Stock Market Outlook entering the Week of February 2nd = Uptrend

- ADX Directional Indicators: Uptrend

- Institutional Activity (Price & Volume): Mixed

- On Balance Volume Indicator: Uptrend

ANALYSIS

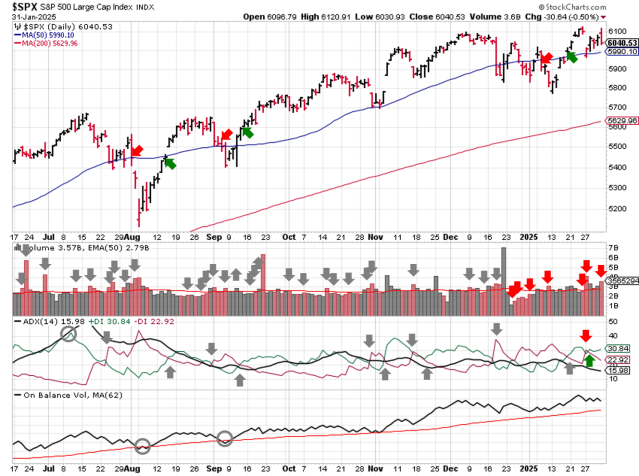

The stock market outlook remains in an uptrend, despite potentially bearish developments last week.

The S&P500 ( $SPX ) fell 1% last week. The index is ~1% above the 50-day moving average and ~7% above the 200-day moving average.

SPX Price & Volume Chart for Feb 02 2025

The ADX flip flopped early last week thanks to high volatility. Institutional activity racked up another 2 days of high volume selling, taking the total to 7 and moving the signal to mixed. 2 days are set to leave the count early this week (potential positive), but the 50-day moving average is close at hand (potential negative).

S&P Sector Performance for Week 05 of 2025

Communications ( $XLC ) led the way for a second week, while it was a tough week for Energy ( $XLE ) and Technology ( $XLK ) sectors. Energy fell back to a Bearish bias, along with Technology. Utilities downshifted to Neutral. Energy remains oversold, and Communications remains overbought.

Sector Style Performance for Week 05 of 2025

Low Beta equities were the best sector style last week, and upshifted to a neutral bias; Momentum stocks were the worst. A few more bias changes to note: High Beta, Mid Cap Growth, and Defensive downshifted to Neutral, while Small Cap Growth moved to bearish.

Asset Class Performance for Week 05 2025

Bitcoin ( $IBIT ) was the worst performer last week, while Gold ( $GLD ) and the U.S. Dollar outperformed. Bonds shifted to a neutral bias.

COMMENTARY

Last week was quite a year. FOMC kept rates unchanged, pausing the rate-cutting cycle they started in September. They cited rationale including: solid economic activity, stabilized unemployment, and “somewhat elevated” inflation.

The advanced (1st) GDP estimate for 2024 Q4 came in lower than expected (2.3% vs 2.6% expected), which is down almost a full percent from 2023 Q4. Not recession territory, but still slowing growth.

PCE was up 20 basis points year over year; core was flat and hasn’t changed since October.

| PCE (y/y) | Actual | Prior |

Expected |

| Headline | +2.6% | +2.4% | +2.6% |

| Core | +2.8% | +2.8% | +2.9% |

Most impactful to Monday’s open are President Trump’s tariffs on Mexico, Canada and China. Per the executive orders, effective February 4, 2025, the United States will impose a:

- 25% tariff generally on all imports from Mexico

- 25% tariff generally on all imports from Canada, except for “energy resources” which have a 10% tariff

- 10% tariff on all imports from China

All three countries announced retaliatory measures are in the works.

On Friday, Reuters posted an article about a possible delay for tariffs, which sent equities higher during the morning. However, the White House shot down that story midday, and the indexes sold-off hard from there. Many investors are looking to Monday, hoping for a reverse “buy the rumor, sell the news” effect.

As always: we cannot predict, we can only prepare. You’ve probably noticed a lot of whipsaws your the signals going back to early December, which means it’s been a traders market (rather than a buy and hold or long-term allocator investor). Last week was no different, and Monday will probably be more of the same. Futures just opened and the indexes are down ~1.5%.

Protect your capital, keep your losses small, and deploy capital when probabilities are in your favor (oversold in bullish trends).

Best to Your Week!

P.S. If you find this research helpful, please tell a friend.

If you don’t, tell an enemy.