Agricultural trial balance is a key financial tool used by farm managers and agricultural accountants to ensure the accuracy of financial records. It serves as a summary of all the ledger balances within a farming enterprise, helping to verify that all financial transactions have been properly recorded and balanced.

This tool is essential for managing farm finances, ensuring that all accounts are accurate and up to date. Agricultural businesses can make informed decisions, avoid errors, and keep track of their financial health effectively by understanding and maintaining a trial balance

In this article, we will explore the meaning and purpose of an agricultural trial balance, its components, and its importance in farm management.

We will also discuss the steps involved in preparing a trial balance, common mistakes made, its uses in financial reporting, and how it aids in decision-making. Furthermore, we will touch on the challenges of maintaining a trial balance and why it is a vital tool for agricultural accounting.

Read Also: How to Market your Matured Fishes for Profit

Definition of Agricultural Trial Balance

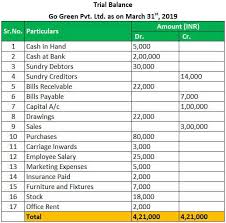

An agricultural trial balance is a financial statement that lists all the balances from the ledger accounts of a farming enterprise at a specific point in time. Its primary purpose is to verify the accuracy of these accounts, ensuring that the total debits equal the total credits.

This balance acts as a check on the accuracy of the bookkeeping process, helping to detect and correct any discrepancies before preparing financial statements like the income statement or balance sheet.

The agricultural trial balance serves as a vital tool for farm owners and managers by providing an overview of the farm’s financial standing.

It ensures that every financial transaction, from income earned to expenses incurred, is properly recorded, which is essential for maintaining transparency and accountability in agricultural operations. Furthermore, it helps streamline financial reporting, offering a clear and organized summary of all account balances.

Components of Agricultural Trial Balance

The agricultural trial balance consists of several key components that represent different aspects of the farm’s financial transactions. These include:

1. Assets: These are the resources owned by the farm, such as land, machinery, livestock, and crops. They are recorded on the debit side of the trial balance.

2. Liabilities: These are the obligations or debts the farm owes to external parties, such as loans or accounts payable. They are recorded on the credit side.

3. Equity: This represents the owner’s investment in the farming business, including retained earnings or capital contributions. It is also recorded on the credit side.

4. Income: All sources of revenue generated from the farm’s activities, such as the sale of produce or livestock, are listed on the credit side of the trial balance.

5. Expenses: These are the costs incurred in running the farming business, such as labor, feed, fertilizers, and fuel, and are recorded on the debit side.

Importance of Agricultural Trial Balance in Farm Management

The agricultural trial balance plays a crucial role in effective farm management by ensuring the accuracy of financial records and providing a clear snapshot of the farm’s financial health. Its importance can be highlighted in several ways:

1. Error Detection: The trial balance helps identify discrepancies in the accounting system. If the total debits do not match the total credits, it signals errors such as incorrect entries or missing transactions, allowing for corrections before the preparation of financial statements.

2. Financial Planning and Control: Farm managers can use the trial balance to assess the farm’s financial standing, which helps in planning budgets, controlling costs, and making informed decisions about future investments, resource allocation, and operational changes.

3. Basis for Financial Statements: The trial balance is the foundation for preparing key financial statements like the income statement and balance sheet. These statements are essential for assessing profitability, monitoring cash flow, and evaluating the overall financial performance of the farm.

4. Compliance with Accounting Standards: For farms required to adhere to financial reporting regulations, a properly maintained trial balance ensures compliance with standard accounting practices, contributing to transparency and accountability in agricultural operations.

