In what seems like record time, Spirit has now exited Chapter 11 bankruptcy protection. The airline is now $795 million of debt lighter and $350 million richer thanks to additional equity investments. It has a mere seven directors on the board who split between finance and industry experience. One of those is CEO Ted Christie who remains at the controls flying the plane, free to pursue a life of religious fulfillment.

Now what?

As the press release says, “Today, we’re moving forward with our strategy to redefine low-fare travel with our new, high-value travel options.” What exactly does that mean? It depends on who you ask. Reuters thinks this means Spirit is now targeting affluent travelers. Ted told CNBC that he’s definitely looking to attract people away from Southwest now that bags don’t fly free. And I say that we still don’t quite know what the airline wants to be. But one thing I can say is that it has not been quiet.

Spirit is a much smaller airline than it was even a year ago. In March 2024, the airline flew just over 4.9 million seats on nearly 26,000 flights. This March? It scheduled just under 4.2 million seats on under 22,000 flights. April is down more than 17 percent on seats year-over-year.

It has left several cities since 2023 including Aguadilla (PR), Charleston (WV), Denver (CO), Los Cabos, Manchester (NH), Monterrey, Ponce (PR), and Puerto Vallarta. (I’m not counting Cap-Haïtien and Port-au-Prince since those presumably will come back eventually when it’s safe.) Meanwhile, it added Birmingham (AL) last year and then this year are the two newbies Chattanooga and Columbia plus a slew of new routes that were added just this past weekend.

The Chattanooga and Columbia adds were already somewhat interesting. It shows Spirit going for small cities with little to no competition that are big enough to support sub-daily flying to Florida and Newark. It’s very Allegiant-y. There may not be a whole lot of those readily available, but then again, the airline’s recent changes show yet another shift.

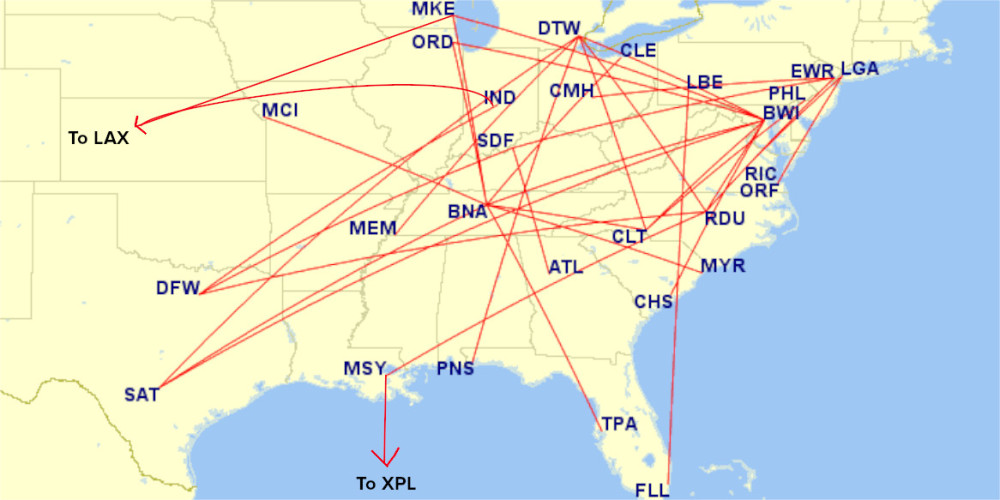

This past weekend, Spirit added 36 new routes. Ok, technically that’s 24 brand new and 12 that are returning after an absence with some dating back to pre-pandemic times. Here’s a map:

Maps generated by the Great Circle Mapper – copyright © Karl L. Swartz.

Every single one of these routes is flying sub-daily. This is a big change from Spirit’s previous value proposition where frequency was the name of the game compared to other low-cost operators. Now, it wants to spread its wings as far as Frontier and Allegiant do thanks to low frequencies.

The two largest gainers this week? They just happen to be major Southwest cities: Baltimore and Nashville. Let’s just take one city to show just how things are changing. Here’s Baltimore.

Here’s a chart that shows departures in July 2025 by destination from BWI versus July 2019.

Data via Cirium

Look at the black lines. Those show service from BWI back in 2019 when the airline hit its high point at the airport. Note that there is not a single route with less than 1x daily frequency. Now look at the yellow. There are still some with more frequency, but the airline had already dipped its toe into flying sub-daily with Cancún, Miami, and Punta Cana. But this week, look at those eight new markets, all flying either 2x or 4x weekly.

What’s interesting is that many of these are markets that Spirit has served in the past. The difference now is it will serve them far less often. Combine that with Southwest’s recent moves to eliminate differentiators and Spirit may think it has a real chance. Then again, Southwest eliminating differentiators means it can make fares even lower and make it up on ancillaries. I’m not sure how this will work, but again, it’s very low frequency so there’s limited risk.

This week’s new adds all look similar, though they likely weren’t added for the same reasons. BWI and Nashville look like an attempt to strike while Southwest is hurting. Detroit was the next biggest add, and that’s a historically important market for Spirit. Besides being its former home base, it’s also a city that other ULCCs haven’t really tried to win. This looks like an attempt to reinforce with this sub-daily strategy.

The new two largest adds were in Charlotte and Raleigh/Durham. I find that interesting since a lot of ULCCs appear to have taken an interest in those markets as of late.

Perhaps my favorite add of all, however, is the decision to fly 2x weekly from New Orleans to Comayagua which is the new airport in Honduras that replaced Tegucigalpa. TACA used to fly to New Orleans for decades until 2005 when it left. Spirit has flown to San Pedro Sula since 2021, starting at 3x weekly. It has grown from there and this summer will now hit 1x daily. With the sub-daily strategy, Spirit can continue to gently ease into experimental markets much easier than it could previously. And whey work like San Pedro Sula, it opens new doors to other opportunities.

We don’t know if this most recent load is a complete picture of what we can expect from Spirit, but it is good to see the airline actually making real network changes for the first time in a long time.