Duvet day here at Monevator as we update our asset allocation quilt with another year’s worth of returns.

The resulting patchwork reveals the fluctuating fortunes of the major asset classes across a decade, and invites a question…

Could you predict the winners and losers from one year to the next?

Asset allocation quilt 2024

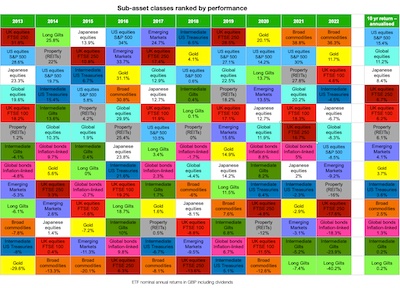

The asset allocation quilt ranks the main equity, bond, and commodity sub-asset classes for each year from 2015 to 2024 from the perspective of a UK investor who puts Great British Pounds (GBP) to work.

We’ve also squeezed in money market funds this year. These can be thought of as cash-like, if not quite as safe as money in the bank.

Here’s what you need to know to read the chart:

- We’ve sourced annual returns from publicly available ETFs that represent each sub-asset class.

- The data is courtesy of justETF – an excellent ETF portfolio building service.

- Returns are nominal. To obtain real annualised returns, subtract the average UK inflation rate of approximately 3% from the nominal figures quoted in the final column of the chart.

- Returns take into account the Ongoing Charge Figure (OCF), dividends or interest earned, and are reported in pounds.

- Again, these are GBP results. If our numbers differ from yours, check that you’re not looking at USD returns. (It’s either that or our minds have been obliterated from staring too long at the crazy pixel explosion above.)

Shady business

While our chart may look like the worst pullover pattern ever, it does offer some useful narrative threads.

For starters we can see investing success is not as simple as piling into last year’s winner. The number one asset in one year typically plunges down the rankings the next. A reigning asset class has only once held onto its crown for two consecutive years – broad commodities achieving the feat across 2021 and 2022.

Long periods of dominance are possible – see US equities. S&P 500 returns have only dropped into the bottom half of the table once in the past decade (in 2022), and stand head and shoulders above the rest in the ten-year return column. If you started investing after the Global Financial Crisis then you have US stocks to thank for the bulk of your growth.

The danger is such patterns gull us into thinking it will always be thus. Whereas in reality, the asset allocation quilt for, say, 1999 to 2008 would have looked very different. US stocks lost 4% per annum over that ten-year stretch.

I suspect S&P 500 tracker funds were a touch less popular back then!

Indeed, US stocks have fallen behind the rest of the world many times over the last century.

And credible voices warn we can’t expect US large caps to rule forever. Albeit such commentators simultaneously acknowledge that they cannot predict when regime change may come.

(We’ve written more about this problem and what you might do about it.)

The golden thread

Gold looks attractive as the leading non-equity diversifier in our chart. Its ten-year return of 10.2% is incredible for an asset class that theorists claim has no intrinsic value.

It’s volatile stuff though. When we first created this asset allocation quilt in 2021, gold’s ten-year return stood at zero after inflation

I remain personally ambivalent about gold.

If you’re a young accumulator you don’t really need it. However aging wealth-preservers may be grateful for gold’s ability to improve risk-adjusted portfolio returns.

And the yellow metal may mitigate sequence of return risk as part of a portfolio designed to cushion the downside.

A chequered past

It’s notable how a truly awful few years can completely contaminate our perceptions about an asset class.

Bond’s ten-year returns were perfectly satisfactory back in 2021. But they have taken a drubbing since.

Now UK government bonds (gilts) look like a liability by the light of the last ten years.

Yet higher bond yields are almost certain to deliver better returns from bonds over the next decade, provided inflation is tamed and the global political outlook doesn’t go from bad to worse.

Over the long run, ditching a key diversifier like bonds is likely to prove a mistake. Splitting your defensive measures between nominal bonds, index-linked bonds, cash, commodities, and gold does make sense though.

Getting defensive

A major Monevator theme over the past couple of years has been to improve our coverage of the defensive asset classes – delving deeper into how they work, when they work, and what the risks are.

Take a look at:

I appreciate that’s a lot of links. But the more you know, the less the disco dance floor of asset returns in our chart above will cause you a headache.

The colour of money

The bond crash has caused many investors to simply replace bonds with cash.

We think of cash as an asset class like any other and so we’ve introduced it to the table, using a money market ETF as a proxy.

More than any other asset class, cash (here our money market ETF) lurks in the lower half of the table.

That’s no surprise. The job of cash is to be liquid and stable, not to make lurching advances and retreats like the more temperamental asset classes.

On the ten-year measure, cash looks okay. But over the long-term it’s delivered only about half the return of longer bonds.

Material matters

Commodities have crept up the ten-year rankings every year since we began the asset allocation quilt. Now they’re up to fourth place and stand in line with their expected real return of about 3%.

Commodities present a fascinating dilemma.

They’re the one asset class that positively thrives when inflation melts bonds and equities. Commodities are also a tremendous diversifier due to their lack of correlation with equities, bonds, and cash.

But you’ll need testicular fortitude to live with the volatility of raw materials.

Commodities have inflicted losses for five out of the last ten years, but redeemed themselves with spectacular 30%+ gains on three occasions – most critically when inflation lifted off in 2021 and 2022.

Commodities had a surprisingly quiet year in 2024, delivering a decent 7% return thanks to a late comeback in the final quarter.

Our asset allocation quilt suggests they’re rarely so moderate. Most years you’ll love or loathe them.

The missing link

Inflation-linked bonds still make sense despite their desperate showing in 2022.

We’d been warning for years before that mid to long duration UK linker funds were badly flawed. But even our preferred short-duration inflation-linked funds haven’t kept pace with inflation, due to the massive hike in yields that accompanied the 2022 bond rout.

One solution is to hedge rising prices with individual index-linked gilts which – if bought on today’s positive real yields and held to maturity – will protect your purchasing power against headline inflation.

We’ve recently written about how to do that:

- See the Using a rolling linker ladder to hedge unexpected inflation section in our post about deciding whether or not you need such a ladder.

- How to buy index-linked gilts demystifies how to purchase individual linkers.

- See our step-by-step guide to constructing your own index-linked gilt ladder if you do want to do it yourself.

Note that to get ten years worth of returns, our asset allocation quilt currently tracks Xtracker’s Global Inflation-Linked Bond ETF GBP hedged. This is a problematic mid to long duration fund, as discussed!

Stitch in time

However you weave your response to the challenges of investing, the asset allocation quilt makes it plain that the best way to anticipate the future is to be ready for anything.

Buy your asset classes on the cheap after they’ve taken a kicking, grit your teeth while they’re down, then reap the reward when their day – or year – comes around again.

Finally, as uncertainty abounds, let’s be thankful that if you banked on the default position of global equities then you did just fine.

In fact, more than fine over the last decade. That 11.5% annualised return – 8.5% in real terms – is excellent.

Take it steady,

The Accumulator