In this week’s Week in Review: Netflix weighs up a bid for F1 rights in the US, StackAdapt completes an impressive funding round, and Ralph Lauren executives discuss how ROI guides marketing investment.

Top Stories

Netflix Considers Bid for F1 Rights in the US

Streaming giant Netflix is considering bidding for F1 broadcasting rights in the US covering the 2026 season, according to multiple reports today. ESPN, the current rights holder, has not secured a deal within its exclusivity window according to Reuters, and Netflix is mulling over making a bid.

Netflix has begun investing in live sports rights after years of saying it was unlikely to ever do so. It’s hosted a number of one-off events, including two NFL Christmas Day games and a boxing match between Mike Tyson and Jake Paul last year. The streamer also has global rights to WWE-owned wrestling show Raw, which it began airing in January.

On its most recent earnings call, executives maintained that the economics of live sports remain difficult, stating that Netflix would only be likely to invest wherever it felt it would be able to expand a league’s reach. That might be part of the thinking behind an F1 bid — Netflix’s Drive to Survive series is credited with helping grow F1’s popularity in America, so bringing live races onto Netflix could help the sport capitalise on interest generated by the show.

StackAdapt Raises $235 Million for Programmatic Expansion

StackAdapt, a demand-side platform (DSP), has announced a $235 million funding raise led by Teachers’ Venture Growth (TVG). StackAdapt said the investment will enable the company to extend its programmatic footprint, while expanding into marketing technology. The round follows a $300 million investment from Summit Partners in 2022, and brings StackAdapt’s total investment to over $500 million.

“The challenges marketing teams face are vast and evolving rapidly,” said Vitaly Pecherskiy, Co-Founder and CEO of StackAdapt. “Much of the pressure to drive growth rests on their shoulders as they work to reinvent operations and discover new ways to reach customers effectively, profitably, and predictably. To help them stay ahead of the curve, we are relentlessly focused on building the most advanced, intelligent, and automated platform to make their success inevitable.”

Ralph Lauren Says ROI is the Only Limit on Ad Spend

Fashion brand Ralph Lauren, like many brands, has been focussing more on measuring the return on investment from its advertising spend, a move which has seen it steadily raise the amount it spends on marketing in recent years. And executives at the company say that its ad spend could likely grow further, so long as the marketing team can still demonstrate strong ROI.

Less than ten years ago, Ralph Lauren’s marketing spend sat at just over three percent of sales. Now it’s jumped up to seven percent, and has at times been higher, as the company has spotted particularly strong opportunities to drive ROI.

“[Seven percent of sales] is not the ceiling,” said Ralph Lauren’s president, CEO and director Patrice Louvet on an earnings call following the brand’s recent earnings. “The message to the marketing teams is you have no limit on marketing investment. The only constraint is ROI”.

Big brands adopting this kind of thinking will be welcome for some on the sell-side, given how it raises those brands’ caps on marketing spend. The risk however is that ad spend gets funnelled not necessarily to those channels which really generate the best returns, but those which are best able to demonstrate short-term returns.

The Week in Tech

tvScientific Raises $25.5 Million in Moves to Bring Performance Marketers to CTV

tvScientific, a CTV ad tech business specialising in measuring and managing performance advertising on streaming TV, this week announced the completion of a $25.5 million Series B funding round. The round was led by investment firm NewRoad Capital Partners, alongside smart TV and streaming company Roku, as well as private equity firm Second Alpha Partners. The round also included existing investors in tvScientific, namely Norwest Venture Partners, Progress Ventures and Sir Martin Sorrell-backed S4S Ventures. Jason Fairchild, Co-Founder and CEO of tvScientific, said the funding would be “critical” to the company’s aim for a tenfold increase in the value of the CTV ad market. He notes that Statista forecasts put the current CTV market at $30 billion, expected to grow to $42 billion by 2028. Read more on VideoWeek.

Outbrain Completes Teads Acquisition

Outbrain, a content recommendation company, completed the acquisition of ad tech firm Teads this week, upon receiving regulatory clearance from the relevant authorities, including the UK’s Competition and Markets Authority (CMA). The deal sees Outbrain buy Teads from its parent company, Altice Teads, for $1 billion, while Altice Teads will take a minority stake in Outbrain. Outbrain CEO David Kostman will serve as CEO of the merged company, with former Teads CEOs Jeremy Arditi and Bertrand Quesada becoming Co-President, Chief Business Officer of the Americas and International respectively.

