Launched in 2011, Wealthfront is a robo-advisor with $75+ billion in assets under management as of January 2025. A robo-advisor is an investment advisory service that uses an algorithm instead of people to help you invest.

Wealthfront is a tax-efficient and low-cost way to invest. Its offering is compelling. For just 0.25%, they do all the heavy lifting using a computer algorithm.

I think robo-advisors are great because they offer professional advisory services, at least a vanilla version (or cosmopolitan, to keep the ice cream analogy as accurate as possible), to the masses by relying on algorithms rather than an advisor-heavy approach.

Many investment advisers won’t meet someone without at least six figures to invest since they get paid as a percentage of assets under management. Robo-advisors can do this because robots don’t need anything but hugs.

Their investment team is impressive, featuring names like their Chief Investment Officer, Dr. Burton Malkiel (A Random Walk Down Wall Street), and Charles Ellis (Winning the Loser’s Game), founder of Greenwich Associates.

At a Glance

- $500 minimum starting balance

- 0.25% annual fee

- Customizable premade portfolios

- Tax loss harvesting

- AI-powered financial advice

Who Should Use Wealthfront

Wealthfront is good for those who want a robo-advisor with tax loss harvesting and don’t care about receiving personalized financial advice. It has three premade portfolios that can be customized with a variety of other investments.

If you want to be able to speak to a human advisor, Wealthfront may not be for you.

Wealthfront Alternatives

Table of Contents

- At a Glance

- Who Should Use Wealthfront

- Wealthfront Alternatives

- What Wealthfront Offers

- About the “Robots”

- How Wealthfront Invests

- Risk Tolerance & Asset Allocation Tool

- Wealthfront Cash Account

- Wealthfront Free Financial Planning

- Portfolio Line of Credit

- How much does Wealthfront cost?

- Wealthfront Alternatives

- Wealthfront Review: Final Thoughts

What Wealthfront Offers

Simplicity and optimization.

All robo-advisors promise investment returns without as much maintenance. With an account minimum of just $500, Wealthfront offers an investment advisory service to the masses.

It took me many years to amass $5,000 in investable assets, and it sat in an index fund at Vanguard while it grew. I didn’t pay much in fees, but I also didn’t get tax loss harvest either (heck, I didn’t even learn about it until many years later!).

I saw my job as an investor as being two primary tasks:

- Determine and establish an asset allocation and,

- Rebalance their portfolio periodically.

Wealthfront does the first task by having you answer a questionnaire about your risk tolerance to establish your asset allocation. Then, its robots do their magic to accumulate the right assets to get the allocation that best fits your risk tolerance.

As an ongoing service, they handle rebalancing, tax loss harvesting, dividend reinvestment, and all the other smaller tasks that can add to your returns but that we often forget to do. That’s where the optimization comes in.

About the “Robots”

Computers are only as good as the people who design and program them, so while I say “robots” a lot in this post (it is a “robo-advisor”), the folks who built the robots and give them the insight to do their automated magic – they’re not robots.

They’re PhDs led by Dr. Burton Malkiel. They hire only PhDs to work on the investment team.

How Wealthfront Invests

Wealthfront has three premade portfolios to choose from, but each can be easily customized. In total, it offers 239 investments, 17 asset classes, and two cryptocurrency trusts.

The three premade portfolios are:

Classic: This is a portfolio of index funds that is globally diversified. Its main holdings as of January 2025 are 45% in US stock via Vanguard’s Total Stock Market Fund, 18% foreign stocks via Vanguard’s FTSE Developed Markets ETF, and 16% emerging market stocks via Vanguard’s FTSE Emerging Markets ETF.

Socially Responsible: This portfolio focuses on sustainability, diversity, and equity. Its main holdings as of January 2025 are 60% US stocks via iShares ESG Aware MSCI USA ETF, 12% foreign developed stocks via iShares ESG Aware MSCI EAFE ETF, and 11% corporate bonds via iShares ESG Aware USD Corporate Bond ETF

Direct indexing: This portfolio invests in individual stocks and is designed for portfolios over $100K. Your portfolio allocation will be determined by your risk tolerance.

In addition to the premade portfolios, there are several investment categories you can invest in. They are:

- US stock ETFs

- Bond ETFs

- Foreign/ emerging markets ETFs

- Global stock ETFs

- Socially responsible ETFs

- Tech/ innovation ETFs

- Cryptocurrency trusts

- Wealthfront exclusive offerings

- Investing strategy ETFs

- Sector ETFs Commodity ETFs

Tax Loss Harvesting

To save money on taxes, Wealthfront uses tax loss harvesting. If an asset drops in value, Wealthfront will sell it and buy a different, yet similar, stock. You can then use that loss to offset any investment gains you have.

Your risk tolerance plays a large part in your asset allocation. Wealthfront helps you determine your risk tolerance through a quiz on the website.

