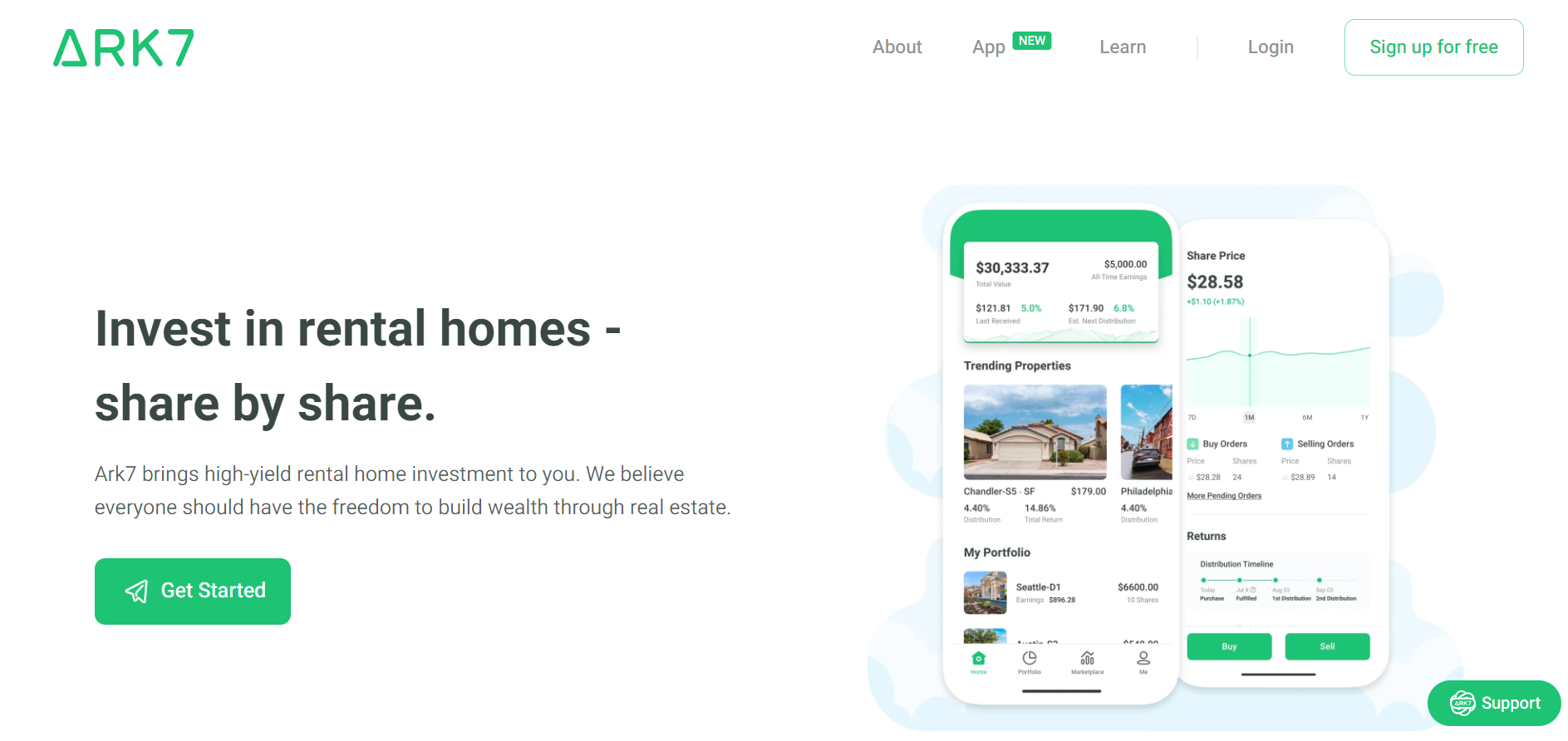

Ark7 is a real estate investment platform that has gained popularity in recent years. It offers investors the opportunity to own shares in income-producing properties without the hassle of being a landlord or dealing with the complexities of traditional real estate investing. In this comprehensive Ark7 review, I will take a closer look at Ark7 and examine if it’s worth your time.

.wp-review-35098.review-wrapper { font-family: ‘Open Sans’, sans-serif; }

Ark7 Summary

The Dinks Ark7 Summary

Ark7 is a fintech start-up with mobile and browser applications. The company buys rental property with an LLC and issues shares to investors. Ark7 then takes a management fee and manages each property on behalf of its investors. The company is new but well-suited for risk-tolerant investors who want a geographically focused investing strategy.

