Weekend Reading – Do you need bonds in retirement?

Welcome to some new Weekend Reading about another important subject: do you need bonds in retirement?

(I want to thank some readers and their email questions related to this subject.)

Before that, some recent reads on my site…

Last weekend, I wrote:

“For anyone drawing down their portfolio in retirement, I believe a bad set of market returns can be a admirable foe to fight.”

This is why I believe navigating the sequence of returns risk is important.

And, given we’re at the start of a new year, I figured why not share a few portfolio updates with you!

Weekend Reading – Do you need bonds in retirement?

It’s a great question and something I get often.

Personally, for what I/we are planning for, my answer is “no”.

For others, it could be helpful.

I will explain.

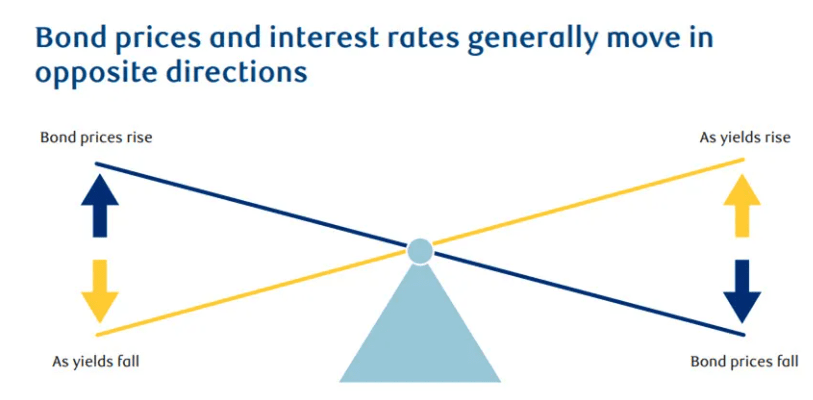

At any age, in any portfolio, bonds have traditionally played a highly useful role in portfolios: limiting downside through interest payments and often moving in the opposite direction of stocks. You may recall that bond prices have an inverse relationship to interest rates as well:

- when interest rates go up, the prices of bonds go down.

- when interest rates go down, prices go up.

With thanks/attribution, source: RBC.

Beyond some income/interest payments, bonds can help balance investment risk based on this inverse relationship.

These would be my key reasons to own bonds, if I did:

- Bonds can help your investing behaviour – riding out stock market volatility.

- Bonds can be used to rebalance your portfolio – keep your portfolio aligned to your investing risk tolerance (i.e., you sell stocks or bonds to get back to your desired asset mix of 60/40 or 70/30).

- Bonds can be used for spending purposes – where some fixed income is needed for near-term spending without selling stocks, and

- Bonds can help protect against deflation – since inflation is a killer for bonds long-term.

(Disclosure: I do not own bonds or bond ETFs at the time of this post and have not for many, many years. That said, bonds as part of a “BAL” ETF or a “GRO” ETF could be very wise based on your risk tolerance.)

Ultimately, holding bonds in a portfolio can be an enabler to portfolio diversification but I believe there are better tools to use, including my own semi-retirement plan.

1. Own Dividend Stocks.

As a relatively patient investor (although I have sold some stocks over the years), I see the real-time benefits of dividend yield from my collection of stocks. This means an investor who exercises patience with a diversified basket of stocks could not only enjoy a higher passive income stream, but also participate in growth from these stocks, AND, said stocks may be taxed much more favourably given the benefits of the dividend tax credit (if you own Canadian stocks in a taxable investing account like I do).

A big reason why we own what we own (many selected Canadian stocks picked low-cost ETF XIU (I have unbundled my dividend stock portfolio for many years now)) is: most of these stocks are bond-proxies for us with some growth upside too.

Have you considered unbundling your Canadian ETF for income?

2. Own Cash-Alternative ETFs / Money Market Funds / Higher Interest Savings.

Cash-Alternative ETFs are investment solutions that aim to provide returns similar to short-term fixed income securities, like money-market funds, through a diversified portfolio of high-quality, short duration instruments. They are low-risk investments that offer:

- Liquidity: easy to buy and sell; ETF transactions settle within a few trading days.

- Capital preservation: the value of the ETF does not change much.

- Consistent cashflow/monthly income.

You may recall this post below. At the time of this post, I still own some Cash-Alternative ETFs inside my LIRA actually. I do that to support future LIRA to LIF drawdowns in the coming years. In doing so, I won’t need to sell any equities inside my LIF for a few years.

A money market fund (MMF) is a type of mutual fund that invests in cash, cash equivalents and short-term debt securities. I like to think of MMFs as a cash investment tool – it also provides liquidity, portfolio diversification, capital preservation and steady income. For a low management expense ratio, investors using MMFs can earn a modest rate of interest income and at the same time to preserve capital and maintain liquidity by investing primarily in high-quality money market securities, generally maturing in not more than one year.

I actually keep some low-cost MMFs inside my RRSP at the time of this post. These MMFs are part of my RRSP Bucket Approach that I am ready to deploy in the coming years – MMFs will be sold for cash withdrawals vs. idle cash just sitting around, earning nothing, before I make our RRSP withdrawals.

I will dive deepeer into all our RRSP-related withdrawals in the coming years, in future posts!

Higher Interest Savings Accounts (HISAs) are just that. They pay a slightly higher interest rate than a traditional savings account. The benefits of a HISA as I see it:

- Risk-free: HISA’s are federally insured up to $100,000 if the bank is insured by the Canada Deposit Insurance Corporation (CDIC).

- Good for near-term saving for upcoming spending.

- Good for emergencies/keep your emergency fund in a HISA.

I/we use HISAs and we keep a fair bit of money in them, for that near-term spending within the year (pay for property taxes, travel) and we have a stand-alone emergency fund too. In fact, we’ve kept our emergency fund at this level for well over 10-years now.

In summary, the decision to keep bonds in your retirement portfolio (or in my case, my semi-retirement portfolio) can vary and I believe it can boil down to your tolerance for investing risk but just as importantly the dependable income sources you will have in any semi-retirement or retirement.

If you want to learn more about how I’ve constructed things to date and what might benefit you too, please check out my FREE Playbook to Retirement Income Planning.

No course fee required. 🙂

More Weekend Reading!

Tawcan was busy re-evaluating how much he might need to reach financial independence. He figures he wants this much invested:

“We will need between $1.25M to $2.34M to reach financial independence if we plan to generate between $10k to $20k in part time income each year. If we take the midpoint again it’d be $1.795M.

If we take a rough average between $1.795M and $2.21M, we’d get $2M. So aiming to have a portfolio value of $2M or more seems like a good idea.”

A portfolio value of $2M is quite high by age 50 and is likely to sustain his family to the tune of about $7,000 per month rising with inflation until age 90-95 and beyond that, that portfolio value could deliver much more wealth than he thinks if rates of return are very favourable.

There is no perfect or right answer of course to his question but I believe he is on the right track given his desire for a high margin of safety.

Route to Retire highlighted and celebrated 6-years of early retirement.

Are you scared to spend money in retirement? You’re not alone.

“Speaking from experience, it gets easier with time.” – Retirement Manifesto @RetireManifesto

One of my favourite dividend stocks is going to increase share buybacks in 2025. $EQB. Nice!

My friend Dividend Growth Investor mentioned 2024 was an amazing year for U.S. dividends.

Have a great weekend!

Mark