A friend of mine recently made a move that I’ve been telling him to do for the past four years – he finally sold his car and is going car-free. To replace his car, he’s using a combination of ebikes, carshare, mass transit, and rental cars.

Going car-free is not a move that will work for everyone, but I’m willing to bet that many people reading this could probably pull this off. Even if you can’t go completely car-free, I’m almost certain that most two-car households out there could make the move to one car if they really thought about how they use their cars.

For my friend, this move is a huge financial benefit for him. His car is his third-highest monthly expense after his rent and food, so making this move will immediately improve his financial situation, reducing his transportation costs down to potentially nothing.

And while there will undoubtedly be situations where he might need a car, having access to a car won’t be an issue since there are so many car-sharing and rental car options available. The difference now is when he needs a car, he’ll pay to use it, rather than the normal way, where you pay to have the car, even when you aren’t using it.

My Friend’s Car Situation

At the outset, my friend has a situation that makes it possible for him to go car-free, namely that he lives in an urban setting and doesn’t need to drive very often. Indeed, he bought his car four years ago and in those four years, he only ended up putting around 15,000 miles on his car. That’s a far cry from the average miles driven by most individuals, which is usually around 14,000 to 15,000 miles per year. For him, his car was really only used for two things – transporting his dog to dog parks that weren’t within walking distance and playing golf. Both of these things can be addressed by other transportation methods (which I’ll discuss later in this post).

In terms of costs, his car was originally a leased car which he ended up buying at the end of his lease for about $13,000. To pay for the car, he took out a car loan. Interestingly enough, because he put so few miles on it, he was able to sell the car for around $19,000, so after paying his car loan off, he’ll have around $6,000 to work with.

His other fixed costs for the car included the following:

- Parking: $200 per month

- Insurance: $75 per month

- Registration: $75 per year

For our purposes, his fixed car costs were about $500 per month when you add everything up. This is fairly typical for most people – actually a bit below average when you consider the average car payment is between $500 and $700 per month. And that’s just the car payment people are paying – it doesn’t include the insurance, gas, maintenance, and other expenses that go with owning a car.

It’s important to remember that when it comes to fixed costs like car payments, parking, and insurance, you pay these costs irrespective of how much you drive. For my friend, that meant he was essentially paying $500 per month for the privilege of having a car and parking it near him. If he drove more, he’d have additional costs for gas, maintenance, and depreciation, but since he didn’t drive much, those costs were fairly low.

Ebikes Replace The Majority Of His Car Trips

For regular day-to-day trips, my friend’s ebike was already handling most of the load. I’ve written before that ebikes are game changers when it comes to transportation and they may be the best investment you can make based on the return on investment you can get from them.

The math bears this out. According to data from AAA, the average yearly cost of a car comes out to around $12,000 per year (source: https://newsroom.aaa.com/2023/08/annual-new-car-ownership-costs-boil-over-12k/). Even if you’re below this average, you can see that even for someone like my friend who barely drives, his fixed car ownership costs came out to around $6,000 per year.

Meanwhile, a decent entry-level ebike will cost somewhere around $1,000 to $1,500 and has minimal maintenance costs. Your average car user will earn their money back in just a few months solely based on the savings from not having a car. If you invest the money you’d otherwise spend on a car, you’re looking at potentially a million dollars or more of investment returns. That’s an insane return on investment for a $1,000 or $1,500 ebike.

And ebikes really can replace the majority of trips we take on a day-to-day basis. The vast majority of trips most of us take are 5 miles or less. Even if you live deep in the suburbs, you may be surprised to see that the travel distance for the main places you visit (grocery stores, parks, restaurants, etc) is within a few miles. With an ebike, you’re looking at travel times of 20 minutes or less for the majority of your trips.

My friend generally opts to use his ebike to get around, using it for 99% of his trips. Most of the time, his trips with his ebike can be faster than using a car, especially since he doesn’t have to worry about traffic or parking when he’s going places. If there is a difference in travel time, it’s usually only by a few minutes.

One of the main reasons he had his car was to go golfing or to the driving range. However, the main course that we play is within biking distance (just a 15 or 20-minute bike ride). Even when my friend had his car, we would always bike to this golf course, mainly because we found it more enjoyable.

