Weekend Reading – Beyond 60/40 Portfolios

Hey Everyone!

Welcome to a new Weekend Reading edition…this one…about investing with or beyond 60/40 portfolios.

First up, last weekend, I called out a financial guru who continues to get it wrong:

Earlier this week, I wondered where all the hype related to Loud Budgeting went.

Weekend Reading – Beyond 60/40 Portfolios

Inspiration for this Weekend Reading edition arrived via an email from a reader, that goes something like this:

Mark:

“As I am getting older I am finding it harder to stomach the volatility in the markets but up to this point I have managed my investments for years overall fairly successfully.

But they (advisor) want me to sell all my securities and put it in a single managed balanced mutual targeting 6% return. “I dislike mutual funds, for starters the fees and usually they underperform the market.”

Risky?

Probably not but I’m not sure I will invest this way either.

Let me explain.

First up, I will assume the positive: said “advisor” is hopefully putting my reader/their client into a lower-cost fund or ETF that is 60% stocks/40% fixed income. I prefer not to paint all financial advisors nor wealth managers with the same brush although I have been targeted online (sadly) by some advisors and wealth managers on this site based on how I invest = a mix of stocks and ETFs.

Oh well, they don’t get my money to manage. 🙂

I digress.

What is the 60/40 Portfolio?

The 60/40 portfolio can be a simple, effective, diversified investment strategy where 60% of the portfolio is allocated to equities (stocks), and 40% is invested in fixed-income securities (bonds). It’s important to note that this mix has been touted and favoured by both individual investors and institutional pension plans over generations since it offers a good balance of risk and reward.

Confidence in the traditional 60/40 portfolio was shaken though in recent years. I get it. 2022 was a messy investing year for many investors, myself included.

In 2022 in particular, most 60/40 portfolios were down >15%.

By comparison, an all-equity ETF like XAW that I own was only down about 12% in 2022.

(Evidence here: iShares.)

Wouldn’t 70/30 or more equities be better?

I personally make my own case for owning more than 70/30 stocks/bonds based on how I invest.

For this reader, from the advisor, why not recommend 70/30? Why not 80/20?

You can cite Modern Portfolio Theory research – that says the most efficient portfolios are those that include assets whose price movements are negatively correlated – but you can also make a risk/reward case for this individual retiree too. More equity risk for an investor can bring higher returns, yes, but in doing so there are also higher potential losses too – unless it was 2022 – when balanced portfolios were terrible and bonds didn’t help investors at all.

We shall see what the future brings!?

The case for 60/40 portfolios has been: this is a good sweet spot for any retiree just starting out. This was based on the assumption that all retirees must preserve capital and reduce volatility in their portfolios at the time of retirement. Then, moving forward, various research has further suggested retirees should have a bond allocation that matches your age formula – lowering equities as you age.

Part of the reason why I invest the way I do – in my mix of stocks and ETFs – I don’t agree with any bonds-match-your-age-formula advice. This never made too much sense to me since beyond demographic shifts (i.e., people living longer; hopefully me living longer), I believe *stocks can actually be more stable than bonds over long investing periods; while offering higher growth potential over time. Win-win.

*Inflation actually makes bonds riskier than stocks over the long term. Over 15 and 20-year periods, stocks beat bonds pretty much every time and never failed to beat inflation. So, based on history at least, it seems that the longer you can invest the less risky stocks are and the riskier bonds become.

Your investing beliefs may vary.

What is the 60/40 Portfolio Success?

Despite 2022 and other years whereby 60/40 portfolios didn’t shoot the lights out, this stock/bond mix has done pretty darn good. There is nothing to suggest it won’t perform moderately well in the future.

Linking back to the reader: “But they (advisor) want me to sell all my securities and put it in a single managed mutual targeting 6% return.” – I believe this reader should do just fine with a balanced fund long-term.

Vanguard put out an article that caught my eye.

Current to the time of this post, from their 60/40 research and forecasting work:

“The fact of the matter is that the long-term track record of the 60/40 has been consistently strong,” said Todd Schlanger, CFA, a senior investment strategist at Vanguard.

