Wondering why cash flow is tight despite booming sales?

Nearly 60% of U.S. businesses link poor cash flow and forecasting on outdated manual Accounts Receivable (AR) methods.

Here’s a common scenario:

Your company celebrates record-breaking sales, but the AR team drowns in manual work. Staff creates billings, sends invoices by paper or email, and processes payments by hand. Partial automation efforts fall short, as teams still struggle to reconcile data across disparate systems—ultimately defeating the purpose.

It “works” for a while, but then cracks start to show: The month-end close drags on. Missed and late payments slow cash flow. Errors creep in—a $1,200 sale might accidentally become $12,000. The C-suite wants to know, “How do we double down and keep this growth going?” but can’t get an accurate view of profit direction.

As this example shows: Inefficient AR processes aren’t just taxing on your finance team; they directly hurt your ability to scale.

While 61% of businesses cite upfront costs and implementation challenges as barriers to AR automation—the true downside comes from waiting to make a change.

Let’s explore three key reasons to invest in AR automation now and why it’s crucial for the future of your business.

1. Get paid faster

Nobody likes paying their bills. Customers often put it off or just forget. This causes big headaches for businesses—43% report too many late or delinquent payments, and 55% of U.S. B2B invoiced sales are overdue. Nearly half of companies find it difficult to reduce Days Sales Outstanding—impacting cash flow management, forecasting, and overall growth potential.

AR automation makes paying easier, so customers pay quicker. With good AR systems, you can not only mass send emails but more importantly give customers a secure, branded website to pay on with configurable payment options.

Think about it: If you get a bill that says “mail a check” or “call us 9-5,” are you paying right away? Probably not. It goes in the “I’ll do it later” pile. But if you get an email with a bill summary and payment link, you might grab your credit card and pay on the spot.

Now imagine hundreds or thousands of invoices getting paid faster each month. That’s a lot more money flowing into your business instead of being stuck in unpaid bills. With more cash coming in, you’re less likely to need something like a line of credit just to keep the lights on.

In fact, among businesses that have implemented AR automation, 89% are seeing more customers either meet payment terms exactly or pay early and 53% report better cash flow.

2. Slash time spent on manual accounting

From sale to bank clearance, AR is full of steps that eat up time and invite mistakes. Let’s take a closer look at each phase of the process and how automation can solve for inefficiencies:

| AR Step | Manual Process | Errors/Inefficiencies | Automation Solution |

|---|---|---|---|

| Invoice Creation | Staff manually creates invoices, adding details like amount and terms. | Mistyping invoice amount, due dates, or PO numbers. | System auto-generates invoices after a sale. |

| Invoice Delivery | Staff mails or emails invoices individually. | Time-consuming; delays between when an invoice is created and sent to the customer. | Auto-generated invoices are sent in bulk via email. |

| Payment Received | Customer mails in a check or calls in payment. | Missed or late payments. | Customers pay via an online branded payment site linked from email. |

| Payment Processing | Accountant manually records and matches payments to invoices. | Human error in the matching process. | Payments auto-match with invoices. |

| Bank Reconciliation | Accountant manually matches bank deposits with system records. | Errors in manually matching transactions, leading to discrepancies. | Bank transactions are auto-imported and matched to payments. |

| Final Clearing & Reporting | Accountant manually reconciles and ensures payments are recorded before closing the books. | Missed or delayed reconciliations. | Payments auto-clear, and real-time reports are generated. |

Even for those who have implemented some level of automation, AR is still a challenge for many companies to manage: 41% of finance teams still spend time fixing manual errors, 36% still rely on spreadsheets and CSV files to transfer data manually, and 30% manually code transactions to the general ledger.

By implementing AR automation, businesses can reduce time spent on cash collection by 80%. In addition, 67% of businesses that have automated their AR see improved productivity of the AR team.

3. See profit direction in real time

Manual AR processes and data entry errors muddy up real-time financial reporting, making it challenging for businesses to track cash flow accurately. Automation helps solve this, but many companies still struggle with a common issue: Their sales data lives in a CRM, separate from their financial data. This setup requires you to connect sales and finance data through third-party integrations that pull data from various sources, but these integrations are not always in sync (and rarely in real time).

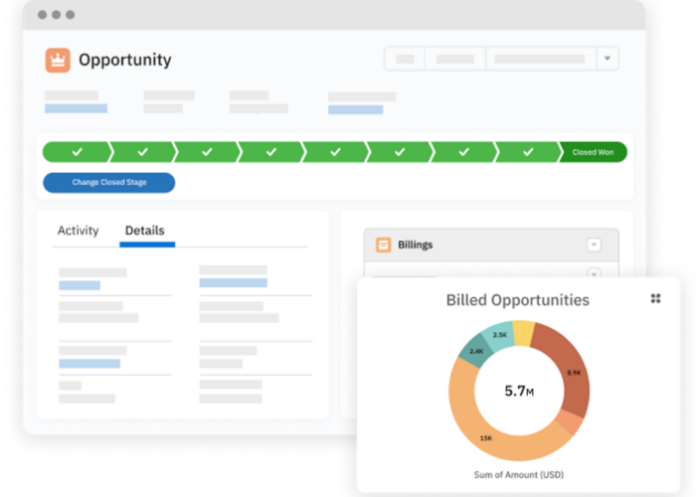

The real advantage comes with embedded AR automation—or solutions built directly into your sales platform. For instance, with an embedded system, you can have a sales record automatically generate a corresponding invoice. This beats bolt-on solutions that rely on third-party connectors to run the same task, which can cause delays or be unreliable.

Solutions like Accounting Seed’s AR Automation, for example, allow you to manage the entire process from bill receipt to reconciliation within one platform. This setup gives businesses a quick view of profitability trends, enables real-time financial reporting, and helps pinpoint where to focus resources for growth.