RRSP facts you must remember this year and beyond!

To help you make the most of your Registered Retirement Savings Plan (RRSP) before the RRSP contribution deadline this year, I thought I would list some of my favourite RRSP facts for this tax year and beyond.

At the end of today’s post, I’ll also highlight just how well you might be able to live in retirement if you have $1 million invested in your RRSP at the time of retirement.

Read on!

RRSP facts and tips for this tax year

Fact: The deadline for RRSP contributions for the 2024 tax year is Monday, March 3, 2025.

Why contribute before the deadline? RRSP contributions made before the deadline can help lower your taxable income for 2024, which may result in tax savings after filing your 2024 tax return.

What if you miss the RRSP deadline? You can still make RRSP contributions, but you won’t be able to deduct those contributions on your 2024 tax return. You’ll have to wait until you file your 2025 tax return.

Key RRSP contribution limit numbers you need to know – your maximum RRSP contribution limit for 2024 is:

- 18% of your earned income from the previous year OR

- $31,560 whichever is lower. Plus unused contribution room from previous years.

You can no longer contribute to your RRSP after the end of the year you turn age 71. Meaning, December 31 of the year you turn 71 years of age is the last day you can contribute to your own RRSP.

If you’re already lucky enough to have maxed out your RRSP and Tax Free Savings Account (TFSA), read up on how to invest in a taxable account here.

Fact: You don’t have to wait until March every year/”RRSP season” to make your RRSP contribution.

So true!

What’s important to remember is you can make your RRSP contribution during the year including during the first 60 days of the new calender year too.

Fact: Your RRSP contribution room is based on 18% of your earned income from the previous year, up to a maximum contribution limit this tax year.

Fact: CRA keeps tabs on your RRSP contributions.

The total amount you can contribute to your RRSP each year will be limited to 18% of your previous years’ earned income or up to a maximum amount (see above) plus any carry-forward contribution room that you may have.

Please know if you have a company pension plan (like I have) or profit sharing plan your RRSP contribution limit is reduced.

I know my RRSP contribution limit thanks to my recent Canada Revenue Agency (CRA) Notice of Assessment (NOA). My CRA NOA includes employment income, net rental income, self-employed income and more.

You should look at your NOA for your details.

Fact: An RRSP is an account.

So please tell others to stop saying “I have to buy RRSPs!” You put assets inside the account to invest in.

Fact: Contributions to an RRSP are tax deductible.

This means you can use these tax deductions to reduce your taxable income. I will be doing this for this tax year.

Fact: Some Canadians shouldn’t use an RRSP to invest.

Gasp!!! Why on earth would I say that???

RRSPs are highly effective for Canadians who will be in a lower tax bracket in retirement versus their contribution years. Think of it as tax arbitrage – you could profit from long-term tax-deferred growth – the difference between your RRSP contribution years (while working, taxed at a higher income level) vs. your RRSP withdrawal years (in retirement, when your taxable income is lower).

That said, if you are just starting out and you have earned income less than $75,000 per year I suggest you focus on your TFSA for investing, first. I think it makes far more sense to maximize contributions to your TFSA first in this case, as much as possible.

If you are a higher income earner, say earning over $75,000 per year then you can consider investing in both accounts: your TFSA and your RRSP.

I personally like maxing out the TFSA in any income bracket. If you are a higher income earner, after the TFSA is full; then contribute to your RRSP. The TFSA is the perfect investing account for every Canadian, in any tax bracket. For those earners in a lower income tax bracket who are likely to end up in a similar income bracket in retirement: the TFSA is ideal.

I’ll continue to maximize contributions to my TFSA every year because…

Should you use the RRSP or the TFSA to invest?

“It depends”.

My bottom line on this: the RRSP vs. TFSA investing debate can be summarized in one sentence instead of reading 43,129 articles every year on this subject:

From my article:

“If you always spend your RRSP-generated tax refund you are undermining the effectiveness of your RRSP because you are giving up your temporary government loan designed for tax-deferred growth.”

Is there a penalty if you over-contribute to my RRSP?

Yes.

There are penalties if you over-contribute to your RRSP although a small exemption exists.

Do you have to pay taxes on my RRSP withdrawals?

You bet.

Remember, an RRSP is simply an investing account for Canadians who (ideally) will be in a lower tax bracket in retirement versus their contribution years.

You should consider the RRSP as a tax-deferred account – you’re not as rich as you think: when you take money out of the RRSP account you have to pay tax you never paid in the first place.

Now, some exceptions apply: RRSPs can be used for home purchases and education and there are programs associated with the RRSP for this. See below for my takes on these.

There are rules and age restrictions when you must collapse the account. In fact, Canadian taxpayers can contribute to their RRSP right up until December 31st in the year they turn age 71.

Back to RRSP withdrawals, if you withdraw money from your RRSP before you turn it into a Registered Retirement Income Fund (RRIF), *withholding taxes will apply to RRSP withdrawals:

- If you take up to $5,000, you’re going to pay 10%.

- If withdrawals are between $5,000 and $15,000, the financial institution will hold back 20%.

- If you withdraw more than $15,000, 30% is held back.

It’s also important to keep in mind that this won’t be the only time you’ll be taxed…

The amount you withdraw from an RRSP will count as income, so you’ll have to declare it once you do your tax declaration for the year that you’ve withdrawn. If the withdrawal ends up putting you in a higher tax bracket, you’ll have to pay more income tax, since the withdrawal tax likely won’t cover the full amount of income tax you’ll owe. That’s why withdrawing prematurely from an RRSP is not a great move and should be a final last resort decision.

