Weekend Reading – More Trump Tariffs

Welcome to a new Weekend Reading edition, this one about more Trump tariffs to navigate.

Just in case you missed last week’s edition and some other posts…

I contributed to a MoneySense article about the Best ETFs in Canada to own.

And a few months ago, a reader asked me if they can retire with $1 million invested in their RRSPs.

They can – since $1 million invested in your mid-60s is still quite a bit of money…

Weekend Reading – More Trump Tariffs

Leading off this Weekend Reading edition, these articles/headlines:

Trump threatens 50% tariffs on EU and 25% penalties on Apple

In that: President Donald Trump is threatening a 50% tax on all imports from the European Union as well a 25% tariff on Apple products unless iPhones are made in America.

Geez.

And…

Trump’s new bill threatens major tax increases for Canadian companies

With that article above (with thanks to The Globe and Mail (subscription)):

“On Thursday, the U.S. House of Representatives passed the Republican legislation, titled the One, Big, Beautiful Bill, with a narrow vote of 215-214. If it becomes law, it will override the Canadian-U.S. tax treaty that has been in place since 1942.

The 1,100-page document includes section 899, a tax proposal created as a retaliatory measure against what the U.S calls “discriminatory or unfair taxes” of foreign countries, including Canada’s digital services tax (DST), which was introduced in 2024.

The U.S legislation is still required to be passed by the Senate and receive presidential approval before it can become law. The White House expects the President to sign the final bill by July 4.

Canadian corporations that receive dividends from U.S. subsidiaries are currently subject to a 5-per-cent withholding rate under the tax treaty between the U.S. and Canada, much lower than the statutory rate of 30 per cent.

But under section 899, Canadian companies would see their tax rate increase by five percentage points each year until it reaches 20 percentage points above the statutory rate, or 50 per cent. It would remain in place until the “unfair tax” is removed.

Similarly, Canadian individuals who own U.S. securities directly are subject to a 15-per-cent withholding tax rate under the current treaty, reduced from the statutory rate of 30 per cent. Under section 899, the withholding rate could ultimately rise to 50 per cent.”

Yikes.

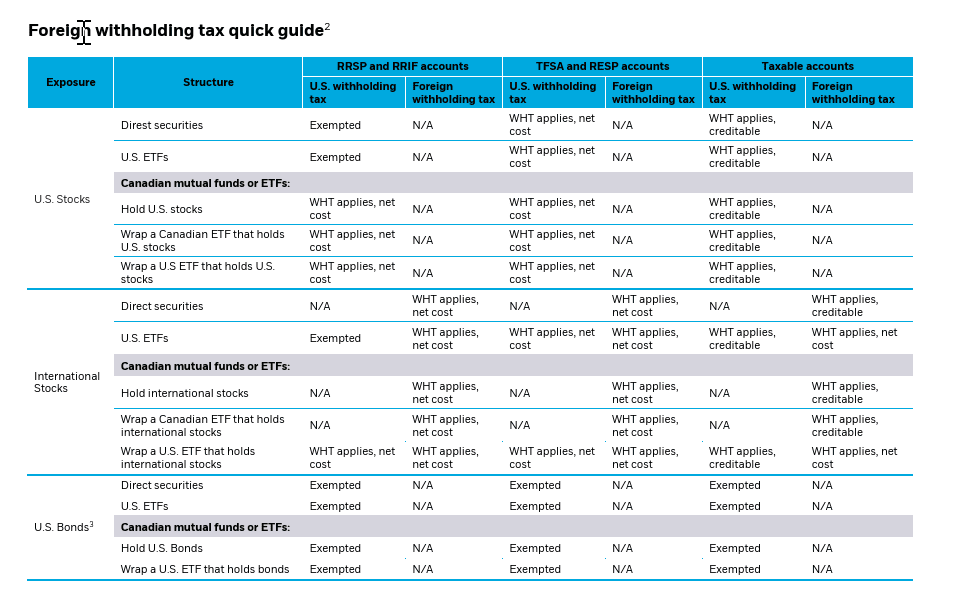

So, my understanding is if you own Canadian ETFs (like I do) that hold U.S. stocks or U.S. ETFs, well, your foreign withholding tax (FWT) bill will go up if this comes to pass.

