Canby Auto Show

While the Millikan portfolio is dated July 1, the information is primarily June data. The Millikan portfolio is narrowly focused on four Exchange Traded Funds (ETFs). As readers will see in a moment, I am deviating from the basic asset allocation recommendations as we have yet to see the impact of proposed tariffs and the “Big-Bad-Bill” that is under consideration. To play it safe I am loading up on short-term U.S. Treasuries (SHV). This is a conservative position not all readers may wish to follow. This is where I become an advocate for using different investment models with different portfolios.

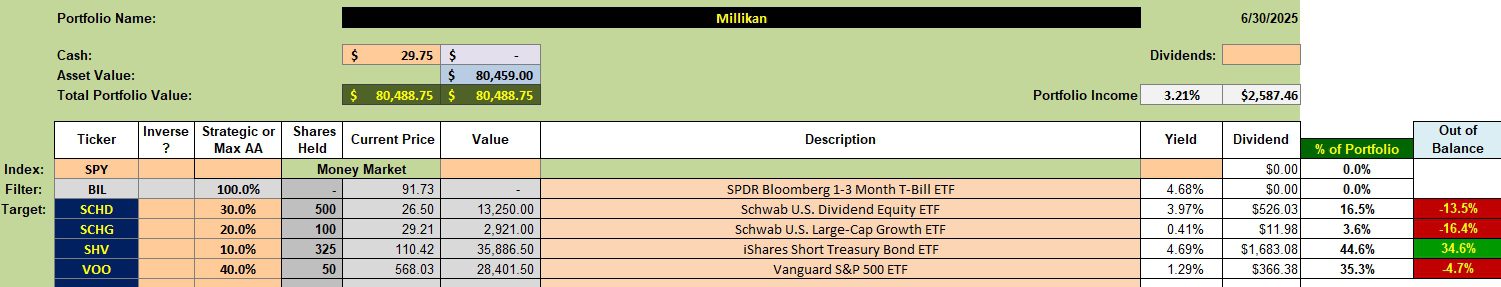

Millikan Security Holdings

Below are the current holdings for the Millikan. Under normal times I would attempt to follow the asset allocation recommendations found in the third column from the left. Over on the right you will see the % of Portfolio and how much out of balance we find the different asset classes.

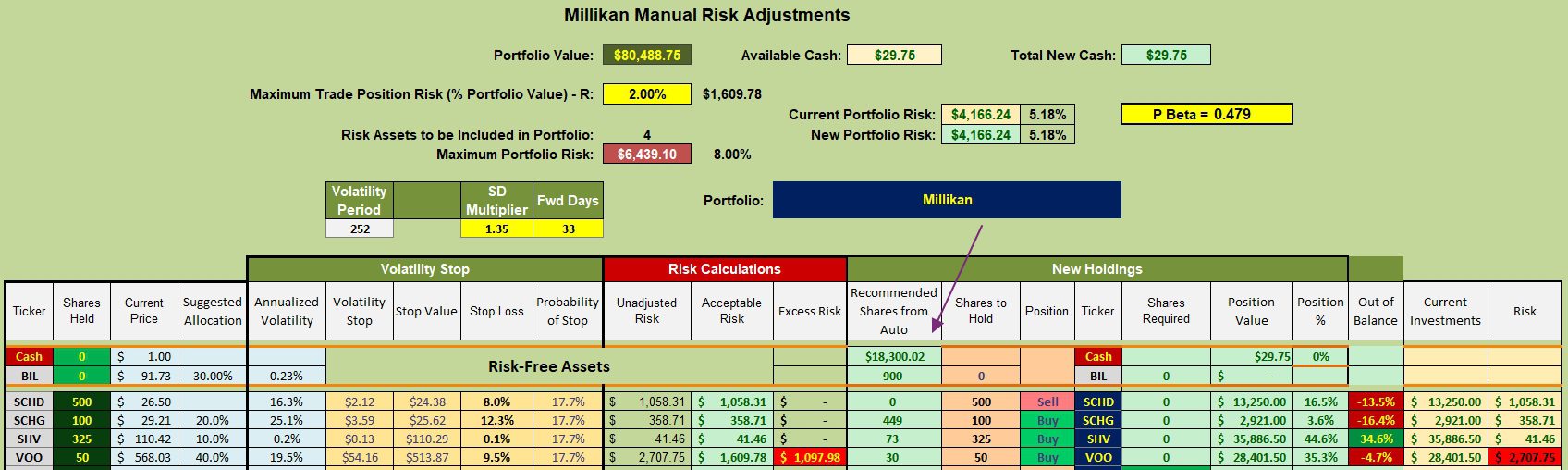

Millikan Rebalancing Recommendations

The purple arrow points to the number of shares recommended by the initial asset allocation model. As mentioned above, I am playing a cautious game with the Millikan by investing heavily in SHV, a short-term treasury Exchange Traded Fund (ETF). By investing heavily in SHV I lower the portfolio beta to a very low value of 0.479.

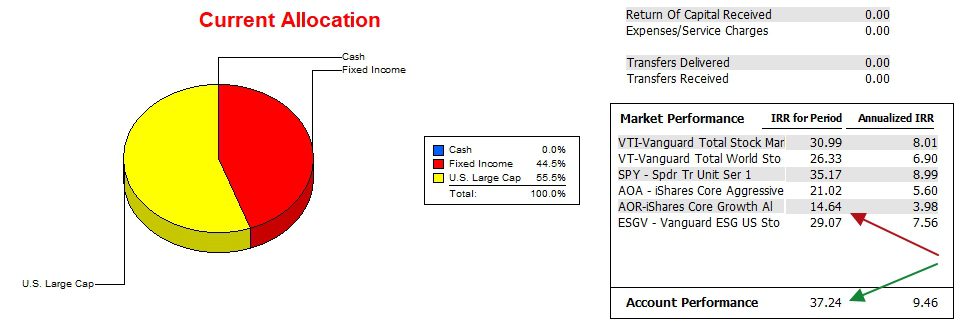

Millikan Performance Data

Since 12/31/2021 the Millikan has outperformed all tracked benchmark including the S&P 500 (SPY).

Millikan Risk Ratios

A few points to highlight in the Risk Ratio table.

- This last month the Millikan lost a little ground to the AOR benchmark as the Information Ratio declined from 0.38 to 0.36.

- The Jensen Performance Index improved as the portfolio now has a lower beta value. Also, the short-term interest rate was lowered, a plus for the Jensen.

- Since the Sortino Ratio is higher the portfolio gained in value since the last of May.

- The slope of the Jensen is very high and likely will not be sustained over the next year.

Comments and Questions are always welcome.

(Visited 4 times, 4 visits today)

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.