In this week’s Week in Review: Unilever CEO plans a big shift of ad spend towards influencers, Gracenote data charts the evolution of FAST, and Amazon launches a new CTV product.

Top Stories

Unilever Plans Massive Shift of Ad Spend Towards Social Media and Influencers

Unilever CEO Fernando Fernandez, who took the reins at the consumer goods giant last month, has said he plans to put 50 percent of the company’s marketing budget into social media and influencer marketing as he seeks to drive growth across its brands, up from around 30 percent currently. In a fireside chat with Barclays MD Warren Ackerman, Fernandez described the move as “probably the biggest change in [Unilever] going forward”.

Unilever’s marketing budget has risen quickly over the past few years, up from 13.1 percent of revenues in 2022 to 15.9 percent in the second half of last year. And Fernandez said he plans to keep total investment high, as he believes total marketing spend in 2022 was too low to be competitive.

However with this higher budget, the CEO believes Unilever needs a change in tactics. In the interview he referenced consumers being sceptical of traditional ads, saying that “messages from brands coming from corporations are suspicious messages”. So Unilever wants to do more work with influencers, who Fernandez believes are more trustworthy from consumers’ perspectives.

Scale will be a major component of this strategy. “There are 19,000 zip codes in India, there are 5764 municipalities in Brazil. I want one influencer in each of them,” said Fernandez. “In some of them, I want 100, but at least I want one in each of them.”

FAST Evolves Beyond Back Catalogues, but Metadata Issues Persist

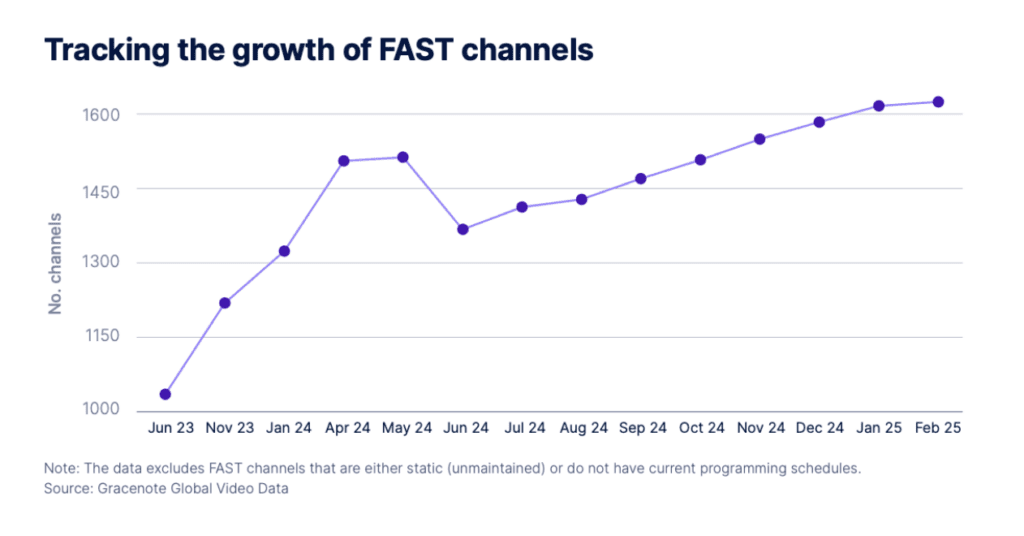

The number of free ad-supported streaming TV (FAST) channels available globally has increased 42 percent since the middle of 2023, and now exceeds 1,600 channels globally, according to new research from Gracenote, Nielsen’s content data business. The US is the largest FAST market by a wide margin with 1,189 channels, followed by 153 in the UK, and 109 in Germany.

As the FAST market grows, the programming on FAST channels is evolving from largely archive content to more original programming, local news and live sport. More than 70 percent of FAST content tracked by Gracenote was produced post-2010, and just 13.4 percent of programmes on FAST channels were made before 1990.

But as the number of FAST channels swells across markets, content discovery remains a big issue according to Gracenote’s data. Some FAST channels are missing basic metadata, with 66 FAST channels seen by Gracenote in February containing no genre information. Data from a mid-2024 study meanwhile found that 31 percent of programmes on FAST channels had no genre data, 66 percent had no production country data, and 24 percent had no ratings information.

Amazon Launches AI-driven CTV Buying Tools

Amazon Ads has unveiled a unified offering on the Amazon DSP called Complete TV, designed to help TV buyers plan, manage and measure their streaming TV buys. The tool is partly designed to help manage workflow for TV buyers, combining deals negotiated at Upfronts with the rest of each advertiser’s CTV buying. Complete TV also provides AI-driven recommendations for managing streaming budget allocation across Prime Video and premium streaming publishers, according to Amazon.