To transport his clubs, we’d typically use my Urban Arrow and put the clubs into the bike. Here’s how it looks:

If he was biking on his own, he’d use his Burley Travoy Trailer, which is a bike trailer from Burley that almost seems designed to hold golf clubs. Here’s an example of how we use that trailer:

The nice thing about biking to the golf course is that the weather is never a problem since we only go golfing when it’s nice out, and not when it’s raining or cold. But in short, even when it comes to something like golf where a car seems necessary, it’s actually not.

Potentially Get A Cargo Bike To Replace Larger Car Trips

One thing that made my friend keep his car for so long was that he sometimes needed it to bring his dog to the dog park. He used to live a few blocks from his regular dog park so he could easily walk to it, but he recently moved to a new apartment where the walk would be closer to 15-20 minutes one way. This isn’t a long walk, but it still means 30 to 40 minutes per day of walking that he might not want to do. In addition, he sometimes has other shorter trips he takes where he wants to take his dog with him.

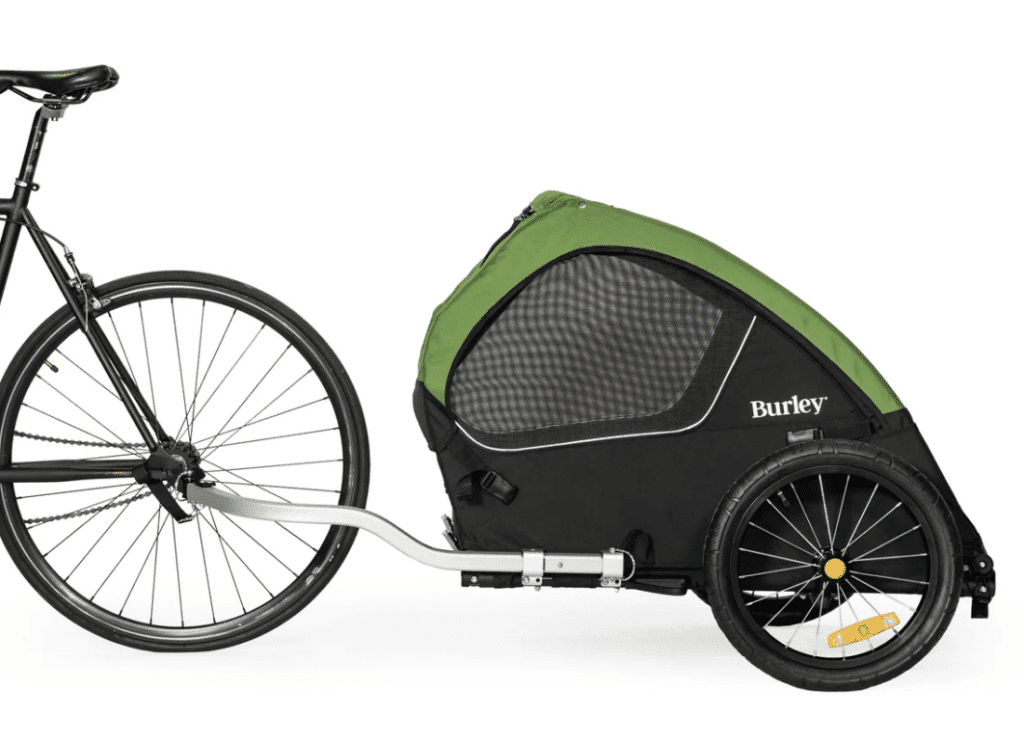

My solution to him was to get a dog trailer for his bike. Burley, for example, sells a dog trailer for $400. Not cheap, but far cheaper than owning a car just to take your dog around occasionally.

My buddy is a bit weird with his dog though and refuses to take him in a Burley because he wants his dog to be in front of him so he can see him, rather than in a trailer behind him. One potential solution that he’s contemplating is getting a front-loading cargo bike like the Urban Arrow. This is the primary bike I use to transport my two children around.

Another cargo bike he’s looking at is a three-wheeler from Bunch Bikes. Interestingly enough, Bunch sells an ebike specifically for carrying dogs, with a little side door so that your dog can easily hop into the bike.

Getting a cargo bike like this is going to be expensive. Even the Bunch Bike comes in at nearly $6,000. Still, it’ll be far cheaper than spending $500 per month indefinitely just to sometimes take his dog to the park. And the ongoing maintenance costs for a cargo bike like this will be minimal. It’ll also be helpful because he can use a cargo bike for grocery trips or other trips where he needs to carry a lot of cargo.

