Six weeks after MFE launched its long-awaited takeover bid for German broadcaster ProSiebenSat.1, a competing offer has been announced by PPF Group, a Czech investment firm that currently holds a 15 percent stake in the German media group.

The two bids differ in structure; MFE, the broadcaster’s largest shareholder, is looking to buy all shares in ProSieben that it does not currently own, amounting to a full takeover of the business. PPF on the other hand is seeking to raise its holding to 29.99 percent, the same stake as MFE currently owns. The move would essentially make the two shareholders rivals in controlling ProSieben’s future.

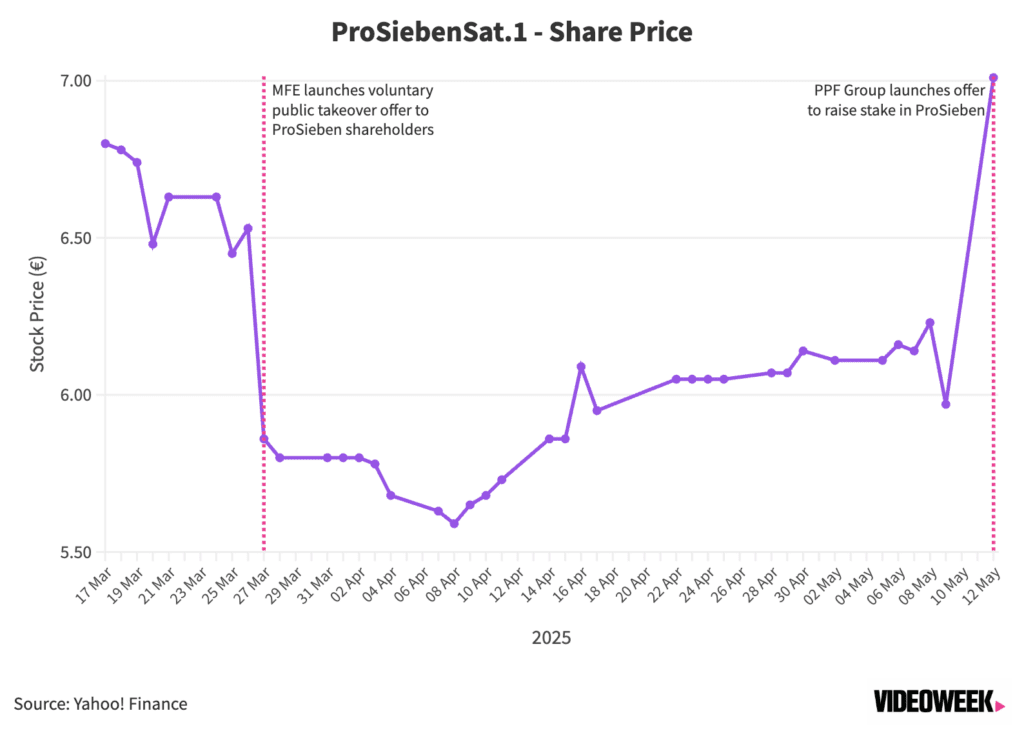

However, the PPF bid is more financially appealing to ProSieben shareholders at €7.00 per share, compared with the €4.47 offer from MFE; the minimum price allowed under German takeover law. And the Czech firm’s offer prompted a 17 percent increase in ProSieben’s share price, compared with the MFE bid at the end of March, which was met by a 10 percent decline.

Jostling for ProSieben

The Berlusconi-owned MFE has pursued an aggressive takeover agenda in seeking to build a pan-European media holding company, and has been vocal in pushing changes in strategy at ProSieben. One year ago, the Italy-based company submitted a series of motions to split up the German business and change its capital structure. The shareholders rejected the proposals, which ProSieben said served the “unique interests of MFE.” And last month, reports suggested that ProSieben has lined up a series of legal advisers, including Morgan Stanley, to defend against the MFE bid.

By way of contrast, PPF has announced its full support for the company’s current strategy, which suggests it would allow the broadcaster to retain its independence. “Despite ProSiebenSat.1’s challenges and the turbulent market environment, I believe that the management has the right strategy in place, which we fully support,” said Didier Stoessel, Chief Investment Officer at PPF Group.

The bid has been welcomed by the ProSieben management, acknowledging the premium price point and commitment to the Executive Board. The company stated that the Czech firm’s offer allowed shareholders “to monetise their investment short-term, with a better all-cash alternative to the public takeover offer published by MFE.”

“PPF has been a long-standing investor in ProSiebenSat.1 having a deep understanding of our business,” said ProSieben CEO Bert Habets. “The Executive Board is supportive of PPF’s increased commitment to ProSiebenSat.1, as evidenced by the terms of its offer, and appreciates its support for our digital transformation strategy.”

The strategy in question involves streamlining the business, according to ProSieben, which last week announced plans to cut 430 employees through voluntary redundancies. The broadcaster expects cost-savings to materialise in the second half of 2025, and full-year savings realised in 2026.

Meanwhile the period of acceptance for MFE’s offer opened to shareholders last week, giving them until 6th June to accept the terms.

Follow VideoWeek on LinkedIn.