Executive summary:

- U.S. equity indices closed lower in February

- Growth/stagflation worries with softer economic readings and hotter inflation indicators

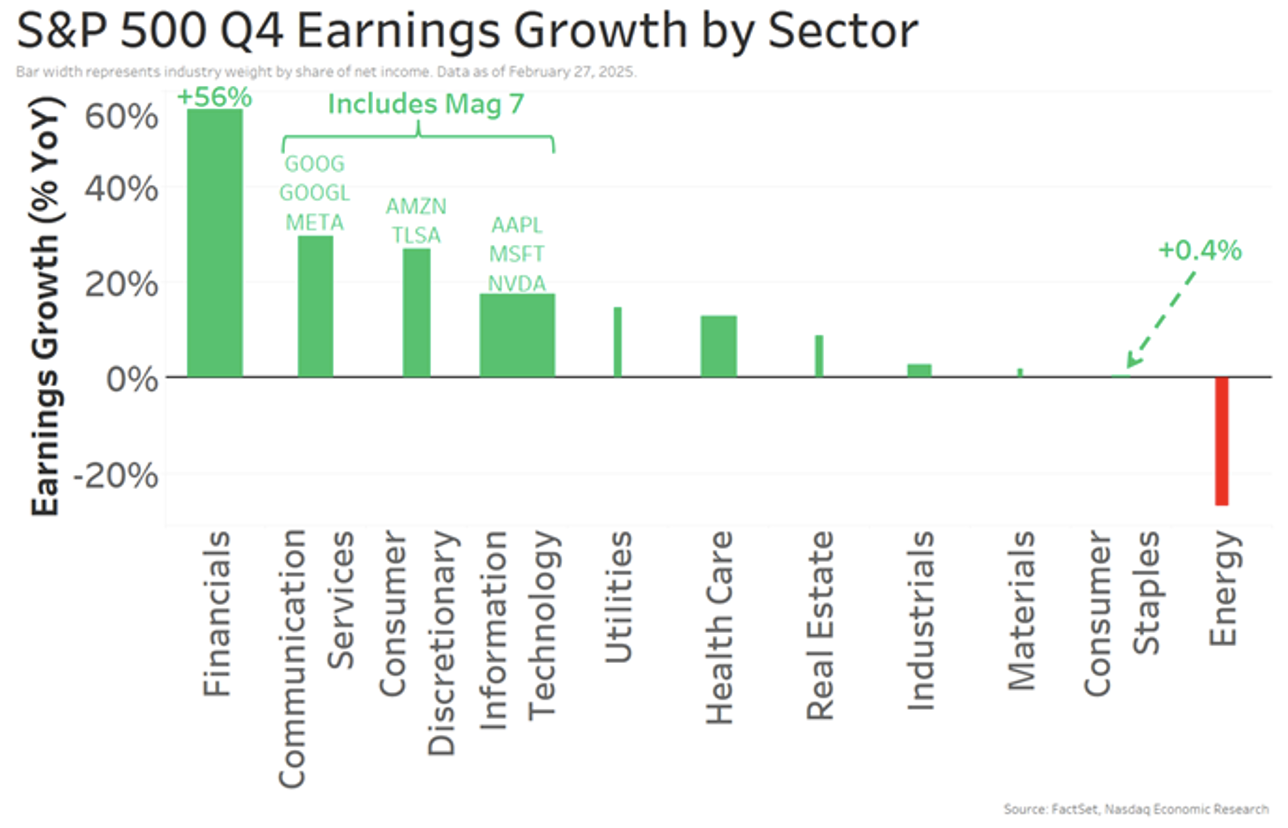

- 10 of 11 Large-cap sectors see positive earnings growth – most in 3 years

- Developments out of Washington continue to dominate headlines

Index performance for February:

All the major U.S. equity indices declined in February. The S&P 500 remained positive for the year while the equal-weighted index outperformed the official index. Underperforming sectors included Tech, Consumer Discretionary, Communications and Industrials, while Consumer Staples, Real Estate, Energy and Utilities performed well. Treasuries saw lower yields, the Dollar Index dropped slightly, gold rose modestly, and oil had its first monthly loss since November 2024.

The risk-off sentiment dominated the market due to several bearish narratives. Concerns about growth and stagflation arose from softer economic readings and hotter inflation measures. Uncertainty around Trump’s trade, immigration, tax and Ukraine policies added to the market’s unease. The Fed maintained a cautious stance amid a hotter CPI report and broader macro uncertainty. Trade war developments played a significant role with Trump announcing tariffs on Canada, Mexico, and China, though these were delayed pending negotiations. Analysts highlighted the slowing growth and inflationary impacts of Trump’s policies, and February consumer confidence saw its biggest decline since August 2021.

Economic data for January showed mixed results, with a hotter CPI report raising fears of recession and stagflation. Softer nonfarm payrolls and retail sales reports, along with softening housing data, added to the concerns. The ISM services index missed expectations while the ISM manufacturing index was stronger. Fed Chair Powell’s Congressional testimony emphasized the need for more work on inflation and stated that Trump’s comments would not impact Fed policy decisions. Despite the defensive tone, there were positive developments including the House GOP passing a budget resolution, January core PCE inflation meeting expectations and Treasury support following the Fed’s signaling to slow or pause QT mid-year. Early signs of a Ukraine peace deal were dashed after a tense meeting between Trump and Zelensky resulted in no agreement.

