Then and Now – Enbridge

For a few years now, I’ve highlighted some of the stocks and ETFs I own in my portfolio. I started a series on this site called Then and Now to highlight current holdings or my plans to change things up.

This was the first post in this series. Today’s post is an update, including if I continue to own Enbridge in my portfolio right now.

Read on: Then and Now – Enbridge.

Then – back in 2014 on this site

Back in 2014, I wrote the following as part of this original post:

I’m going to start a new series on my site entitled Then and Now where I revisit some older blogposts and either rip them to shreds (because my thinking has changed since then) or I’ll confirm my position on some personal finance subjects. I have no idea how often I’ll run these types of posts but I figure it would be something fun to try. It might be interesting to learn from my past so I can apply those lessons learned for the future.

I went on to write:

“My interest is in the future because I’m going to spend the rest of my life there.” – Charles Kettering, American Engineer, Inventor of the electric starter, Former head of research at GM.

Fun quote. 🙂

Today’s updated post is my look back on my investing journey owning Enbridge and how that stock fits into my portfolio today (or not at all)!

Then – back in 2008 to 2011

Backing up even further, Enbridge (ENB) was my first blue-chip Canadian dividend paying stock that I owned.

I purchased ENB at a time when I was starting to unload many of my high-priced mutual funds within my Registered Retirement Savings Plan (RRSP) in particular. These were the very early days of my DIY stock investing journey – before My Own Advisor was formally launched in 2009 and even before the Tax Free Savings Account (TFSA) existed.

I recall buying Enbridge, with a $500 purchase using their Transfer Agent (then CIBC Mellon Trust), in December 2008.

I continued buying Enbridge using the Transfer Agent, taking advantage of the full Dividend Reinvestment Plan (DRIP) throughout 2009 and into early 2010.

I stopped my full DRIP with the Transfer Agent before the end of 2010 and then in the months that followed, I transferred all existing Enbridge shares I owned at the time from that Transfer Agent to my discount brokerage taxable account.

I also purchased some ENB in my RRSP as well in 2010. I received a 2-for-1 stock split in May 2011 for all holdings.

Between 2011 to 2016

Since summer 2011, I was slowly adding to my ENB holdings here and there while ramping up purchases in other dividend paying stocks (i.e., Canadian banks stocks, utility stocks). During this time, I was also diversifying my holdings beyond Canadian stocks into low-cost indexed funds for extra diversification and growth. I was also selling some dividend ETFs I owned at the time like HDV and others. Little did I know, this approach would serve me well in the coming decade on my journey to semi-retirement…

From 2016 onwards

During 2016, I started buying even more low-cost indexed funds but I didn’t sell any ENB stock. The dividend raises from Enbridge kept coming in every year and with DRIPs running for this stock up until a few years ago, the number of ENB shares continued to grow thanks to those dividend reinvestment plans.

Enbridge Now 2025

I continue to own Enbridge stock at the time of this post in many accounts.

Enbridge currently makes up just under 5% of our total personal portfolio value.

I have no intention of selling any Enbridge stock.

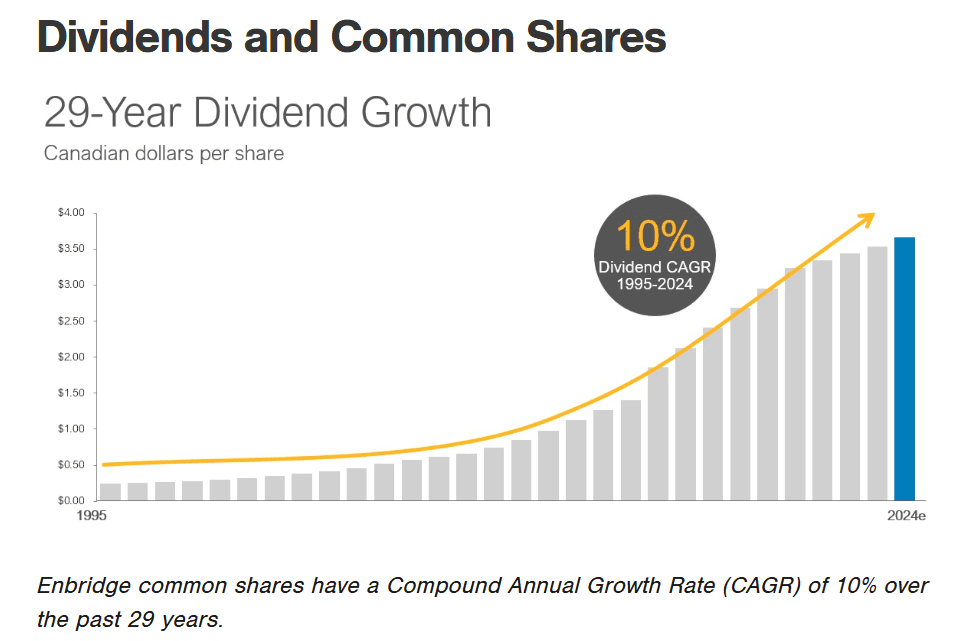

I expect both growing dividend income (i.e., this is a bond-proxy for me) with some slight long-term price growth from Enbridge over time. This will complement the income and growth of other stocks and ETFs we own for semi-retirement funding.

Source: Enbridge > Investors.

We’ll see what the future holds!

Over the coming year or so, as I share more about our portfolio including how that is structured for semi-retirement income and growth, I’ll update some other previous posts in this series.

I look forward to your comments including if you own Enbridge stock yourself, and why or why not.

Mark