If you asked me what one of Google’s superpowers as a company is, I’d reply right out: its ability to roll out strategic acquisitions that are instrumental to each phase of its life.

Corporate acquisition isn’t simple, as integrating an acquisition into the core of a company’s business model is something only a few companies can pull off.

And Google seems to have had the playbook for it over the years, even when some acquisitions might have sounded overpriced at the time when they did happen.

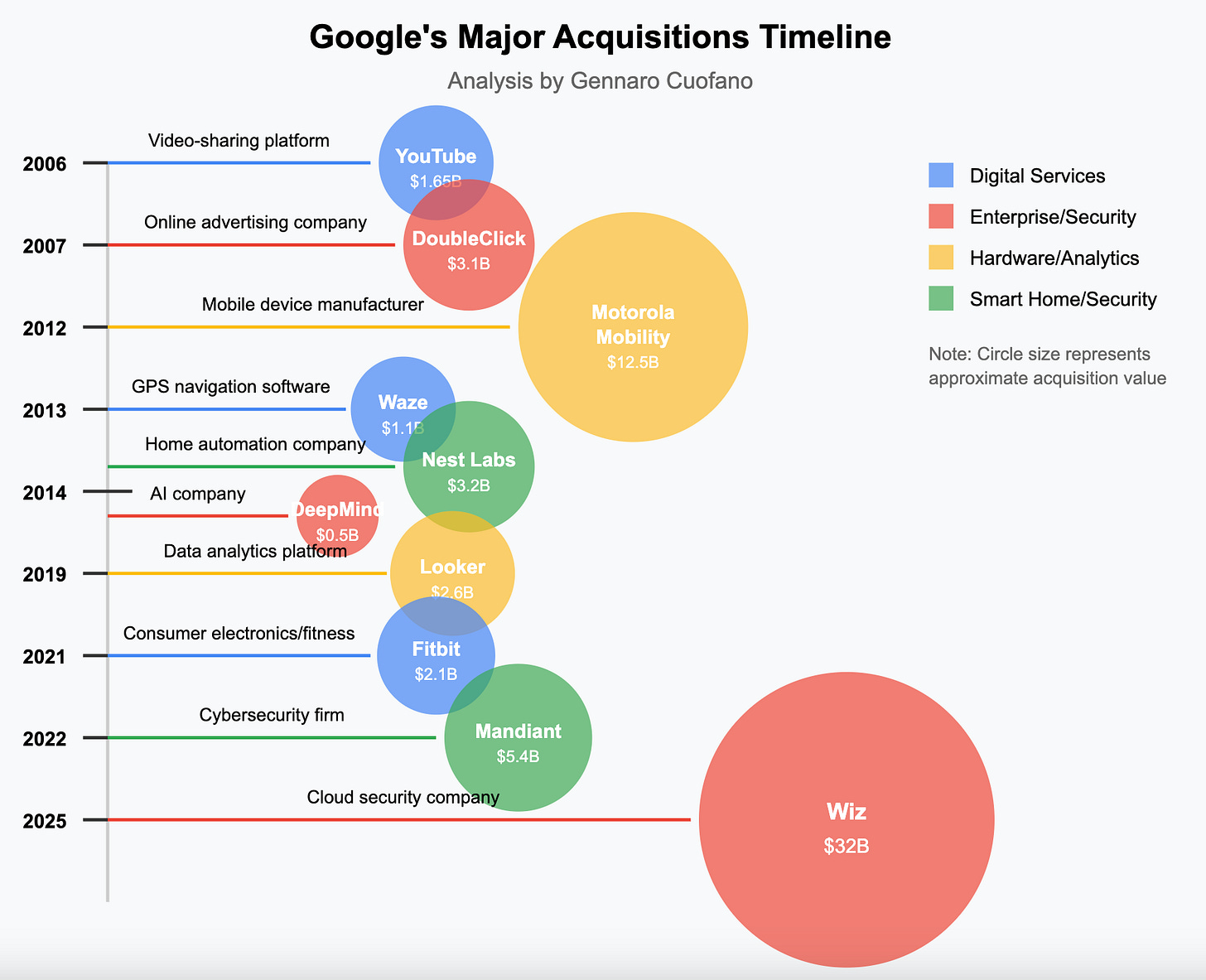

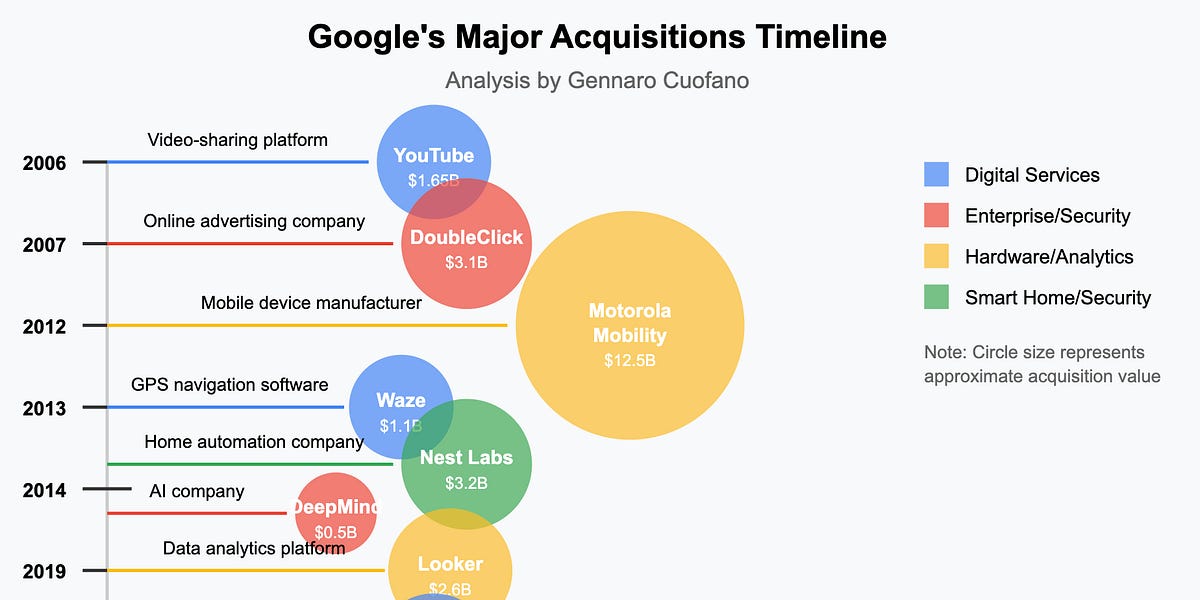

Indeed, over the years, Google has acquired companies like DoubleClick, which has been instrumental to Google’s advertising business model.

YouTube, which at this moment is probably the most interesting business within Google, and what might grant it a life after search, as it’s the closest thing to a social media platform the company has.