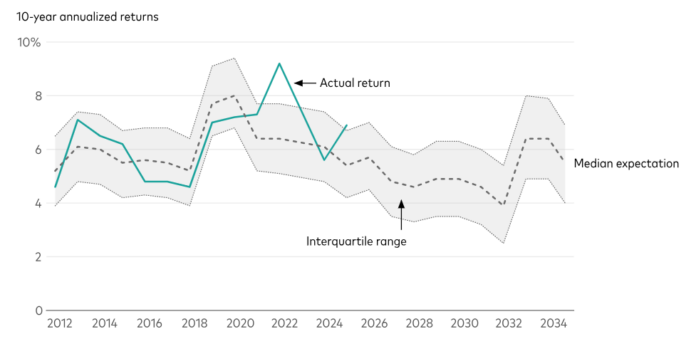

Image Source: Vanguard.

And…

To further quantify this, we ranked the historical periods by percentile and identified the interquartile range (the 25th and 75th percentiles). Since 1997, the interquartile range of 10-year returns remained relatively tight around its 6.8% average annualized return at 5.6% to 7.6%.

So, my reader shouldn’t have too many concerns when it comes to retirement portfolio withdrawals:

Earn 6% or so annualized over time from the 60/40 portfolio and withdraw 3.5% to 4% in the first few years of retirement, then withdraw even more inflation adjusted.

The 60/40 Portfolio: A Time-Tested Strategy

I hope I have demonstrated in this post that 60/40 or anything similar should remain a tried-and-true strategy that can help investors achieve their financial goals over time – asset accumulation or asset decumulation – as long as they remain invested and stick to their plan.

This means, the success of any investment strategy depends on an investor’s ability to stick with their plan long-term; balancing their risk for reward while keeping their fees low. That could be in a 70/30 mix, 80/20 mix or even upwards of 100% stocks at times.

In recent years, while I remain almost always invested, I’m no longer 100% stocks all the time every time.

Since we have been working towards semi-retirement in recent years, we’ve had a plan in place to increase our cash wedge while owning a mix of dividend stocks that should provide rising income along with owning low-cost ETFs that should deliver growth. On that note, I hope to report our next dividend income update soon.

This stock and ETF hybrid investing mix, along with cash/cash equivalents as part of our diversification, should be a sensible approach in the face of future uncertainty. Simply put, I want our portfolio to be constructed to be ready for a range of scenarios in **semi-retirement. **I have news to share on that in the coming month.

60/40 portfolios seem to deliver a solid rate of return that may also help investors remain emotionally disciplined too – which can make the success rate in building wealth or maintaining wealth in retirement just that much higher.

Curious, any retirees or aspiring retirees actually living with a 60/40 portfolio? Are you using this asset mix as part of your drawdown plan? If so, how is that going? If not, for others, including dividend investors or other indexing fans, why not?

Related Reading: BlackRock suggests you consider going beyond the 60/40 portfolio with a slice of alternatives or defensive positions.

More Weekend Reading – Beyond 60/40 Portfolios

Still one of my fav. quotes… @morganhousel

Like Morgan Housel so rightly and concisely referenced in his book The Psychology of Money:

“You don’t have to be a perfect investor. Getting wealthy and staying wealthy is “about consistently not screwing up.””

How true… @dollarsanddata

Source: https://x.com/dollarsanddata/status/1887495334118437056

Related to our political climate – in this Globe article (subscription) when it comes to boycotting American goods, be careful, it could hurt Canadian workers too. From the article:

“If boycotts continue long-term, American companies may scale back their Canadian operations, putting jobs at risk, he said. In 2023, 2.67 million people were employed by foreign multinational enterprises in Canada, with 62 per cent working for U.S.-controlled companies, according to Statistics Canada.”

I dunno. I see lots of short-term pain coming. I’m not sure how tarrifs don’t hurt everyone including the time and energy diverted away from major government issues – it takes away capacity from solving real problems like healthcare, education and housing in this country; not that we have any working government in Canada right now anyhow. My wife and I try to shop local and Canadian where we can even before this trade-war started. This recent nonsense has only accelerated our bias to buy and support local businesses.

Stay well, stay safe and have a great weekend. Enjoy the Super Bowl! Go Philly!!

Mark