Steps Involved in Preparing an Agricultural Trial Balance

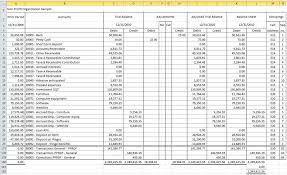

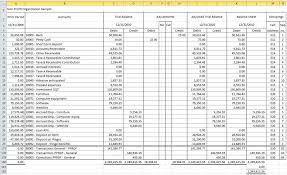

Preparing an agricultural trial balance involves a systematic process to ensure that all transactions are accurately recorded. Below are the key steps to follow:

1. Post Ledger Entries: Ensure that all financial transactions from the farm’s journals (such as sales, purchases, and expenses) are correctly posted to the respective ledger accounts.

2. Calculate Account Balances: Determine the balance of each ledger account. This is done by summing up all the debit entries and all the credit entries in each account and then calculating the net balance.

3. List Account Balances in the Trial Balance: List all the ledger account balances in the trial balance format. Debit balances (assets and expenses) are placed on the debit side, while credit balances (liabilities, income, and equity) are placed on the credit side.

4. Total the Debit and Credit Columns: Add up the totals for both the debit and credit columns. If the two totals match, it indicates that the accounting records are in balance. If there is a discrepancy, further investigation is needed to identify and correct the errors.

5. Review and Adjust: If errors or discrepancies are found, adjustments are made by reviewing the original transactions and correcting any mistakes. Adjusting entries may be required to account for accruals, deferrals, or any unrecorded transactions.

Common Mistakes in Agricultural Trial Balance

While preparing an agricultural trial balance, several common mistakes may occur that can result in discrepancies between the debit and credit columns. These errors can lead to inaccurate financial statements if not corrected. Below are some of the most frequent mistakes:

1. Omission of Transactions: A transaction might be completely left out of the ledger, meaning it will not appear in the trial balance, leading to imbalances.

2. Transposition Errors: When numbers are reversed (e.g., recording 652 instead of 562), it can cause discrepancies that are often difficult to detect but will impact the trial balance totals.

3. Posting to the Wrong Account: Recording transactions in the wrong ledger account, such as posting an expense as an asset, can result in incorrect balances in both the trial balance and the final financial statements.

4. Double Entry Error: Failing to apply the double-entry principle correctly, where a transaction is recorded only on one side (either debit or credit) rather than on both, leads to an imbalanced trial balance.

5. Calculation Errors: Simple mathematical errors, such as incorrect addition or subtraction of account balances, can cause the trial balance totals not to match.

6. Duplication of Entries: Posting the same transaction more than once can distort the figures in the trial balance, leading to inflated account balances.

Uses of Agricultural Trial Balance in Financial Reporting

The agricultural trial balance serves as a foundational tool in the financial reporting process of a farming enterprise. Its accurate preparation and maintenance help in various aspects of financial management and reporting. Some of its key uses include:

1. Basis for Preparing Financial Statements: The trial balance provides the information needed to prepare critical financial statements, including the income statement, balance sheet, and cash flow statement. These statements offer insights into the farm’s profitability, assets, liabilities, and overall financial health.

2. Simplifies Auditing Processes: A well-prepared trial balance makes it easier for auditors to review the farm’s financial records. It helps trace transactions, verify their accuracy, and ensures that all accounts are balanced, which reduces the time and effort required for audits.

3. Helps in Compliance with Tax Regulations: Farms are required to submit accurate financial reports for taxation purposes. The trial balance helps in calculating the taxable income by ensuring that all revenues and expenses are recorded correctly, thereby simplifying the tax filing process.

4. Monitoring Financial Performance: The trial balance provides a snapshot of the farm’s financial performance at a specific point in time. Farm owners and managers can use this to monitor ongoing financial health, track expenses, and evaluate if they are meeting their financial goals.

5. Supports Decision-Making: By providing a clear overview of the farm’s financial status, the trial balance helps in making informed decisions, such as investments in new machinery, expanding livestock, or improving crop production.