Pros

- Highly specific geographic opportunities

- Strong operational discipline

- User friendly interface

- Low investing minimums

- Good quality opportunities

- Competitive returns

Cons

- New platform

- Lack of managerial control

- Loss risk

- Lack of leverage

- Less tax flexibility

.wp-review-35098.review-wrapper {

width: 100%;

float: left;

}

.wp-review-35098.review-wrapper,

.wp-review-35098 .review-title,

.wp-review-35098 .review-desc p,

.wp-review-35098 .reviewed-item p {

color: #555555;

}

.wp-review-35098 .review-title {

padding-top: 15px;

font-weight: bold;

}

.wp-review-35098 .review-links a {

color: #26af1a;

}

.wp-review-35098 .review-links a:hover {

background: #26af1a;

color: #fff;

}

.wp-review-35098 .review-list li,

.wp-review-35098.review-wrapper {

background: #ffffff;

}

.wp-review-35098 .review-title,

.wp-review-35098 .review-list li:nth-child(2n),

.wp-review-35098 .wpr-user-features-rating .user-review-title {

background: #26af1a;

}

.wp-review-35098.review-wrapper,

.wp-review-35098 .review-title,

.wp-review-35098 .review-list li,

.wp-review-35098 .review-list li:last-child,

.wp-review-35098 .user-review-area,

.wp-review-35098 .reviewed-item,

.wp-review-35098 .review-links,

.wp-review-35098 .wpr-user-features-rating {

border-color: #26af1a;

}

.wp-review-35098 .wpr-rating-accept-btn {

background: #26af1a;

}

.wp-review-35098.review-wrapper .user-review-title {

color: inherit;

}

.wp-review-35098.review-wrapper .user-review-area .review-circle { height: 32px; }

{

“@context”: “http://schema.org”,

“@type”: “Review”,

“itemReviewed”: {

“@type”: “SoftwareApplication”,

“name”: “Ark7”,

“image”: “https://www.dinksfinance.com/images/2023/05/ark7-logo.jpg”,

“url”: “https://ark7.sjv.io/k0o0Gz”

},

“reviewRating”: {

“@type”: “Rating”,

“ratingValue”: 0,

“bestRating”: 100,

“worstRating”: 0

},

“author”: {

“@type”: “Person”,

“name”: “James Hendrickson”

},

“reviewBody”: “Ark7 is a fintech start-up with mobile and browser applications. The company buys rental property with an LLC and issues shares to investors. Ark7 then takes a management fee and manages each property on behalf of its investors. The company is new but well-suited for risk-tolerant investors who want a geographically focused investing strategy.”

}

Understanding Ark7: A Brief Overview

Real estate investing has long been considered one of the best ways to build wealth and generate passive income. However, for many people, investing in real estate is out of reach due to high transaction costs and significant paperwork requirements. Ark7, at its core, is a solution to this problem. It allows investors to access real estate markets without requiring large amounts of capital.

Ark7 is a real estate crowdfunding platform that was founded in 2017 to democratize real estate investing. The platform allows everyday investors to access high-quality real estate deals that were previously only available to high socioeconomic status or institutional investors. While the platform has fees and is less flexible from a taxation standpoint, it is suitable for investors who want to invest in a targeted geographic manner.

What is Ark7?

At its core, Ark7 is a platform that allows investors to purchase fractional shares in properties. What Ark7 does is buy a property, put it under a corporate umbrella and issue shares in the corporation. This means that investors can own shares in a corporation that owns a property, rather than having to purchase the entire property themselves. By pooling their resources with other investors, individuals can invest in high-quality real estate deals that they may not have been able to access on their own.

At its core, Ark7 is a platform that allows investors to purchase fractional shares in properties. What Ark7 does is buy a property, put it under a corporate umbrella and issue shares in the corporation. This means that investors can own shares in a corporation that owns a property, rather than having to purchase the entire property themselves. By pooling their resources with other investors, individuals can invest in high-quality real estate deals that they may not have been able to access on their own.

Ark7 was founded by Andy Zhao (an ex-Google engineer), James Weng, and Lynn Yang who recognized the potential of real estate investing for building wealth and generating passive income. They wanted to create a platform that would allow everyday investors to access real estate markets with more ease and lower cost than existing markets allowed for.

How Does Ark7 Work?

Ark7 is a fintech start-up with mobile and browser applications. Ark7 buys rental property under an LLC and issues shares in that LLC that sell at varying prices based on the underlying economic value of the property.

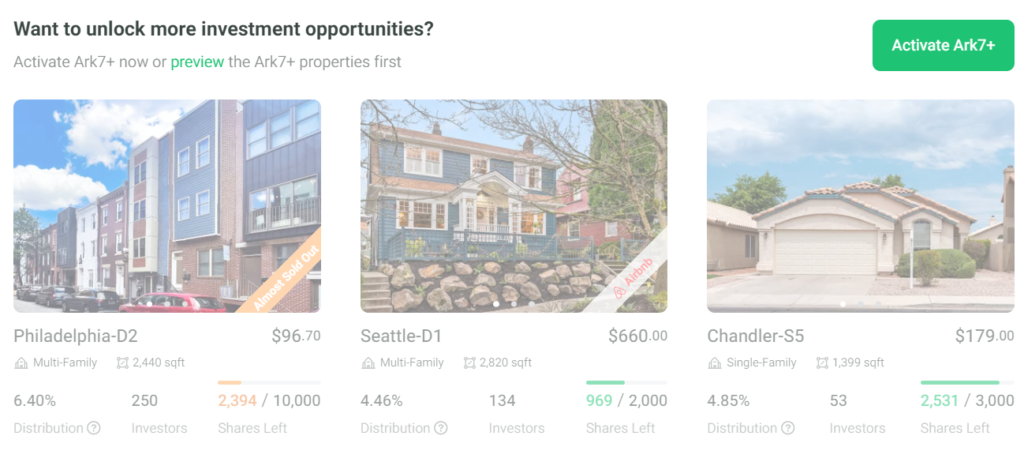

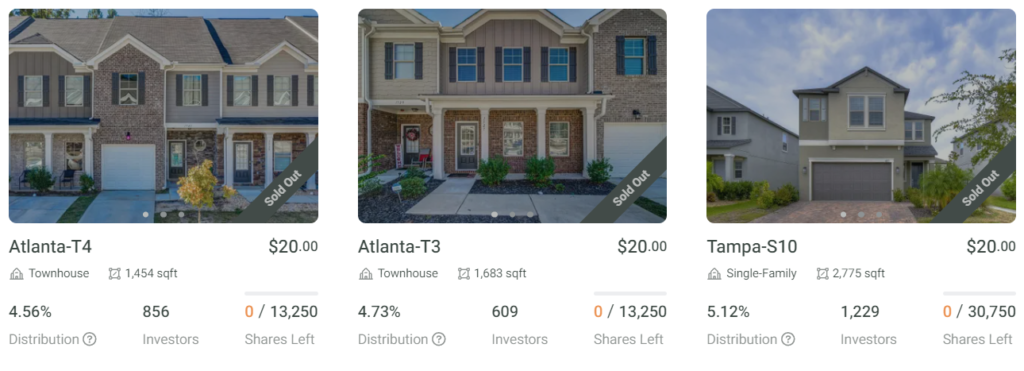

Share prices are determined by the property’s value and can vary a great deal across markets. Ark7 allows the securities to be traded and has options for holding your investment in an IRA.

When you buy shares in the LLC, you receive a part of the monthly property income proportionate to the percentage you own. For example, if you owned 10,000 shares in a property and there were 20,000 shares outstanding, you’d be entitled to 50% of the income, less fees.

Rental properties listed on Ark7 are located in various real estate markets and cities around the country. Ark7 is active in ten states with a good amount of market data for app users to review. The company requires a three-month minimum hold on its properties. Users are provided a very consumer-friendly user exchange to peruse, analyze, and buy into properties, as well as monitor the investments they make and track dividend payments. The company indicates it has close to 90,000 active users, pays out $1.4 million in dividends monthly and its portfolio is worth around $19 million. Its securities are registered with the SEC.

Ark7 is a full-service organization. The company manages all the real estate, including collecting rent and dealing with any necessary property management and maintenance. For these services Ark7 charges between 8% and 15% of the rental income. Ark7 offers retirement accounts and opportunities for accredited investors.

Key Features of Ark7

As an emerging fintech, Ark7 has some features that other fractional ownership of real estate companies do not. These are: offering highly specific investment opportunities and a high degree of operational discipline.