“Advertisers deserve easier ways to plan and manage their streaming TV spend,” said Kelly MacLean, Vice President of Amazon DSP. “Complete TV is a first-ever tool that automatically manages upfront commitments and scatter budgets, using real-time pacing insights and AI-powered capabilities to help advertisers reach high-value audiences, drive ROI, and eliminate media waste.”

Amazon also says the platform will have “industry low” fees, with 0 percent fees for programmatic guaranteed deals on Amazon’s own properties, and 1 percent fees for PG deals on streaming publishers.

The Week in Tech

Google Can Keep AI Investments but Not Chrome Says DOJ

The US Department of Justice (DOJ) has softened its orders against Alphabet aimed at disarming Google’s search monopoly, dropping the proposal that would force the tech giant to sell its investments in AI companies. But the DOJ is still calling for Google to divest its Chrome web browser, maintaining the “core components” of the initial remedies proposed in October 2024. Judge Amit P. Mehta, who ruled Google’s dominance of the search market illegal in August 2024, submitted his final remedies proposal last Friday. The judge reaffirmed that “Google must divest the Chrome browser – an important search access point – to provide an opportunity for a new rival to operate a significant gateway to search the internet, free of Google’s monopoly control.” Read more on VideoWeek.

The Trade Desk’s First CTV OS Client Sonos Abandons its Hardware Plans

Sound systems manufacturer Sonos has abandoned its plans to create a new CTV hardware device, The Verge has reported, despite having spent months developing the product. The news has implications for demand-side platform The Trade Desk, whose in-development CTV operating system ‘Ventura’ had reportedly signed up Sonos as its first hardware client. Read more on VideoWeek.

Barb Plans Unification of CFlight and Advanced Campaign Hub into a Single Interface

Barb, the UK’s major TV measurement body, on Tuesday announced it has appointed media data solutions business RSMB to create a single unified user interface which will bring together its pre-campaign planning tool Advanced Campaign Hub and its post-campaign reporting solution CFlight. Barb says the redesign will make life easier for TV buyers using both tools, while also speeding up the process of rolling out new capabilities. The new system has the working name ‘Total Campaign Reporting Suite’, and is planned to launch in January next year. The existing Advanced Campaign Hub and CFlight interfaces will continue operating as normal until then. Read more on VideoWeek.

LiveRamp to Cut 5 Percent of Workforce in $6.5 Million Restructuring

LiveRamp, an identity resolution specialist, is to lay off 65 employees, according to an SEC filing on Thursday, representing around 5 percent of its staff. The redundancies are part of a $6.5 million restructuring which includes pay-outs for the affected employees. “The restructuring is part of a broader strategic reprioritisation to build a stronger, more profitable company by tightening our focus and simplifying and driving efficiency into our business processes,” said the ad tech firm.

Chartbeat Acquires Publisher Monetisation Business FatTail

Chartbeat, a US-based data and analytics company, has acquired ad tech firm FatTail for an undisclosed fee. The acquisition integrates FatTail’s publisher-focused revenue management business with audience data from Chartbeat, which also owns Tubular Labs, a social video intelligence company. “FatTail gives publishers control over their advertising revenue,” said FatTail CEO Doug Huntington. “By integrating with Chartbeat, we’ll further automate direct advertising and unlock new levels of data-driven optimisation, helping publishers reach more readers, drive down costs and grow their business. We’re thrilled to join forces and build the future together.”

Kantar Explores Further Divestment

Kantar is exploring the sale of its Worldpanel division, the market research giant’s shopping behaviour unit, for £5 billion, according to Sky News. Meanwhile the FT has reported that WPP and Bain, Kantar’s owners, are seeking to break up and sell the company, shifting from previous plans to pursue a stock exchange listing. The rumours follow Kantar’s $1 billion sale of its measurement arm, Kantar Media, to investment firm H.I.G. Capital in January.

US Watchdog Media Matters Sues X Over “Libel Tourism”

Media Matters, a US media watchdog, is suing Elon Musk’s X for “libel tourism”, after the social media company filed three lawsuits against the group in Texas, Ireland, and Singapore. Media Matters, which flagged the appearance of ads next to pro-Nazi content on X in 2023, argues the suits should have been brought in San Francisco, where X was headquartered at the time. “X initiated a vendetta-driven campaign of libel tourism, spanning three jurisdictions in three countries, all arising from the same conduct: Media Matters’ use of X’s platform in accordance with X’s Terms of Service and its truthful reporting on the results,” said Media Matters.

