With another tax year almost wrapped up, are you ready to tackle year-end payroll? We know it can be a bit painful, so we’ve prepared some tips to make the process as smooth as possible.

Finalising your 2024/2025 tax year

Wrap up outstanding items

Before processing your last pay run for the 2024/25 tax year, approve any outstanding leave requests, timesheets and overtime to ensure your employees’ final pay is accurate.

Double-check payroll reportings

Review key reports like the P32, P11s, Gross to Net, and Account Transactions to ensure your posted pay runs are reconciled.

If you’re in the construction industry, don’t forget to review and reconcile your Construction Industry Scheme (CIS) Suffered report for the tax year.

Posting your final pay run

There’s a few things to consider when posting your final pay run:

- Ensure your final payment date falls between 6 March – 5 April 2025.

- If you run weekly payroll, you may have a week 53 this year—don’t worry, Xero will handle this automatically.

- Xero will submit an Employer Payment Summary (EPS) to HMRC once your final pay run is complete.

- If you’re not paying employees, post a NIL pay run to trigger an EPS.

- If you need to make any changes after processing the pay run, you have until 19 April 2025 to make any adjustments.

- Provide employees their annual tax summary (P60s). Review the P60 reports, once you’re happy that all year to date payments are included, share P60s with your employees by 31 May 2025 via Xero Me.

Get ready for 2025/26 tax year

We’ve put together a payroll facts and figures guide for 2025/26 to help you navigate the new tax year.

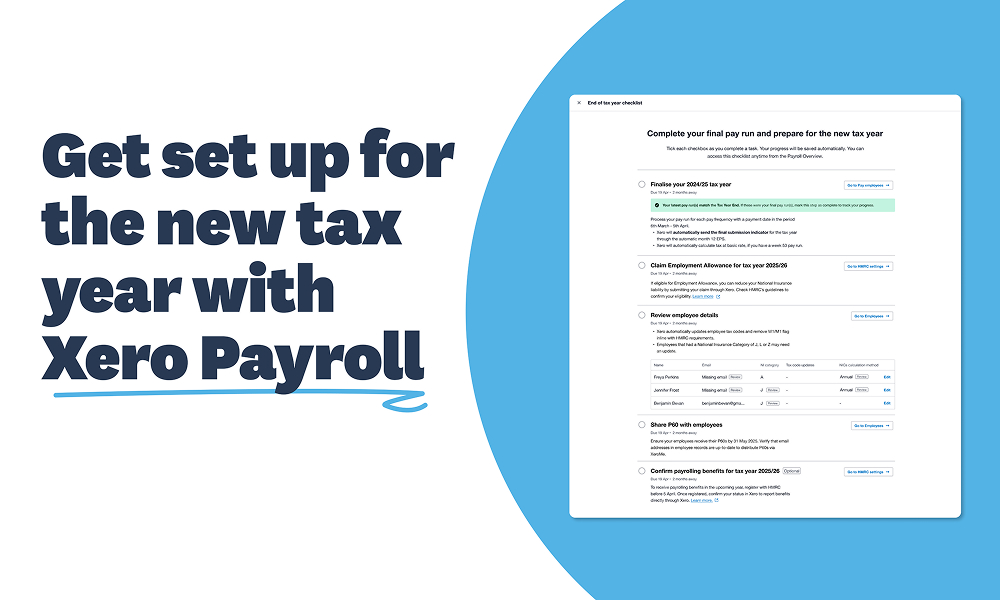

Use our handy checklist in Xero Payroll > Payroll Overview to update your settings before running your first 2025/26 pay run.

Key updates to check:

Employment allowance

If you’re eligible, activate it in Payroll Settings > HMRC tab.

National Insurance

Review director National Insurance calculation methods and keep an eye out for employees on any deferment certificates who may need to be updated. If you have employees working in a UK freeport, investment zones, or who are qualifying veterans, you might be able to claim relief by updating their category letter.

Tax codes

If you were on a W1/M1 tax code, Xero will switch you back to the normal tax method at the start of the new tax year. Any tax code updates from HMRC (also known as P9X) will be automatically applied in Xero.

Corporation Tax UTR for CIS suffered

If you’re in the Construction Industry and claiming CIS suffered, enter your Corporation Tax UTR in Payroll Settings > HMRC tab. If it’s not already there, you’ll be prompted to add it when scheduling your next Employer Payment Summary (EPS) and entering an amount of CIS suffered.

Payroll benefits

From April 2026, a new UK government mandate will require employees’ benefits (like company cars, insurance) to be reported via payroll, meaning you won’t need the P11D form across most benefits. It’s a good idea to start doing it now.

- If you offer these benefits, register with HMRC before the new tax year.

- For benefits you’re already payrolling in Xero Payroll, check their values and availability dates for the new tax year.

- For company cars or vans, leave the “available to” date blank if employees are keeping them—Xero will roll them over automatically.

- By 6 July 2025, submit your P11D(b) form to report any National Insurance due on these benefits.

- Employers won’t need to include loans or accommodation in payroll right away, this will be optional from April 2026.

New payroll changes to consider for the 2025/26 tax year

Statutory Neonatal Care Leave and Pay

From 6 April 2025, parents with babies in neonatal care for 7+ days within 28 days of birth can take up to 12 weeks of leave, providing some much-needed peace of mind during a difficult time.

- Leave must be taken within 68 weeks of birth and is usually added to the end of other Statutory Leave, like Maternity or Paternity leave

- To qualify for this pay, employees must earn at least £125 per week (the Lower Earnings Limit) and have been continuously employed for at least 26 weeks.

- Payment is made at the new statutory weekly rate of £187.18, or 90% of average weekly earnings, whichever is lower.

- Xero Payroll will support this from April 2025.

Workplace postcode required for Freeport and Investment Zone NI categories

From 6 April 2025, employers claiming National Insurance contributions relief in Freeports or Investment Zones must provide their employees’ workplace postcode to HMRC. This applies to those using special tax site NI letters (F, I, S, L, N, E, K, or D). Update your employee records in Xero payroll to avoid rejected Full Payment Submissions (FPS).

Upcoming changes from April 2026

- In the Autumn budget, the UK government announced updates to mandate the reporting of benefits in kind through payroll software, in real time, from April 2026. It will be introduced in a phased approach, requiring employers to payroll most benefits initially, Employers will not be required to payroll loans and accommodations initially.

- Also coming into effect from April 2026, employers will no longer be required to provide more detailed employee hours data to HMRC. More information on this announcement can be found here.

Learn more about payroll year end with our webinar available here.

The post Get set up for the new tax year with Xero Payroll appeared first on Xero Blog.