The secret is out. Rich people read. A lot. Millionaires read. It is what they do. But they don’t read any old thing. They are selective. They read what serves them, educates them, helps them think better and more clearly.

Books come in many flavors. Many books are profession specific. Then there is the large catalog of books meant to entertain. Novels can teach us something, but do so in a way nonfiction does not.

Then we come to the power books. Often called classics, they cover a wide range of topics, often teaching us something about ourselves.

Finally, we get to the books that can change our life forever. Books that allow us to enjoy any path we choose in life. Books that change the world.

Today we will review 10 books that made more people millionaires than any other books. Why find the best books on becoming a millionaire? Simple. We want our financial life in order so we can pursue the many interests we have. Money is important because it allows us to do things we enjoy. Money for money’s sake is something most people are uninterested in. They want more than money. They want what money can buy: unfettered use of our time and resources to explore things of interest.

Thomas J. Stanley and William D. Danko gave us our first definitive look at what a millionaire looks like. This is important because our worldview of millionaires is colored by the media. We think of rich people spending on outlandish consumer goods to impress the world.

In fact, most millionaires are quite the opposite. Millionaires look normal in every way. They actually seem poorer than the typical family. Yet millionaires amass a large net worth without sending up a flair informing the world they are financially rich.

In The Millionaire Next Door you get an inside look at the life of real millionaires. They are not what they seem, based on media accounts. But they live an incredible life, rich and vibrant. They value family above all and demand value from goods and services they buy.

Most of all, this book shows quickly how much millionaires are the same, which is good news because it tells us we can copy their success. And it really is not that hard once you know their secrets.

Thomas J. Stanley took it one step further with his follow up to The Millionaire Next Door.

In the Millionaire Mind we discover there is a massive difference between a mere millionaire and a deca-millionaire (someone with at least $10 million is liquid net worth).

Most interesting was one “mere” millionaire that accidentally got into the study group. Of course, the deca-millionaires have plenty to teach, but when contrasted with the individual with only a million dollar liquid net worth, it became clear there was a serious difference in thinking.

In other words, anyone can become a millionaire, but to get to “real” levels of financial wealth took a fundamentally different mindset from the rest of society. The difference between a millionaire and a deca-millionaire is instructive and worth your reading time. Highly recommended.

I published an entire blog post on William N. Goetzmann’s Money Changes Everything: How Finance Made Civilization Possible. This book is that important.

While Goetzmann provides a solid history of money, he focuses on how money was used throughout time. He also compares and contrasts. We might think of money in the Western world way only. But that would be wrong. Money also existed in China for a long time and was used in very different ways.

Almost everything we see in our modern world exists because of money. Without money humans would still be living in a Stone Age world, or something similar to it.

Money does something nothing else can do: it can accumulate. You can also lend and borrow money much easier than any other economic system. How can you build a fleet of ships or any great public works project without money? With money you can pay workers without resorting to barter or promises of future payment in goods or services.

Money settles the account at the time of the transaction. With barter you need two individuals that have something the other wants. On a large scale this becomes impossible to manage.

Large armies marched on finance. Throughout history the better funded army won more than lost. Finance is a powerful tool of war, whether on the attack or in defense.

The same applies in our modern world. The better financed get the better deals, can buy the best investments, buy the best pieces of real estate, and so on. Those who have money have options.

In my opinion, Money Changes Everything is one of, if not the best, book on money ever written. Money Changes Everything is a book millionaires read and re-read. It is that important.

Before there was a written language there was accounting, according to David Graeber in Debt: The First 5000 Years. Accounting led to contracts which required verbiage to clarify terms which led to the written language. This is why most, if not all, really old writing discovered by archeologists are a type of accounting ledger.

Why is it important to understand what debt is? If you do not understand what debt really is and what is does, you are at the mercy of debt. Graeber explains debt is borrowing from your future self. The idea is that you borrow when you have good reason to believe that money borrowed from your future self will generate a greater return today than waiting. Adjusted, for the cost of money (interest), of course.

Our modern world has lost sight of this basic concept of debt. Debt acquired for consumption is harder to justify unless your life is dire danger (an immediate medical need or food or shelter). Consumer debt spending borrows from your future self, but where is the possibility of a greater return than waiting?

Understanding money (Money Changes Everything above) is only the start. Money is a store of wealth and a medium of exchange. But that is just a basic definition. Money is so much more. It is debt in coin.

In our modern world we are comfortable with electronic data entries for tracking and managing our money and money assets (stocks, bonds, bank accounts, et cetera). In the distant past tally sticks were used to track debt, and hence money. (I’ll let the book explain the details.) As time went on other forms of recording money developed.

