In this week’s Week in Review: Viaplay cuts its losses, YouTube plans a cheaper ad-free subscription tier, and ProSieben shares rise following rumours that MFE is lining up a takeover bid after Germany’s upcoming elections.

Top Stories

Viaplay’s Turnaround Continues Despite Drop in Ad Revenues

Northern European broadcaster Viaplay’s organic sales from core operations were up 4.7 percent year-on-year in Q4, according to financial results released this week, while operating losses fell to -92 million SEK, from -2.8 billion SEK the previous year. The results mark a continued turnaround for the business, which initiated a major strategic rethink half way through 2023 due to unsustainably high losses.

Losses had mounted as Viaplay’s ambitious international expansion, centred on its subscription streaming service, had failed to bring in revenues as quickly as hoped. Since mid-2023 the company has scaled back its international presence, while focussing more on sports and unscripted content.

President and CEO Jørgen Madsen Lindemann said these strategies are paying off, as is the launch of a hybrid subscription tier for the Viaplay streaming platform. But while the ad-supported tier is helping bring in new subscribers, advertising revenues as a whole for the business were down three percent on an organic basis, as growth in radio and digital ad revenues wasn’t enough to offset linear TV declines.

YouTube Plans Lower-Priced Ad-Free Tier in Video Podcast Push

YouTube is planning a lower-priced, ad-free version of its paid video service, Bloomberg reported on Thursday. The “premium lite” package will soon be announced in the US, Australia, Germany and Thailand, according to a source familiar with the plans.

The current YouTube Premium plan costs $13.99 per month in the US, offering the entire YouTube catalogue without ads. The cheaper plan would not remove ads from music videos, according to the report, but is aiming to attract viewers to podcast content on the platform. The move follows Spotify’s push into video podcasts, with ad-free content available to Spotify Premium subscribers.

The plans would also have ramifications for creators monetising their content on YouTube, and even the type of content they create, potentially shifting their reliance on ad revenues to a focus on subscription revenue-sharing agreements.

ProSieben Shares Jump Following Rumours MFE is Preparing a Post-Election Takeover Bid

German broadcaster ProSiebenSat.1’s share price rose by ten percent this morning following a report from Italian newspaper La Stampa that MFE-MediaForEurope, the media conglomerate known to be interested in buying ProSieben, is lining up a takeover bid for after Germany’s elections this Sunday.

MFE already owns a 29.99 percent stake in ProSieben (since reaching 30 percent ownership would require it to make a full takeover offer under German law). And MFE executives have openly talked about making a full takeover offer for the German broadcaster, as part of MFE’s wider strategy to create a pan-European TV powerhouse. Late last year, MFE secured a €3.4 billion loan to finance M&A deals, and CEO Pier Silvio Berlusconi said he would be monitoring both ProSieben’s financial status and the wider German economy, to help determine when to make a move.

Separate reports also emerged this week that ProSieben is preparing to cut around 500 staff as a cost cutting measure, in part due to the pressure it’s under from MFE and fellow shareholder PPF. Manager Magazin reported that the cuts are likely to be announced following ProSieben’s Q4 earnings release on March 6th.

The Week in Tech

X Accused of Making Threats Against IPG to Increase Spending

X has reportedly threatened US advertising group IPG to make its clients spend on the platform, according to the WSJ, using Elon Musk’s ties to the Trump administration to suggest the agency’s pending merger with Omnicom could otherwise be jeopardised. The reports, which name X CEO Linda Yaccarino as one of the people making these perceived threats, follow the company’s lawsuit accusing advertisers of boycotting X, and a probe into the IPG-Omnicom tie-up launched by Jim Jordan, the Republican chair of the House Judiciary Committee. A spokesman for IPG said the holding company does not “make spending commitments on behalf of clients to any partner or platform, and decision-making authority always rests with the client.”

Roku Shares Jump at Q4 Results

Roku, a smart TV and streaming company, topped Wall Street estimates in its Q4 revenues and full-year forecasts, sending its shares up 14 percent. The platform segment, which includes ad and subscription revenues, grew 25 percent YoY, driven by political advertising and the launch of Peacock, Disney+ and Max on its streaming service, The Roku Channel. “We continue to make progress growing ad demand through deeper third-party platform integrations, improving the Roku Experience (which starts at our Home Screen) to expand monetisation, and growing Roku-billed subscriptions,” the company said.

