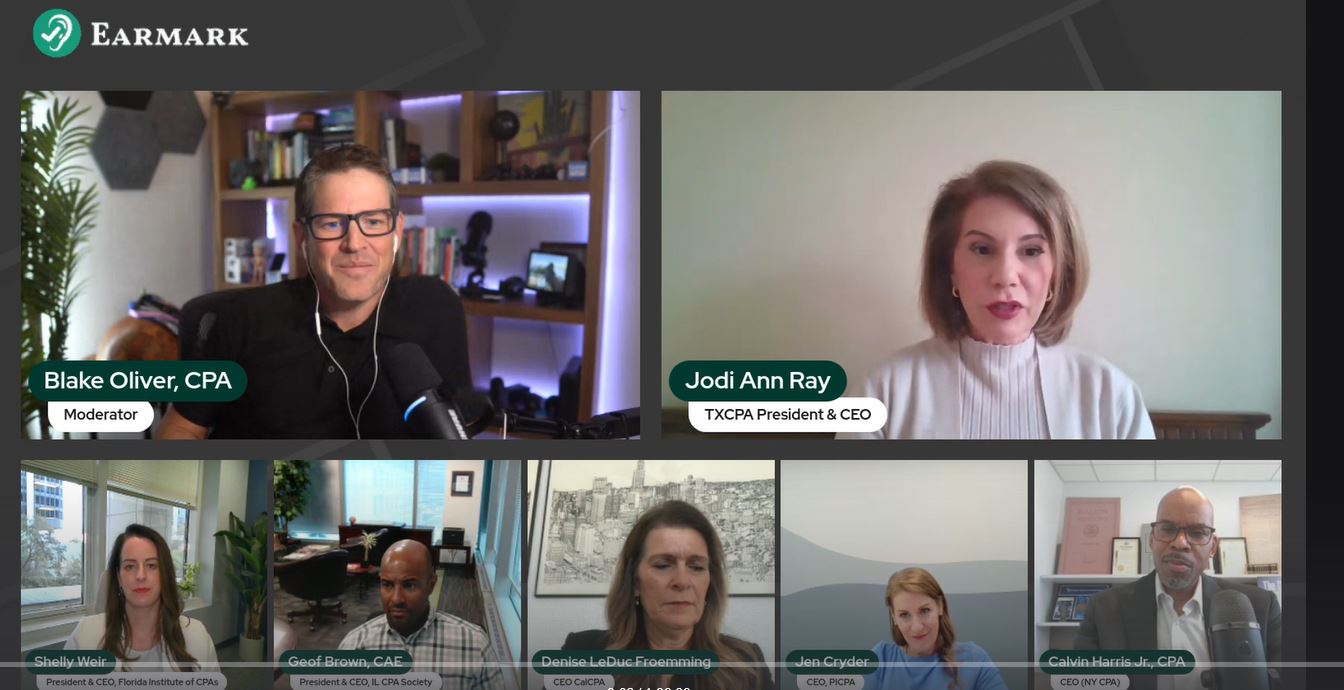

Editor’s Note: On Tuesday, March 4, executive leaders from six of the largest state CPA societies – Geoffrey Brown (ICPAS), Jennifer Cryder (PICPA), Denise LeDuc Froemming (CalCPA), Calvin Harris Jr. (NYCPA), Jodi Ann Ray (TXCPA) and Shelly Weir (FICPA) – joined together on an Earmark webinar hosted by Blake Oliver.

This roundtable discussion was an important step in communicating our shared vision and explaining the complexity of legislative reform. You can read a recap of the session on CFO.com and watch the full replay via Earmark Webinars.

Below, you’ll find a co-authored article offering further clarity on changes to CPA licensure and dispelling some myths about what comes next.

Co-authored by:

- The California Society of CPAs

- The Florida Institute of CPAs

- The Illinois CPA Society

- The New York State Society of CPAs

- The Pennsylvania Institute of CPAs

- The Texas Society of CPAs

The CPA profession is built on a foundation of integrity, expertise and adaptability. As the business world rapidly evolves, so too must the requirements for becoming a CPA. Recently, discussions around changes to CPA licensure have sparked questions and, in some cases, misconceptions. As leaders of state CPA societies across the country, we want to set the record straight and provide clarity on what these changes mean for the profession and its future.