Another one is DeepMind, which has not only become Google’s main AI arm, but its CEO, Demis Hassabis, has also become the CEO of Google’s AI efforts.

As Google has just acquired a security company called Wiz in its largest deal so far, I want to go back and spot some key patterns in Google’s acquisition strategy.

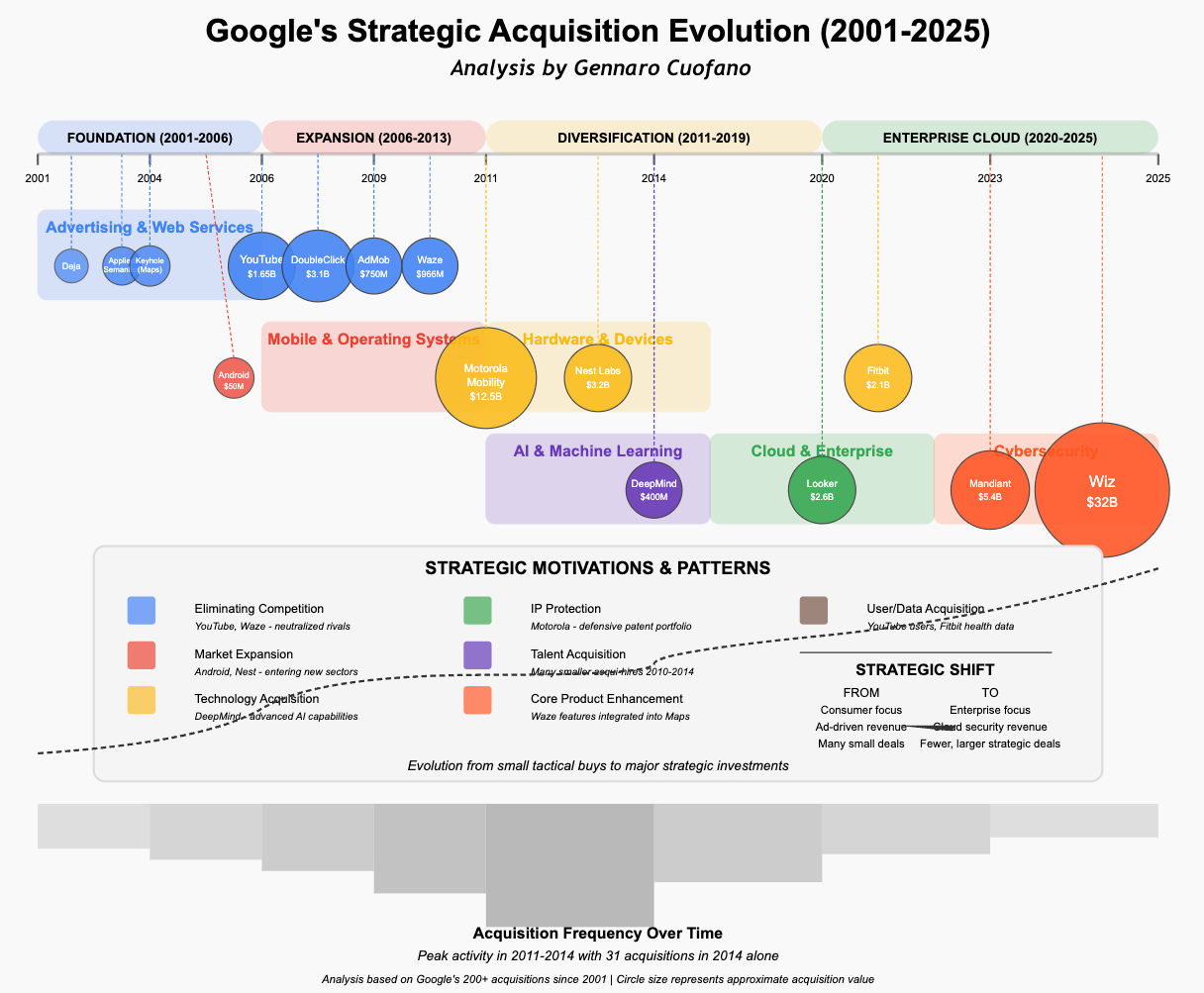

This is an analysis of Google’s 200+ acquisitions since 2001 to check whether some clear patterns emerge in their M&A approach, and it seems we can pull out some playbook!

Over the years, some key patterns of Google’s acquisition strategy come in a few blocks.

This is part of an Enterprise AI series to tackle many of the day-to-day challenges you might face as a professional, executive, founder, or investor in the current AI landscape.