Generating Reports the Right Way

Putting together any accounting or financial report involves making sure the bookkeeping is correct (transactions are properly categorized) and then performing journal entries to reflect financial changes outside of the accounting software. The time it takes to do this varies based on the skill of the bookkeeper, but this is the foundation of all reporting. Without a strong foundation and accurate books, your report data can be misleading.

Putting together more specific reports with actionable, digestible metrics and visualizations can take hours depending on the amount of data that needs to be put into a given template. That’s where a software like Malartu can significantly reduce the time it takes to create these types of reports. In fact, scroll to the bottom of this post for a free-trial of our pre-built template for rental real estate investors.

But that brings us to our next point: Alone, these metrics won’t tell you all that much. You need to know what you’re looking for in the data to make it meaningful.

Keeping Your Focus

In many cases, dashboards and reports help tell a valuable story even when analyzing just a few metrics. For example, a glance at a comparison between your utilities expense ratio and industry benchmarks will immediately shed light on strategic opportunities you may have been missing.

In most industries and niches there are a select few metrics we refer to as “north star” metrics. We like to think of this metric as the one that’s the most important to keep on track, all things considered.

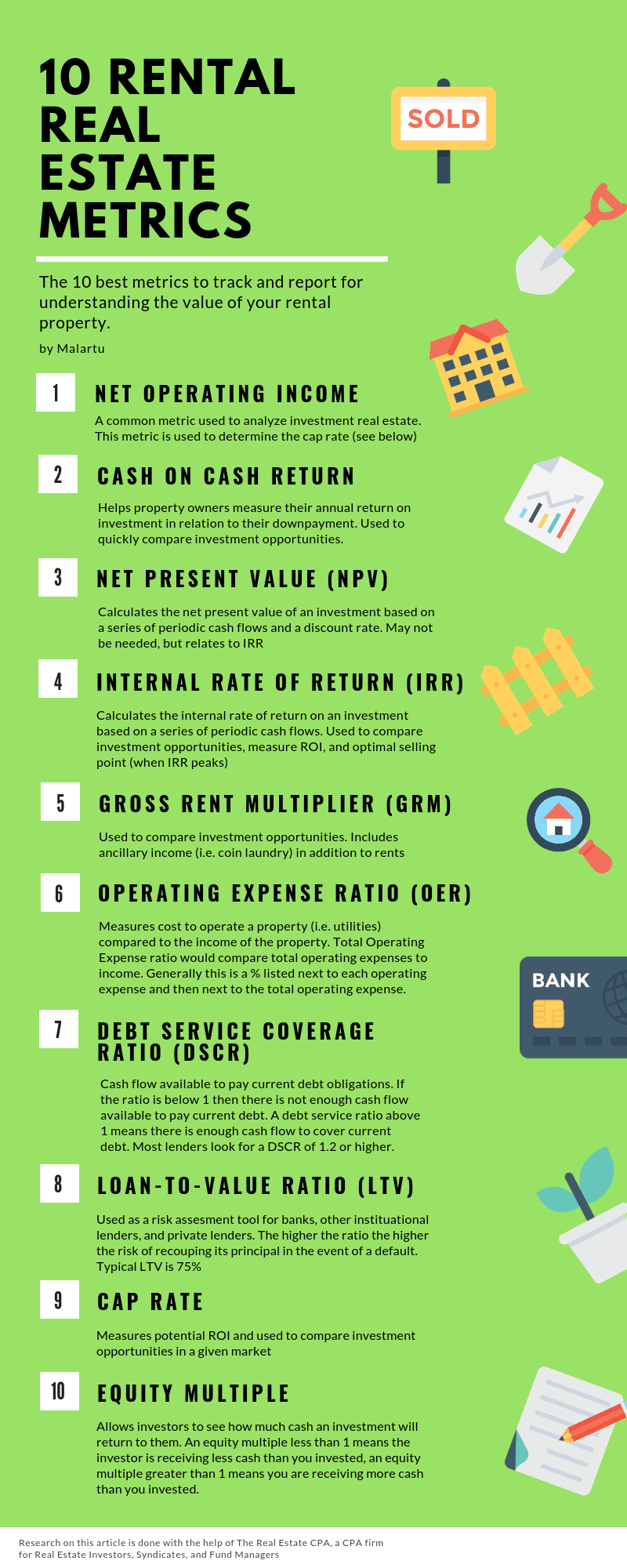

It’s not always possible to peg just one “north star,” but if we had to pick one for rental real estate and portfolio management it would be net operating income (NOI), closely followed by the internal rate of return (IRR) for each investment.

The higher a property’s net operating income, the more the property is worth. Plain and simple. It is a key part of calculating a properties capitalization rate (cap rate), which is a common metric used to compare real estate investments. It can be argued that the cap rate is really the “north star” and not NOI, but because the cap rate varies market to market, focusing on increasing NOI through increasing revenue (i.e. rents) and reducing expenses will almost certainly steer you in the right direction.

The other guiding metric (let’s call it “Sirius,” the brightest star in the sky), would be the IRR. The IRR is a metric sophisticated investors use to measure ROI, compare investment opportunities, and determine the optimal selling point. This is because IRR takes into account both the timing and magnitude of future cash flows. In many cases, the higher the IRR the better, and the longer an investment can sustain a high IRR, the better. The year (or other period) the IRR peaks, indicates the property’s optimal selling point.

Real Estate is in Our Name

At The Real Estate CPA (Hall CPA), we exclusively service real estate investors and business owners, which allows us to have a deep understanding of the various accounting and tax strategies available to this select group.

Meanwhile, other accounting firms service several different industries, which makes having this deep level of understanding about any particular industry difficult and leads to missing key strategies that can help real estate investors, especially as it pertains to advisory services.

All of our CPAs are real estate investors themselves or grew up in a real estate family, which allows us to provide unique operational insights that other accountants may never see.