Bluesky Extends Maximum Video Length to Three Minutes

Bluesky, the social media service set up as an alternative to X, now allows videos up to three minutes long, the company announced on Monday. The microblogging service previously had a 60-second time limit on videos, and also introduced a vertical video feed in January. The moves are designed to make Bluesky’s capabilities closer to its competitors, such as X and Threads.

The Week in TV

Channel 5 Launches ‘5’ Streaming Service with Expanded Paramount Content Slate

Channel 5, the Paramount-owned UK channel, has become the latest European broadcaster to revamp its streaming offering, replacing its My5 BVOD platform with a rebranded streaming service called 5. The new offering combines Channel 5’s linear network and catch-up service under the new brand, alongside other Paramount content, including programming from CBS, Comedy Central and MTV, as well as selected titles from Paramount+.

The announcement also confirms that Paramount has dropped plans to merge My5 with Pluto TV, the US broadcaster’s free ad-supported streaming TV (FAST) service. Instead, 5 will feature 15 FAST channels curated from Paramount shows, including Police Interceptors, Geordie Shore and The Yorkshire Vet, alongside channels based around the network’s MTV Reality content and Channel 5’s children’s strand Milkshake! Read more on VideoWeek.

ZDF Revamps Streaming Service to Attract Younger Viewers

ZDF, a German public broadcaster, is overhauling its Mediathek streaming service and website, DWDL.de reported last week. The revamped streaming service, which will launch on 18th March, is designed to attract a younger audience with a proposition more in line with Amazon or Netflix. The relaunch follows similar moves by public broadcasters in the UK such as ITV and Channel 5, which launched its new streaming service ‘5’ this week.

DAZN Brings In-Car Streaming Service to Audi

DAZN has partnered with Audi to make the sports streaming service available in the German manufacturer’s cars, the companies announced on Wednesday. From this month, DAZN will be available via the Audi Application Store in new Audi models A5, Q5, A6, A6 e-tron and Q6 e-tron. “DAZN has been a leading and driving force for innovation in the global sports industry since our launch in 2016,” said Alice Mascia, CEO DACH at DAZN. “We enable sports fans to watch their favourite sport live wherever they want. Thanks to the development of mobility, the demand for in-car entertainment is also playing an increasingly important role for sports fans worldwide. For this reason, we are delighted to be working with Audi to pioneer this area and bring DAZN into cars with the best live sport.”

Amazon Prime Brings Shoppable Ads to Europe

This week Amazon introduced new interactive ad formats for Prime Video in Europe, including shoppable ads, pause ads, and a Shoppable Carousel enabling users to scroll through products using their TV remote. “I think what we’re bringing to the table is a layer of shopability that hasn’t really existed at this scale before,” David Amodio, Head of Video Sales Specialists Northern EU at Amazon, said at the Connected TV World Summit.

US Judge Expedites Lawsuit Against Paramount-Skydance Merger

A US judge has expedited a lawsuit aimed at blocking the merger between Paramount Global and Skydance Media, Variety reported last week. The suit, brought by a group of New York City pension funds, alleges that Paramount failed to get maximum value from its sale by refusing to consider a $13.5 billion bid from venture capital firm Project Rise, and accuses Paramount owner Shari Redstone of favouring the Skydance deal because it benefits her at the expense of minority shareholders. Paramount has argued that the Project Rise offer came in after the close of the “go-shop” window, while Skydance accuses the investor group of “seeking to hijack” the merger.

NBC Extends Olympics Rights in $3 Billion Deal

NBC has extended its deal to show the Olympic Games until 2036, the US broadcaster announced on Thursday, under a $3 billion agreement with the International Olympic Committee. The Comcast-owned network has held exclusive Olympics rights since 1988, and signed an $8 billion extension in 2014. The latest renewal includes the winter games in 2034 and the summer Olympics in 2036.

Joyn Viewing Climbs 17 Percent in February

Joyn, the streaming service from ProSiebenSat.1, saw a 17 percent YoY increase in viewing hours in February 2025, according to the German broadcaster. ProSieben said the streaming service reached 8.3 million users in February, up 9.1 percent from the previous month. Joyn’s growth was driven by Germany’s Next Topmodel, which saw viewing increase 44 percent YoY.

