A lot of people follow Warren Buffett’s investing moves. Why not? He’s the best investor in history. If you disagree, come at me in the comments.

I don’t follow Buffett’s moves too much for a few reasons:

- He has research on companies he invests in that you and I don’t. I’ll admit that I don’t know insider trading laws, but I guarantee he has people on his team talking to Apple’s management before he buys 100 million shares.

- By the time we learn what he invested in, the stock price has already gone up. He buys at tremendous volume, and that demand can move the price on its own.

- Don’t try to beat him; just join him. You can buy Berkshire Hathaway stock and copy his trades for yourself. Let your money piggyback with the best investor of all time and focus on your unique skills to make more money.

Over the weekend, Berkshire Hathaway revealed that it had $325 billion in cash and equivalents (US treasury bills). That’s enough money to buy half of Walmart or all of AT&T and have more than $100 billion left over.

This isn’t the normal amount of cash he has on hand. When smart investors have this much cash on hand, it means that they don’t see a better investment. They see the markets as “expensive.” Buffett can buy stocks all over the world. In recent years, he’s been buying a lot of Japanese stocks. He has invested in the Chinese electric vehicle company BYD. So, with extreme access to every investing market, he’s still choosing to hoard cash.

I think I know why. I don’t think it’s complicated.

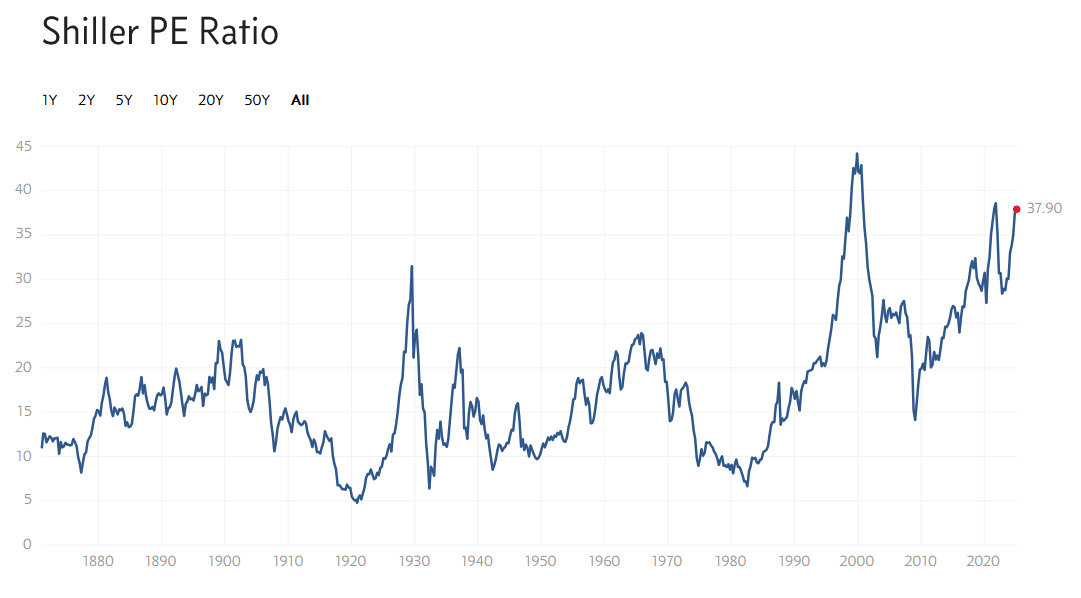

For a decade and a half, I’ve been saying that you can know how the stock markets are going to go, by looking at the Shiller PE (or CAPE). It’s not a perfect indicator in the short term, but it can predict when the big crashes are coming (eventually) and when you can buy at a discount.

Here’s the historical, Shiller PE chart:

You can see the stock market bubbles of 1929 and the dot com bust of 2000. You can see the drop in 2008. However, in this case, there wasn’t a big spike ahead of time. It’s easy to say in hindsight, but it was the best buying opportunity of the last 25 years. Finally, you can see the drop in the market after October 2021, after the euphoria of surviving the pandemic drove up the markets.