French Ad Tech Firm Smile Wanted Announces €10 Million Raise

Smile Wanted, a French ad tech firm, has completed a €10 million funding round led by Elevation Capital Partners, alongside the Banque Publique d’Investissement (BPI). The business specialises in cookieless curation, and has partnerships with sell-side platforms (SSP) including Equativ, Xandr, Pubmatic and Magnite. The company plans to use the funds to expand into the American and Asian markets. “Our ambition is to make Smile Wanted a major player in programmatic advertising, with growth driven by innovation and internationalisation,” said Smile Wanted CEO Gary Abitan. “We were looking for strategic partners to accelerate our development and take a new step in our growth. With Elevation Capital and BPI, we have found committed investors, capable of supporting us in different geographies and supporting our ambition in a shared approach to value creation.”

Elon Musk’s X Seeks $44 Billion Investment

Elon Musk-owned X is in talks to raise $44 billion from investors, the same amount he paid for the social media business in 2022. The funds would be used to pay down some of the company’s debt, according to Bloomberg, as well as funding the firm’s investments in payments and video products. The move comes one month after a stark email from Musk, as seen by The Verge, in which he told staff: “Our user growth is stagnant, revenue is unimpressive, and we’re barely breaking even.”

DoubleVerify Launches Content Controls for Facebook and Instagram Feed and Reels

DoubleVerify has launched content-level controls for Facebook and Instagram Feed and Reels, the media verification firm announced on Tuesday. The tools enable advertisers to avoid content they deem unsuitable to place their ads, according to DV, building on its post-bid controls for Facebook and Instagram released last year. “By combining content-level controls with post-bid measurement, we’re enabling brands to maximise both the quality and impact of their campaigns,” said DV CEO Mark Zagorski. “Advertisers can ensure their ads appear in environments that align with their brand, powering media effectiveness and boosting advertising ROI.”

The Week in TV

DAZN Scores $1 Billion Investment From Saudi Arabia

Saudi Arabia’s Public Investment Fund (PIF) has agreed to invest $1 billion in DAZN, the UK-based sports streaming service. Surj Sports Investment, PIF’s sports division, will acquire a minority stake (less than 5 percent) in DAZN, according to the FT, making the streaming company its official broadcaster partner for airing Saudi sports. Half the cash will also be invested in a separate broadcasting joint venture for sports in the Middle East, according to people familiar with the deal.

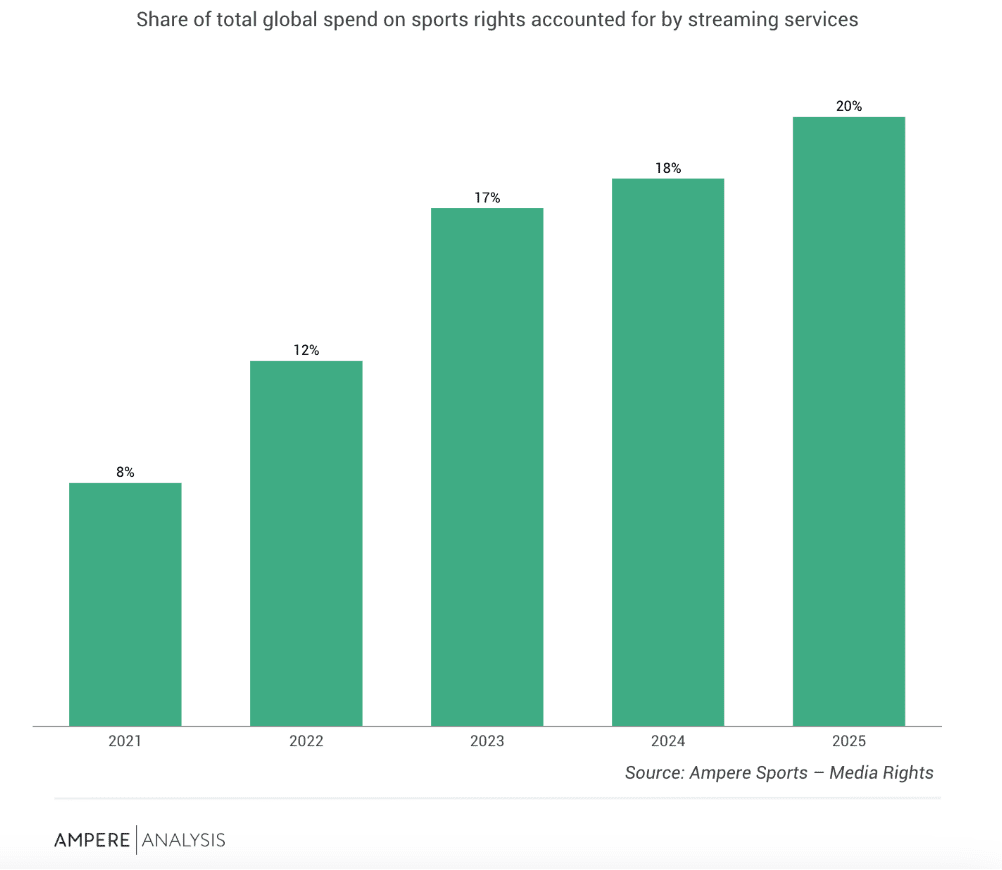

Streaming Companies to Make Up 20 Percent of Global Sports Rights Spend This Year

