May 2025 Dividend Income Update

Hey Folks!

Welcome to our latest update: our May 2025 dividend income update.

A reminder for anyone new to the site, this series is a monthly update related to our hybrid investing approach for semi-retirement funding that I started some 15+ years ago.

This is how we invest:

- We invest in Canadian and a few remaining U.S. dividend paying stocks – about 25-30 stocks that collectively deliver income and growth over time…and

- We invest in some low-cost equity ETFs – that deliver long-term growth for extra diversifcation.

You can always read a bit more about what we own, why and where (i.e., in what accounts) on this dedicated My Dividends page I keep updated here.

May 2025 Dividend Income Update

In a recent post on my site, I shared why I feel I get the best of both worlds from my approach.

Your mileage may vary of course!

- Dividends come in, I get paid, and I can spend, save the cash or reinvest those dividends as I please.

- I leave the low-cost ETFs alone for total return and buy more when I can.

May was quite the month for dividend raises:

- Pembina Pipeline (PPL)

- Telus (T)

- Sun Life (SLF)

- Bank of Nova Scotia (BNS)

- Bank of Montreal (BMO)

- Royal Bank (RY)

- and more!

And, to go along with that, low-cost ETF HEQT that I own in my small LIRA continued to DRIP a few shares.

Like I reported last month, purposely, we’ve sold off most of our U.S. stocks over the years in favour of moving proceeds to XAW in registered accounts but Trump’s One Big, Beautiful Bill Act has me thinking.

In particular, when it comes to U.S. withholding tax.

From the article:

“For example, the U.S. currently imposes a 15 per cent withholding tax on dividends Canadians receive from U.S. companies. Under tax treaties, however, an equivalent tax credit from the Canadian government generally offsets the withholding tax.

If the measure becomes law and the Trump administration designates Canada as a country with discriminatory taxes, a new five per cent withholding tax would go into effect. That tax would increase by five percentage points per year to a maximum of 20 per cent. It is not known if Canada would adjust its tax credits to offset such a tax.”

I haven’t made any rash moves with my portfolio but such a Bill if passed is a major cause for concern.

I might consider owning more QQQ in fact, as a slight mitigation, since U.S. foreign withholding taxes and the impact of this Bill should it go through in its current form (which is unlikely) would be minimal – the distributions paid on QQQ are minor since QQQ is designed for growth.

There are also some corporate class funds I might consider.

Who knows where things might go from here…sign of the Trump times.

May 2025 Dividend Income Update

For the most part, I continue to keep my head down and stick to our long-term plan. That means:

- I stay invested.

- I buy more equities where I feel it makes sense.

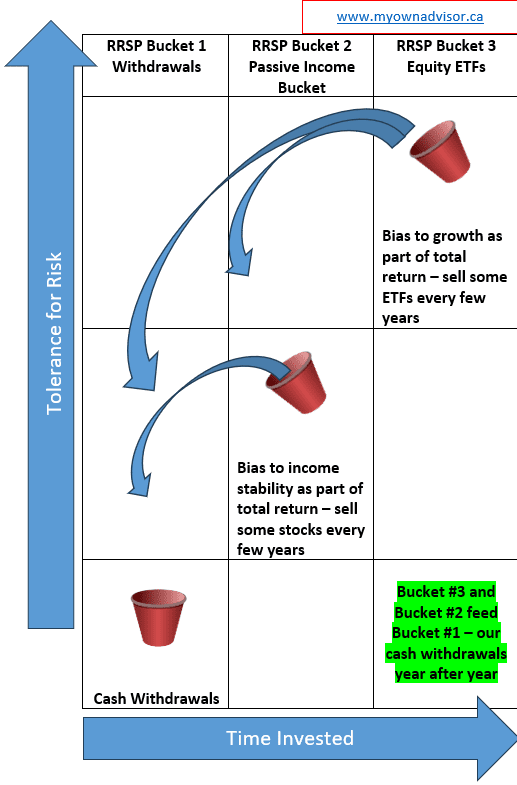

- I continue to try and reduce any future sequence of returns risk in my 50s by keeping all near-term spending for the next 1-2 years in cash/cash equivalents. This way, I/we spend from that and we won’t be selling any stocks nor any equity ETFs to fund our lifestyle.

On that note, it is my hope by the end of 2025, we’ll have all cash/cash equivalents in place for 2026 and 2027 spending.

Like I mentioned last month, with reinvested dividends and distributions (DRIPs) “turned off” in most investing accounts now, cash/cash equivalents should build up again during 2026 and 2027 for future spending needs after that in 2028+.

This means we might not be selling any stocks or ETFs for a few years to fund our lifestyle. Probably not a bad thing!?

May 2025 Dividend Income Update

So, so far, so good with our hybrid investing approach to meet our future spending objectives.

Thanks to many dividend raises in May, coupled with a few more units of HEQT DRIPped inside my small LIRA each month, our income moved higher this past month – by quite a bit in fact.

Our *projected annual dividend income trend for the 2025 calendar year is now:

*Recall these PADI updates on my site focus on 1. our non-registered accounts, 2. our RRSPs, and 3. my small LIRA from a former job years ago. I have reported things this way since January 2023 since these are the first accounts I will use to fund semi-retirement along with any part-time work: live off taxable dividend income, live off RRSP withdrawals and live off LIRA/LIF withdrawals.

I share this information not to brag. Hardly. I know folks that earn much more income from their portfolio than I do. Rather, I share it to tell part of our overall investing journey – to keep me honest, motivated and accountable for my investing decisions. I hope this transparency and what I share helps you out too.