In this comprehensive guide, we will walk you through the process of using LedgerDocs tools to generate your own business bank statements. We will cover everything from the basics of what a bank statement is, to why you might need to create one, and how you can do it yourself for. By the end of this guide, you will have the knowledge and tools necessary to create professional and accurate bank statements that can aid in your business’s financial management.

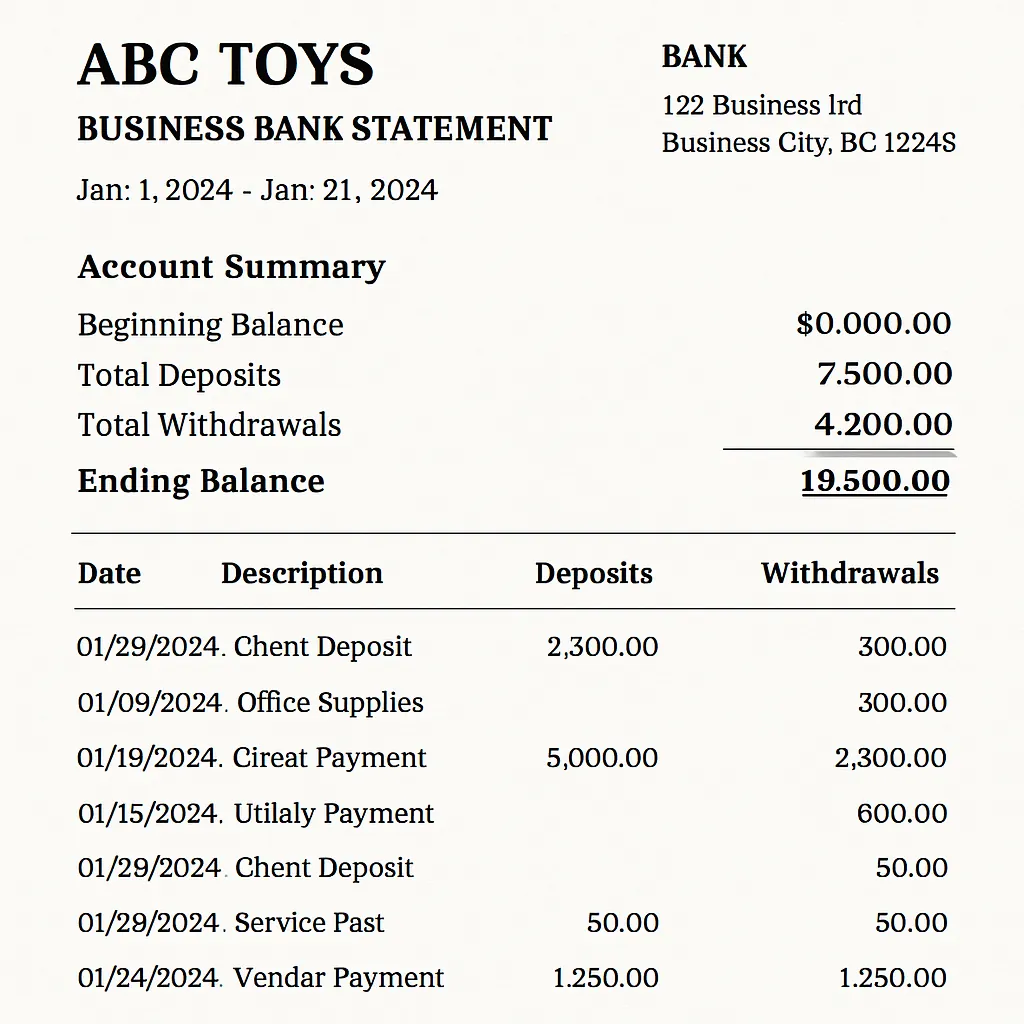

A business bank statement is an official document provided by your bank that summarizes all the transactions in your business account over a specific period. This document includes details such as deposits, withdrawals, interest earned, and any fees charged. It serves as an essential tool for managing your business’s cash flow, preparing for tax season, and making informed financial decisions. Bank statements provide a clear snapshot of your financial activity and can be used to track the financial health of your business over time.

