February 2025 Dividend Income Update

Well hello, and welcome to my latest: our February 2025 dividend income update.

Wild times…

As many readers will already know, this monthly update is a progress report on our hybrid investing approach established for the last 15+ years:

- We invest in Canadian and some U.S. dividend paying stocks – about 25-some stocks that collectively deliver income and growth, and

- We invest in some low-cost equity ETFs – that deliver (hopefully) long-term growth for extra diversifcation even during current tariff wars triggered by the U.S. government.

You can always read a bit more about what we own on this dedicated My Dividends page here.

February 2025 Dividend Income Update

What will the investing year bring?

That was my question last month.

With tariff wars heating up and escalating now, I think we’re in for a rough investing year.

In my financial projections for this 2025 investing year to plan semi-retirement with, I’ve anticipated a 10% correction. It could be more.

I’ll update this post in a few months to share some specific asset decumulation plans for 2025 or 2026 once things get finalized at my workplace for the coming year.

The good news is, some stocks have already raised dividends in 2025 to support our retirement income plan:

- Great West Life (GWO)

- Manulife Financial (MFC)

- TC Energy (TRP)

- Canadian Natural Resources (CNQ)

- Tourmaline (TOU)

- Brookfield (BN)

- and more.

On that note, hopefully more to come!

A reader recently asked me: “Mark, what do you own where?”

Well, in our taxable accounts, I’ve essentially created our own Canadian dividend fund over the last few decades. I/we own many of our Canadian stocks there.

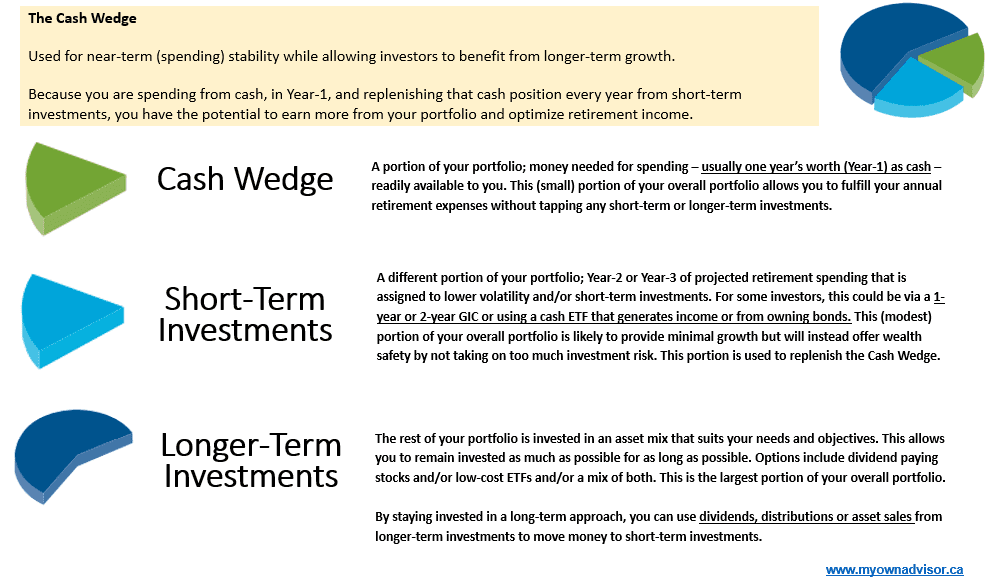

In our RRSPs and my small LIRA, we own a mix of Canadian stocks but increasingly over the last 10-years more low-cost ETFs for that aforementioned extra diversification beyond Canada. It’s also where I keep a growing cash wedge in support of future registered withdrawals.

Some RRSP assets for us exist in the form of cash/cash equivalents – a home for us to fund one if not two-years’ worth upcoming RRSP withdrawals without touching our portfolio. We have Year 1 now ready (cash wedge) to fund our 2025 RRSP withdrawals, if needed.

Finally, for our other main investing account, TFSAs, while we keep some cash ready for the odd strategic purchase during the year (i.e., to buy more equities when those assets go on sale) those TFSAs are usually fully invested via a mix of Canadian stocks and my favourite low-cost ETF for global growth: XAW.

February 2025 Dividend Income Update

Where does that put our forecast?

Last month, I mentioned:

“At the time of this post, we’re projecting we might earn close to $52,000 in 2025 from a few key accounts (not all our accounts mind you) to help fund semi-retirement. That assumes no dividends nor distributions get cut in our portfolio and it also assumes we don’t buy many equities in 2025 either.”

Well, factoring in those recent dividend raises, I’m happy to report we’re now projected to earn about $49,545 this calendar year from part of our portfolio. That assumes no dividends nor distributions from key ETFs like XAW or QQQ get cut in our portfolio and it also assumes we don’t buy many equities in 2025 either. *Basically, I report cashflow from our portfolio.

To put that projected annual dividend income in perspective:

- That’s averaging over $4k per month.

- That’s doubled from what I was earning from our portfolio just 5 years ago.

*Recall these all PADI updates focus on 1. our non-registered accounts, 2. our RRSPs, and 3. my small LIRA from a former job many years ago. I have reported things this way since January 2023 since these are the first accounts I will use to fund semi-retirement along with part-time work. These updates do not include any TFSA assets at all nor any future pension income from work.

Image: Our resort, just outside/north of San Pedro, Belize, February 2025.

Our view every morning from Belize:

The biggest part of our financial journey is now trying to stay the course amidst major political and market calamity. My hunch is things might get much worse before they get better. I want to be wrong on that.

Throughout my investing journey and running this site over the last 15+ years, I have generally saved like a pessimist while investing (in stocks) like an optimist. Well, we’ll see how 2025 shakes down…!?

I look forward to keeping you updated every month as I march forward.

Onwards and upwards for your investing journey too – let me know what you’re investing in and how that is coming along so far in 2025 during these trying times.

Mark