Today we are going to tell you everything you need to know about Investment Policy Statements (IPS). We are also sharing free resources and templates to help you take quick action.

.A A A

The Investment Policy Statement (IPS) is a document that dictates how you invest your money.

If you’re working with a financial advisor, the IPS will also dictate how they invest your money for you.

The IPS instructs them how, when, and where to invest so you can reach your financial goals.

In other words, with a simple Investment Policy Statement in place, your advisor can’t go rogue with your money.

Information Included on an Investment Policy Statement

While Investment Policy Statements can look different based on the client, their portfolio, and their investing goals, details found on a simple IPS typically include:

- Your investment objective. Do you want growth, income, or safety?

- Your time horizon. How long do you need your money to be invested?

- Your income needs. Do you want to reinvest and rebalance or take regular withdrawals?

- Your desired asset allocation. How much of your money do you want in each asset class (i.e. stocks, bonds, real estate, cash)?

- Your need for liquidity. How much cash do you need in reserves to fund near-term expenses?

- Your investment philosophy. Do you want your investments actively managed or passively managed? Are there certain asset classes or stocks you would like to stay away from (e.g., tobacco companies)?

Remember, perfect is the enemy of good. Having an IPS is better than not having one at all.

Start simple and know that this is a fluid document that will change over time.

At a minimum, you should review your Investment Policy Statement every year and ask yourself the following questions:

- Have there been any meaningful changes to my investment goals since the IPS was last updated?

- Do I plan to change my asset allocation significantly in the next 12 months?

- Does my current investment portfolio match up with the asset allocation documented in the Investment Policy Statement?

📝 Note: The state of the economy or the stock market should not influence a change to your IPS. Your IPS should only change if your financial needs and goals have changed.

Do Individual Investors Need an Investment Policy Statement (IPS)?

An IPS is likely even more important if you’re a do-it-yourself (DIY) investor.

DIY investors are often more emotionally attached to their investments.

For that reason, it’s critical they have a set of guiding principles to dictate how and where their money is invested.

Investment Policy Statements are valuable because they help investors remain committed to their strategies.

And, staying the course with your investment plan is critical to long-term success.

How Can the IPS Help You Better Invest Your Money?

At the end of the day, an Investment Policy Statement is most valuable in times of stock market uncertainty and investment fads.