When you withdraw from your RRSP, your financial institution will provide a T4RSP showing the amount you withdrew, and how much tax was withheld. You must declare this amount on your T1 General Income Tax Return in the calendar year you withdrew it. You can find the income tax rates for the current year on the Canada Revenue Agency (CRA) website.

So, RRSP withdrawals count on your tax return as income. At that time, you may have to pay more tax on the money — on top of the withholding tax. It depends on your total income and tax situation.

*Quebec has some different rates for withholding taxes.

These are just some of the RRSP facts.

Read more in how to navigate your RRSP and RRIF withdrawals below:

Other RRSP uses?

There are two important programs you can use to take money out of an RRSP without incurring taxes – but be careful!

There are two programs you can use to take money out of an RRSP without incurring taxes – but be careful!

1. The Home Buyers’ Plan (HBP) allows you to take tens of thousands out of your RRSP to put towards the down payment on your first home and you won’t be taxed on it. That’s the good news.

The bad news?

You’ll have to pay that back into your RRSP over the next 15 years.

Actually, thanks to the TFSA, I don’t think you need to use the RRSP Home Buyers’ Plan any longer.

2. The Lifelong Learning Plan (LLP) allows you to take out up to $10,000 a year, or up to $20,000 in total each time you participate in the LLP to help pay for your or your spouse’s education. You can’t use it for your child’s education – this is where RESPs come into play. You do have to pay back 10% per year for up to 10 years.

The punchline – why RRSPs should matter to you!

Again, as referenced above, there are two great tax benefits that RRSPs provide Canadian investors:

- a tax deduction today from your RRSP contribution, and

- long term tax deferred growth.

With your tax deduction, you can reduce the taxes you pay today.

With tax deferred growth, investments in your RRSP can compound over time without being taxed as long as money made stays in the account.

Based on our long-term investment plans, we strive to maximize contributions to both our RRSPs, every single year leading up to semi-retirement.

RRSP “do’s” and “don’ts” for this year!

There are my personal rules and opinions:

1. Do use the RRSP to reduce your reduce your taxable income this year. If you’re in a high tax bracket, contributions to your RRSP could help push you into a lower tax bracket.

2. Don’t bother using the Home Buyers’ Plan personally. With so much TFSA contribution room available to every adult Canadian now, I see no reason why this plan should be used. There is also the First Home Savings Account (FHSA) as well so don’t bother borrowing your own RRSP money from your future self.

3. Don’t consider any RRSP-generated tax refund as a financial windfall. It’s essentially a tax-deferred government loan. You’ll to pay taxes on your RRSP withdrawals. If you leave your RRSP intact until the mandatory RRIF age, well, you’ll pay tax on RRIF income as well.

4. Don’t always wait until age 71 to turn your RRSP into a RRIF. Consider withdrawing from your RRSP or RRIF in your 50s and 60s, this way, you can “smooth out taxation” and potentially defer inflation-protected government benefits like CPP and OAS. Win-win.

5. Don’t bother with any RRSP loan. That’s generally a bad idea. I mean it. Yes, while a short-term loan to contribute to your RRSP might sound like a good idea – let’s face it – borrowing for investing is not generally a good idea for most of us. Don’t Canadians have enough debt??? Especially so if you have a healthy mortgage to pay.

Instead, if you have a big mortgage this is what I would do vs. getting any RRSP loan:

- Continue to pay your mortgage.

- Pay off all consumer/credit card/car loan debt.

- Get your emergency fund in place.

- THEN – contribute to your RRSP.

Ignore the media and don’t dig yourself another financial hole. If you cannot afford to make regular RRSP contributions in the first place then I don’t believe you should consider any RRSP loan.

We’ve been debt-free for over a year now and remaining debt-free can work for you too.

RRSP contributions can work wonders over time…

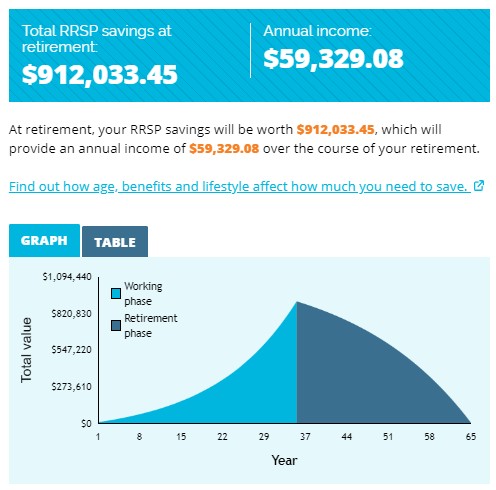

Consider a 25-year-old that started with just $1,000 in their RRSP in that year.

If said 25-year-old consistently socked away $500 per month for the next 35 years, at 7% average rate of return for 35 years, they would have a nearly a million dollar portfolio in their RRSP by age 60 for retirement.

Source: With thanks to Get Smarter About Money.

Add on CPP and OAS government benefits in your 60s, and that’s a very healthy retirement for many Canadians who have no debt. That RRSP portfolio value could be yours if you follow my guidelines!

Happy investing this “RRSP season” and ideally throughout the year.

Mark

Other RRSP reading:

Learn about the best ETFs for your RRSP here.

Learn more about dividend growth investing inside your RRSP here.

Can you have too much in your RRSP?? Yes but a very nice problem to have!!

Here is my free case study for some early retirement inspiration.

Mark