Challenges in Maintaining an Agricultural Trial Balance

Maintaining an accurate agricultural trial balance comes with several challenges, especially for farm managers who may have limited accounting expertise or complex financial transactions. Below are some common challenges faced:

1. Complexity of Agricultural Transactions: Farms often deal with a wide range of transactions, including sales, purchases, subsidies, loans, and barter agreements, which can make recording and categorizing transactions more complex compared to other businesses.

2. Seasonality of Income and Expenses: Agricultural businesses experience fluctuating income and expenses based on the seasons. This variability can make it difficult to maintain accurate, up-to-date financial records, as expenses may be incurred far in advance of revenue collection.

3. Multiple Revenue Streams: Many farms have multiple sources of income, such as livestock, crops, and value-added products. Accurately recording income from different sources and maintaining separate ledger accounts for each can be a challenge.

4. Manual Errors in Record Keeping: Farms that rely on manual accounting systems are more prone to human errors such as incorrect postings, duplication of entries, or mistakes in calculations, leading to an inaccurate trial balance.

5. Inventory Valuation: The valuation of agricultural products (e.g., crops and livestock) at different stages can be tricky. Estimating the value of livestock, harvested produce, or standing crops can lead to inaccuracies in the trial balance if not properly recorded.

6. Lack of Accounting Knowledge: Many farm owners may not have formal accounting training, making it harder to understand the technicalities of maintaining a trial balance, leading to errors or omissions in financial reporting.

Read Also: Introduction and Feasibility Study on Fish Farming

Agricultural Trial Balance and Decision-Making

An agricultural trial balance plays a critical role in decision-making by providing a comprehensive overview of the farm’s financial status.

Farm owners and managers can use the information derived from the trial balance to make strategic and operational decisions that enhance profitability and sustainability. Some ways the trial balance aids decision-making include:

1. Budgeting and Cost Control: By analyzing the trial balance, farm managers can identify areas where expenses are high or revenue is lagging. This allows them to adjust their budgets, implement cost-cutting measures, or allocate resources more efficiently to maintain financial stability.

2. Investment Decisions: The trial balance helps assess the farm’s current financial position, such as available cash, liabilities, and profit margins. This information is crucial when deciding whether to invest in new equipment, expand operations, or diversify farming activities.

3. Evaluating Farm Performance: Regularly reviewing the trial balance helps farm managers compare the farm’s current financial performance with previous periods. This enables them to evaluate whether the farm is growing, stagnating, or declining, guiding long-term strategic planning.

4. Debt Management: Farms often rely on credit to finance operations. The trial balance provides insights into outstanding liabilities, helping managers decide whether they can take on additional debt or if they need to focus on paying down existing obligations.

5. Risk Management: The trial balance can reveal financial risks such as high levels of debt, low cash reserves, or declining revenue. By identifying these risks early, farm managers can take proactive steps to mitigate potential financial difficulties.

In conclusion, the agricultural trial balance is a fundamental tool in the financial management of farming enterprises.

It ensures that all financial transactions are accurately recorded and that the farm’s accounts are balanced, serving as the foundation for preparing financial statements like the income statement and balance sheet.

Farm owners and managers can detect errors, maintain accurate records, and comply with accounting standards when regularly preparing and reviewing the trial balance

This article has covered the key aspects of agricultural trial balance, including its definition, components, steps involved in preparation, and its critical role in farm management. We also discussed common mistakes, challenges in maintaining the trial balance, and how it supports decision-making and financial reporting.

Whether you’re managing a small farm or a large agricultural operation, understanding the trial balance will help ensure the accuracy of your financial records and provide the insights needed for informed business decisions.

Utilizing this essential tool, you can maintain a strong financial foundation and achieve long-term success in your farming business.

Do you have any questions, suggestions, or contributions? If so, please feel free to use the comment box below to share your thoughts. We also encourage you to kindly share this information with others who might benefit from it. Since we can’t reach everyone at once, we truly appreciate your help in spreading the word. Thank you so much for your support and for sharing!

Read Also: How to Make an Avocado Tree Bear Fruit