Regardless of how money was and is used, it is a transaction involving debt. The currency in your wallet is a debt owed to you from a prior transaction, including from investments and labor. Money in this manner is a store of value with a huge risk from rising prices (inflation). I can trade some of the debt owed me when I purchase a good or service (medium of exchange).

Debt: The First 5000 years is instructive. Millionaires read this book because understanding money and debt is vital to building financial wealth.

Money makes people do strange things. As we saw in selections above, money and debt allow us to do things you can’t without money or debt. Morgan Housel shows us why we act the way we do around money.

What seems intuitive is turned on its head when money is involved. In concept, money is easy. Spend less than you earn. Invest. Wait. Ta-da! You have a lot of money.

So why do we do stupid things when money is involved? In our deepest mind we want gratification NOW! Even at the cost of our future self.

We even have sayings for this: A bird in the hand is worth two in the bush. And other sayings.

When money is involved we are our worst enemy. I am writing this while on the return leg of a 16-day cruise to Hawaii. With all the beauty to see and entertainment to enjoy, there are people packing the ship casino, playing for long hours. The odds are terrible. Most lose. And they lose a second time when they miss great opportunities to meet new people from around the world and see wonders of our world that are breathtaking. Crazy money behavior, indeed.

Of course, there is much more on how psychology plays a role in our interactions with money. The Psychology of Money is an easy book to read. No heavy jargon or complex maneuvers for understanding money and how it works on your brain. Instead, Housel provides simple stories in simple language that will serve you for a lifetime.

In my humble opinion, this book also makes a great gift for young people. Start them out right so they can avoid the worst problems created by poor money skills. And it starts with how we think about and understand money.

What is your time worth? If you have a job your employer and you have agreed to a price on a certain amount of your time. Is your time away from work worth the same as time at work? Interesting thought, don’t you think?

What about debt? Time has a price here too. A $100,000 loan for one year with one payment at the end will generate an interest charge of $10,000.

Every loan has a price. That price can then be converted into time. Interest paid on a loan comes from your time required to earn the money to pay that interest.

Time is money, they say. And it is. Money is also time. It works both ways. If you borrow someone money, the interest you are paid comes from their time.

Understanding the history of interest is a vital part of your financial education. It is impossible to build financial wealth when you are giving your time, a part of your life, away. Something to think about on your journey to life as a millionaire.

Bad habits get us into trouble. The myths surrounding money create bad habits.

For example, Garrett Gunderson dispels the myth that your net worth is an indicator of your financial wealth. It isn’t. Your cash flow is a far better determinant of your financial wealth. The more passive the cash flow the better. Gunderson teaches you how in his book.

Cash flow isn’t the only lesson in Killing Sacred Cows. Examples:

- Hard work alone can actually do more harm than good.

- Debt isn’t what you think. (A common message in our book selections.)

- How to become a better investor. Not by market timing or other such nonsense. Instead, reduce risk without wasting a lot of time or money. Done right, your investment returns will improve with less risk.

- Dump the scarcity model. More risk does not neatly match returns. Even the myth that it takes money to make money is dispelled.

- And more.

Myths become our sacred cows. And if you want the life of a millionaire you need to think like a millionaire. That requires the removal of some sacred cows.

Originally a series of short financial parables set in ancient Babylon and distributed to U.S. bank and insurance company customers, George S. Clason gave us a remarkable guide for the proper financial mindset.

Now considered a classic, The Richest Man in Babylon is a powerful book of parables that bring money into focus. As we saw above in The Psychology of Money and other book selections above, it is our attitudes towards money that play a key role in how much money we “have” in our life. Notice I said “have.” Many people earn a lot of money in their life. Few keep and grow any significant portion of that money brought in.

The timeless lessons Clason brought to people in the early 1920s are still relevant today and must-read among millionaires to be. The Richest Man In Babylon has been minting millionaires for a long time and will continue to do so far into the future. Be one of them.

Current events can cloud our judgment. If I tell stories involving recent or current political leaders I get pushback. Many people find it hard to separate their biases when engaged in learning. That is why it is so important we read books that teach us lessons about life, and money within our lives, from the past.

George Goodman published under the name of the famous early economist, Adam Smith. Supermoney lives up the name.

Supermoney is conversations the author had with people inside the financial industry. How things work when the covers are pulled back is a powerful tool in understanding the acquiring and keeping of financial wealth.

The private conversations in the back rooms are not so different then from today. Each conversation instructive.

George Goodman writing as Adam Smith introduces us to a young Warren Buffett for the first time. If Buffett, and his style of investing, interests you, then you want to see how Buffett started his journey as a household name synonymous with successful investing.