Having an accurate and up-to-date business bank statement is crucial for various reasons. It not only helps you keep track of your financial transactions but also assists in identifying patterns and trends in your cash flow. This information is vital for making strategic business decisions, such as when to invest in new projects or cut back on expenses. Furthermore, during tax season, accurate bank statements simplify the process of calculating your business’s taxable income, ensuring compliance with tax regulations and reducing the risk of errors.

Why Would You Need to Create Your Own?

There are several compelling reasons why you might want to create your own business bank statements:

- Record Keeping: Maintaining your own records ensures you have a backup in case of any discrepancies with your bank. This is particularly important in instances where banks may make errors in reporting or when you need to verify transactions.

- Financial Planning: By regularly reviewing your bank statements, you can identify spending patterns, cash flow trends, and areas where you can cut costs. This proactive approach to financial planning allows you to make informed decisions that can improve your business’s profitability and sustainability.

- Loan Applications: Lenders often require bank statements to assess your financial health when applying for a business loan. Providing accurate, self-generated bank statements can expedite the loan application process and improve your chances of securing funding.

- Tax Preparation: Accurate bank statements simplify the process of calculating your business’s taxable income. They provide a comprehensive overview of your financial activities, ensuring you report all necessary information to tax authorities and avoid potential penalties.

LedgerDocs makes it easy to create accurate, professional bank statements, even when your clients’ banks don’t provide downloadable copies.

- Connect Bank Accounts Securely

Clients link their bank accounts directly in LedgerDocs without sharing login credentials with you or anyone else. The connection is secure and read-only. - Fetch Transactions Automatically

LedgerDocs pulls in monthly transaction data directly from connected accounts, giving you up to 24 months of historical data with no manual effort. - Generate Custom Bank Statements from Transactions

If actual bank statements aren’t available, LedgerDocs automatically creates professional, easy-to-read PDF bank statements using the imported transactions. These generated statements are ideal for catch-up bookkeeping, audits, and financial reviews. - Export in Your Preferred Format

Export transactions and generated statements in formats like QuickBooks Online and CSV, so they fit seamlessly into your accounting workflow.

Tips for Maintaining Accurate Bank Statements

Creating your own bank statements is just the first step. Here are some tips to ensure your statements remain accurate and useful:

- Regular Updates: Update your bank statements regularly—monthly is a good practice. This will help you stay on top of your financial situation and make timely adjustments to your financial strategies as needed.

- Reconcile with Bank Records: Always reconcile your generated statements with the official records from your bank to catch any discrepancies early. This practice can prevent potential financial issues and ensure the accuracy of your financial reporting.

- Secure Storage: Keep both digital and physical copies of your bank statements in a secure location to prevent loss or unauthorized access. Proper storage practices help safeguard your sensitive financial information from potential threats.

- Use Accounting Software: Consider using comprehensive accounting software that integrates with your bank accounts for real-time updates and easy statement generation. This can streamline your financial management processes and provide more accurate and up-to-date financial information.

Common Mistakes to Avoid

When creating your own business bank statements, be mindful of these common mistakes:

- Incorrect Data Entry: Double-check all entries to ensure accuracy. Even minor errors can lead to significant discrepancies in your financial reporting, affecting your decision-making and financial planning.

- Ignoring Reconciliation: Failing to reconcile your statements with bank records can lead to errors and potential financial issues. Regular reconciliation is essential for maintaining the accuracy and reliability of your financial documents.

- Lack of Backup: Always maintain backups of your statements to avoid losing vital financial information. Having backups ensures that you can recover your financial data in case of technical failures or accidental data loss.

Conclusion

Creating your own business bank statements empowers you to take control of your business’s financial health. By following the steps outlined above and using the right tools, you can easily generate accurate and professional-looking statements. These self-generated documents can be invaluable in managing your business finances, supporting financial planning, and ensuring compliance with financial regulations.

Remember, the key to successful financial management is consistency and accuracy. With regular updates and careful reconciliation, your LedgerDocs-generated bank statements can be a valuable asset in managing your business’s finances effectively. Whether you’re planning for growth, applying for loans, or simply trying to understand your spending habits, accurate bank statements are an essential tool in your financial toolkit. Embrace the process of creating your own bank statements and experience the benefits of having a clear and comprehensive view of your business’s financial health.

Want to see our tool in action? Schedule a free demo.