The Need for Change

The business landscape has transformed dramatically in recent years, with advancements in technology, evolving regulatory requirements and increasing market complexities reshaping the role of CPAs. The CPA licensure model must adapt to ensure that new professionals are equipped with the skills and knowledge necessary to meet these growing demands. The changes being implemented are designed to maintain the strength and relevance of the CPA credential while continuing to uphold the profession’s rigorous standards.

State CPA societies have listened to the profession and are committed to leading together from the front. We have collaborated to make much-needed changes that broaden access while maintaining the integrity and trust of the CPA license.

Why is the CPA License Important?

The CPA license is more than just a credential – it is a symbol of trust, expertise, and accountability. Here’s why it matters:

- The CPA license protects the public. CPAs are held to strict ethical and technical standards, ensuring the accuracy and integrity of financial statements, which safeguard investors, businesses and the public.

- CPAs understand the specialized needs of business and government to keep the economy thriving. The profession plays a critical role in supporting businesses with services that foster growth and economic stability.

- The CPA license represents a higher level of authority and legal recognition than a credential. CPAs are subject to oversight by regulatory bodies and must adhere to – and maintain – a high code of conduct throughout their careers. This accountability ensures public trust and means CPAs provide greater consumer protection than credentialed accountants or financial advisors.

Top 10 Misconceptions

1. “We are lowering the standards, and the 150-hour requirement is dead.” We are not lowering the standards. The 150-hour requirement remains, but we are re-establishing pathways that previously existed to provide candidates with more options to meet the requirement.

2. “The licensure pathway is changing, but mobility is not being addressed.” In addition to evolving the licensure model, we are also working to put a mobility fix into law. This is just as important as the additional pathway to licensure, ensuring that CPAs can continue to work across state lines without unnecessary compliance burdens.

3. “An accounting concentration is the same as an accounting major.” Not necessarily. Coursework requirements have been part of state laws for years – this is not new. The intent is to ensure foundational accounting knowledge while maximizing flexibility for candidates. Expanding pathways requires options beyond an accounting degree.

4. “This change can right all past issues in the profession.” While this change is significant and beneficial, it cannot resolve every challenge the profession has faced. However, it represents meaningful progress that seeks to address critical needs.

5. “This licensure change alone will solve the talent shortage.” While an important step, this change is just one part of a broader strategy. NPAG has identified multiple workstreams necessary to attract top talent to the profession. Demographic trends make clear that a long-term human capital strategy is essential for the success of CPAs and the organizations they serve.

6. “This change is easy and without risk.” Adjusting licensure requires legislative changes across 55 jurisdictions, each with its own process and challenges. Timing and feasibility vary by state, and we are actively managing the risks associated with opening these laws.

7. “Once we change licensure laws, everything else will fall into place.” No, changing the law is just one step in a process. State societies will then be tasked with assisting students, candidates, educators, firms and companies through the transition and with supporting broader recruitment and retainment strategies.

8. “A single state can implement these changes alone.” No state can do this alone. The success of this initiative is rooted in collaboration among state societies, built on relationships and years of behind-the-scenes work. Unified efforts are critical for the profession’s future.

9. “This is just another minor adjustment.” This is a once-in-a-generation conversation. What started as a response to hiring challenges has evolved into a deep reflection on what the future demands from CPAs. We should recognize and celebrate the progress made.

10. “This decision was made without broad input.” On the contrary, this process has involved extensive input from thousands of members and stakeholders. We have taken our responsibility seriously, crafting changes in the best interest of the profession through extensive research and dialogue.

Looking Ahead

Change can be challenging, but it is also necessary. The CPA profession has always evolved to meet the needs of the business world, and this latest step ensures that future CPAs will be well-equipped for success. As leaders of the CPA profession in our respective states, we are committed to supporting candidates, educators and employers through this transition.

We encourage open dialogue and welcome questions about these changes. Our goal is to ensure that the CPA profession remains strong, relevant and prepared for the future. Let’s work together to embrace this evolution and continue to uphold the integrity and excellence of the CPA credential. Please connect with your state society for more information.

Thanks for reading CPA Practice Advisor!

Subscribe for free to get personalized daily content, newsletters, continuing education, podcasts, whitepapers and more…

Subscribe

Already registered? Log In

Need more information? Read the FAQs