The Week for Publishers

Tastemade Acquired by Food Delivery Business Wonder

Food-focussed media business Tastemade has been acquired by food delivery startup Wonder, which owns Grubhub and Blue Apron in America, for $90 million according to the Wall Street Journal. Tastemade, founded in 2012, grew through distributing food-related content on social platforms, as well as its own website, and has since expanded into streaming on free ad-supported streaming TV (FAST) platforms. The deal is part of Wonder’s ambition to build a food ‘super app’, encompassing takeout delivery, meal delivery kits, content, and advertising.

Brave Sues News Corp Content Scraping Dispute

Tech business Brave, which owns a browser and search engine, has filed a lawsuit against News Corp accusing the publisher of trying to bully Brave out of the search market. News Corp has sent a cease and desist letter to Brave, accusing it of unfairly scraping paywalled content and selling it on to AI businesses and other Brave customers, according to Reuters. Brave meanwhile says its scraping comes under fair use, and is something “which all search engines must do to exist,” according to a statement.

The Guardian Joins The Trade Desk’s OpenPath

The Guardian has signed up to OpenPath, The Trade Desk’s product which creates direct paths to publishers, Adweek reported this week. The Guardian’s advertising chief in North America, Sara Badler, said that the move was driven by sustainability concerns, as the direct supply paths created by OpenPath allow a lower overall carbon footprint. Badler added that OpenPath enables The Guardian to sell inventory for a high price with a relatively low take rate.

French Publishers File AI Lawsuit Against Meta

French trade groups the National Publishing Union (SNE), the National Union of Authors and Composers (SNAC), and the Society of Men of Letters (SGDL) have filed a lawsuit against Meta, accusing the tech company of illegally using copyrighted content to train its AI models on a massive scale. SNE Director General Renaud Lefebvre described the lawsuit as a “David versus Goliath battle”, but said he hopes the lawsuit can serve as an example for others.

The Hill and AP News See Biggest Traffic Gains in Tough Month for News Publishers

The Hill and AP News saw the highest levels of month-on-month traffic growth globally in February out of all English language news websites, according to Press Gazette’s analysis of Similarweb data. Total traffic for The Hill was up 16.7 percent, while AP News’s traffic grew by 5.5 percent. Out of the top 50 publishers globally however, CBC, Reuters, Indian Express, and News18 were the only other titles to see growth, while traffic fell for all other publishers.

The Week for Brands & Agencies

FTC Issues Second Request for Information into Omnicom-IPG Deal

The US Federal Trade Commission (FTC) has issued a second request for information into Omnicom and Interpublic Group’s proposed merger, the two companies said this week, as part of its regulatory oversight of the deal. The agencies described the request as “a standard part of the regulatory process”, and say they still expect the deal to close in the second half of this year. Ad Age however has reported that the FTC could significantly delay proceedings, as it explores what the two companies’ combined proprietary media offering would look like, and how advertisers would be affected.

Heineken Extends Media Contract with Dentsu

Japanese holding group Dentsu this week announced that drinks maker Heineken has handed it an extended media contract, with the renewed two-year deal covering 100 markets including the UK, Italy, Germany, Spain, Mexico, Brazil, India and South Africa. Dentsu was appointed to Heineken’s global media agency roster back in 2016. “As the world moves into the algorithmic era, finding new ways to reach and engage consumers, drive relevance and stand out from the pack will be critical, and we’re proud to continue our partnership with Dentsu on this journey,” said Olya Dyachuk, global media and data director at Heineken.

WPP and Publicis Compete for Coca-Cola’s North America Media Business

WPP is defending Coca-Cola’s North America media account against Publicis, according to Adweek. COMvergence data shows that Coca-Cola’s US media spend sat just below $800 million last year, according to Adweek. WPP handles Coca-Cola’s business through a bespoke unit called OpenX, created when it won the account back in 2021. Publicis meanwhile was the runner-up back in 2021.

Publicis Sapient Announces New Partnership with AWS

Publicis’ digital transformation arm Publicis Sapient has announced a five year “global strategic collaboration agreement” with Amazon Web Services (AWS), which will see it use AWS’s AI and machine learning technologies to assist clients in their digital transformation. “Our collaboration puts the power of AWS’s advanced generative AI services at the fingertips of our shared C-suite customers globally, from CEOs, CIOs and CMOs, to deliver transformative value with AWS security, reliability, and scalability,” said Publicis Sapient CEO Nigel Vaz. “Together, we will create solutions that transform how businesses operate IT and deliver innovative products, services, and experiences.”