Highly Specific Investment Opportunities

One of the key features of Ark7 is the highly specific investment opportunities that it provides to investors. The platform offers access to a range of different types of properties, from single-family homes to multi-unit apartment buildings. This diversity of investment options allows investors to tailor their portfolios to meet their investment goals and risk tolerance.

One of the key features of Ark7 is the highly specific investment opportunities that it provides to investors. The platform offers access to a range of different types of properties, from single-family homes to multi-unit apartment buildings. This diversity of investment options allows investors to tailor their portfolios to meet their investment goals and risk tolerance.

Tailoring investment goals and risk tolerance usually means diversification, but not always. Unlike other REITs or fractional ownership apps, Ark7 allows budget-conscious investors to make highly targeted investments.

For example, if an investor felt that single-family homes in Texas were likely to outperform other asset classes, they would be able to execute a strategy around this using Ark7. In contrast, companies such as Fundrise, which issue shares in a pool of assets, are not able to provide this level of exactness.

Very Good Operational Discipline

Ark7 exercises a high degree of discipline in its internal operations. For example, for each property in the Ark7 marketplace, the company will look at over 1,000 possible opportunities. Ark7 usually uses three factors to evaluate opportunities: the presence of massive socioeconomic development, population growth, and pro-growth domestic policies.

Ark7 also thoroughly vets local real estate market conditions and communities around the candidate property. Its team looks for nicer homes in communities with good accessibility, good public schools, and a pleasing appearance. It also looks at neighborhood comparables, such as local rental rates, and local policies on renting, zoning, and other natural factors (Coinmonks.com).

In addition to highly focused investments and good operational discipline, Ark7 has several other advantages.

User-Friendly Platform

In contrast with competing apps such as HappyNest, the Ark7 platform is easy to use and navigate, making it accessible to a range of investors. The platform is also well-designed, with clear and concise information about each property and the investment opportunity it presents. The user interface is intuitive, and investors can easily track their investments and the income generated.

Investing in real estate can be complicated, but Ark7 makes it simple. The platform provides investors with all the information they need to make informed investment decisions, and the user interface is designed to be user-friendly and accessible to everyone.

Using Ark7

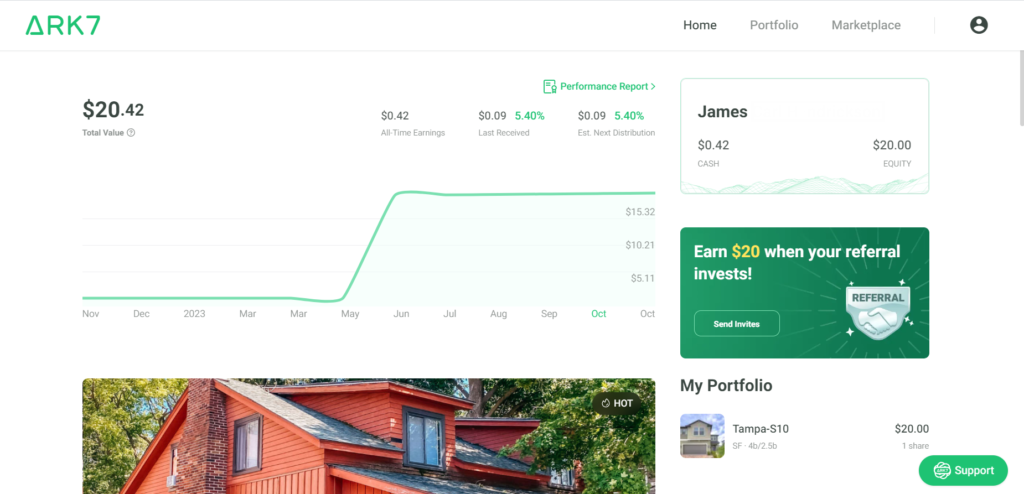

After you open an account you’ll get a dashboard that looks like this.

The dashboard shows you a bunch of properties, as well as the cost of a share, your total portfolio overview, and some tabs to access the marketplace and your portfolio. When you click on a property it will give you information about its location, conditions, share pricing, and cash distribution data.

Most of what is available to retail investors on the platform are single-family homes. To get access to commercial and multifamily properties, you’ll need to be an accredited investor. Ark7’s channel for accredited investors is called Ark7+. The Ark7+ accredited investor opportunities are greyed out until you apply, see here:

In general, their interface is simple and well-designed. Money deposited is credited promptly.