Stocks have only been this expensive twice before – the dot com bust and that October 2021 peak. It’s being driven by the investment in AI. I feel it’s a generational game changer, so maybe the high price is justified. However, I feel that, like the dot com bust, two things can be true. New technology (internet or AI) can change everything, and the markets can crash while companies figure out how to leverage it into increased profits and productivity.

The markets may also be high because the new administration is seen as creating a better business environment. Less regulation can translate directly into more profits. The Consumer Financial Protection Bureau’s (CFPB) mission is to protect consumers from unfair financial practices. The new administration is trying to close that agency, which will allow banks to push the limits without fear of repercussions. It should be good for their profits – not good for consumers who get taken advantage of.

However, there are a lot of potential negative financial signs:

Inflation is high again.

The core inflation rate was 3.3%. The Federal Reserve wants to get that down to around 2%. The core inflation rate doesn’t count the price of food or energy. Have you seen the price of eggs lately?

Tariffs are an uncertainty.

It’s almost universally agreed that tariffs hurt the economy and raise inflation. Tariffs have been threatened and rescinded several times in the last month. Some have been enacted and remain. Who knows what’s coming tomorrow?

The Federal Reserve probably won’t lower the interest rate as expected.

As CNBC explains the Federal Reserve “is stuck in neutral” while waiting on Trump’s policies. With inflation being high again, there’s no reason for them to lower rates. With the uncertainty around tariffs, it’s impossible for them to project a long-term outlook.

The Potential for Disaster

Remember the CFPB that I mentioned above? It was created as a direct response to the subprime banking collapse in 2009 that sent markets down 50%. Without that guardrail (and others in the government), will history repeat itself?

The Musk/DOGE factor

Back in November, Elon Musk said that Americans would experience “temporary hardship” and agreed that the markets would “tumble” as he tried to eliminate $2 trillion in expenses from the US budget. By many estimates, he has barely gotten started. While the DOGE website has claimed $55 billion in cuts, many independent news sources have explained that the real number is likely less than $10 billion.

The idea is that a smaller government will be more nimble and efficient in the long run. That very well could be true. There’s been a lot of talk of reducing “waste” in the government, but that shouldn’t cause hardship. If you eliminate waste in your budget, you cancel the streaming channel that you never watch. It’s literally wasted money, and you experience no hardship from something that you didn’t use.

So far, it seems like DOGE is cutting indiscriminately. Musk has literally shown up with a chainsaw to illustrate that he’s lopping off parts of the government.

In my last article, a commenter said that I should be careful about getting political. I don’t see this as political since it is a big deal economically. Going back to the CFPB example above, it shouldn’t be political to say that eliminating Big Bank’s watchdog is very likely to hurt consumers. It’s not political to say that removing the police station in your town is probably going to increase crime. In either case, eliminating them doesn’t reduce “waste.” The impact is real, not like canceling the streaming service you weren’t using.

In any case, we don’t even have to dig into the waste. We’re simply assessing the investing environment now, during the time that Elon Musk admitted that there would be a market “tumble.”

So What Do You Do?

That’s up to you. There’s a philosophy that you should never time the market. I don’t even know what that means anymore. It feels that whenever it is mentioned, it’s assumed that there are people who sell off all their stocks and put them in cash to invest after an upcoming crash. I don’t know anyone who actually does that, but I guess it happens?

I DO look to time the market through tactical asset allocation. I have a Rule of 20, where my bond allocation should be the Shiller PE minus 20. So today, that would be 17.9% of my money in bonds. I’m an aggressive investor, so this is really a lot for me. As I get older, I may change it to a Rule of 10 or even a Rule of Zero, which matches the Shiller PE. This is what feels right for my risk tolerance.

Yesterday, Retire By Forty asked Should You Sell Stocks When You’re Fearful? His answer was similar to mine: adjusting your asset allocation is a prudent response. After all, that’s what Warren Buffett is doing. He’s not selling all his stocks. He’s simply holding more cash and US treasuries.

Many times when people sell off their stocks, it’s because the market has already crashed. They are fearful because they’ve already lost a lot of money and have lost faith in the stock market. There’s a difference between selling when the Shiller PE is at near all-time highs as they are now and selling when the Shiller PE is 15 after the financial crisis in 2009.

I’ll let the numbers guide me. What are your thoughts? Let me know in the comments below.