Headcount at Big Holding Groups Falls

Total headcount across the big six agency groups (Publicis, Omnicom, WPP, Interpublic Group, Dentsu, and Havas) fell by 1.6 percent in 2024, according to Campaign’s analysis, the first drop since the pandemic. Publicis was the only holding group out of those six companies to buck the trend and grow total headcount last year, according to Campaign. Ad Age meanwhile reported this week that total US employment in advertising, public relations, and related services fell by 1,600 jobs in February, the third consecutive month of decline.

Eight New Members Join the WFA

The World Federation of Advertisers (WFA), an industry trade group, this week announced the addition of eight new members: TUI, Zalando, Allwyn Entertainment, Accor, Four Seasons, PUIG, Zurich Insurance, and Income Insurance. “We’re delighted that our services continue to attract more corporate members, demonstrating the value that WFA provides to marketers around the world,” said Stephan Loerke, WFA CEO. “Our ability to deliver industry leading advice in key areas such as sourcing, media and AI empowers our members to identify the right priorities for their businesses and drive growth.”

IAB UK Launches Initiative to Help SMEs Grow Digital Campaigns

Trade group IAB UK this week announced the launch of a new initiative which it says will provide free expert support for SMEs looking to grow their businesses through digital advertising. IAB UK is looking for SME ‘Digital Advertising Champions’ to submit case studies around how they’ve grown through digital advertising, and all businesses which submit case studies will receive a tailored IAB UK resource pack, to help them get more value out of their ad budgets.

Hires of the Week

Financial Times Promotes Jon Slade to Chief Exec

The Financial Times has announced Jon Slade as Chief Executive of the British newspaper. Slade has served as Chief Commercial Officer at the FT since 2014, and will take over from John Ridding, who has led the publisher since 2006.

Spark Foundry Hires Kelly Metz and Anthony Dario from Omnicom

Spark Foundry, a Publicis agency, has hired two former Omnicom execs to its investment practice. Kelly Metz, formerly Chief Investment Officer (CIO) at OMD, will take on the same role at the media agency. Meanwhile Anthony Dario joins Spark Foundry as EVP Video Investment, after four years with OMG. Current CIO Lisa Giacosa will also transition to the new role of Global Client Lead and Chief Transformation Officer.

IAS CPO Srishti Gupta Joins IAB Tech Lab Board of Directors

IAB Tech Lab, an international trade body that produces technical standards for the digital advertising industry, has appointed Srishti Gupta to its Board of Directors. Gupta is Chief Product Officer (CPO) at Integral Ad Science (IAS), an ad tech business focused on ad measurement and verification. She previously served as CPO of Rokt, and Director of Ads Measurement at Amazon.

IAB Europe Elects Sustainability Standards Committee Leadership

Advertising trade body IAB Europe has named Steffen Hubert as Chair of the Sustainability Standards Committee. Hubert is Associate Director & Sustainability Lead at ProSiebenSat.1, and also represents the German Association for the Digital Economy (BVDW). Meanwhile Emanuela Recalcati, Head of Creative Solutions at GroupM Nexus, has been appointed Vice-Chair of the Committee, which aims to reduce the energy consumption and emissions associated with digital advertising delivery.

Lauren Benedict to Lead Ad Sales at Roku

Roku, a US-based smart TV and streaming company, has hired Lauren Benedict as VP of Global Ad sales and Partnerships, overseeing global revenue operations across Roku Media. Benedict joins from creator platform Spotter, where she served as Chief Revenue Officer, following more than 10 years at Hulu and Disney.

DoubleVerify Announces Three UK Appointments

DoubleVerify, a media measurement and verification business, has announced three UK appointments. Carl Kisseih (formerly Nielsen Marketing Cloud) joins as Lead Enterprise Sales Director, Owen Boyne (formerly The Telegraph) as Enterprise Sales Director, and Chris Mort (formerly MIK Studio) as Global Client Partner.

This Week on VideoWeek

Google Can Keep AI Investments but Not Chrome Says DOJ

Barb Plans Unification of CFlight and Advanced Campaign Hub into a Single Interface

Comcast’s ‘Universal Ads’ Takes a Novel Approach to Reaching Small Advertisers

The Sell-Side View: Q&A with Samsung Ads’ Lydia Parker

Channel 5 Launches ‘5’ Streaming Service with Expanded Paramount Content Slate

The Trade Desk’s First CTV OS Client Sonos Abandons its Hardware Plans

Ad of the Week

Pluto TV, Intrigue if Free, Feel the Free

Follow VideoWeek on Twitter and LinkedIn.