Paramount and Nielsen Strike New Measurement Partnership After Ceasing Business Last Year

Paramount has signed a new deal with Nielsen, ending a long-running dispute between the media firm and measurement business. The agreement sees Nielsen provide measurement services across Paramount’s national and local broadcasting, cable networks, and streaming services, Paramount+ and Pluto TV. The entertainment company ended its previous partnership with Nielsen last year after failing to agree on pricing terms, leading Paramount to partner with Nielsen rival VideoAmp. Paramount and VideoAmp announced an extension of their partnership last month.

Snap Benefits From TikTok Uncertainty in Q4 Revenue Boost

Snap is benefiting from uncertainty around TikTok’s future in the US, CEO Evan Spiegel said on the firm’s earnings call on Tuesday. The social company doubled the number of active advertisers on Snapchat during Q4, driving revenues up 14 percent YoY. Spiegel cited improvements to Snap’s advertising platform, including investments in AI to optimise ad placement and enhance personalisation.

Amazon Reports Double-Digit Growth for Ads Business

Amazon revenues climbed 10 percent YoY in Q4, the tech giant reported on Thursday, with the ads business growing 18 percent during the quarter. But its guidance for the current quarter came in below expectations, sending shares down 2 percent. Amazon CEO Andy Jassy also noted the performance of ads on its Prime Video streaming service. “We’re quite pleased with the early progress, and head into this year with momentum,” he said. “We’ve made it easier to do full-funnel advertising with us – from the top of the funnel, with broad reach advertising that drives brand awareness; to mid-funnel responsive ads that let companies specify certain keywords and audiences, to attract people to their detailed pages or brand store on Amazon; to bottom of the funnel, where sponsored products help advertisers serve relevant product ads to customers at the point of purchase.”

Investment in Performance Ad Products Drives Pinterest Revenues Above $1 Billion

Pinterest forecasts 13-15 percent YoY revenue growth for Q1, according to the social sharing company’s latest earnings, sending its shares up 19 percent. The company reached $1 billion in revenues during Q4, up 18 percent YoY, noting the role of its AI-driven suite of lower-funnel ad products, Performance+. “In today’s advertising environment, proving performance has never been more important,” said Pinterest CEO Bill Ready. “As such, we’ve spent the last two and a half years building a suite of lower-funnel tools that captures our users’ inherent commercial intent. Our efforts are paying off.”

BrightLine and TripleLift Launch Shoppable Ad Marketplace

BrightLine, a shoppable CTV ads business, has announced a partnership with ad tech firm TripleLift to offer interactive CTV ad inventory through multi-publisher and PMP deals. The inventory ranges from FAST channels to premium live sports across BrightLine-enabled streaming services, including the Roku Channel, Samsung TV Plus, FuboTV, Sling and Vizio. “As we advance programmatic delivery of interactive formats, partnering with TripleLift was a natural choice, given their proven success in programmatically selling high-impact creative across web and mobile,” said Rob Aksman, President of BrightLine. “Their strong focus on expanding into CTV programmatic was particularly compelling to us.”

Ocado Ads Launches Self-Serve Retail Media Platform with LiveRamp

Ocado Ads, the UK grocery company’s retail media network, has launched Audience+, an offsite self-serve media platform, in partnership with identity resolution specialist LiveRamp. Audience+ will allow agencies and brand partners to use Ocado’s first-party shopper data via LiveRamp’s Clean Room technology, according to the companies, helping them plan, activate and measure offsite media campaigns across ad platforms. The partners said the move reflects the growing demand for self-serve solutions within retail media.

X Adds Shell, Nestlé and Lego to “Advertiser Boycott” Lawsuit

Elon Musk’s X has added more companies to its lawsuit against brands it accuses of organising an advertising “boycott”, including Shell International, Nestlé, Abbott Laboratories, Colgate-Palmolive, Lego, Tyson Foods and Pinterest. Initially filed in August 2024, the lawsuit accuses the group of conspiring to withhold “billions of dollars in advertising revenue” from X. The legal action also took aim at the Global Alliance for Responsible Media (GARM), prompting the brand safety initiative to shut down last year.

Criteo Shares Surge at Retail Media Growth

Criteo, a French ad tech business, reported a 1 percent revenue dip in 2024 compared with 2023. But the company’s retail media revenues gained 24 percent YoY, and its share price surged 18 percent at the results. Outgoing CEO Megan Clarken handed over to new CEO Michael Komasinski “to lead Criteo into its next chapter of AI-driven innovation and growth.”

Banks Sell Down $5.5 Billion of Musk’s Twitter Debt

A consortium of banks led by Morgan Stanley have sold $5.5 billion of around $13 billion of debt they lent to support Elon Musk’s $44 billion acquisition of Twitter in 2022, according to Reuters. Sources said the company’s decline under Musk reduced the value of the debt, but the banks gained traction with investors in light of Musk’s influence with Donald Trump. However, one investor source said he declined the deal because it was unclear that Musk’s closeness with Trump was boosting X’s revenues enough to justify buying debt with no credit ratings.

