It’s a new year for businesses across Australia, and you may be looking to jump-start the engine that once ran smoothly in 2024. With 12 months ahead of you, the best way to get underway is through proper planning with a roadmap.

For any roadmap, it is important to have clear and achievable goals for your business, with key dates and goals that will motivate you for the year ahead. With 2025 looking like the year of change and adjustment, you need to control what you can manage, like preparing for recurring annual events, and be flexible about goals and projects.

What does your small business roadmap look like for 2025?

2025 Key dates for small businesses

As we transition from 2024 to 2025, businesses across Australia should prepare for what is ahead. In an election year, it can be unpredictable whether business will continue as usual or the new guard will try to shake things up. What we can predict, though, is that there will be a concerted effort to address issues like the cost of living and reduce inflation pressures.

Key dates that businesses should look out for are:

- Federal Budget: March 25th

- Federal Election: on or before 17th May

- End Of Financial Year: 30th June

Federal budget 2025-2026

The 2025-26 budget release date has been announced via the parliamentary calendar. With an election looming, the Labor Party will want to announce the budget to help secure a second term. In the event of a Coalition victory, however, expect the budget to be released post-election.

When the budget for the year is released, there will be various initiatives, but the most important areas will revolve around these particular subjects:

- Cost of living

- Inflation reduction

- Energy pricing

- Housing affordability

With these issues in mind, how do they compare with the previous year? Much of the same. In a survey conducted by us here at Reckon in 2024, the areas of concern were:

- Cost of living help 78%

- Inflation reduction 64%

- Instant asset write-off 51%

- Housing affordability 49%

- Utility affordability 47%

- Personal income tax 70%

These areas of concern are still at the top of the list of small businesses, and an extension to instant asset write-off for 2025-2026 should be a development to put on your watchlist for 2025.

Federal election

With the Federal Election set for this year around mid-May, small businesses must prepare for either a Labor government second term or a Coalition party first term. Depending on which party takes government, there will be an initiative in place for businesses to benefit from.

EOFY & final super increase

Whether it is single-touch payroll finalisation or spending that last bit of the financial budget, small businesses will be well-versed in the needs of EOFY.

This year will be the last of the legislated superannuation increases, as the minimum superannuation contribution guarantee will be 12%. This change will most likely be automated in your payroll software, but it may be time to consider if you don’t already have dedicated software.

Small businesses mustn’t get complacent in preparing for EOFY, as you’ll be juggling your own commitments while vying for time with your bookkeeper or accountant, just as every other business will be.

Goal setting in 2025

As a small business owner, you know your business’s ‘ups and downs’; goal setting and management are about realistic expectations. During busy periods, you’ll have your plate full managing your busy and the influx of work, which will eat into your time keeping track and analysing your business goal progress. Meanwhile, you may agonise over meeting measurable steps toward your goals in slower periods. Delegating work where you can and managing your time effectively will help you work towards any goal.

You need the proper process to achieve a goal. Whatever goal or project management philosophy you follow, you can easily measure success by breaking goals into smaller parts.

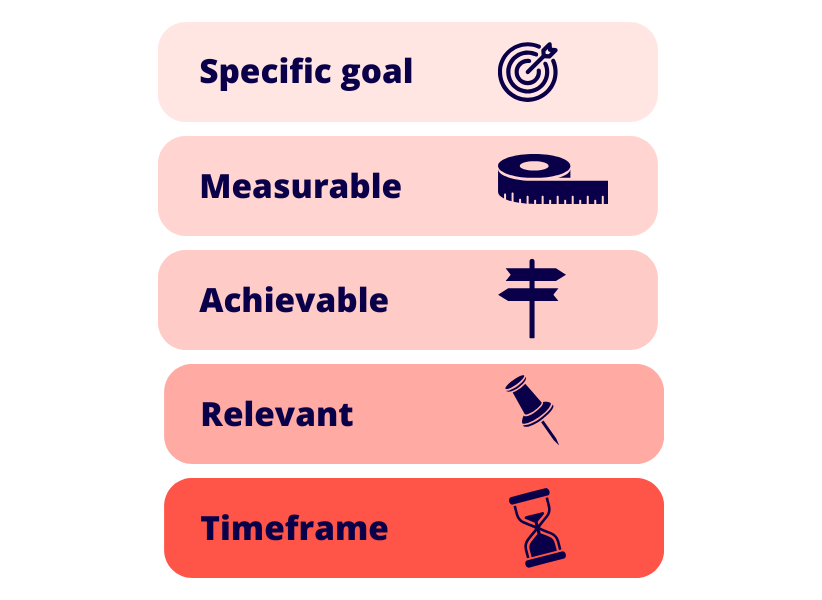

A typical goal-setting framework is SMART. Here is a breakdown of how the SMART framework is used:

- S: Specific goal.

- M: Measurable outcomes

- A: Achievable outcomes

- R: Relevant to your business

- T: Timeframe

In practice, say you want to increase your revenue in 2025 by introducing a new product to sell. Breaking this down with the SMART framework would look like this:

- S: Increase sales revenue by 10% with new product/s.

- M: Track monthly sales reports of products to ascertain effective sales strategy.

- A: Set reasonable sales targets to make sure that goal is reachable.

- R: Ensure the new product is relevant to your business and current product line.

- T: A specific timeframe of 12 months is appropriate for this goal.

There are more frameworks or philosophies businesses use for goals and project management; what is essential is that your goal is right for your business. Where methodology and process, like customer research, are helpful, leveraging your time and resources will require savvy decision-making.

For the year ahead, you should have at least a working skeleton roadmap with key dates and milestones for your business. You can seek and add sales and service opportunities where appropriate with a detailed plan. In the end, using your resources and experience will help you achieve what you want to accomplish in 2025.