We’ll see how this all shakes down to be honest.

Trump could change his mind a few dozen times before anything is passed on July 4th and even then, one might hope Canada drops the Digital Services Tax (DST) we implemented a year ago to reduce the possibility of more targeted attacks to annex us.

I’ve been on record to share that I don’t intend to change our portfolio very much with Trump in office.

That said, I might look into holding different ETFs (corporate class ETFs) if he doubles-down on Canada.

These ETFs are helpful and suitable for DIY investors who want total return exposure to the large-cap U.S. equity market (e.g., S&P 500) or other markets, but are not looking for regular distributions. This would be helpful in the case of getting taxed on any foreign withholding taxes (in my opinion).

As a primer / reminder from My ETFs page, here where foreign withholding taxes apply:

Source: BlackRock.

For other Weekend Reading beyond Trump Tariffs

It’s big bank earnings season in Canada. Some banks might raise dividends again this quarter, others might hold the line. We shall see over the coming week. A good reminder on that:

Source: https://x.com/CDInewsletter/status/1919354386934878352

Not that he needs the money of course, but my friend Dividend Growth Investor highlighted that Bill Gates could have been the world’s first trillionaire investor – could have – had he held his own company stock long enough…

Nice interview by a local friend of mine Kanwal Sarai with portfolio and wealth manager Jenny Harrington. Among other subjects, they discussed:

- Why dividends at all?

- Jenny believes dividends serve a need: as part of a pragmatic portfolio that grows at a higher rate of inflation.

- The notion that 100% growth is just not certain – which is a challenge in an uncertain world.

- Her belief that dividends are psychologically helpful because moreso than a total return strategy the biggest risk to your retirement plan is your bad behaviour; not being comfortable enough with waiting for growth and therefore selling something at the wrong time.

- Her recommendation for building a responsible diversified portfolio: consider 80% or so in a broad market fund and buy 20% stocks/dividend income stocks.

I read an impressive amount of dividend income earned by Dividend Hawk.

Reader Question of the Week (adapted for the site):

Hi Mark,

I have been a long time reader of your site and have learned lots from yourself and your community of DIY investors. Thank you for creating great educational content and congratulations on your recent transition to part-time work.

The struggle that I have is tracking the performance of my portfolio across multiple accounts and multiple institutions. My wife and I have a few self-directed accounts and business accounts. I have used some tools via Yahoo Finance and from The Measure Of A Plan, but I find that none of the portfolio values/performance figures are the same, even though I have doubled checked that all the transactions are the same across all platforms. I am curious to know what you, or your readers use to accurately track their portfolio performance and dividend payments?

Hopefully this is a subject that you feel has value to your readers and the responses will help your community!

Great question and thanks very much for your readership.

To be honest, I keep it very simple. In terms of tools, I know many Canadian brokerages like RBC, TD, Questrade, Interactive Brokers and more include portfolio performance tools. It’s much easier to figure out rates of return and monitor performance when everything is under one roof.

Here is a good listing for the Best Online Brokers in Canada.

When it comes to what I use to track rising dividend and distribution income, I use a spreadsheet. That’s it. Very simple. I use my spreadsheet to tally and contribute to these updates:

I can’t speak to the cybersecurity controls related to these tools below, I don’t use them and I’m not advocating for them per se but I do know of them and they seem well-suited to what you might be looking for – just do some due diligence on what they do with your data:

https://www.portseido.com/portfolio-tracker/canada

https://www.sharesight.com/ca/

https://wealthica.com/how-it-works/

Readers, help for this reader? What tools might you use? Thanks to reader Mary from reminding me about Wealthica.

In case you missed this webinar below, I will link to the recording as soon as my partners at TD Direct Investing post it and I will also share some audience Q&A that I didn’t have time to answer with my debate partner Henry Mah in a future blogpost. Stay tuned for both of those items!

Have a great weekend!

Mark