The Week in TV

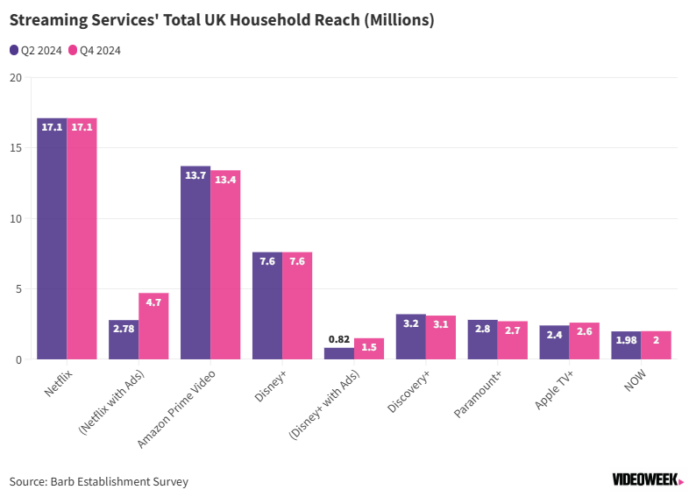

Viewers Continue to Migrate to Ad-Supported Tiers as UK SVOD Growth Stagnates

As is the case in the US, the battle for subscribers between the major international streaming services seems to have largely stagnated in the UK. New data from UK measurement body Barb’s ‘Establishment Survey’, which measures the total number of UK households reached by each subscription video on-demand (SVOD) service, found that 20 million UK homes had access to at least one SVOD service in Q4 last year – the same number as in Q2. And looking at figures for individual services, there’s been very little movement. Barb’s data did however show one significant change in the UK’s streaming landscape across the second half of the year. While Netflix and Disney’s total subscriber figures were unchanged, the number of households subscribed to their ad tiers grew significantly. Read more on VideoWeek.

Fox to Launch Sport and News Streaming Service This Year

Fox will launch a new streaming service with content from Fox News and Fox Sports this year, CEO Lachlan Murdoch said in the US broadcaster’s latest earnings call. The announcement follows the cancellation of Venu Sports, the proposed streaming joint venture between Fox, Disney and Warner Bros. Discovery. “We’re huge supporters of the traditional cable bundle, and we will always be,” said Murdoch. “But having said that, we do want to reach consumers wherever they are, and there’s a large population that are now outside of the traditional cable bundle — either cord cutters or cord nevers.”

Disney+ Posts Quarterly Profit Despite Subscriber Losses

Disney+ subscribers declined by 1 percent YoY during Q4, according to Disney’s earnings announcement on Wednesday. But price rises bumped average revenue per user (ARPU) on Disney+ up 4 percent, leading the streaming segment to another quarter of profitability. Total revenues were up 4.8 percent YoY, with the entertainment division growing 9 percent.

Canal+ to Reduce French Cinema Investment in Rebellion Against Disney Deal

Canal+ has threatened to reduce the amount of money it pays to fund French cinema production, Broadband TV News reported last week. The French broadcaster currently invests an annual €220 million in French film production, in return for the rights to broadcaster films six months after their theatrical release. But after Disney struck a similar agreement for a smaller sum, Canal+ Group CEO Maxime Saada told the Senate Culture Committee that its own payments will come down. “The question is by how much,” he said.

ProSieben Brings German Broadcaster Content to Joyn

ProSiebenSat.1 has announced content partnerships with German media companies ARD Plus, WDR mediagroup and High View, bringing their content to ProSieben’s Joyn streaming service. The agreement makes this content available for free in Germany, Austria and Switzerland, with sales handled by Seven.One Media. “With the high-quality new content cooperation with ARD Plus, WDR mediagroup and High View, we are further expanding the content offering on our streaming platform,” said Henrik Pabst, Chief Content Officer at ProSiebenSat.1. “This is how we are reinforcing Joyn’s clear promise to bundle the most diverse content for viewers in one place, for free.”

M6 Publicité Partners with Nomalab for Video Ad Delivery

M6 Publicité, the French broadcaster’s sales house, has partnered with media production platform Nomalab for delivery of its video ads across linear and addressable TV, as well as the M6+ streaming service. Nomalab will also provide subtitles and audio description, according to the announcement. M6 said advertisers and agencies can now choose between Peach, Extreme Reach and Nomalab to manage their ads across the video services.