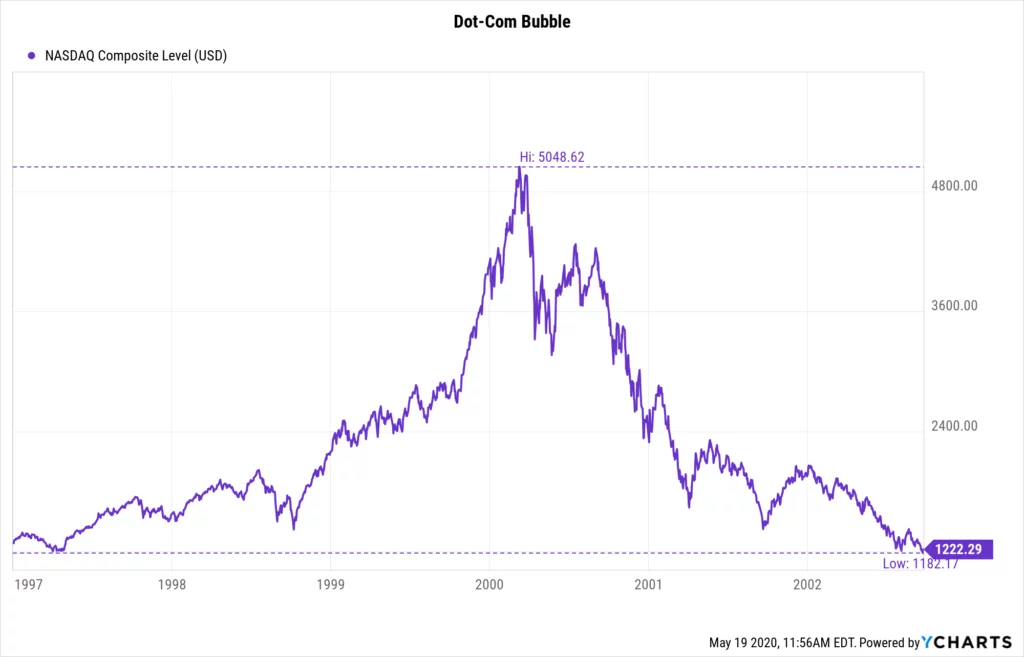

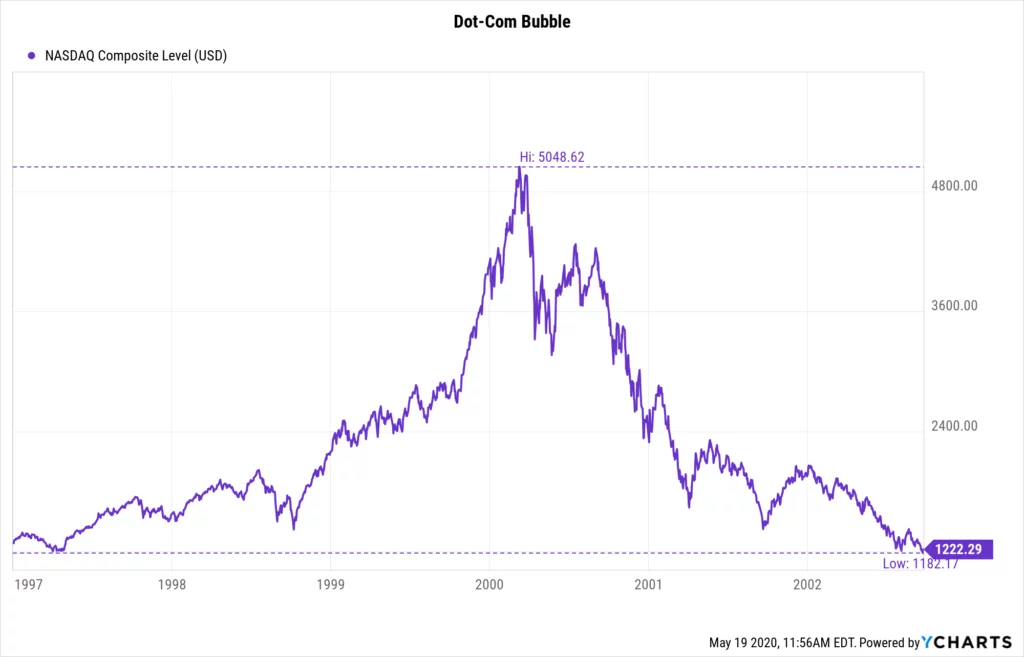

For example, consider how valuable having an IPS during the late ’90s internet bubble would have been.

An investor without an Investment Policy Statement could have easily been tempted to put their retirement nest egg in soon-to-be-worthless internet stocks.

An Investment Policy Statement (IPS) can help protect you from chasing fads, like the dot-com bubble.

However, the investor with an IPS would likely be prohibited from putting all their eggs in that now-defunct basket.

Why?

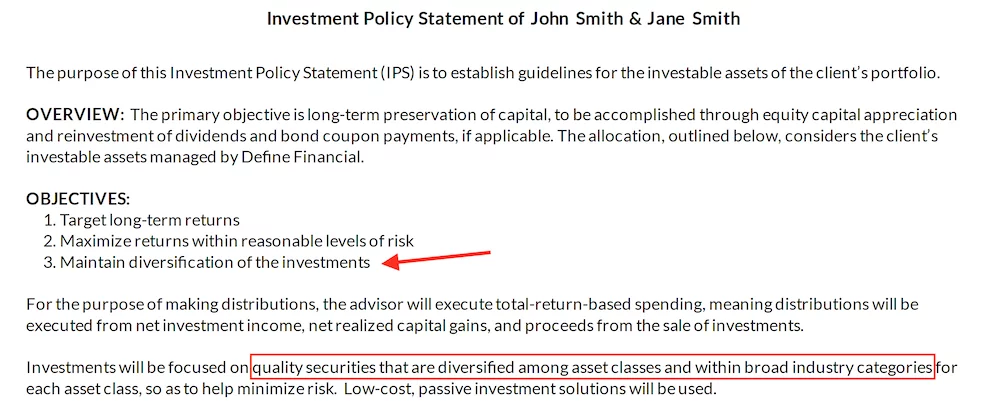

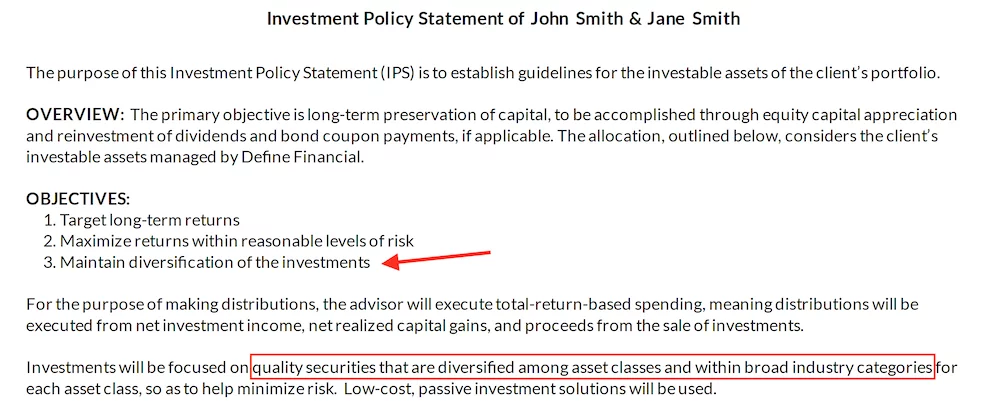

Because their IPS would have been created to reduce unnecessary risks and maintain a diversified portfolio of stocks and bonds.

Their IPS would have had rules in place to prohibit making concentrated investments.

The objectives outlined in an Investment Policy Statement (IPS) should prohibit concentrated investments and help to reduce risk.

The Investment Policy Statement (IPS) is Critical to Financial Success

A financial advisor’s job is to help clients reach their stated goals.

Maintaining a portfolio that is in line with a client’s unique needs, goals, and risk tolerance does just that.

The Investment Policy Statement (IPS) just takes everything a step further:

It forces investors —and their trusted advisors —to put their investment needs and goals in writing.

If you want to stay the course so you can meet your long-term financial goals, creating an IPS is critical.

And remember, this is important whether you work with a financial planner or not.

An IPS will serve as the voice of reason when you’re tempted to invest in risky, currently-trending (read: bubble) investments.

If you create this document to rely on its wisdom for the long term, the odds are in your favor that you will achieve your desired financial goals.

Think the IPS has to be complicated? Think again!

- Investment Portfolio Review Checklist (Free PDF)

- Consumers: Download Sample Investment Policy Statement (Printable PDF)

- Institutions & Organizations: Download Sample Investment Policy Statement (Printable PDF)