Scapia resumes onboarding of their travel credit cards on the Federal Bank platform

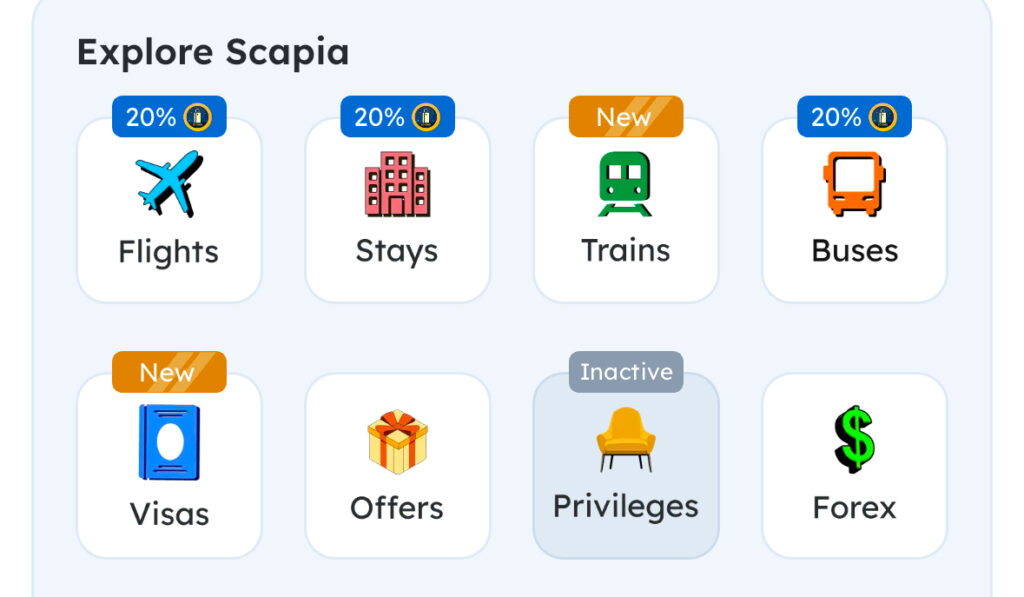

In 2023, Scapia launched its credit cards focused on the travel space. Scapia was unique because their card products and the whole app and experience are concentrated on travel. For instance, the company has an app that accompanies the card, where one can book flights and stays and even apply for visas.

In 2024, Scapia had to stop onboarding new customers because the regulator asked Federal Bank, their banking partner, to discontinue onboarding new co-brand credit card customers.

Scapia resumes issuance of credit cards.

Last week, Scapia officially relaunched its credit card. Scapia’s core philosophy revolves around simplifying travel rewards. They shot a video, narrated by Naseeruddin Shah, to announce their comeback.

Instead of point systems and redemption processes, Scapia offers a different model: zero forex markup, unlimited domestic lounge access, and travel rewards through its “Scapia Coins” programme. Here is how the card works:

- Zero Forex Markup: Scapia eliminates forex markup, making it ideal for international travel and online purchases in foreign currencies. However, you don’t earn rewards on these purchases.

- Unlimited Domestic Lounge Access: When INR 10,000 is spent monthly, one can access unlimited domestic airport lounges across India. Scapia also offers the ability to spend money on specific airport outlets (up to INR 1,000) and then reimburses you for these in the form of Scapia Coins (1 Coin worth INR 0.2).

- Scapia Coins Rewards Programme: The card gives back 10% Scapia Coins on every transaction. On Travel Spends through the app, Scapia is currently offering 20% Scapia Coins. With the current conversion of 5 Scapia coins = 1 Rupee, that converts to 2% on regular spends and 4% on travel spends. These coins can be redeemed for travel bookings, including flights and hotels, through the Scapia app.

- Lifetime Free Card: No joining fees, no annual fees.

I signed up for the card when it opened for applications again, and the card was delivered today with a pretty good limit. I hear that the card is also open for existing Federal Bank customers. I have no dearth of credit cards for lounge access but I like this feature where I can sit at a coffee shop and be reimbursed for it, rather than head to the lounge.

You can apply for the card here. Alternatively, you can email me your contact details (Name, Phone, City, Email) for a referral where you earn 1500 Scapia Coins on activation (s c a p i a (at) l f a l (dot) n e t).

Bottomline

Scapia has started onboarding customers again. This travel-focused credit card has some unique perks, is free for life, and offers zero markup on international spending. One of the unique ones is the ability to earn coins for airport spending, which bypasses the need for lounge access altogether. Apply here.

What are your thoughts and experiences with the Scapia Credit Card?

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

More from Live from a Lounge