The Week for Publishers

Digital Bundles and Ad Targeting Are Offsetting New York Times’ Declining Print Business

The New York Times released its Q4 financial results this week, showing that advertising revenue rose just 1 percent year-on-year during the quarter. The Times’s earnings press release said that “some advertisers continue to avoid hard news topics.” But the New York Times said its ad products continued to deliver even in the face of this challenging environment, growing its digital ad revenue by 9.5 percent YoY. The company noted the role of more advertiser-friendly lifestyle content in the mix, as well as the NYT’s ad targeting capabilities, including its BrandMatch contextual targeting tool. Read more on VideoWeek.

Mantis Sees Ads Blocked on Fifty Percent of Super Bowl Content

Reach’s contextual ad tech business Mantis, which also works with third-party publishers, released data this week finding that 47 percent of Super Bowl content across its network was incorrectly targeted by agency brand safety ad blockers. Mantis said that Super Bowl content frequently contains words which are targeted by blunt blocking tools, such as ‘victims’, ‘injuries’, ‘wounds’, and ‘incident’. “These blunt tools are costing publishers and advertisers valuable opportunities, and it’s time for disruptors in the industry to ensure perfectly brand-safe and suitable content isn’t being sidelined,” said Mantis’s managing director Fiona Salmon.

Forbes Lays Off Five Percent of Staff

Business publisher Forbes is laying off five percent of its global staff, citing financial underperformance, Adweek reported this week. Chief executive Sherry Phillips said in an internal memo that the publisher is “reprioritising resources and reorganising some areas to further increase efficiency and laser focus on the core strength of our brand,” according to Adweek.

The Sun Launches New Paid Premium Subscription

UK news publisher The Sun has launched ‘Sun Club’, a new paid digital subscription which gives readers access to exclusive content, including video content, as well as some discounts and perks which are given to print subscribers. Sun Club costs £1.99 at launch, cheaper than the publisher’s existing £4.99 subscription which lets readers opt-out of personalised advertising (as part of its ‘consent or pay’ mechanism.

Bustle Digital Group Sued for Unpaid Rent

Bustle Digital Group, a digital media company which owns titles including Bustle, Nylon, and Elite Daily, is being sued over unpaid rent for its New York Offices. BDG hasn’t paid rent since October 2023, according to Adweek. These missed payments, alongside late fees and unpaid bills, add up to around $2.7 million. BDG’s CEO Bryan Goldberg told Adweek that the group is nearing a deal with its landlord, and referenced $500,000 worth of repairs which he claimed his group has paid for — seemingly a point of contention.

Le Monde Reports Strong Growth in Paid Digital Subscriptions

Louis Dreyfus, CEO of French newspaper Le Monde, believes that revenues from digital subscriptions will be enough to pay for the publisher’s entire newsroom within two years, according to an interview with Press Gazette. Dreyfus said that 77 percent of Le Monde’s revenues now come from paying readers, with over half coming from subscriptions. He added however that advertising remains an important revenue stream, and said he’s against offering an ad-free experience to paid subscribers, citing the need to deliver reach for advertisers.

The Week for Brands & Agencies

Publicis Posts 6.3 Percent Organic Growth in Q4

French agency holding company Publicis Groupe released its Q4 financial results this week, showing another strong quarter in which organic revenues were up 6.3 percent year-on-year. The company saw solid growth across all its regions, with full-year organic growth of 4.9 percent in the US, 5.4 percent in Europe, and 6.3 percent in Asia Pacific. On an earnings call following the results, CEO Arthur Sadoun said he is confident of continuing to outperform the industry, even with the looming merger of rivals Omnicom and Interpublic Group. Read more on VideoWeek.

Omnicom Forecasts Growth Slowdown This Year

Omnicom posted 5.2 percent year-on-year organic revenue growth in Q4, while the group also issued a more cautious outlook for 2025, with organic revenue growth forecast in the range of 3.5-4.5 percent. The American agency group’s share price dipped slightly following the results. “2025 is going to prove to be a very interesting year, with all the changes in the US government, plus some of the policies that they’re considering and the implications they possibly have on things like the auto sector and other sectors,” said group CEO John Wren. “We’re not pessimistic. We still remain optimistic, but I think we’re going to be conservative at this point in the year, until we get a little bit further along, and a bit more guidance from our clients.” Read more on VideoWeek.

Dentsu Launches New Adobe-Powered AI Platform

Japanese agency group Dentsu this week announced ‘Adobe GenStudio dentsu+’, which it describes as a generative AI-powered integrated marketing ecosystem for brands. The tool combines a number of Adobe’s services across Experience Cloud and Creative Cloud with Dentsu’s own technology and audience intelligence, including Dentsu’s data and identity platform Merkury. The agency group says the new offering will help brands plan, create, manage, activate, and measure content at scale.

