Weekend Reading – Creating Your Retirement Paycheque

Hello!

Welcome to a new Weekend Reading edition about creating your retirement income paycheque. I’m developing mine in real-time!

In case you missed my most recent post, here was our June 2025 dividend income update. It moved higher…

Weekend Reading – Creating Your Retirement Paycheque

Headlining this Weekend Reading edition, I want to thank Joel How to DIY with retirement paycheques.

Some themes from Joel’s well-written post that you’ll recongize as a dedicated reader/subscriber here:

1. Track your expenditures / spending patterns prior to retirement.

“You can’t manage what you don’t measure.” – My Own Advisor.

2. Determine what assets you have and when you could use them. This includes when CPP and/or OAS benefits may come online, at age 65 or later.

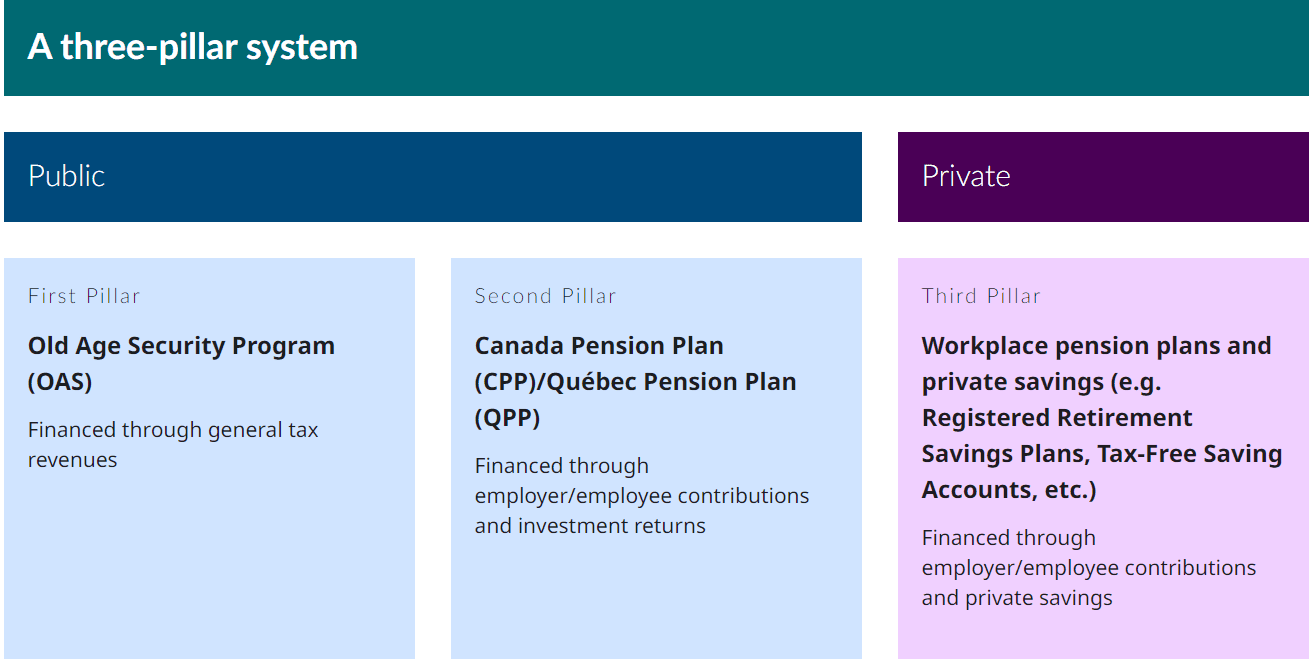

3. Design retirement income planning around income pillars, including those beyond CPP and OAS:

Source: Government of Canada.

I share this information for this Weekend Reading edition since while it could be “old news” to many My Own Advisor readers it becomes important context for all the free case studies on my site – how other successful DIY investors have designed their retirement income needs and wants. 🙂

You can find all these free Retirement Income case studies on my site here.

4. Finally, consider taking-down registered accounts (like RRSPs, group plans and defined contribution plans, etc.) before or around the same time as you take government benefits.

This means I would personally leave Tax-Free Savings Accounts (TFSAs) largely alone early in retirement, defer TFSA assets for big capital expenses, maintain TFSA capital for unknown larger expenditures as you age/rising healthcare costs, or maintain the TFSA where you wish for general estate planning since all compounding and withdrawals are tax-free. Of note: if the beneficiary of the TFSA is the surviving spouse or common-law partner then as a “successor holder” the tax-free treatment can continue!

“The first rule of compounding: Never interrupt it unnecessarily,” – Charlie Munger.

Let me know your thoughts on these subjects and much more, anytime. My readers including successful retiree contributors are also ready to engage with you, too! 🙂

More Weekend Reading – Beyond Creating Your Retirement Paycheque

A reader recently asked me about some investing philosophies, well, I provided them this link:

While the “4% rule” remains a decent rule of thumb, back-of-the-napkin retirement income planning as I call it here….

….you should know that Mr. 4% Rule himself Bill Bengen believes that rule is too low and he should have taken out more.

A good Morningstar article on that.

“Bengen said he follows his own advice. When he retired in 2013, his research called for 4.5% as the worst-case scenario. “Turns out, I could have taken out more,” he said.”

This is what a $3-million+ stock portfolio can look like…although I would likely dial-down the concentration risk myself with three stocks delivering >30% of the income…but everyone’s risk tolerance is different!!

Impressive all the same – with thanks from:

https://x.com/CDInewsletter/status/1944772372403466520/photo/1

Great of Nelson to share this and a link to his site.

“Another update on my buddy Jim’s portfolio, a plumber who retired in 2021 with $3M.

Since March: – Portfolio value up $210,000 to $3.9M – Annual income generated increased to $151k – Income up despite CAD/USD f/x rate weakness –

His spending is still ~$70k/annually.”

Happy saving and investing in stocks and ETFs.

Have a great weekend,

Mark

Share your unique link and earn up to 40% commission! https://shorturl.fm/l7Jii