than imagined.

Suppose you want to make a large purchase as you enter retirement, for an RV, as an example. You need $300,000 (you expect luxury in your retirement) for the RV. If the funds come from a Roth there are no tax consequences, but, as we will see shortly, if the funds come from a traditional IRA not only will your taxes be higher, but more of your Social Security benefits might get clawed into taxable income on your federal return and your Medicare premiums may be higher for a year.

While the Roth is simple in concept, the Roth can do more than lower your taxes. That becomes an issue when stacked against the traditional IRA.

Traditional IRA

At the open of this article we compared the Roth and traditional IRA. If your tax bracket remains static the end result is a tie. But there are more things to consider than taxes.

As noted in the Roth section above, Medicare premiums once you reach age 65 become a concern. Medicare premiums are not a tax, but they are still money out of pocket. In my opinion, we need to consider all benefits and all costs when comparing the Roth with the Traditional IRA.

For 2025, most people on Medicare, Part B will pay $185.00 per month, or $2,220 for the full year. This premium is per person. Both pay the premium in a marriage once both reach Medicare age. The $185 per month most people pay in Medicare premiums can climb to $628.90 per month (and per person for married couples). This adds up to $7,546.80 in 2025. A married couple both on Medicare get to double this to $15,093.60.

In my office I spend serious time with retirees optimizing how much they can withdraw from their traditional IRA without clawing more Social Security benefits into income and avoiding a bump in Medicare premiums. Traditional IRA distributions add to income. This can push more Social Security benefits into the Taxable Amount column. Combined, this can push you into a higher tax bracket for some of your income.

Now that we got the bad news out of the way I want you to be aware of one massive benefit traditional IRAs have over the Roth, the Qualified Charitable Deduction (QCD).

The QCD works like this: once you reach 70½ you can have up to up to $108,000 (for 2025) sent directly to the charity of your choice. QCD distributions are excluded from income without itemizing. This is a very powerful tool for taxpayers that tend to give more to charity. The QCD also satisfies the required minimum distribution requirement (RMD) too. In other words, if your RMD is $22,500 for 2025 and you are 70½ or older and have your traditional IRA send $10,000 directly to your church, you only need to withdraw $12,500 more to satisfy your 2025 RMD. The total distributions meet the RMD level of $22,500. The Roth IRA can do the same, but the traditional IRA had a deduction going in.

Roth vs Traditional IRA (Which Is Better?)

A simple, one size fits everyone answer, is not available. What works for one may not work for another. Your facts and circumstances will determine your course of action.

The Roth, in its simplicity, seems to be the default choice. But that does not mean you should take the easy way out and just go with the Roth. Laziness will cost you. Current deductions can save serious money, especially if you get a larger Premium Tax Credit.

The lower your tax bracket in your earning years the easier it is to use the Roth. You already qualify for most credits and deductions without more coming off the top. Also, the lower your tax bracket the year you contribute to your IRA the more likely you will have a higher tax rate when you take a distribution. (Remember, traditional IRA distributions increase your income. That can result in a higher tax bracket.)

If you are in a high tax bracket, contributions to a traditional deductible IRA (if allowed) is often a better choice since it becomes more likely your top tax bracket in retirement will be lower since the bar is so high going into the IRA. This is where I remind you that you can also contribute to your retirement plan at work. IRA and 401(k) rules vary so I tried to stay with the IRA in this article. Remember, your work retirement plan probably gets transferred to an IRA when you retire.

The Wealthy Accountant’s Solution

If the answer is not clear, what is the answer, according to The Wealthy Accountant?

Personally, I bifurcate my retirement plan investments. I put some into the Roth and some into the traditional. Each year I review my tax situation to determine what percentage goes into each to maximize my tax benefits.

I may not hit the perfect sweet spot. But I will be closer to the real world optimum with my approach.

If I need a large chunk of money early in my retirement I can tap my Roth. I also tend to contribute heavily to charitable organizations. When I hit 70½ I will make full use of the QCD. Once RMDs kick in the QCD will satisfy that requirement. And I don’t have to itemize. I get the full standard deduction plus the ability to fund charities of my choice without creating a taxable event.

In other words, I set my situation to have the best of both worlds. I leave room for choices and when I have choices I can more easily keep my tax burden low.

One last point to discuss before I go. Your beneficiaries will have a very different experience when inheriting a Roth or traditional IRA. Roth IRA beneficiaries do have RMDs, but the distribution is not included in income. Inherited traditional IRAs often require RMDs with full liquidation by the end of the 10th year. A spouse and minor children have different rules.

The key takeaway is that you must review your personal tax and financial situation annually to make the best choice for you. What I do is irrelevant to what is best for you. You need to discover what is best for you. And then do it.