Havas Acquires E-Commerce Media Agency Channel Bakers

Havas this week acquired a majority stake in Channel Bakers, an LA-based e-commerce media agency, for an undisclosed fee. Channel Bakers, launched in 2015, has a global team of 80 staff across four continents. It is an Amazon Ads Advanced Partner, and says it has strategic partnerships with Walmart and a number of other retailers. Havas says Channel Bakers will be integrated into its own global e-commerce proposition, Havas Market, though it will retain its own brand identity.

Fragmented Approaches to Cross-Media Measurement Create Headaches for Marketers

The World Federation of Advertisers (WFA) this week unveiled new research on global marketers attitudes to cross-media measurement, outlining where the major headaches are. One big issue for marketers is the number of data silos which exist in individual media channels, making it hard to combine and compare datasets — 86 percent of respondents listed this as a hurdle to cross-media measurement. And while progress is being made in individual markets, different approaches are being used, which creates difficulties for global marketers. Seventy-four per cent of respondents say that they are ‘missing’ comparable cross-market approaches, according to the WFA.

Amazon Ramps Up Spending on X

E-commerce giant Amazon is ramping up its ad spend on social platform X, the Wall Street Journal reported this week, despite wider concerns in the industry about brand safety on the platform. Amazon has been ranked by Ad Age as the world’s biggest ad spender for three years, and so could individually have a significant impact on X’s revenues. Amazon CEO Andy Jassy was personally involved in the decision, according to the WSJ’s sources.

Hires of the Week

Guardian Promotes Imogen Fox to Global Chief Advertising Officer

Guardian News & Media has promoted Imogen Fox to Global Chief Advertising Officer, taking on commercial responsibility for the Guardian’s international ads business. Fox joined the Guardian in 2004 as Assistant Fashion Editor before progressing to Head of Fashion, then moved to the commercial department in 2016, becoming Chief Advertising Officer in 2023.

TF1 Hires Comms Strategist From Netflix

TF1 Group has named Anne-Gabrielle Dauba-Pantanacce as Chief Communications & Brand Officer, succeeding Maylis Carçabal, who has been promoted to Chief Communications Officer at parent company Bouygues. Starting 1st April, Dauba-Pantanacce will take over TF1’s communication and brand operations as the French broadcaster presses ahead with its digital acceleration strategy. Dauba-Pantanacce joins from Netflix, where she served as Vice President of Communications and Public Relations for France and Southern Europe since October 2021.

Venatus Appoints CTO, CPO and CRO

Venatus, a gaming ad tech business, has announced a trio of leadership appointments. Prabhu Prakash Ganesh joins as Chief Technology Officer, following stints at Zally and MIQ; Fleur Bennett as Chief Publisher Officer, having previously served at Google and AppNexus; and Dora Michail-Clendinnen as Chief Revenue Officer, after four years as Chief Strategy Officer at Ozone.

Dentsu Names Jeff Greenspoon as Chief Global Client Officer

Dentsu has promoted Jeff Greenspoon to Chief Global Client Officer, where he will oversee the development of global client-centric solutions. Greenspoon has been with the agency group for more than a decade, with roles including CEO of Dentsu Canada, Chief Business Officer for Dentsu Americas, and Global Practice President, Integrated Solutions.

WBD Names Two Presidents of US Advertising Sales

Warner Bros. Discovery has promoted Ryan Gould and Robert Voltaggio to lead US ad sales. Gould joined Warner Bros. in 2012, and will serve as President of US Advertising Sales, Go To Market. Voltaggio joined Discovery in 2005, and becomes President of US Advertising Sales, Platform Monetisation.

This Week on VideoWeek

Freely’s “Broad Church” Approach is Bridging the Gap Between Live TV and Streaming

Viewers Continue to Migrate to Ad-Supported Tiers as UK SVOD Growth Stagnates

tvScientific Raises $25.5 Million in Moves to Bring Performance Marketers to CTV

“Silly Behaviour” in Pitches and an Approach from IPG: What We Learned from Publicis’ Q4 Earnings

YouTube Finds its CTV and Shorts Strategies Can Go Hand-in-Hand

Omnicom Reassures Clients in Pre-Merger Repitching Period

Digital Bundles and Ad Targeting Are Offsetting New York Times’ Declining Print Business

Here’s How the UK’s Biggest News Businesses Are Using Short-Form Video Platforms

Ad of the Week

Bud Light, Big Men on Cul-De-Sac

Follow VideoWeek on Twitter and LinkedIn.