Weekend Reading – Expert Predictions for 2025

Hi Folks!

Welcome to some new Weekend Reading, sharing some expert predictions for 2025.

I’ll also recap how well some experts guessed 2024 performance. (Surprise! – not very well!)

Some recent reads on my site:

I provided our latest November 2024 dividend income update, with just a few weeks to go in our 2024 investing year:

And since a new reader was curious about how I invest, and why, I’ve linked to some key resources below:

Why my approach as a hybrid investor remains unchanged including my desire to “live off dividends”.

Weekend Reading – Expert Predictions for 2025

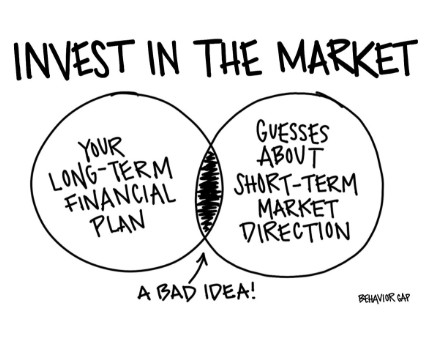

My goodness, how far off can you get??

Image source/great sketch with thanks to: Behavior Gap

Unless something dramatic happens in the coming two (2) weeks, which could happen I guess (!), fair to say that stock market predictions by some financial experts were simply downright awful in 2024. I can’t really blame them. They cannot predict the future – they all demonstrate that with us. That said, they do have to put food on the table just like you and me too. 🙂

Here are some great examples (reference: Business Insider) from late-2023 for 2024:

“The S&P 500 could experience its worst crash since 2008 next year as a recession kicks off, according to the 2024 outlook of BCA Research. BCA Research said a recession next year would put the S&P 500 in a range of between 3,300 and 3,700 before an eventual rebound materializes.”

“Equities are now richly valued with volatility near the historical low, while geopolitical and political risks remain elevated. We expect lackluster global earnings growth with downside for equities from current levels,” JPMorgan said. – they predicted a bearish price for the S&P 500 of 4,200.

and even some of the most bullish-strategists, like Tom Lee from Fundstrat; got it wrong:

“His S&P 500 price target of 5,200 represents gains of about 14% from current levels.”

Here in Canada, we were off too although not nearly as bad as most.

“Our forecasts for equity market returns essentially line up with earnings growth projections. We see some room in certain markets (e.g., Canada) for P/E multiple expansion, but we are not relying on valuation expansion to drive our return targets. Expectations for earnings growth in 2024 are respectable and in the range of long-term averages – a return to normal.

Our targets are 23,000 for the S&P/TSX Composite Index and 4,900 for the S&P 500 Index.”

But even worse, was perma-bear David Rosenberg:

“So, Plan A, (a 2024 recession) in my view, has a 60% chance of occurring. I believe that interest rates still matter, but they can often work with long lags….

…I assign a 25% chance of the Plan A recession turning into a true “hard landing”, replete with a nefarious default cycle and credit contraction. Of course, Plan C is that I am completely off my rocker, and we see the economy emerge unscathed and that Goldilocks is something more than just a fairy tale —to that, I attach 15% odds. Not impossible, but certainly implausible.”

Well, his 15% odds turned about to be 100% totally plausible. The stock market was on fire in 2024. That said, recession worries loom.

Even though this was a bad week for some stocks, like oil and gas including those in my portfolio, for 2024, YTD at the time of this post:

- TSX-60 stocks (as measured by low-cost ETF XIU) are up over 20%.

- NASDAQ-100 stocks (as mesured by low-cost ETF QQQ) are up about 30%.

- The S&P 500 (as measured by low-cost ETF IVV) is up >27%.

(Disclosures: I prefer to own my own DIY basket of Canadian stocks vs. XIU. I own QQQ. I own XAW that includes > 55% IVV along with stocks from around the world ex-Canada.) Sources: iShares, Google.

I still make predictions for fun now and then, and I even get a few right too: my Sens did not make the playoffs last year (sigh); I was correct with my Telus and CNQ dividend raises, and, we did buy a new PHEV without any car loan.

What are some Expert Predictions for 2025?

Peter Hodson, friend of the site and founder of 5i Research, wrote in the Financial Post recently that:

“Love him or hate him, Donald Trump is going to be the next U.S. president come January. …So, we have history on our side here with the prediction that the market will do well in 2024.

How much upside? No idea.

More specifically, here is what some analysts and strategists are targeting for the S&P 500 for 2025:

- UBS = 6,400

- Morgan Stanley, Goldman Sachs, JP Morgan = 6,500

- RBC, Barclays = 6,600

- BMO, HSBC = 6,700. As per BMO (as of Nov. 18):

“Bull markets can, will, and should slow their pace from time to time, a period of digestion that in turn only accentuates the health of the underlying secular bull. So, we believe 2025 will likely be defined by a more normalized return environment with more balanced performance across sectors, sizes, and styles.”

Averaging out what I’ve read about the S&P 500, it seems another 10% upside could be gained in 2025.

Brian Belski, BMO’s chief investment strategist, recently stated, “We think Canada offers value and cyclicality and increase in stock picking, especially relative to the US.” His forecast puts the TSX at 28,500 by the end of 2025. This figure, beyond 25,200 today represents an increase of close to 13% at the time of this update.

Will this happen? U.S. stocks will go up 10%? TSX stocks will jump by 13%?

Again, no idea.

As always, time will reveal all and it will be interesting to report back.

More Weekend Reading…

My friend Tawcan shared his top-5 conviction stocks. I like his calls on waste management companies as well, I’m biased though on those stocks, since I’ve owned some of those for a few years now myself and will continue to do so. I would also put BlackRock (BLK) in my personal conviction list. BLK is up about 30% YTD.

My successful U.S. dividend blogger and friend, Dividend Growth Investor, shared a number of stocks that just raised their dividends – he included a few key Canadian names too!

Rob Carrick reminded DIY investors not to forget about the TSX over the S&P 500 (subscription).

From Rob:

“Falling rates have rekindled interest in dividend stocks and driven up returns for the dividend aristocrats index. Dividend investors, enjoy the moment. Just now, you’re pulling in dividend income with a tax advantage in non-registered accounts, plus big share price gains. The S&P 500, with its flashy tech stocks, cannot keep up.”

Solid stuff at Morningstar – some selected pros and cons related to dividend investing including the best of pro from this approach from the article:

“So you do have that option of creating your own dividend at any time. You can sell a share, you can sell fractions of shares now very easily with many brokerage platforms. So you always have this option to create income by selling shares of stocks that you own. But that creates a whole other set of questions: Which shares do you sell from your portfolio? Then do you have subsequent decision regret because, “Oh, I sold those shares and now those shares have gone up.” And I’m not suggesting in any way that you settle for a suboptimal strategy or anything like that, but simply saying from a psychological standpoint: Dividend investors don’t face those questions because they are receiving that regular income from their portfolio without having to sell shares.”

Retirement income projections reports

As 2024 comes to a close, I suspect we’re all wondering what 2025 might bring. I know I am…

That might include wondering about any income to be delivered from your existing retirement portfolio.

If you are ever curious about that question at any age, and need any support with your retirement income projections, at a low-cost, reports tailored to you, with money-back guarantees – learn more on this page here.

And, I also provide you a standing 10% discount to all My Own Advisor readers from yours truly for any reports generated for you.

Just mention my site when you contact me. That’s it. Happy to offer and honour – always.

All my best for your investing progress as 2024 comes to a close…we’ll see what 2025 brings soon…

See you next week!

Mark