Bullet summary:

- Risk-off sentiment prevailed due to:

- Growth/stagflation worries with softer economic readings and hotter inflation indicators.

- Uncertainty around Trump’s trade, immigration, tax, and Ukraine policies.

- Increased retail selling pressure and extended positioning.

- A cautious Fed amid a hotter CPI report and macro uncertainty.

- Early signs of a Ukraine peace deal, though no deal was signed after a tense meeting between Trump and Zelensky.

- Trade war developments:

- Trump announced tariffs on Canada, Mexico and China, but they were delayed pending negotiations.

- Analysts flagged negative growth and inflationary impacts from Trump’s policies.

- February consumer confidence saw its biggest decline since August 2021.

- Economic data:

- Hotter January CPI report raised recession/stagflation fears.

- Softer January non-farm payrolls and retail sales reports.

- Housing data showed softening.

- January ISM services missed expectations, while ISM manufacturing was stronger.

- Labor markets continue to cool with the February 22nd Initial Jobless claims coming in at the highest levels of 2025.

- January core PCE inflation was in-line with expectations.

- Fed Chair Powell’s Congressional testimony:

- Emphasized more work needed on inflation.

- Comments from Trump will not impact Fed’s policy decisions.

- Fed officials noted the need to remain restrictive pending better clarity on inflation and tariffs.

Sector performance total return for February:

Earnings commentary:

According to FactSet data, the blended earnings growth rate for Q4 S&P 500 EPS is 18.2% which is higher than the expected 11.9%. The blended revenue growth rate is 5.3%. Of the 97% of S&P 500 companies that have reported, 75% have beaten consensus EPS expectations, slightly below the one-year and five-year averages. Additionally, 63% have surpassed consensus sales expectations, just above the one-year average but below the five-year average. Overall, companies are reporting earnings 7.5% above expectations, better than the one-year average positive surprise rate but below the five-year average. Sales are 0.8% above expectations, which is below both the one-year and five-year positive surprise rates.

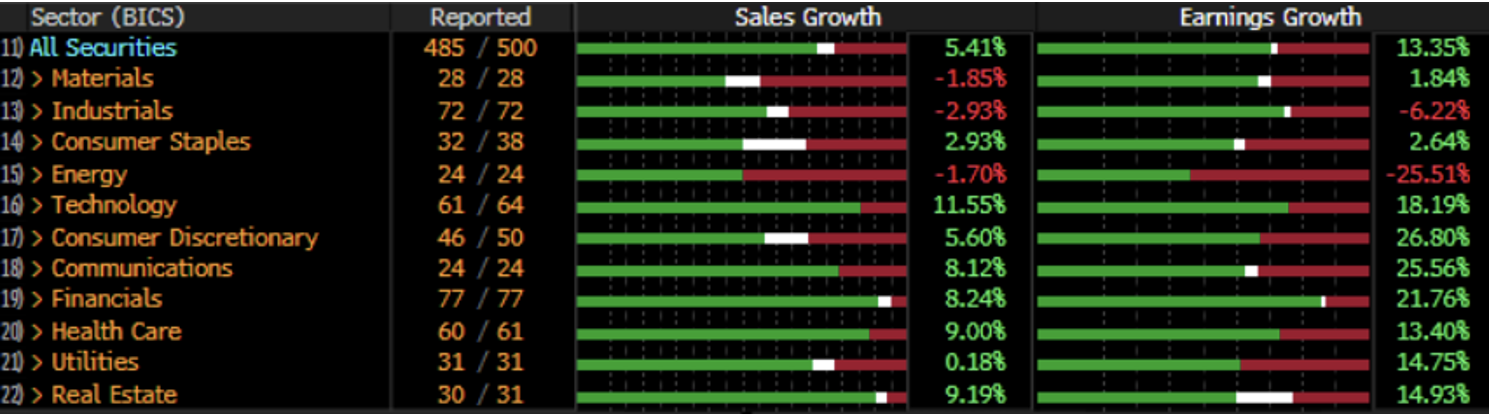

Sales and earnings results by S&P sector:

Broad-based earnings growth for Large Caps:

Two-day price reaction following earnings releases:

Fed Fund Futures are pricing in a 90+% chance of a hold at the March meeting:

10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity:

Gold:

Oil:

DXY:

Looking ahead:

Market’s focus this week will be on Friday’s nonfarm payrolls report for February. Economists predict the unemployment rate to remain at 4% with 160,000 new jobs added. The reading will come as new and continued jobless claims continue to rise to start the year. There will be numerous Fed Speak headlines over the next week ahead of the March 19th FOMC meeting, most notably will be Chair Powell’s keynote speech on the economic outlook at Chicago Booth’s 2025 US Monetary Policy Forum. Note that Q1’25 triple witch will occur on March 21st.

Economic Calendar:

The information contained herein is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. All information contained herein is obtained by Nasdaq from sources believed by Nasdaq to be accurate and reliable. However, all information is provided “as is” without warranty of any kind. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED.