It’s clear that we in the US have entered a self-inflicted economic downturn. While there is plenty that is not clear regarding how bad it will be and how quickly things will improve, every airline’s management team has to be sitting around right now thinking about how they are going to deal with this unfortunate development. Broader capacity cuts are likely coming at some point, but where that capacity comes from will, as always, be interesting. For me, Chicago is the most fascinating city to watch, because there is a lot of game theory going on there at the moment which has led to big growth as of late.

Frankly, I’m surprised we haven’t seen more cuts already. Consumers are increasingly anxious about the present situation — the Consumer Confidence Index hit a 12-year low in March — and if consumers aren’t confident, they will cut back on spending. It’s not all bad news for the best-positioned airlines like Delta and United, however. As the March release noted, “The decline was also broad-based across income groups, with the only exception being households earning more than $125,000 a year.” In other words, premium may hold up better.

Even if premium holds up, there is going to be an impact on every carrier. The massive tariffs that were recently implemented will not help demand. Yes, reduced trade is generally bad for business and bad for airlines, but it’s more than that.

Further, because of the huge expected impact of these tariffs, consumers have to rethink how they prioritize spending. A smart consumer is moving up purchases of cars, electronics, and clothes before the tariffs jack up the price. Airfare is not going to be hit by tariffs, so that means people may shift their already-reduced spending plan away from travel.

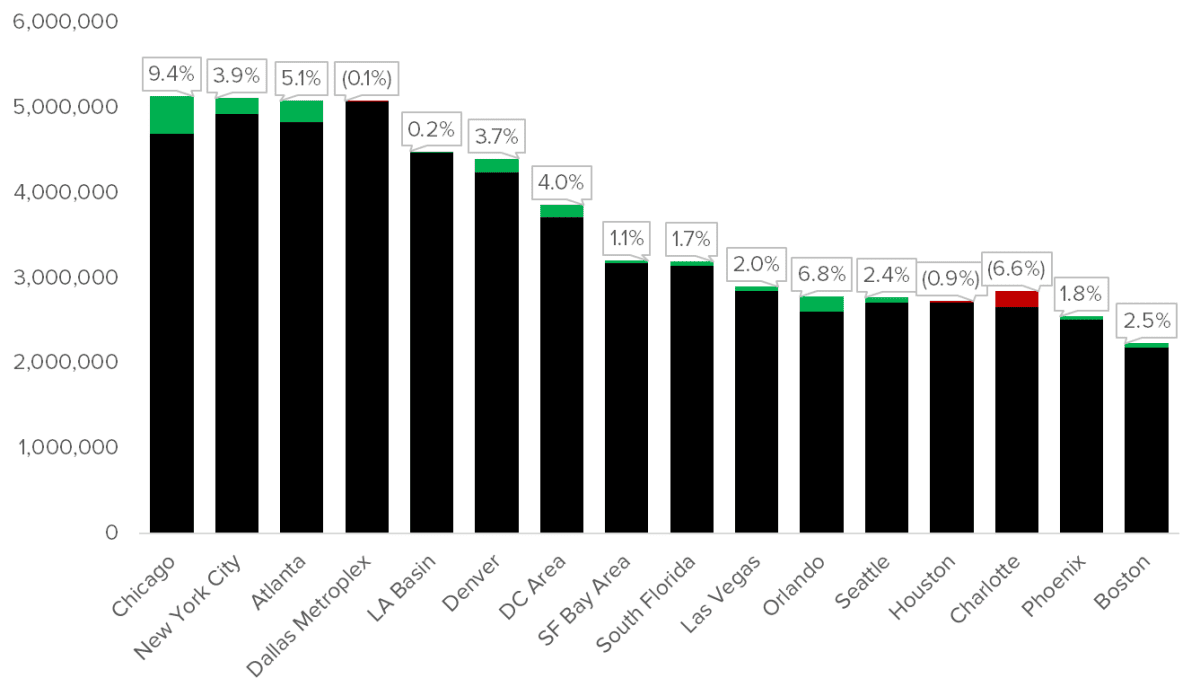

With that backdrop, you’d think airlines would have already pulled down flying, but they have not, at least not significantly. I could have sworn Delta said it was loading a capacity cut at the end of March, but that has yet to materialize. Right now, of all the 16 markets that have more than 2 million domestic seats scheduled this summer, only three are down year-over-year. Take a look at July 2025 vs July 2024:

Data via Cirium

Of course Charlotte stands out on the down-side, but it’s the mighty Chicagoland area that really pops at the very top. This July, seats are expected to be up nearly 10 percent vs last year. That seems insane, but there is a reason for this. It’s a reason I covered back in February.

You’ll remember that O’Hare has a convoluted way of figuring out how to allocate gates. It may be convoluted, but United studied up and did the math. It began playing the game last year, and now it is expecting to gain six more gates in the annual allocation as a result of its work. American, meanwhile, had not restored service post-pandemic and appeared to have been caught off-guard by this move.

Because of United’s efforts to maximize capacity while American was looking elsewhere, it has set something in motion that will likely end with United continuing to take more and more gates over time. But to do that, United has to keep pumping capacity into the airport. American could have decided to give up, it could have opted to maintained, or it could have decided to try to fight. It chose the latter option. American is now pouring capacity into O’Hare to try to prevent losing more gates.

Here you’ll see total domestic seats departing Chicagoland for each of the big three players in the market:

Data via Cirium

You can see how United started running away from the pack in summer 2021, and then you can see how this year is when American realized what was happening. What this means is that in July, American domestic seats from O’Hare are up a staggering 24 percent year-over-year while United continues to increase pressure by increasing 13 percent. Southwest is relatively flat, but we all know it has plenty of strategic decisions to make separate from this downturn.

The end result here is that there’s a ton of capacity in this market that’s chasing what is likely to be declining demand. The difference in this market is that the capacity coming in isn’t really tied to demand. It’s these external factors that are pushing airlines to make different decisions.

Who will blink first? I can’t imagine it’s United. It has its eyes set on winning more and more gates. It would be shocking for the airline to give that up unless it’s a catastrophic demand in decline like you get from a pandemic. Meanwhile, American is in catch-up mode. If it gives up, it might make sense, but is it really willing to cede Chicago to United? Only American knows that answer. And Southwest, well, it’s a wildcard. I suppose it depends on what the board wants to do there.

In other cities, capacity can easily go up and down with demand, but Chicago is different. For that reason, it’ll be the most fun to watch.