Good Quality Investments

One of the biggest advantages of using Ark7 is the access it provides to good-quality real estate investments. The properties in the Ark7 app are all typically newer, well-maintained properties in good neighborhoods. You’re not buying trailer parks or $500 houses in Detroit.

Diversification

Most fractional ownership real estate apps offer diversified real estate investments. Ark7 is no exception. It offers a diversified portfolio of real estate investments, reducing the risk of any one property underperforming. This diversification provides investors with more stability and security in their investments. Moreover, investors can choose from a range of investment options, including long-term holds, short-term flips, and more.

Returns: How Much Does Ark7 Pay?

Ark7 generates income for investors in two ways:

- monthly rent payments

- capital gains.

As of the time of this writing, listed properties on the Ark7 marketplace were paying annualized rent payments of between 4.5% and 7.3%, and capital gains appreciation rates between 4.1 and 20.7%.

In Ark7 both sources are essentially passive for investors. While some effort is required to select and monitor investments, as well as communicate with the Ark7 team, small investors don’t need to spend much time beyond some initial due diligence and ongoing investing monitoring.

Ark7 also offers IRA options. Their IRA options allow your returns to grow in tax-advantaged accounts. This increases the real returns of the investment because the impact of taxation on profits is lessened or eliminated. With Ark7 the accounts are held in custody for you. You hold the assets in the account because you aren’t involved in the day-to-day management of the companies running your properties – making them suitable for being held in an IRA.

Referral Program

Since Ark7 is in a growth phase, they have a generous referral program. If you sign up, you can pick up some extra money by getting a friend to join — you’ll both get $30. Thirty dollars isn’t a lot, but when you factor in a couple of years of additional passive income the $30 gives you, it starts to look worth it. You can sign up here.

Since Ark7 is in a growth phase, they have a generous referral program. If you sign up, you can pick up some extra money by getting a friend to join — you’ll both get $30. Thirty dollars isn’t a lot, but when you factor in a couple of years of additional passive income the $30 gives you, it starts to look worth it. You can sign up here.

Potential Drawbacks of Ark7

Ark7 has several potential drawbacks.

The Platform is New

Ark7 was founded in 2019. Running a high-growth fintech startup is notoriously difficult. About 80% of fintech startups fail within the first 15 years of business operation. And, while Ark7 is a relatively new investing platform with an interesting business model, it has not yet stood the test of time.

Lack of Managerial Control

One potential drawback of using Ark7 is the lack of control that investors have over their investments. As fractional owners, investors have limited control over the underlying property and its management. This lack of control may be a concern for some investors who prefer to have more control over their investments.

Risk of Capital Loss

In addition, while Ark7 offers a diversified portfolio, there is still a risk of loss associated with real estate investments. Real estate values can fluctuate, and unexpected events such as natural disasters or economic downturns can negatively impact the performance of real estate investments. Investors should be aware that Ark7 investments could lose up to 100% of their value.

Lack of Leverage

Traditional real estate investing allows owners a high degree of leverage. Take for example the case of a homeowner who buys a house for $100,000 and puts down $20,000. If the value of the house grows to $150,000, the homeowner has received an investment return of 250%. The amount of leverage an Ark7 share provides is unclear as the platform is still new, however, it is likely less than directly owning real estate.

Unclear If You Can Borrow Against Your Ark7 Shares

One advantage of traditional real estate is the ability to borrow and use your real estate as collateral. Borrowing is the principle underlying mortgages, home equity lines of credit, and the like. The ability to borrow is non-trivial. Many high-net-worth investors can grow their real estate portfolios aggressively and quickly using leverage. However, it is not clear if this is an option with Ark7.

Less Taxation Flexibility

Payments from Ark7 are taxed as LLC partnership income, per Ark7. This is slightly less flexible than the taxation of REIT distributions, which can be considered ordinary income, capital gains, or return of capital (Reit.com). In addition, Ark7 shares don’t have as many tax advantages as directly owning real estate such as the deductibility of interest and property tax payments.

