Small business tax deductions provide a great way for business owners to offset expenses and lower tax bills. And in business, expenses—especially your employees on payroll—add up quickly. Are employee wages tax deductible?

If you’re a sole proprietor or single-member LLC who files Schedule C, read on. You may be happy with what we have to say.

Are employee wages tax deductible?

Yes, employee wages are typically tax deductible. You can claim a tax deduction for qualifying wages and salaries, bonuses, commissions, and paid time off you give employees.

The IRS has rules on tax-deductible employee pay requirements. To claim a tax deduction, the employee pay must be:

- Ordinary and necessary*

- Paid or incurred in the tax year,

- Reasonable, AND

- For services performed

*Ordinary expenses are common and accepted in your field of business. Necessary expenses are helpful and appropriate for your business.

What kinds of pay are tax deductible?

There are many ways you can pay employees. You can pay them in cash, property, or services.

You can deduct the value of all qualifying payments to employees, including:

- Regular wages and salaries

- Overtime pay

- Awards

- Bonuses

- Commissions

- Sick pay

- Vacation pay

- Education expenses

- Fringe benefits (e.g., health plans)

- Loans or advances you don’t expect the employee to repay

- Property transferred to an employee as payment for services

- Employee business expense reimbursements

Are fringe benefits tax deductible?

Yes, the cost of fringe benefits is generally tax deductible. Examples of fringe benefits include:

- Qualified employee benefit programs benefits

- Accident and health plans

- Adoption assistance

- Cafeteria plans

- Dependent care assistance

- Educational assistance

- Group-term life insurance coverage

- Welfare benefit funds

- Meals and lodging

- Car use

- Flights on airplanes

- Property or service discounts

Can I deduct my salary?

No, you cannot deduct your salary or any personal withdrawals you make from your business. Sole proprietors are not employees of the company.

How to claim an employee wage deduction on Schedule C

You can claim an employee wage deduction on Schedule C (Form 1040), Profit or Loss from Business. Sole proprietors and single-member LLCs use Schedule C to report income, expenses, cost of goods sold, and other business information.

To claim an employee wage deduction, you must:

- Keep detailed payroll records, including wages paid to employees, gross wages, payroll taxes, and other payroll-related expenses.

- Complete all payroll tax forms, including Forms 941, 940, and W-2s.

- Claim the employee wages in the “Expenses” section on Schedule C.

And here’s the best part—you can claim more than just the wages you give to employees. Again, you can also claim fringe benefits. And, you can deduct the cost of employer-paid payroll taxes.

Here’s how.

1. How to claim employee wages as a tax deduction

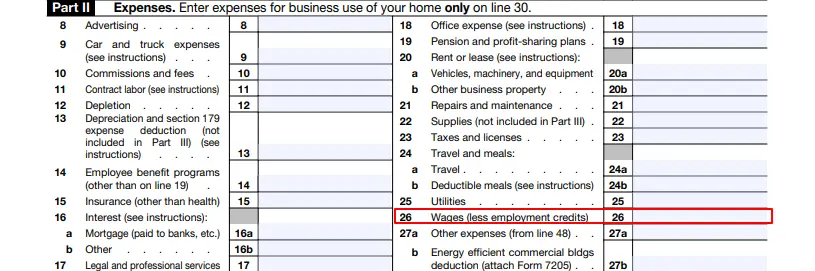

To claim employee wages, fill out line 26 on Schedule C, “Wages (less employment credits).” Exclude what you paid to yourself and any credits received.

2. How to claim employer-paid payroll taxes as a tax deduction

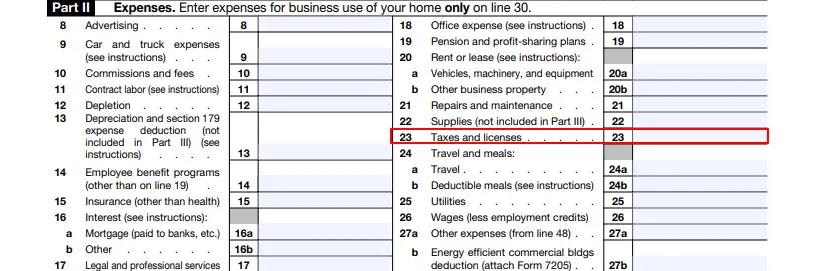

Do not include employer-paid payroll taxes as wages. Instead, report these on line 23 of Schedule C.

Employer-paid payroll taxes include:

- Social Security tax

- Medicare tax

- Federal unemployment tax

- State unemployment tax

3. How to claim other payroll-related costs as a tax deduction

Include other payroll-related costs on the appropriate lines in Part II of Schedule C.

For example, you would record employee benefit programs (such as qualifying health insurance premiums) on line 14, “Employee benefit programs.” You would record retirement plan contributions on line 19, “Pension and profit-sharing plans.”

Let’s say you let employees use a car or other property that you lease to them. You would deduct the cost on line 20a or 20b, under “Rent or lease.”

What other tax deductions can you claim?

There are several available tax deductions for small business owners. You may be eligible to claim the following deductions to lower your tax bill:

- Business startup costs

- Business use of car

- Rent expense

- Home office

- Charitable donations

- Office supplies

- Insurance

- Depreciation

- Legal fees

- Advertising and marketing

- Business taxes

- Inventory

- Bad debts

- Business phone bill

- Travel expenses

Make claiming tax deductions a stress relief, not a stress giver.

Keep detailed records throughout the year to back up your claims. You can use accounting software to streamline expense tracking. Look for accounting software that integrates seamlessly with online payroll your payroll records are pulled into your books.

Consider consulting a tax professional, like an accountant or business tax attorney, to help you maximize your tax deductions.

This is not intended as legal advice; for more information, please click here.