One year since launching its new streaming service TF1+, the French broadcaster’s efforts appear to be paying off, posting a solid first year’s results for the AVOD service. TF1+ launched in January 2024 to replace MYTF1, the commercial broadcaster’s catch-up service, with a more competitive streaming offering. The new platform had 15,000 hours of content at launch, and the volume doubled to 30,000 hours over the course of the year, according to TF1’s full-year earnings.

The broadcaster has also spent the last few months working to make TF1+ into a “full-funnel marketing platform”, adding new ad tools to attract performance advertisers from a wider variety of brands. The company also boosted the ad load on the platform, now showing an average 5 minutes of ads per hour, compared to less than 4 minutes on MYTF1, and is aiming to reach 6 minutes per hour. The group added that TF1+ increased its brand awareness capabilities, citing figures from research firm Iligo, from a 73 percent brand awareness rate in February 2024 to 78 percent at the end of the year.

The business additionally boosted monetisation on its streaming service, according to the results. In 2024, average CPM on TF1+ was €13.5, compared with €12 on MYTF1, and the company aims to raise this to €15. Coupled with a 55 percent YoY rise in streaming consumption, this helped increase TF1’s digital ad revenues by 39 percent YoY, making 2024 TF1’s strongest year for digital revenues.

“Global appeal”

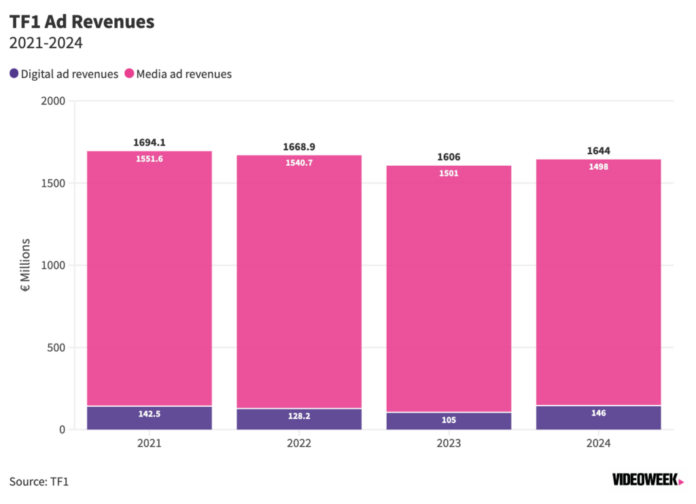

Total ad revenues were up 2 percent on the previous year, though they remained below 2021 and 2022 levels owing to ongoing struggles for linear TV advertising. The broadcaster cited “unprecedented competition during the summer and less favourable market conditions at the end of the year”, referring to the Paris 2024 Olympic Games being shown on rival broadcaster France Télévisions, and a slowdown in linear sales during the fourth quarter.

Programming costs were also up 7 percent YoY, including the content investment required to launch TF1+. But the group’s production business, Newen Studios, posted a 4.6 percent increase in revenues, delivering on its strategy of selling content to other broadcasters and streaming companies, such as the historical drama Marie-Antoinette for Canal+ and crime thriller Memento Mori for Amazon Prime Video.

TF1 is looking to collaborate further with international streaming firms, according to the broadcaster, including a new co-production with Netflix: the daily soap opera Tout pour la lumière. The company is aiming to develop fresh IP with “global appeal”, as part of its strategy to reinforce its studio’s “position on the international stage.” To support those efforts, TF1 will rebrand Newen Studios as Studio TF1 next month, and open a new theatrical distribution division in 2026.

On the linear side, TF1 is seeking to “maintain a distinctive position in terms of reach”, noting it will air the Women’s Euro 2025 and the Women’s Rugby World Cup this year. The company further plans “to revamp its commercial offer” in 2025, beginning with changes to its linear ad pricing model, reducing the pricing unit from 30 seconds to 20 seconds.

And the company has bold ambitions for its young streaming service, aiming to “establish TF1+ as the premium alternative to YouTube.” This includes rolling out the service to other French-speaking markets, having launched in Belgium, Luxembourg and Switzerland last year. And TF1 will continue to develop the streaming service’s full-funnel strategy, using data capabilities to better compete for different ad budgets.

“The Group will deploy integrated advertising solutions and innovative technological tools to support brands with their entire digital strategies, from brand awareness to conversion,” said TF1. “To grow its revenue, the Group will continue to work on all of TF1+’s value drivers, particularly by using data to drive monetisation.”

Follow VideoWeek on Twitter and LinkedIn.