Streaming companies will account for 20 percent of global spending on sports rights in 2025, according to forecasts from Ampere Analysis. The research firm expects streaming services to spend a combined $12.5 billion on sports rights this year, driven by increased investment from Netflix and Amazon, while DAZN will remain the world’s top spender on sports rights. “DAZN will account for one-third of streaming spend on sports in 2025, boosted by its $1 billion deal for the 2025 FIFA Club World Cup,” said Danni Moore, Senior Analyst at Ampere. “This is on top of its increased investment over the past five years in top-tier sports rights in major European markets such as Germany, Italy, Spain and most recently France. Moreover, DAZN’s share of the global sports rights market will be even higher once its acquisition of Foxtel in Australia completes.”

Netflix Eyes Sunday NFL Rights

Netflix is planning to pursue a Sunday NFL package, according to Chief Content Officer Bela Bajaria, following the success of its Christmas Day NFL matches. “I definitely want the Sunday games,” Bajaria said on ‘The Town’ podcast. The update continues the streaming giant’s pivot towards live sports, after reports emerged this month that it is considering bidding on F1 rights.

Disney-Reliance Merger Moves IPL Behind Paywall

The Indian joint venture (JV) between Disney and Reliance Industries will move IPL cricket matches behind a paywall, according to Reuters, using a hybrid model where a subscription kicks in after content consumption reaches a threshold. The IPL has been available for free in India since 2023, when JioCinema secured the five-year rights for $3 billion. The $8.5 billion merger combines Disney+ Hotstar and Jio Cinema into a new streaming app called JioHotstar.

Ad Acceptance by Streaming Viewers on the Rise Globally

Willingness among global consumers to accept ads in exchange for lower-cost streaming services has risen to 62 percent, up from 58 percent in 2024, according to Kantar Media’s annual international TGI Global Quick View report. The research suggests that ad acceptance is particularly high in North America (65 percent) and APAC (66 percent), compared with just 23 percent in the Nordics. And the proportion of consumers who search online for products they see advertised while watching streaming content has also increased to 56 percent, with ad-supported Disney+ subscribers (63 percent) being particularly active in searching for advertised products.

The Week for Publishers

The Guardian Agrees Deal with OpenAI

UK newspaper The Guardian has agreed a licensing deal with AI giant OpenAI, the companies announced this week, making The Guardian’s reporting and archive journalism available as a news source within OpenAI’s ChatGPT. The agreement will also see The Guardian roll out ChatGPT Enterprise to develop new products, features, and tools. “This new partnership with OpenAI reflects the intellectual property rights and value associated with our award-winning journalism, expanding our reach and impact to new audiences and innovative platform services,” said Keith Underwood, chief financial and operating officer of Guardian Media Group.

Publishers Focus on Audience Growth and Revenue Diversification, but ESG Efforts Wane

Growing audiences is the strategic priority most commonly cited by publishers, according to new survey data from UK trade group the Association of Online Publishers (AOP), with 85 percent of those surveyed ‘strongly agreeing’ that it’s a priority. Developing new revenue streams through product innovation (80 percent) and increasing advertising revenues (79 percent) were the next most common priorities.

The survey also found that publishers are putting less focus on ESG (environmental, social, and governance) initiatives. ESG’s importance to employees fell from 70 percent last year to 51 percent this year; importance to investors from 51 percent to 44 percent; importance to business values from 62 percent to 44 percent, and importance to advertisers from 58 percent to 39 percent.

ChatGPT Traffic Referrals Rise, but Account for Less Than 0.1 Percent of Publisher Traffic

The volume of traffic referrals top publishers received from AI chatbot ChatGPT rose eight times between last August and this past January, according to Press Gazette’s analysis of Similarweb data. Total global visits to 14 leading publishers rose from 435 million in August to 3.5 million in January. But these sites received 3.8 billion total visits in January, meaning that ChatGPT accounted for less than 0.1 percent of their total traffic.

Hearst CEO Predicts Difficult Year Ahead

Steve Swartz, the CEO of international media business Hearst, said in an annual letter to employees this week that he expects a tough year ahead for the company, despite reaching record revenues and profits in 2024. Swartz said last year’s strong performance was mainly driven by good results for its ratings agency Fitch and its local TV networks, which benefited from spending around the US elections, according to The Hollywood Reporter. But Swartz said that an increasingly competitive and tough ad market will make conditions hard in 2025.