It’s pretty simple. It takes a few seconds to through the questionnaire and get your recommended investment plan: (you can do this yourself without putting any personal information, they don’t ask for or require an email to play with this tool)

Scroll down to see the breakdown:

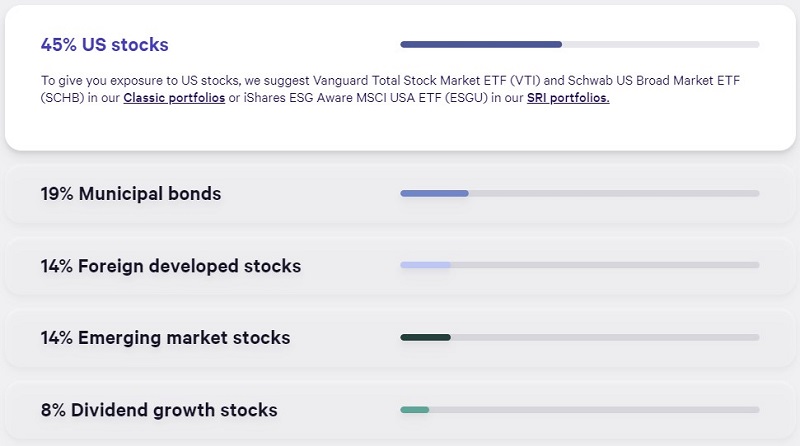

Under each category, they list the three leading ETFs. In theory, you could go and buy these allocations directly. If you click on each of the bars, you’ll see a breakdown.

You can play around with the Risk Tolerance slider to see how the allocations change (the portfolio is 7.5, the max is 10), plus see the difference between a Taxable Investment Mix and a Retirement Investment Mix. I like that the Projected Performance is a spread versus a single line as it’s often depicted because it more accurately reflects the data.

As you can see, the investment options for the taxable account consist of the Vanguard Total Stock Market Fund and Schwab US Broad Market ETF. If you want to invest in a socially responsible fund, it suggestsiShares ESG Aware MSCI USA ETF.

Wealthfront Cash Account

Finally, sometimes you’ll have cash not invested in the markets, and Wealthfront has a cash account that currently pays 4.00% with FDIC insurance up to $8,000,000.

There are no monthly fees and no minimum balance requirements.

Wealthfront Free Financial Planning

Wealthfront offers a free automated financial planning experience that is available to everyone.

It is an automated financial advice engine that takes your individual data, like income, spending, and investing, to protect your financial assets and ability to meet future goals.

It considers life events, like buying a house and having children, and adjusts your plan accordingly. And it does this regularly, rather than once a year or once a quarter, as you would with a human advisor.

You will link all of your accounts so the software can see your current standings. It will calculate your networth and give you a plan to meet your goals. You can get a snapshot of your finances, explore various scenarios, and then look at different tradeoffs. If you’ve never built a plan, they have an interactive Financial Health Guide that helps you get started.

Portfolio Line of Credit

If you have an individual or joint account with a balance of at least $25,000, a Portfolio Line of Credit lets you request cash up to 30% of the current value of your account, and they’ll send it over as quickly as one business day.

Your portfolio becomes a line of credit. (hence the name!)

The interest rate is variable and depends on the effective funds rate, plus 1.08% (rate schedule & definitions):

Their interest rate could beat a home equity line of credit (since it’s technically a margin lending product and not a traditional loan), and since there are no fees, it’s even cheaper. And unlike a regular loan product, there is no credit check, no minimum monthly payments, and the loan is secured by the assets in your portfolio.

How much does Wealthfront cost?

Wealthfront doesn’t charge a commission or account maintenance fees; instead, it relies on an account management fee. The account management fee is 0.25% of assets. This is on top of the fees charged by the underlying ETFs, which average 0.12%.

Wealthfront Alternatives

There’s a lot to like about Wealthfront, but it’s always a good idea to comparison shop before signing on to any investment account. It is your hard-earned money, after all. Here are a few Wealthfront alternatives to consider.

Betterment

Betterment is another robo-advisor that offers tax loss harvesting. You can get started for $10, and it charges either $4 a month or 0.25%. You will be charged the 0.25% if you set up recurring monthly deposits of at least $250 or you have a balance of at least $20,000.

It also has a cash reserve account that earns 4.00% APY and has a $0 minimum balance requirement. FDIC insurance goes up to $2 million.

If you have a balance of at least $100,000, you can get personalized one-on-one advice from a CFP®. There is an annual management fee of 0.65% for this service.

Here’s our full Betterment review for more information.

SoFi® Investing

Loan giant SoFi also offers robo-advisor services. You can start with $50 and it charges 0.25%, the same as Wealthfront. It doesn’t have a cash reserve account exactly, but it does offer bank accounts, including a high-yield savings account that earns up to 3.80% APY (unlocked with direct deposit or by depositing $5,000+ every 30 days, otherwise 1.00% APY).

One big benefit of SoFi Investing is that it offers human financial advisors to all clients at no additional costs. But it does not provide tax loss harvesting.

Here’s our full review of SoFi Investing for more information.

M1 Finance

With M1 Finance, your portfolio is called a “pie,” and within this pie, you can add as many “slices” as you wish. These slices can be individual stocks, ETFs, or expert pies. It does not provide tax loss harvesting.

You can get started for $100 and the first 90 days are free. After that, the fee is $3 a month, unless you have a balance of at least $10,000 or an active personal loan.

It has a high-yield savings account to serve as your cash reserve account that earns 4.00% APY.

Here’s our full review of M1 Finance for more information.

Wealthfront Review: Final Thoughts

Wealthfront has top-notch software and automation, a stunning Ph.D. investment team led by one of the greats, and is low-cost. You’ll pay 0.25% no matter what your balance is, which is a deal when your balance is small but could get pricey as your balance grows.

They also offer tax loss harvesting, which not every robo-advisor does. So, if that’s something you are looking for, Wealthfront is worth considering.

Regarding advice, they only offer automated advice, and there is no option to speak to a human advisor.

If you’re using Wealthfront, I’d love to hear about your experience!