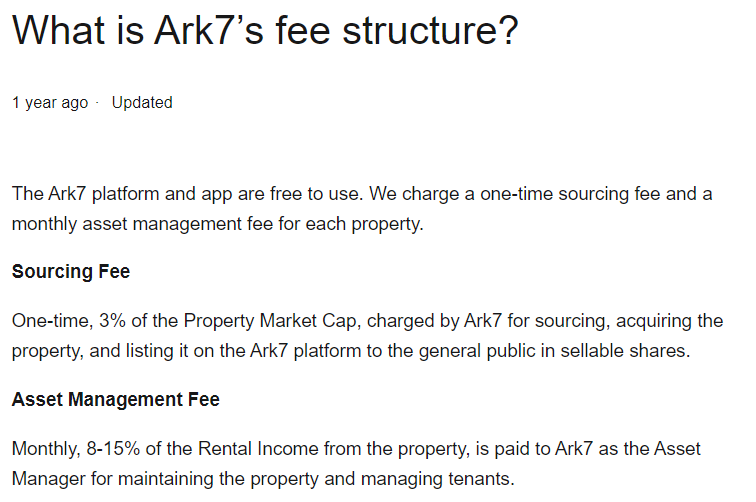

Fees and Pricing Structure

The platform charges investors a one-time sourcing fee of 3%, which is deducted from the rental income generated by the properties in which they have invested. This fee covers the cost of managing the properties, including property maintenance, tenant management, and other administrative tasks. Ark7 also charges between 8% and 15% monthly for management fees. They also charge an annual fee for IRS accounts.

Here is the fee structure from its webpage.

It is important to note that investors may be subject to other fees, such as a documentation fee or transaction fee. These fees are typically charged when investors make a transaction on the platform, such as when they invest in a new property or when they withdraw funds from their accounts.

Ark7 also charges annual fees for their IRAs. This is a $100 custodial fee, per property, per year. Ark7 will waive the fees if your IRA balance is more than $100,000 and caps the fee at $400 per year.

Ark7’s fees generally lower the platform’s return on equity. However, these rates are comparable to fee structures charged by realtors and management companies. In this regard, they likely reflect the underly unavoidable economic costs of owning and operating real estate. Tenants need to be screened, properties need to have appliances updated, roofs repaired, etc.

What are Ark7’s Long-Term Prospects?

While the fintech real estate space is extremely competitive, Ark7 is well funded.

Any potential investor looking at Ark7 may wonder if the platform will be around in the next five to ten years to deliver on the returns investors are anticipating. In this regard, Ark7 is well-funded. It received two tranches of funding one of $2,000,000 in 2019 (Crunchbase) and one of $9,000,000 in 2022 (Pitchbook). While exact figures are not available, Ark7 has likely sold at least over an additional $1,000,000 worth of securities. In addition, Ark7 charges management fees on the $19 Million worth of property it manages.

In short, the company appears well-funded and has a cash-generating business model. This suggests it will be around for the medium to short term.

Is Ark7 Right For You?

On the whole, Ark7 is a good fit for risk-tolerant investors who are interested in passive geographically targeted real estate investments.

Relative to its competitors, Ark7 offers quality investments in geographic real estate. It is however a newer platform. In addition to market risk, interest rate risk, and asset risks, investors take on the added risk of investing through a new platform with unproven longevity.

However, real estate as an asset class is generally desirable. If you’re looking for a way to generate a steady passive income stream from real estate investments, then Ark7 may be a good fit for you. However, if you prefer more control over your investments or are looking for higher returns, you may want to consider other options.

Ultimately, whether or not Ark7 is right for you will depend on your individual investment goals and risk tolerance. If you’re looking for less risky returns, you may want to consider a REIT index fund. However, if you are risk-tolerant and want a low-maintenance way to make concentrated investments in real estate and generate passive income, Ark7 is a great option.

Sign up For Ark7

Signing up with Ark7 is easy. Pretty much all that is required is a US bank account and a social security number. The process is just like opening a bank account — you need to fill out a couple of forms and provide your address and other identifying information. A simple account gets you access to Ark7’s single-family home investments. You need to be an accredited investor to get access to their multifamily and commercial listings.

You can sign up for Ark7 here, or click on the button below.

Ark7 Review: Bottom line

Ark7 is a legitimate platform that lets risk-tolerant investors passively invest in real estate for as little as $20.

The fees you pay when you use Ark7 can be high, which can reduce your potential returns. You also need to keep your money invested for a minimum holding period, between three months and a year.

However, the platform is innovative, interesting, and well-suited for investors who want a targeted real estate strategy.