Immediate Invests in Video with New Test Kitchen

Publishing group Immediate Media this week unveiled a new multi-media studio and kitchen space, the Good Food Test Kitchen, which the company describes as a major investment in its multimedia output. Good Food is the UK’s number one food media brand according to Immediate, and the test kitchen will be used to create video and photo content, as well as for developing and testing recipes.

Axel Springer CEO Flags Interest in Wall Street Journal

Mathias Döpfner, CEO of European publishing giant Axel Springer, said in an interview with the Financial Times this week that he would be interested in buying the Wall Street Journal, though he said his chances of actually acquiring the paper are “close to zero”. Döpfner is known to be looking for media acquisitions following the separation of Axel Springer’s media businesses from its classified ads unit. The FT noted that there have been rumours that Rupert Murdoch, the WSJ’s current owner, might be considering a sale amid an ongoing succession legal drama.

The Week for Brands & Agencies

Dentsu Posts 2.6 Percent Organic Growth in Q4

Japanese agency group Dentsu released its Q4 financial results this week, revealing that the company ended the year on a positive note with 2.6 percent organic growth year-on-year in the final quarter. This wasn’t enough however to take full year results into positive territory, as full year organic revenues were down by 0.1 percent. Dentsu’s CEO and president Hiroshi Igarashi said the company is implementing a new mid-term management plan to try to spur growth, which will see the company work to increase its media capabilities in key markets.

FTC Probes Omnicom’s IPG Merger

The US Federal Trade Commission (FTC) has opened an investigation into Omnicom’s proposed merger with fellow agency holding group IPG, Ad Age reported this week. FTC lawyers have begun interviewing relevant parties, according to Ad Age, asking about the potential impact of the merger on competition and transparency in the ad agency sector. Significantly, lawyers are not known to be asking about collusion between agencies on issues like brand safety, an issue raised by some Republican lawmakers. The interviews are reportedly part of an initial approval review.

Publicis Groupe Acquires Influence Marketing Business BR Media Group

Publicis Groupe has agreed a deal to acquire Latin American influencer marketing and content business BR Media, the French agency group announced this week, for an undisclosed fee. BR Media has a network of over 500,000 creators, according to Publicis, and partners with more than 500 global and local clients. Publicis says the acquisition will strengthen its influencer offering in Latin America, while the ability to link Publicis’ data and identity offering Epsilon with BR Media’s proprietary technology will strengthen BR Media’s proposition.

Voxcomm Warns Pay-to-Play Pitch Schemes are Putting Relationships at Risk

Agencies are increasingly being asked to pay intermediaries in order to be able to pitch for client accounts, the global agency trade group Voxcomm reported this week, a trend which Voxcomm warned is putting agency/client relationships at risk. In some cases this practice is explicit, while in others it might be more subtle. An intermediary which puts together pitch shortlists might, for example, more frequently shortlist agencies which pay it for separate services (such as consultancy in how to win pitches). The practice emerged a few years back in the UK, according to the Voxcomm, but has since spread to other markets.

IPG Nears Deal to Sell R/GA

Interpublic Group is nearing a deal to sell digital agency R/GA to a management-led buyout group backed by private equity business Truelink Capital, Ad Age reported this week. A deal could be announced within a few weeks, according to the report. IPG has been actively seeking to offload a few of its agency brands over the past year, having already sold Huge to private equity firm AEA Investors back in December.

Hires of the Week

Advertising Association Appoints Allwyn UK CEO Andria Vidler as President

The Advertising Association (AA) has named Andria Vidler, CEO of Allwyn UK, operator of The National Lottery, as president of the UK trade body. Vidler takes over from Alessandra Bellini, who will continue her work with the AA as Chair of the Ad Net Zero UK Group. Alongside the AA’s Chair, Dame Annette King, and Chief Executive, Stephen Woodford, Vidler’s role will cover the trade association’s initiatives for driving public trust in advertising (Value of Trust), talent recruitment and retention (All In), and sustainability (Ad Net Zero).

Condé Nast Names Andrea Latten as Chief Business Officer UK

Global media company Condé Nast has promoted Andrea Latten to Chief Business Officer for the UK. Latten has been with the publisher for 13 years, most recently serving as UK Head of Industry for Fashion, Luxury and Beauty. In her new role, Latten will focus on driving revenue growth, spearheading content and events for Condé Nast brands, and client partnerships.

British Airways, Love Departed

Follow VideoWeek on Twitter and LinkedIn.