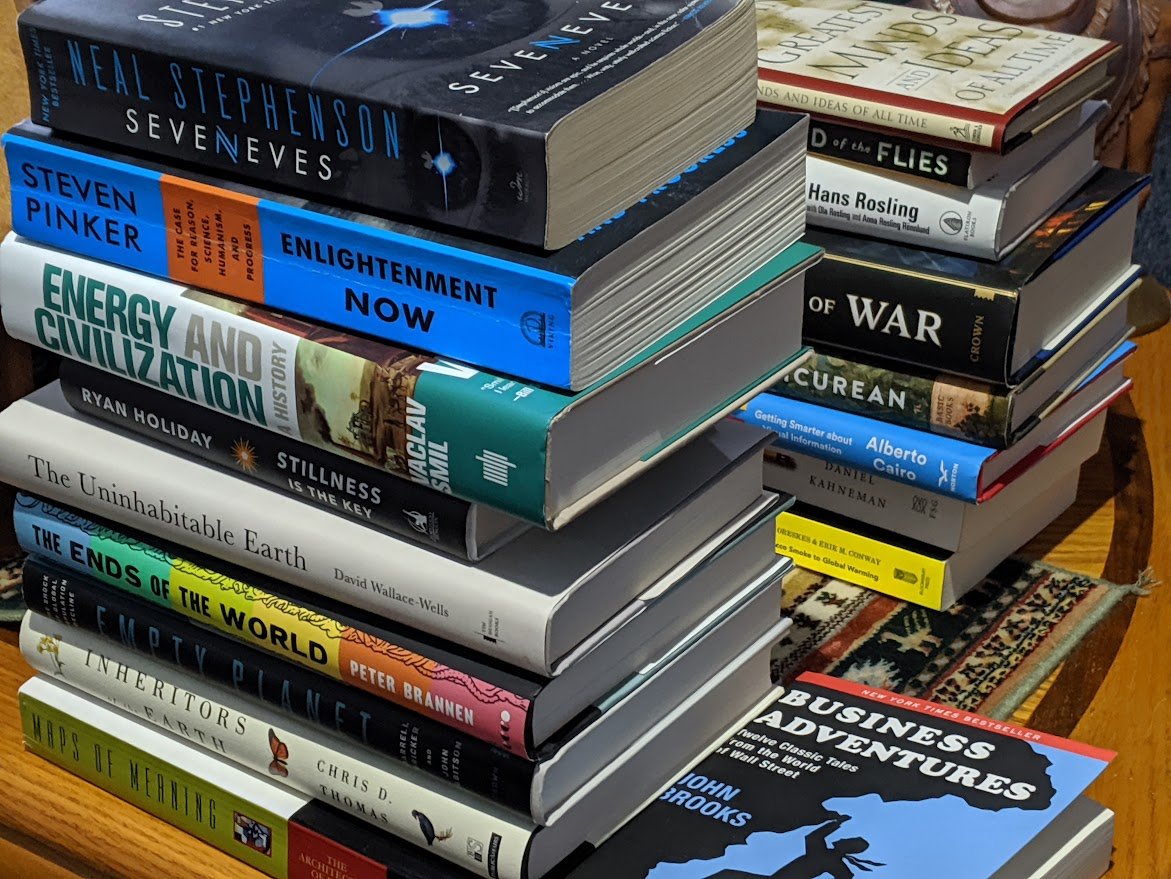

Business Adventures contains 12 stories from businesses of yesteryear. Again, because we can be biased when reviewing current events, we look far enough into the past to learn valuable financial skills.

How much can we learn about the rise of Apple? Or Nvidia? Or Tesla? Plenty, if we can remove ourselves from the detritus surrounding these current business success stories.

Many, many, many business success stories from years past have already imploded. When we step back we can see how a company starts a meteoric rise and then comes back to earth or even disappears. Those are the lessons of Business Adventures.

Remember the stock market crash of 1962? Well, Brooks does, and we are well served if we pay special attention to this event practically nobody even knows about today. (Yet, Warren Buffett, once again, commented on this past market very accurately.)

Other topics discussed:

- How Ford screwed up so bad with the Edsel and what it led to.

- The rise and fall of Xerox.

- The collapse of a brokerage firm.

- How American banks once tried to save the British pound.

- A history of the federal income tax.

- And more

All the books above have made many people a millionaire. Each and every book can do the same for you. But there is one more book you need to read so a surprise from left field doesn’t take you out.

How do you plan for the unexpected, a black swan event? According to the author of The Black Swan, Nassim Nicholas Taleb, it is impossible to prepare for a black swan event because it is an unseeable event.

However! You can prepare to unforeseen events, in a manner of speaking. An emergency fund is not technically for a black swan event since you can see the possibility of emergency events. Still, the emergency fund is a powerful wealth retention tool.

The concept of black swan events is difficult to understand. That is why it takes an entire book to present the concept. It also lays the foundation to your response.

That is why millionaires read The Black Swan and so should you. And that is why you have this bonus selection in your hands

Happy reading!