He’s got some extra money from selling his car, so it’ll be up to him to decide what he wants to do with it. I personally think he should just get a trailer to carry his dog around, but that’s something he doesn’t want to do.

Replace Car Trips With Carshare

While my friend hasn’t gotten a cargo bike yet and is still debating whether he wants to spend the money to do that, he has solved his car problem by replacing his car trips with carshare.

In Minneapolis (where we live), there are two types of carshare systems – free-floating cars and fixed cars. They’re run by the same company (an organization called Hourcar), so one membership gets you access to both types of cars.

Free-floating cars are ones where you can pick them up wherever they happen to be parked, then park them anywhere you want in the service area. Free-floating carshare systems typically charge you by the minute, so you’re charged for the time you’re actually driving (similar to how shared scooters or bikes work). By contrast, fixed carshare uses cars that are parked in specific spots. The difference is that when you rent one of these cars, you have to return the car to the same parking spot. Pricing for these cars is typically by the hour.

Based on my friend’s car usage patterns, carshare is a clear winner for him. If he doesn’t want to walk the 15 or 20 minutes to the dog park, he can instead drive it in about 5 or 10 minutes depending on traffic. Evie, the free-floating carshare system in Minneapolis charges 22 cents per minute, so he’s looking at $2.20 each way if it takes him 10 minutes to drive to the park. Even if he makes this drive every day, he’ll pay $4.40 per day in car costs or $132 per month. That’s far less than the $200 he’d have to pay just to keep his car parked in a parking lot.

For longer trips (such as going to play golf at a suburban golf course), the options are to either hitch a ride with someone or use Hourcar, which is the fixed carshare system in Minneapolis. Hourcar costs $7.48 per hour if you get the $7 per month membership (which is reimbursed each month as a ride credit), so if he drove to a golf course and had the car checked out for 5 hours, he’d pay $37.40. This might sound expensive to use a car for five hours, but when you consider that my friend might do this type of drive once or twice a month, it’s still far less than the monthly cost of owning his car. Even if he went golfing once per week and drove each time, he’d still pay less in a month for carshare compared to what he’d pay with owning his car.

I think it’s important to remember that while a carshare system like Evie or Hourcar might seem expensive per use, it’ll still cost less than owning a car if you’re not driving often and are only using a car when it’s necessary. From a monthly standpoint, my friend has to use $500 worth of the carshare systems each month to equal the fixed cost of owning his car. He’ll never do that – not with his current travel patterns.

When you think about it, owning a car sort of forces you to use your car more often than necessary since you need to make it worthwhile to cover your fixed costs. But at the same time, using it more often increases your car costs since you now have to pay for fuel and increased maintenance and depreciation.

Rare Situations – Rental Cars and Rideshare

Finally, in rare situations, my friend can use rental cars or rideshare like Uber or Lyft.

Rental cars would be limited to road trips where using carshare wouldn’t make sense. The amount of times per year my friend goes on a road trip is low, at most, once or twice a year. Renting a car for a few days would not be expensive or a big deal.

And of course, when all else fails, he can always use Uber and Lyft. It’s unlikely he’d need to Uber or Lyft very often, but it is nice to have that option if needed.

Final Thoughts

After my friend sold his car, he said that it felt like he was trading in his car for dozens of cars. This is true – by replacing his car with carshare, he basically gives himself dozens of cars in his neighborhood. That’s pretty nice.

The big thing my friend is doing with this move to a car-free life is that he makes it so he only pays for a car when he actually needs it. This is in stark contrast to his previous car situation, where he had a car that cost him several hundred dollars per month, regardless of whether he drove it or not. At the same time, it removes a source of stress for him. Instead of worrying about how his car is doing, he can instead park whatever car he’s driving and walk away. Someone else handles the insurance, maintenance, parking, and fuel on his cars.

On the financial side, my friend will save thousands of dollars every year by taking advantage of the transportation options around him, namely ebikes and carshare.

For my friend, going car-free makes sense. Your situation might not let you go car-free, but you might be able to do more than you think. My family hasn’t gone car-free, but we’ve stuck to being a one-car household despite having two young children, and I don’t think we’ll ever get a second car.

The important takeaway here is to look at your situation and think about how you are actually using your car and whether the cost of it makes sense. My guess is that there are many more people out there in a similar situation who could make this same move as my friend did if they thought outside the box a little bit.

Related