December 2024 Dividend Income Update

Hey Everyone, welcome to my final update for 2024 – for the year that was – our December 2024 Dividend Income Update.

Welcome to a new investing year, with new investing opportunities and likely some new risks to manage as well.

More on that below!

December 2024 Dividend Income Update

For new and established readers here at My Own Advisor, a reminder this is our monthly update to share how we are progressing with our hybrid portfolio – a structure that was established now over 15 years ago as of this year follows:

- We invest in a mix of Canadian stocks, including those inside our taxable accounts for income and growth, and

- We invest in a growing amount of low-cost ETFs inside our registered accounts like our RRSPs, TFSAs and my LIRA to offset the weightings of the Canadian stocks we own for global, growth-oriented diversification.

I’m not sure about the returns from your portfolio in 2024 but ours were stellar even with a growing cash position for risk management in the months and years ahead…

In fact, the returns were so good in 2024, we reached Financial Independence.

My/our version of Financial Independence is really about working on our own terms, something we’ll share more about as the months in 2025 move along.

Looking back to 2024 and our final dividend income tally, it was amazing to see the growth despite some limited taxable investing since our focus all last year was on other accounts (in this goals post here; TFSAs and RRSPs in that order).

Here are some key stocks that delivered major gains for us in 2024, even with minimal dividend income delivered from some of these stocks due to lower yields and/or lower weights in our portfolio compared to other stocks or ETFs:

- Walmart (WMT), up close to 70%.

- Capital Power (CPX), up close to 60%.

- Brookfield (BN), up over 50%.

- Manulife (MFC), up nearly 50%.

- Royal Bank (RY) and National Bank (NA), up close to 30%.

- and more…

Even boring, lazy, ETFs we own like our favourites such as XAW and QQQ were up 26% in 2024 each respectively.

My goodness, what a year for equities on the back of 2023 which was also a great investing year.

Makes me wonder what the future holds? Reversion to the mean coming in 2025 or 2026??

In last month’s update, I mentioned I bought a few more shares of Brookfield (BN) in October 2024 close to $71 per share in my taxable account since I had the money to do so.

In December, well, I just couldn’t help myself when Canadian Natural Resources (CNQ) was trading at $43 per share, so I bought more of that before I ran out of cash before the holidays! CNQ is now up 10% since those days already and remains one of my top-5 stocks now into early 2025.

I’ll update this post later this year:

Also in December, many Canadian banks we own raised dividends: RY, NA, CM, BMO, TD and EQB. Only BNS did not raise their dividend but they should deliver a small dividend raise sometime in 2025; I predict something in the 3-5% range.

When I add it all up including other dividend raises for doing nothing but staying invested in those stocks and ETFs, it was a big month and a big investing year for us overall. Sure, some stocks lagged in price (e.g., Telus) while others jumped in value (e.g., CIBC (CM)) but you’ll get that with investing in a basket of individual stocks or you’ll see it bundled in a low-cost ETF as well. Just the way it goes. Not every stock nor every stock in any ETF can be a winner.

Which brings me back to my hybrid investing approach: my mix of stocks and ETFs for both income and growth. It is working for me/us and while that approach helped us realize Financial Independence I continue to expect some stocks will underperform any index and others might shoot-the-lights out now and then too. I’ll keep you posted on any massive portfolio shifts but I don’t expect much in 2025…but never say never!

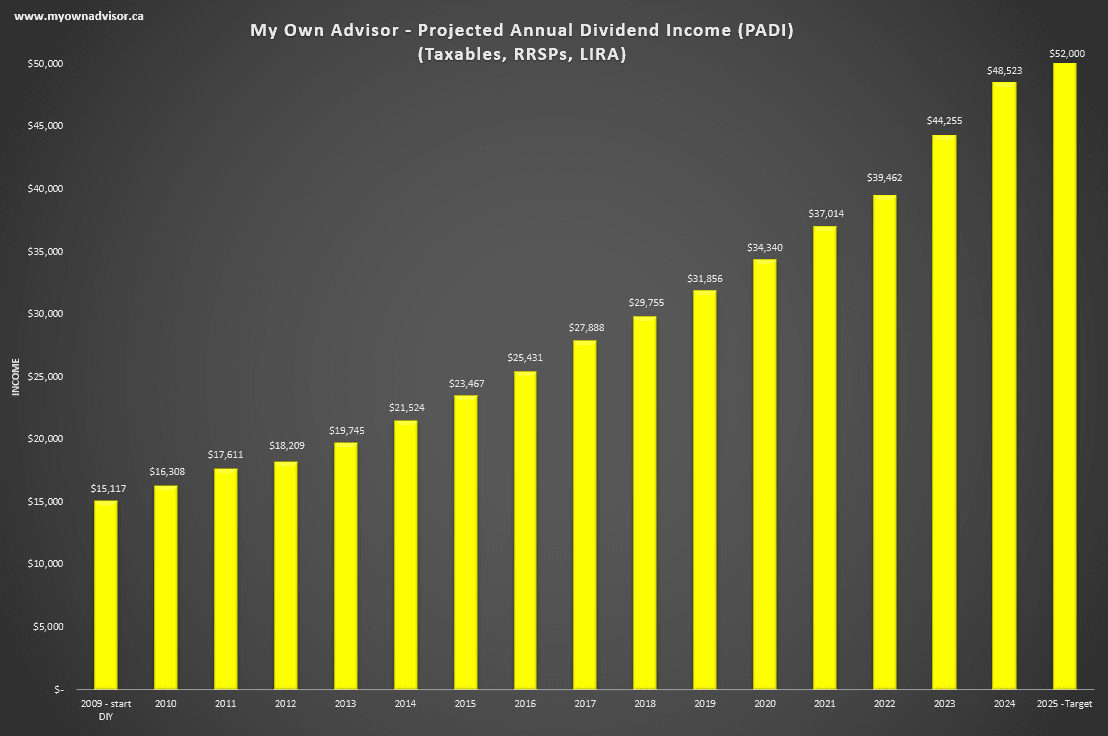

This rewarding end to the 2024 calendar year pushed our final dividend income tally for the year to $48,523.

As you can see from my chart, we reached a new all-time high in 2024 which averages out to earning just over $4,000 per month from a few key accounts that I/we will tap early in semi-retirement. Other accounts, other assets, other income streams will complement this and in some cases, will occur later in life too…

You’ll also note I’ve put in a target for 2025…not there yet but will monitor.

I’ll share more investing and income-from-our-portfolio thoughts in future posts but suffice to say that 2024 was a great year financially and it will be interesting to see how 2025 evolves for all of us!

I wish you well in your saving and investing plans for this new year and as always, I welcome any commentary on my path – happy to engage. 🙂

Mark